Introduction to eToro Trading in the Philippines

The Philippines is home to a growing number of investors who are eager to explore the world of online trading. With its easy-to-use platform and low fees, eToro has become one of the most popular platforms for traders in the country. In this article, we will take a look at what makes eToro so attractive to Filipino traders and how they can get started with their own trading journey. We’ll also discuss some tips on how to make smart investments and maximize profits from your trades. So if you’re looking for an introduction into the exciting world of eToro Trading in the Philippines, then read on!

Understanding the Basics of eToro Trading

eToro is a revolutionary online trading platform that has revolutionized the way people trade in the Philippines. With its intuitive user interface and easy-to-use features, eToro allows traders to access markets from around the world with just a few clicks of their mouse. In this article, we will explore the basics of eToro trading in the Philippines and how it can help you make smarter decisions when investing your money.

Understanding the Basics of eToro Trading

The first step to understanding eToro trading is learning about its core features. At its most basic level, eToro provides users with an intuitive platform for making trades on different financial instruments such as stocks, currencies, commodities and indices. The platform also offers advanced tools such as copy trading which allows users to automatically copy successful trades made by other experienced traders on the network. Additionally, users have access to real-time market data and news updates so they can stay informed about current trends in global markets.

In addition to these core features, eToro also offers several educational resources including webinars and tutorials designed to help new traders learn more about how to use their platform effectively. This makes it easier for beginners who are just starting out in online trading or those who want additional guidance before committing any capital into investments through their account.

Finally, one of the biggest advantages of using eToro is that it charges no commissions or fees for placing orders which makes it very cost effective compared to traditional brokers or exchanges where investors may be charged hefty transaction costs each time they buy or sell assets on their platforms.

Advantages of Using eToro for Philippine Traders

1. Low Fees: eToro offers some of the lowest fees in the industry, making it an attractive option for Philippine traders who are looking to maximize their profits.

-

User-Friendly Platform: The eToro platform is designed with ease of use in mind, allowing users to quickly and easily navigate through its features and functions without having to be tech savvy or experienced traders.

-

Variety of Assets: With a wide range of assets available on the platform, Philippine traders can diversify their portfolios by investing in stocks, commodities, currencies and more.

-

Copy Trading Feature: This feature allows users to copy successful trades from other investors on the platform which makes it easier for newbies to get started trading without needing any prior knowledge or experience about financial markets and investments.

-

Social Networking Features: eToro also provides social networking features that allow users to connect with other traders around the world as well as share ideas and strategies for successful trading activities within a supportive community environment

Setting Up an Account with eToro

eToro is a popular online trading platform that allows users to trade stocks, commodities, and currencies from the comfort of their own home. With eToro’s easy-to-use interface and wide range of features, it has become one of the most popular platforms for traders in the Philippines. If you’re interested in getting started with eToro trading, here’s how to set up an account:

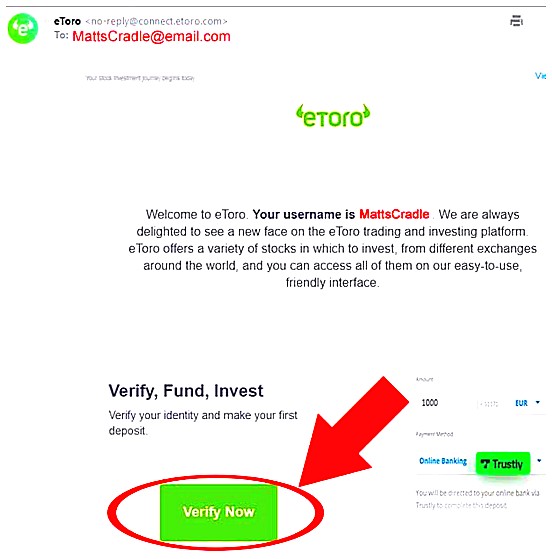

- Visit etoro.com and click on "Sign Up" at the top right corner of your screen.

- Enter your email address and create a secure password to register your account with eToro.

- Verify your identity by providing personal information such as name, date of birth, address, phone number etc., along with proof of identification documents like passport or driver’s license if required by local regulations in the Philippines .

- Once you have completed all these steps successfully , you will be able to access your newly created eToro account!

- Now it’s time to fund your account so that you can start trading – simply select “Deposit Funds” from within the dashboard menu and choose between bank transfer or credit/debit card payment options available for Filipino customers . You may also use other payment methods such as PayPal or Skrill if they are supported by eToro in your country .

With this step-by-step guide , setting up an account with eToro should be relatively straightforward ! All that remains now is for you to explore all the features offered by this powerful online trading platform – good luck!

How to Fund Your Account on eToro

Funding your account on eToro is easy and straightforward. You can use a variety of payment methods, including bank transfer, credit/debit card, PayPal, Skrill, Neteller and more.

To fund your account:

- Log in to your eToro trading platform with your username and password.

- Click the “Deposit Funds” button located at the top right corner of the page.

- Select your preferred payment method from the list provided (e.g., Bank Transfer).

- Enter the amount you wish to deposit into your account and click “Continue” to proceed with the transaction process as instructed by eToro’s system prompts or messages displayed on-screen for further instructions if needed; depending on which payment method you choose for funding purposes).

- After completing all necessary steps required for making a successful deposit into your eToro trading account balance, you will receive an email notification confirming that funds have been credited into it successfully!

Choosing Assets to Trade on eToro

When it comes to trading on eToro, one of the most important decisions you will make is choosing which assets to trade. The platform offers a wide range of markets and instruments for traders in the Philippines, including stocks, commodities, indices, cryptocurrencies and more. With so many options available, it can be difficult to decide which ones are right for you.

The first step in selecting your assets is determining what type of trader you want to be. Are you looking for short-term gains or long-term investments? Do you prefer high risk/high reward trades or low risk/low reward trades? Your answers will help guide your asset selection process.

Once you have an idea of what kind of trader you want to be, take some time to research each asset class offered by eToro. Read up on their historical performance and any news related to them that could affect future prices. This will give you a better understanding of how they might perform over time and whether they’re suitable for your investment goals.

It’s also important to consider fees when choosing assets on eToro as these can add up quickly if not managed properly. Look at the spreads (the difference between buy and sell prices) as well as any other commissions associated with each market before making a decision about which ones are best suited for your trading style and objectives.

Finally, remember that diversification is key when investing in any market – even those offered by eToro in the Philippines! Try not to put all your eggs into one basket; instead spread out your capital across multiple asset classes so that if one fails then another may still succeed. This way no single loss has too much impact on overall returns while still allowing potential profits from multiple sources simultaneously

Analyzing Market Trends and Developing Strategies for Successful Trades

The world of eToro trading in the Philippines is an exciting and potentially lucrative one. To maximize your chances of success, it is important to understand market trends and develop strategies for successful trades. In this article, we will explore some key tips for analyzing market trends and developing strategies that can help you make profitable trades on eToro.

First, it’s essential to stay up-to-date with current events that may affect the markets. This includes keeping tabs on news related to economic indicators such as inflation rates or employment figures, political developments, natural disasters, etc., as these can all have a significant impact on the markets. Additionally, staying informed about changes in global financial regulations or technological advancements can also provide insight into how certain markets may be affected by them.

Once you are familiar with current events affecting the markets, you should then focus on researching specific assets that interest you most. Analyzing historical data regarding price movements and other relevant metrics will give you a better understanding of potential opportunities or risks associated with each asset class. You should also take note of any technical analysis tools available through eToro which could help inform your decisions when making trades; these include charting patterns like support/resistance levels or trend lines which can indicate whether an asset is likely to move up or down in value over time.

Finally, once you have gathered enough information about a particular asset class it’s time to start formulating strategies for successful trades using what has been learned from research and analysis thus far. Depending on your risk appetite there are various approaches one could take such as day trading (where positions are opened and closed within 24 hours) or swing trading (where positions are held longer than 24 hours). It’s important to remember that no matter what strategy is chosen there will always be inherent risks involved so caution must be taken when placing orders – particularly if leverage is being used – as losses could quickly mount up if not managed properly!

In conclusion, exploring the world of eToro trading in the Philippines requires knowledge about both current events impacting global markets as well as individual assets being traded via this platform; only then can traders begin forming their own unique strategies tailored towards maximizing profits while minimizing losses along the way!

Executing Trades on the Platform

eToro is a revolutionary trading platform that has made it easier than ever for traders in the Philippines to access global markets. With eToro, you can easily execute trades on stocks, commodities, indices and currencies from around the world. The platform also offers advanced tools such as copy trading and social trading which allow users to follow other successful traders and automatically replicate their strategies. In this article we will explore how to get started with eToro Trading in the Philippines and how to successfully execute trades on the platform.

Managing Risk and Protecting Profits

eToro trading is becoming increasingly popular in the Philippines, as it offers investors a wide range of options for managing their investments. With eToro, traders can take advantage of the global markets and access multiple asset classes from around the world. However, with any type of investing comes risk and it is important to understand how to manage that risk while still protecting your profits. In this article we will explore some tips on how to manage risk and protect profits when trading on eToro in the Philippines. We will look at strategies such as diversification, setting stop losses, using leverage wisely and more. By understanding these concepts you can ensure that you are able to maximize your returns while minimizing your risks when trading on eToro in the Philippines.

Tips for Maximizing Gains from Trading on eToro

1. Start small and build up your portfolio gradually: Don’t invest too much money in one go, as this can be risky. Instead, start with a smaller amount of capital and slowly increase it over time as you become more experienced with trading on eToro.

-

Diversify your investments: Investing in multiple different assets is important to spread out risk and maximize gains from trading on eToro. Consider investing in stocks, currencies, commodities or cryptocurrencies for the best results.

-

Research before investing: Before investing any money into an asset, make sure to do thorough research into its past performance and current market conditions so that you know what kind of returns to expect from it.

-

Use stop-loss orders: Stop-loss orders are great tools for limiting losses when trading on eToro by automatically closing trades once they reach a certain level of loss set by the trader beforehand.

-

Monitor markets regularly: Keeping track of the markets will help you stay ahead of changes that could affect your investments so that you can adjust accordingly if needed to maximize profits from trading on eToro

| eToro Trading | Traditional Stock Trading |

|:—:|:—:|

| Access to global markets and assets | Limited access to local markets and assets |

| Low transaction fees and commissions | High transaction fees and commissions |

| User-friendly platform with advanced features for trading, charting, analysis, etc. | Difficult user interface with limited features for trading, charting, analysis, etc. |

| Easy account setup process with no minimum deposit requirements or paperwork needed. No need to open a separate bank account or maintain a certain balance in order to trade. Instant deposits/withdrawals available via credit/debit cards & other payment methods. No need for brokers or intermediaries as trades are executed directly from the platform. Leverage of up to 400x on some instruments allows traders to increase their potential profits (or losses). Real-time market data feeds provide up-to-date information on prices & trends across different asset classes. Social trading capabilities allow users to copy successful strategies of experienced traders in real time. Requires opening a separate bank account and maintaining a certain balance in order to trade through an intermediary broker who charges commission fees per transaction as well as additional costs such as maintenance fees or custodian services fee if applicable; withdrawals may take several days depending on the type of brokerage service used; difficult user interface without any advanced features like charts or analysis tools; leverage is not available unless you use margin accounts which come with high risk levels; real-time market data is not always available due lack of infrastructure in some countries; social trading is not possible since there are no established platforms that facilitate this kind of activity yet

What is eToro trading and how does it work?

eToro is an online trading platform that allows users to trade a variety of financial assets, including stocks, commodities, currencies and cryptocurrencies. It works by allowing users to open an account with eToro and deposit funds into it. Once the user has deposited funds they can then use the platform to buy or sell different assets. The user can also copy other traders on the platform in order to benefit from their knowledge and experience.

How can Filipino traders benefit from using eToro?

Filipino traders can benefit from using eToro in a variety of ways. First, eToro provides access to a wide range of markets and assets, including stocks, commodities, cryptocurrencies, indices and more. This allows Filipino traders to diversify their portfolios and take advantage of different opportunities across the globe. Additionally, eToro offers advanced trading tools such as copy trading which allows users to automatically copy the trades of experienced investors on the platform. Finally, eToro has low fees compared to other brokers making it an attractive option for Filipino traders looking for cost-effective investments.

What types of assets are available for trading on eToro in the Philippines?

eToro offers a variety of assets for trading in the Philippines, including stocks, ETFs, commodities, cryptocurrencies, indices and currencies.

Are there any risks associated with trading on eToro in the Philippines?

Yes, there are risks associated with trading on eToro in the Philippines. These include market risk, counterparty risk, liquidity risk and leverage risk. Additionally, traders should be aware of the potential for price manipulation or fraud as well as other legal and regulatory risks that may arise from trading on eToro in the Philippines.

Does eToro offer any educational resources to help new traders get started?

Yes, eToro offers a range of educational resources to help new traders get started. These include an extensive library of trading tutorials and videos, webinars with professional traders, and a comprehensive FAQ section. Additionally, the platform also provides daily market analysis and commentary from experienced analysts.

Is there a minimum deposit requirement to start trading on eToro in the Philippines?

Yes, there is a minimum deposit requirement to start trading on eToro in the Philippines. The minimum amount required to open an account and begin trading is $200 USD or its equivalent in Philippine Pesos.

What fees are associated with using eToro for Philippine traders?

The fees associated with using eToro for Philippine traders include a spread fee, overnight financing fee, and withdrawal fee. The spread fee is calculated as the difference between the buy and sell price of an asset on eToro. Overnight financing fees are charged when positions are held open overnight. Withdrawal fees vary depending on the payment method used but typically range from 0% to 2%.

Are there any customer support services available for Filipino users of eToro Trading Platforms?

Yes, eToro offers customer support services for Filipino users of its trading platforms. Customers can contact the eToro Customer Support team via email or live chat in English and Tagalog. Additionally, customers can also access a range of educational resources on the platform to help them get started with their trading journey.

05.05.2023 @ 13:43

Toro, the first step is to set up an account. To do this, simply visit the eToro website and click on the “Join Now” button. You will then be asked to provide some basic information such as your name, email address, and phone number. Once you have provided this information, you will be asked to create a username and password for your account. After completing these steps, you will be able to access the eToro platform and start trading. Overall, eToro is a great option for Philippine traders who are looking for a user-friendly and cost-effective way to invest in the global financial markets. With its low fees, variety of assets, and copy trading feature, it is a platform that is well-suited for both beginners and experienced traders alike.