Introduction to eToro and Trading in the Netherlands

eToro is an online trading platform that allows users to invest in a variety of financial instruments, including stocks, commodities, currencies and indices. It has become increasingly popular among traders in the Netherlands due to its user-friendly interface and wide range of features. eToro also offers educational resources for new traders who are looking to learn more about investing and trading on the platform. In this article, we will provide an introduction to eToro and discuss how Dutch traders can get started with trading on the platform. We will also explore some of the benefits associated with using eToro as well as any potential risks involved when trading in the Netherlands.

Advantages of Trading on eToro in the Netherlands

1. Low Fees: eToro offers low fees for trading in the Netherlands, making it an attractive option for traders who want to save money on their trades.

-

Variety of Assets: eToro offers a wide range of assets that can be traded in the Netherlands, including stocks, commodities, indices and cryptocurrencies. This allows traders to diversify their portfolios and take advantage of different markets at once.

-

Easy-to-Use Platform: The eToro platform is designed with simplicity in mind and makes it easy for new traders to get started quickly without needing any prior knowledge or experience with trading platforms.

-

Social Trading Features: eToro’s social trading features allow users to follow experienced investors and copy their trades automatically if they wish to do so – this helps inexperienced traders learn from more experienced ones while still managing their own portfolio independently if they prefer that approach instead.

-

Regulatory Compliance: As a regulated broker, eToro complies with all applicable regulations set by Dutch authorities such as AFM (Autoriteit Financiële Markten) which ensures user funds are kept safe and secure at all times when using the platform

The Different Types of Assets Available for Trade on eToro

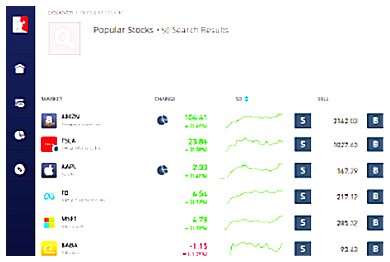

eToro is a popular online trading platform that allows traders in the Netherlands to buy and sell a variety of assets. On eToro, you can trade stocks, commodities, currencies, indices, ETFs (Exchange Traded Funds), cryptocurrencies and more. Here’s an overview of the different types of assets available for trade on eToro:

Stocks: You can buy or sell shares from some of the world’s biggest companies such as Apple Inc., Microsoft Corporation and Amazon.com Inc.

Commodities: Commodities are physical goods such as gold, silver and oil which are traded on global markets.

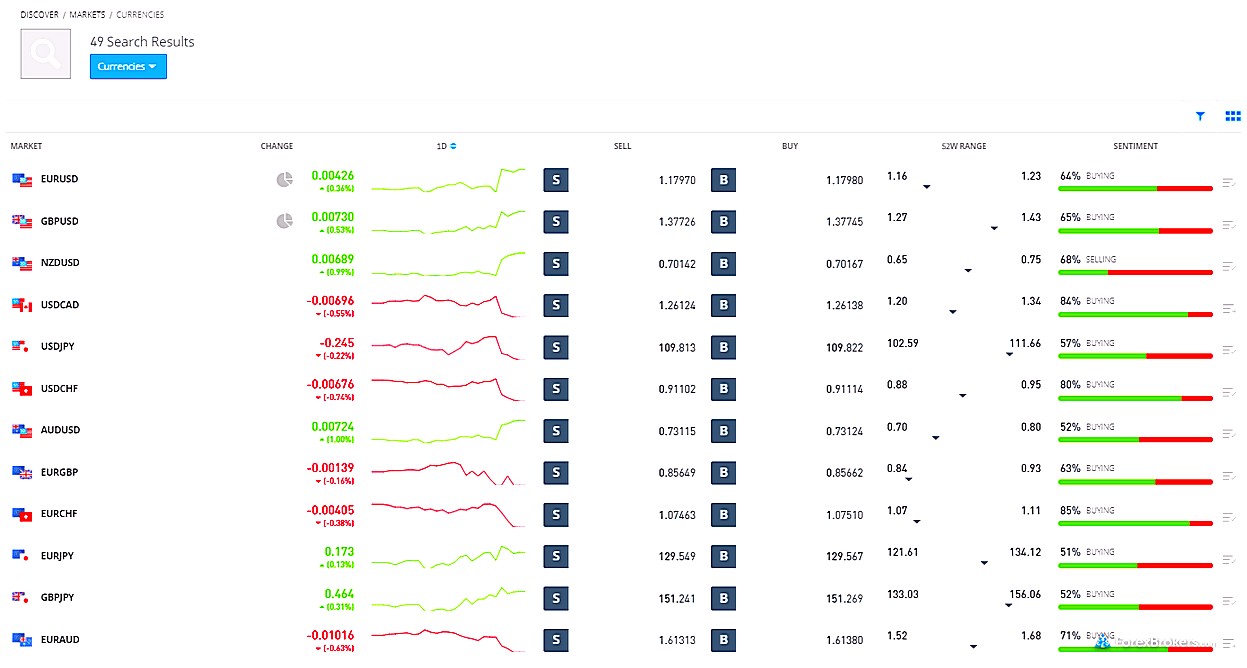

Currencies: Currencies are also known as Forex or FX trading where you can speculate on currency exchange rates between two countries or regions.

Indices: Indices track groups of stocks that represent an entire market sector such as tech stocks or banking stocks.

ETFs (Exchange Traded Funds): Exchange-traded funds allow investors to diversify their portfolios by investing in multiple asset classes at once without having to purchase individual securities directly.

Cryptocurrencies: Cryptocurrencies are digital tokens used for secure payments over the internet and include Bitcoin, Ethereum and Litecoin among others

Setting Up an Account with eToro

Setting up an account with eToro is easy and straightforward. All you need to do is provide your name, email address, country of residence, and create a password. You will then be asked to verify your identity by providing proof of ID and proof of address. Once you have completed these steps, you can start trading on eToro in the Netherlands!

Understanding the Fees Involved with Trading on eToro

When trading on eToro in the Netherlands, it is important to understand the fees involved. Knowing these fees can help you make more informed decisions about your investments and maximize your returns.

eToro charges a commission for each trade made on its platform. This fee is based on the size of the position taken and may vary depending on the asset class traded. Additionally, there are overnight financing fees charged when positions are held overnight or over weekends and holidays. These fees also vary by asset class and market conditions.

In addition to commissions and financing costs, eToro charges an inactivity fee if no trades have been made within a certain period of time (usually 12 months). This fee is designed to discourage traders from leaving their accounts inactive for long periods of time without making any trades or managing their portfolios actively.

Finally, eToro also charges withdrawal fees when funds are withdrawn from an account via bank transfer or credit card payments. The amount of this fee varies depending on which payment method is used but typically ranges between 0-2%.

By understanding all of these different types of fees associated with trading on eToro in the Netherlands, investors can better plan their investments and manage their portfolios more effectively while minimizing unnecessary costs along the way.

Leverage and Margin Requirements for Dutch Traders

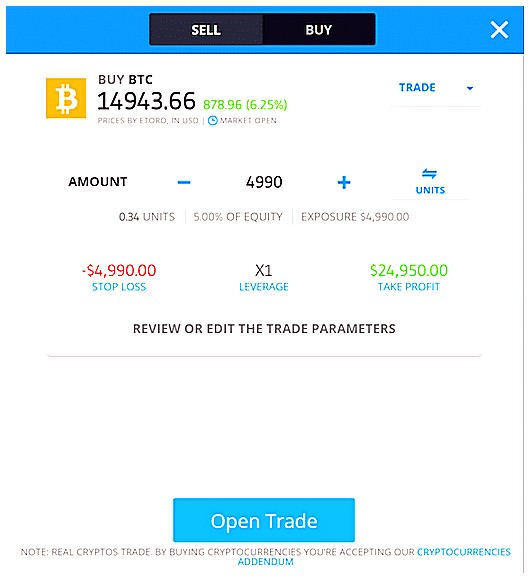

The Netherlands is a great place to trade on eToro, as it offers traders the opportunity to take advantage of leverage and margin requirements. Leverage allows traders to open larger positions with less capital, while margin requirements help protect their trading accounts from losses due to market volatility.

When trading on eToro in the Netherlands, traders can choose between two types of leverage: fixed and variable. Fixed leverage is offered at a set ratio (e.g., 1:30) and remains constant throughout the duration of the trade; this type of leverage is ideal for conservative investors who want to limit their risk exposure. Variable leverage allows traders to adjust their level of risk by changing the amount they borrow against their account balance; this type of leveraged trading may be more suitable for experienced investors who are comfortable taking higher risks in order to potentially generate greater returns.

In addition, Dutch traders must meet certain margin requirements when using leveraged trades on eToro. These requirements vary depending on whether you’re opening a long or short position – for example, if you’re opening a long position then your minimum required margin will typically be 2%, whereas if you’re opening a short position then your minimum required margin will usually be 5%. It’s important that all Dutch traders understand these rules before entering into any leveraged trades so that they don’t put themselves at risk of suffering large losses due to market fluctuations or other factors beyond their control.

Developing a Strategy for Successful Trading on eToro

Trading on eToro in the Netherlands can be a lucrative venture, but it requires careful planning and strategy. Developing a successful trading strategy is essential for any trader looking to make money on eToro. In this article, we will discuss some of the key elements that should be considered when developing a trading strategy for success on eToro.

First and foremost, traders need to understand their own risk tolerance level before investing in any asset class or market sector. It is important to identify your personal goals as well as what type of investment strategies you are comfortable with. This will help you determine which assets are best suited for your individual needs and objectives. Additionally, it is important to assess the current market conditions and develop an appropriate plan based upon these factors.

Once you have determined your risk tolerance level and identified potential investments, it is time to create a trading plan that outlines how much capital you want to allocate towards each trade and how often trades should occur. Your trading plan should also include specific entry points at which point you enter into positions as well as exit points where profits are taken or losses cut off if necessary. Having a clear understanding of these two components will ensure that your trades remain profitable over time while minimizing risks associated with volatile markets or unexpected events like news releases or economic data releases that could impact prices significantly without warning.

Finally, having access to reliable research tools such as technical analysis charts can provide valuable insight into future price movements so traders can stay ahead of trends instead of reacting after they’ve already occurred in the markets. Utilizing these resources effectively along with other forms of analysis such as fundamental analysis can give traders an edge when making decisions about when and where to invest their funds on eToro in order maximize returns while minimizing risks associated with unpredictable markets conditions

Using Technical Analysis to Enhance Your Trades

Trading on eToro in the Netherlands is a great way to take advantage of the financial markets. With access to a wide range of assets, including stocks, commodities, indices and cryptocurrencies, you can diversify your portfolio and potentially increase your returns. However, trading can be risky and it’s important to understand how to manage risk when trading online. One way to do this is by using technical analysis as part of your strategy. In this article we will discuss how you can use technical analysis to enhance your trades on eToro in the Netherlands.

Technical analysis involves studying price charts and patterns over time in order to identify potential buying or selling opportunities. By looking at historical data such as highs and lows, support levels and resistance points you can gain insight into where prices may go next – allowing you to make informed decisions about when best to enter or exit positions for maximum profit potential. Technical indicators such as moving averages (MA) are also useful tools for traders; these help determine trends within markets which could indicate future price movements that may be profitable for traders who act accordingly.

Using technical analysis allows traders on eToro in the Netherlands an additional layer of protection against losses due to market volatility or unexpected events that could affect prices negatively. By having a better understanding of what factors influence asset prices they can adjust their strategies accordingly – increasing their chances of making successful trades while minimizing risks associated with them too! Additionally, many experienced traders find that combining fundamental analysis with technical helps them make more accurate predictions about future price movements which further enhances their ability generate profits from trading activities on eToro in the Netherlands.

Overall, incorporating technical analysis into your trading strategy is an effective way not only protect yourself from loss but also increase profitability through more informed decision-making processes based upon historical data points gathered over time – something all savvy investors should consider doing if they want success when investing via eToro in the Netherlands!

Utilizing Social Features to Follow Other Traders’ Strategies

eToro is a popular online trading platform that has recently become available in the Netherlands. With eToro, traders can invest in stocks, currencies, commodities and more from around the world. One of the unique features of eToro is its social trading capabilities which allow users to follow other traders’ strategies and even copy their trades automatically. In this article we will discuss how you can utilize these social features to your advantage when trading on eToro in the Netherlands.

Protecting Yourself from Risk When Trading on eToro

When trading on eToro in the Netherlands, it is important to take steps to protect yourself from risk. Here are some tips for doing so:

-

Make sure you understand the risks associated with each trade before making a decision. Do your research and read up on the markets and different strategies available. This will help you make informed decisions about which trades to make and how much money to invest in them.

-

Set realistic goals for yourself when trading on eToro in the Netherlands. Don’t expect overnight success or unrealistic returns; instead, focus on setting achievable targets that will help you grow your portfolio over time without taking too much risk at once.

-

Utilize stop-loss orders when trading on eToro in the Netherlands as this can help limit potential losses if a trade goes against you unexpectedly or market conditions change suddenly.

-

Diversify your investments across different asset classes and markets so that any losses incurred by one position can be offset by gains made elsewhere within your portfolio of investments .

5 . Monitor your positions regularly so that you can adjust them quickly if needed due to changing market conditions or other factors outside of your control .

6 . Consider using leverage carefully , as it has both benefits and drawbacks depending upon how it is used . Leverage allows traders to increase their exposure while also increasing their potential profits , but it also carries greater risks than traditional investing methods do .

| Feature | eToro Netherlands | Other Trading Platforms |

|---|---|---|

| User Experience | Easy to use, intuitive platform with advanced charting tools and real-time market data. | Difficult to navigate interface, limited charting tools and delayed market data. |

| Fees | Low trading fees compared to other platforms. | High trading fees compared to eToro Netherlands. |

| Leverage | Up to x30 leverage available for certain assets. | Limited leverage options depending on the asset being traded. |

What are the advantages of trading on eToro in the Netherlands?

The advantages of trading on eToro in the Netherlands include:

1. Low fees – eToro offers competitive fees and spreads, allowing traders to keep more of their profits.

2. Variety of markets – eToro provides access to a wide range of global markets, including stocks, commodities, indices and cryptocurrencies.

3. Easy-to-use platform – The user interface is designed for beginners and experienced traders alike, making it easy to get started with trading on eToro quickly and easily.

4. CopyTrader feature – This allows users to copy the trades of other successful investors on the platform automatically so they can benefit from their knowledge without having to manually research each trade themselves.

5. Security – All funds are held securely in segregated accounts at top tier banks across Europe ensuring that your money is safe at all times while trading on eToro’s platform

Are there any restrictions or limitations when trading on eToro in the Netherlands?

Yes, there are restrictions and limitations when trading on eToro in the Netherlands. These include: a maximum leverage of 1:30 for retail clients; a minimum deposit requirement of €200; no hedging allowed; and no scalping allowed. Additionally, certain CFDs may not be available to Dutch traders due to local regulations.

How can I open an account with eToro to start trading in the Netherlands?

To open an account with eToro to start trading in the Netherlands, you will need to visit their website and register for a new account. Once registered, you will be able to access the platform and begin trading. You may also need to provide some personal information such as your name, address, date of birth, etc., before being able to trade on the platform. Additionally, depending on where you are located in the Netherlands, there may be additional requirements that must be met before opening an account with eToro.

What types of financial instruments are available for trading on eToro in the Netherlands?

eToro offers a wide range of financial instruments for trading in the Netherlands, including stocks, ETFs, commodities, indices, cryptocurrencies and currencies.

Does eToro offer any special features that make it a preferred platform for Dutch traders?

Yes, eToro offers several special features that make it a preferred platform for Dutch traders. These include its easy-to-use interface, low trading fees, and access to the Netherlands’ largest stock exchange (Euronext Amsterdam). Additionally, eToro provides an extensive range of financial products such as stocks, ETFs, commodities and cryptocurrencies. The platform also allows users to copy other successful traders on the network in order to benefit from their expertise. Finally, eToro is fully regulated by the Dutch Authority for Financial Markets (AFM) and offers a secure environment for investors.

Is there a minimum deposit requirement to begin trading on eToro in the Netherlands?

Yes, the minimum deposit requirement to begin trading on eToro in the Netherlands is €200.

Are there any fees associated with using etoro’s services when trading from within The Netherlands?

Yes, there are fees associated with using eToro’s services when trading from within The Netherlands. These include spreads, overnight financing charges and withdrawal fees.

Is customer support offered by etoro tailored specifically for Dutch traders, and if so, what language is it provided in?

Yes, eToro offers customer support tailored specifically for Dutch traders. The customer support is provided in the Dutch language.

05.05.2023 @ 13:47

eToro is een online handelsplatform dat gebruikers in staat stelt te investeren in verschillende financiële instrumenten, waaronder aandelen, grondstoffen, valutas en indices. Het is steeds populairder geworden onder handelaren in Nederland vanwege de gebruiksvriendelijke interface en het brede scala aan functies. eToro biedt ook educatieve bronnen voor nieuwe handelaren die meer willen leren over investeren en handelen op het platform. In dit artikel zullen we een introductie geven tot eToro en bespreken hoe Nederlandse handelaren aan de slag kunnen met handelen op het platform. We zullen ook enkele voordelen bespreken die gepaard gaan met het gebruik van eToro, evenals eventuele potentiële risicos bij het handelen in Nederland.

Voordelen van handelen op eToro in Nederland

1. Lage kosten: eToro biedt lage kosten voor handelen in Nederland, waardoor het een aantrekkelijke optie is voor handelaren die geld willen besparen op hun transacties.

2. Verscheidenheid aan activa: eToro biedt een breed scala aan activa die kunnen worden verhandeld in Nederland, waaronder aandelen, grondstoffen, indices en cryptocurrencies. Dit stelt handelaren in staat om hun portefeuilles te diversifiëren en tegelijkertijd te profiteren van verschillende markten.

3. Gemakkelijk te gebruiken platform: Het eToro-platform is ontworpen met eenvoud in gedachten en maakt het gemakkelijk voor nieuwe handelaren om snel aan de slag te gaan zonder enige voorkennis of ervaring met handelsplatforms.

4. Sociale handelsfuncties: De sociale handelsfuncties van eToro stellen gebruikers in staat om ervaren investeerders te volgen en hun transacties automatisch te kopiëren als ze dat willen – dit helpt onervaren handelaren te leren van meer ervaren handelaren terwijl ze hun eigen portefeuille onafhankelijk beheren als ze de voorkeur geven aan die aanpak.

5. Regulerende