What is eToro Trading?

eToro Trading is an online trading platform that allows users to trade a variety of financial instruments, including stocks, commodities, currencies and indices. It offers users the ability to copy other traders’ portfolios and strategies in order to diversify their investments. eToro also provides educational resources for those interested in learning more about investing and trading. In this article we will explore how eToro Trading works in Mexico and what opportunities it presents for Mexican investors.

Benefits of eToro Trading in Mexico

1. Low Fees: eToro trading in Mexico offers some of the lowest fees available for online trading, making it an attractive option for investors looking to maximize their returns.

-

Accessibility: With its user-friendly platform and mobile app, eToro makes it easy to access markets from anywhere in the world with just a few clicks. This makes it ideal for those who want to trade on the go or don’t have time to sit down at a computer all day long.

-

Variety of Assets: From stocks and commodities to cryptocurrencies and forex, eToro provides traders with access to a wide range of assets that can be traded on its platform – something that is not always available through other brokers in Mexico.

-

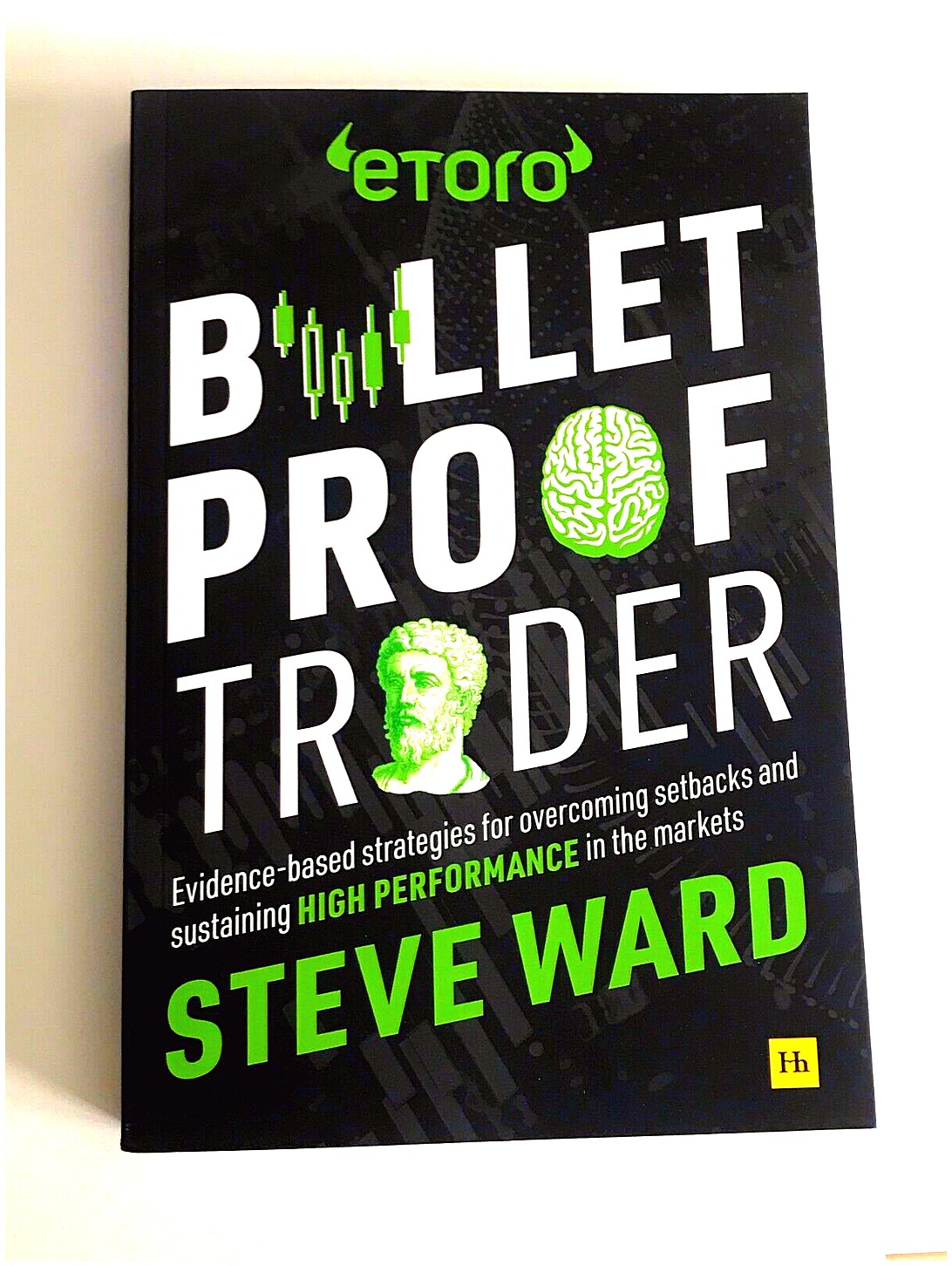

Educational Resources: For those new to trading or wanting to brush up on their skills, eToro also provides educational resources such as webinars and tutorials which can help users get up-to-speed quickly without having to invest too much time into learning about the market first hand.

-

Copy Trading Feature: One of the most popular features offered by eToro is its copy trading feature which allows users to automatically replicate trades made by experienced traders – allowing even novice investors gain exposure into more complex strategies without having any prior knowledge or experience themselves

How to Get Started with eToro Trading in Mexico

Are you interested in getting started with eToro trading in Mexico? If so, then this article is for you! We will discuss the basics of eToro trading and how to get started.

eToro is a social investment network that allows users to trade stocks, commodities, currencies, and other financial instruments. It also provides access to copy-trading services which allow users to follow experienced traders’ strategies. The platform has become increasingly popular among Mexican investors due to its ease of use and low fees.

To get started with eToro trading in Mexico, first create an account on the platform by providing your personal information such as name, email address and phone number. Once your account is created you can start funding it via bank transfer or credit/debit card. After funding your account you can begin investing in different assets available on the platform including stocks, ETFs (Exchange Traded Funds), indices and cryptocurrencies like Bitcoin (BTC). You can also take advantage of copy-trading services where you follow experienced traders’ strategies automatically or manually based on their performance history.

It’s important to note that before investing any money into eToro trading it’s best practice to understand all risks associated with it as well as familiarize yourself with the features offered by the platform itself such as leverage ratios or stop loss orders etc., which are essential tools for managing risk while trading online. Additionally be sure to read up on any applicable taxes related to investments made through eToro Trading in Mexico before making any trades so that you don’t incur any unnecessary costs down the line.

Finally if at anytime during your journey into learning about eToro Trading feel overwhelmed or unsure about something always reach out for help from customer service representatives who are more than happy answer questions regarding anything related directly or indirectly towards using their services safely & securely within Mexico’s borders .

We hope this article has provided useful insight into getting started with eToro Trading in Mexico!

Understanding the Different Types of Assets Available for Trade on eToro

eToro is a popular online trading platform that allows users to trade a variety of assets from around the world. In Mexico, eToro has become increasingly popular as traders look for ways to diversify their portfolios and capitalize on global markets. While there are many different types of assets available for trade on eToro, it’s important to understand the differences between them before making any trades. This article will explore the various asset classes available for trading on eToro in Mexico and provide an overview of each one.

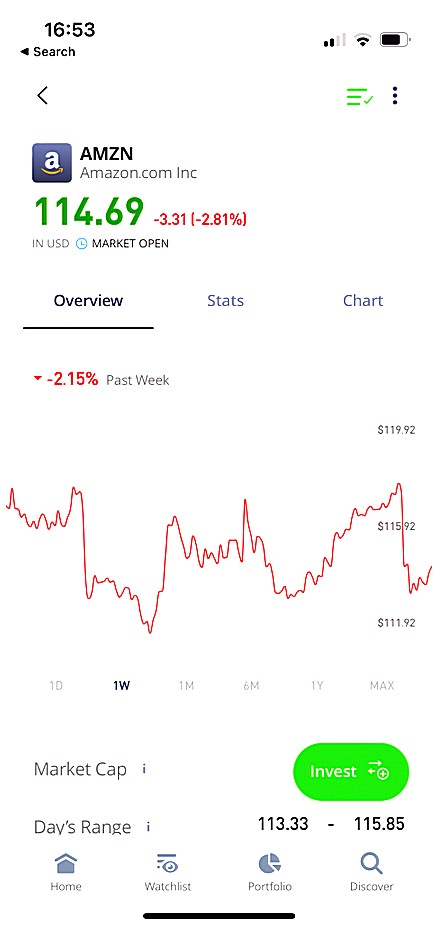

The most common type of asset traded on eToro is stocks. Stocks represent ownership in publicly-traded companies and can be bought or sold through the platform with relative ease. Other stock market indices such as S&P 500, NASDAQ Composite Index, Dow Jones Industrial Average (DJIA), FTSE 100 Index, DAX 30 Index are also available for trading on eToro in Mexico.

In addition to stocks, traders can also access foreign exchange (forex) pairs which allow investors to speculate on changes in currency values over time by buying or selling two currencies against each other simultaneously. Commodities such as gold and oil are also tradable through the platform along with cryptocurrencies like Bitcoin and Ethereum which have become increasingly popular among Mexican traders due to their high volatility levels compared to traditional assets like stocks or commodities. Finally, ETFs (Exchange Traded Funds) offer investors exposure to multiple underlying securities at once while minimizing risk by diversifying across several sectors or countries at once – these funds can be found under “ETFs” tab within the platform’s main menu bar when accessing it from Mexico City location settings..

Understanding what types of assets are available for trade is essential if you want success when investing with eToro in Mexico – whether you’re looking for long-term investments or short-term gains via day trading activities – so make sure you do your research beforehand!

The Advantages and Disadvantages of Using eToro for Mexican Traders

Advantages of Using eToro for Mexican Traders:

1. eToro offers a wide range of trading instruments, including stocks, commodities, indices and cryptocurrencies. This allows traders to diversify their portfolios and increase their chances of success in the markets.

2. The platform is easy to use with an intuitive user interface that makes it simple for new traders to get started quickly.

3. eToro also provides educational resources such as webinars and tutorials that can help Mexican traders gain valuable insights into the world of trading and make informed decisions about their investments.

4. As a regulated broker, eToro provides its users with access to advanced tools such as CopyTrader which allow them to copy successful trades from other experienced investors on the platform in order to maximize profits while minimizing risk exposure.

5. Additionally, customers benefit from competitive spreads and fees when trading on the platform which helps them save money over time by reducing transaction costs associated with investing in Mexico’s financial markets .

Disadvantages of Using eToro for Mexican Traders:

- While there are many advantages associated with using this platform, one potential disadvantage is that it does not offer support for Spanish-speaking customers or any local payment methods specific to Mexico which could be inconvenient for some users who prefer these services .

- Additionally, due to regulatory restrictions imposed by certain countries (including Mexico), certain assets may not be available on the platform or may have limited functionality compared to what is offered elsewhere .

Tips for Maximizing Profits from Trades on the eToro Platform

1. Start small and build up your portfolio gradually. Begin with low-risk trades to get a feel for the platform before investing larger amounts of money.

-

Utilize copy trading, which allows you to follow experienced traders on the eToro platform and replicate their trades in order to maximize profits.

-

Research potential investments thoroughly before committing any funds, including reading reviews from other users who have used the same asset or service in question.

-

Take advantage of leverage when trading stocks, commodities, currencies and indices by using borrowed capital to increase your exposure and potentially boost returns on investment (ROI).

-

Set stop losses on each trade you make so that if prices move against you too quickly then it will automatically close out at a predetermined price level in order to limit losses incurred from market volatility or sudden changes in sentiment among investors/traders alike.

6 . Monitor news sources regularly for updates about economic trends that could affect your investments; this can help inform decisions about when is best time buy or sell certain assets as well as alerting you of upcoming events that may influence prices either positively or negatively depending upon how they are interpreted by markets around the world

Analyzing Risk Management Strategies When Utilizing the eToro Platform

The world of eToro trading in Mexico is a complex one, and it’s important to understand the risk management strategies that can be used when utilizing this platform. By understanding the different risks associated with eToro trading, investors can make informed decisions about their investments and maximize their returns. This article will analyze some of the key risk management strategies available on the eToro platform and how they can help Mexican traders manage their portfolios more effectively. We’ll discuss topics such as diversification, stop-loss orders, leverage, margin requirements, and hedging techniques. By understanding these concepts and applying them appropriately within your portfolio, you can reduce your overall exposure to risk while still achieving great returns from your trades.

Exploring Popular Markets Offered by the Mexican Version of the Platform

The world of eToro trading in Mexico is a great way to explore the many popular markets offered by the Mexican version of the platform. With access to stocks, commodities, indices, and currencies from around the world, traders can take advantage of an array of opportunities available through this unique online broker. In this article we will discuss some of the most popular markets that are accessible through eToro in Mexico and how they can be used for profitable trades. We will also look at how traders can use their own strategies to maximize profits while minimizing risks associated with these markets. Finally, we’ll provide tips on choosing a suitable account type and making sure you get the best out of your trading experience with eToro in Mexico.

Evaluating Customer Support Services Provided by the Company in Mexico

Customer support services are an important part of any trading platform, and eToro is no exception. In this article, we will explore the customer support services provided by eToro in Mexico. We will look at how responsive their customer service team is to inquiries, what types of assistance they offer, and whether or not they provide multilingual support. Additionally, we will assess the overall quality of their customer service and determine if it meets the needs of Mexican traders. By evaluating these aspects of eToro’s customer service offerings in Mexico, we can gain a better understanding of how well-equipped they are to meet the needs of their customers in this region.

Making Use of Educational Resources to Improve Your Knowledge About Trading With Etor

The world of trading with eToro in Mexico can be a daunting prospect for many. Fortunately, there are plenty of educational resources available to help you become more knowledgeable about the process and make informed decisions when it comes to your investments. In this article, we will explore some of these resources and how they can help improve your knowledge about trading with eToro in Mexico.

One great resource is the official website for eToro Trading in Mexico. Here you will find detailed information on how to open an account, deposit funds, trade different assets, manage risk levels and much more. Additionally, the site also provides access to various educational materials such as webinars and tutorials that cover topics like understanding financial markets and developing a successful trading strategy.

Another valuable source of information is online forums dedicated to discussing trading strategies or sharing experiences related to investing through eToro in Mexico. By participating in these conversations you can gain insights from experienced traders who have already gone through similar processes before you do so yourself. This way you can learn from their mistakes while avoiding them yourself at the same time!

Finally, there are numerous books written by experts on the subject which provide useful advice on topics such as money management techniques or psychological aspects involved with trading that should not be overlooked either. Reading up on these topics could give you a better understanding of what’s involved when it comes time for making actual trades using real money through eToro Trading in Mexico!

By taking advantage of all these educational resources available out there today, anyone interested in exploring the world of eToro Trading in Mexico should be able to build up their knowledge base quickly and start making profitable trades soon enough!

| Feature | eToro Trading | Other Platforms |

|---|---|---|

| Fees & Commissions | Low fees and commissions for trading. No additional costs for deposits or withdrawals. Commission-free trades on certain markets, such as stocks and ETFs. Leverage available up to 1:30 on select markets. Competitive spreads with no hidden charges. | Higher fees and commissions than eToro Trading in most cases, including deposit/withdrawal fees, higher spreads, etc. Limited leverage options available in some cases (e.g., Forex). |

| Range of Markets Available | Wide range of markets available to trade – stocks, indices, commodities, cryptocurrencies and more! Access to unique features like CopyTrader™ that allow you to copy the strategies of experienced traders automatically without having any prior knowledge about trading yourself. Ability to invest in CFDs (Contracts For Difference) which are derivatives products that enable investors to speculate on the price movements of an underlying asset without actually owning it themselves. Limited range of markets compared with eToro Trading – typically only offering a handful of popular assets such as Forex pairs or US equities rather than access to multiple global exchanges like eToro does . Fewer special features offered by other platforms when compared with those provided by eToro Trading such as CopyTrader™ or CFD investing capabilities . | |

| Security & Regulation Highly regulated platform providing secure environment for users’ funds through its partnership with leading financial institutions across Europe and beyond . Comprehensive customer protection measures in place including segregated accounts , negative balance protection , investor compensation schemes , Know Your Customer (KYC) processes etc . Generally less regulation applied when compared with other platforms due to their smaller size / lack of resources allocated towards compliance matters . Lower levels of security / customer protection may be present depending upon the jurisdiction where they operate from so always check before signing up! |

What types of investments are available through eToro in Mexico?

eToro offers a wide range of investment options in Mexico, including stocks, commodities, ETFs, indices, and cryptocurrencies. Additionally, eToro also offers copy trading services that allow users to replicate the trades of experienced traders.

How does the trading process work on eToro for Mexican investors?

The trading process on eToro for Mexican investors is similar to that of other investors. To begin, the investor will need to open an account with eToro and deposit funds into it. Once this is done, they can start trading by selecting a financial instrument (such as stocks, currencies or commodities) and placing a buy or sell order. The orders are then executed in real-time according to market conditions. Investors can also use various tools such as charts and technical analysis indicators to help them make informed decisions about their trades. Additionally, Mexican investors may benefit from features such as copy trading which allows them to follow experienced traders’ strategies automatically.

Are there any fees associated with using eToro in Mexico?

Yes, there are fees associated with using eToro in Mexico. These include a commission fee for each trade and an overnight fee if you hold your position open for more than one day. There may also be other fees such as currency conversion charges and withdrawal fees.

Is it possible to trade cryptocurrencies on eToro in Mexico?

Yes, it is possible to trade cryptocurrencies on eToro in Mexico. eToro is a global trading platform that offers cryptocurrency trading services to users in Mexico and many other countries around the world.

Does eToro offer educational resources or tools to help Mexican traders become more successful?

Yes, eToro offers educational resources and tools to help Mexican traders become more successful. The platform provides a range of online tutorials, webinars, articles and videos in Spanish that can be used by Mexican traders to gain an understanding of the markets and how to trade effectively. Additionally, eToro also has a customer support team available in Spanish who are able to provide guidance on any queries or questions related to trading.

What safety measures are taken by eToro to protect its users’ funds and personal information when trading in Mexico?

eToro takes a number of measures to protect its users’ funds and personal information when trading in Mexico. These include:

- All user funds are held in segregated accounts with trusted financial institutions, ensuring that customers’ money is kept safe at all times.

- eToro uses advanced encryption technology to ensure the security of all customer data, including sensitive financial information such as bank account details and credit card numbers.

- The platform also has an extensive Know Your Customer (KYC) process which helps to verify the identity of each user before they can start trading on the platform, helping to prevent fraud and other illegal activities from taking place on the site.

- Finally, eToro also offers two-factor authentication for added security when logging into your account or making transactions online

Are there any restrictions that apply specifically to Mexican traders on the platform, such as minimum deposits or withdrawal limits?

No, there are no restrictions that apply specifically to Mexican traders on the platform. All traders have access to the same features and services regardless of their nationality or location. However, some payment methods may impose certain limits on deposits and withdrawals depending on the country of origin.

How has the popularity of online trading grown among Mexicans since the introduction of platforms like eToro into the market?

Since the introduction of platforms like eToro into the Mexican market, online trading has seen a significant increase in popularity among Mexicans. According to recent surveys, over 50% of Mexican investors now prefer to trade online rather than through traditional methods such as banks or brokers. This is largely due to the convenience and low cost associated with online trading platforms, which allow users to access global markets quickly and easily from their own homes. Additionally, many of these platforms offer educational resources and guidance for novice traders that make it easier for them to get started in investing.

05.05.2023 @ 13:46

Lo que es eToro Trading es una plataforma de trading en línea que permite a los usuarios comerciar una variedad de instrumentos financieros, incluyendo acciones, materias primas, divisas e índices. Ofrece a los usuarios la capacidad de copiar las carteras y estrategias de otros traders para diversificar sus inversiones. eToro también proporciona recursos educativos para aquellos interesados en aprender más sobre la inversión y el trading. En este artículo exploraremos cómo funciona eToro Trading en México y qué oportunidades presenta para los inversores mexicanos.

Los beneficios de eToro Trading en México incluyen tarifas bajas, accesibilidad, variedad de activos y recursos educativos. Además, su función de copia de trading es muy popular entre los usuarios, lo que les permite replicar automáticamente las operaciones realizadas por traders experimentados.

Para comenzar a utilizar eToro Trading en México, primero debe crear una cuenta en la plataforma proporcionando su información personal, como nombre, dirección de correo electrónico y número de teléfono. Luego, puede financiar su cuenta a través de transferencia bancaria o tarjeta de crédito / débito. Después de financiar su cuenta, puede comenzar a invertir en diferentes activos disponibles en la plataforma, incluyendo acciones, ETF, índices y criptomonedas como Bitcoin. También puede aprovechar los servicios de copia de trading, donde sigue automáticamente o manualmente las estrategias de traders experimentados.

Es importante tener en cuenta que antes de invertir cualquier dinero en eToro Trading, es mejor comprender todos los riesgos asociados con él y familiarizarse con las características ofrecidas por la plataforma, como las ratios de apalancamiento o las órdenes de stop loss, que son herramientas esenciales para gestionar el riesgo mientras se opera en línea. Además, asegúrese de leer sobre cualquier impuesto aplicable relacionado con las inversiones realizadas a través de eToro Trading en México antes de realizar cualquier operación para no incurrir en costos innecesarios en el futuro.

Finalmente, si en algún momento durante su aprendizaje sobre eToro Trading se siente abrumado o inseguro acerca de algo, siempre puede buscar ayuda de los representantes de servicio al cliente que