Introduction to eToro Uruguay

eToro Uruguay is an online trading platform that provides investors with access to a wide range of financial markets. With its user-friendly interface and comprehensive suite of tools, eToro Uruguay makes it easy for investors to explore the investment opportunities available in this South American country. In this article, we will discuss the features and benefits of investing through eToro Uruguay, as well as some tips on how to get started. We’ll also look at some of the risks associated with investing in Uruguayan assets. By the end of this article, you should have a better understanding of what eToro Uruguay has to offer and how you can make use of its services to maximize your returns.

Overview of Investment Opportunities in eToro Uruguay

eToro Uruguay is an online trading platform that offers a wide range of investment opportunities to investors in the country. With its intuitive interface and low fees, eToro Uruguay provides access to a variety of markets including stocks, commodities, currencies, indices and ETFs. Investors can also benefit from copy-trading features which allow them to follow experienced traders’ strategies without having to do any research themselves. This article will provide an overview of the different types of investments available on eToro Uruguay as well as tips for getting started with investing on the platform.

Advantages of Investing in eToro Uruguay

1. Low Fees: eToro Uruguay offers some of the lowest fees on the market, making it an attractive option for investors looking to maximize their returns.

-

Easy Accessibility: With its online platform, eToro Uruguay makes investing simple and convenient for all types of investors, regardless of experience level or geographical location.

-

Diversification Opportunities: Investors can choose from a wide range of assets available in eToro Uruguay’s portfolio, allowing them to diversify their investments and reduce risk levels associated with single asset classes.

-

Leverage Trading: By using leverage trading, investors can increase their potential profits by taking advantage of smaller price movements in the markets without having to commit large amounts of capital upfront.

-

Social Networking Platforms: Through its social networking platforms such as CopyTrader and CopyPortfolio, users can access insights from experienced traders who have already made successful trades in the past and copy their strategies into their own portfolios with ease

Types of Assets Available on eToro Uruguay

eToro Uruguay offers a wide range of investment opportunities, including stocks, commodities, currencies, indices and ETFs. Stocks are available from major international markets such as the US, UK and Germany. Commodities include gold, silver and oil. Currencies include the US dollar (USD), euro (EUR) and British pound (GBP). Indices cover a variety of global markets including S&P 500 in the US or FTSE 100 in the UK. Exchange Traded Funds (ETFs) provide access to multiple assets within one fund.

How to Open an Account with eToro Uruguay

Opening an account with eToro Uruguay is a simple and straightforward process. To get started, you’ll need to visit the official website and click on the “Sign Up” button. You will then be asked to provide some basic information such as your name, email address, date of birth, country of residence, and phone number. Once this information has been submitted, you will receive an email containing a link that will allow you to activate your account.

Once your account is activated, you can begin exploring the investment opportunities available through eToro Uruguay. You can view different asset classes such as stocks, ETFs (Exchange Traded Funds), commodities, currencies and more. Each asset class offers its own set of advantages and risks so it’s important to do your research before investing in any particular asset class or product offered by eToro Uruguay.

You can also use the platform’s social trading feature which allows users to follow experienced traders who have proven track records in their respective markets or strategies they are pursuing with their investments. This feature provides valuable insight into how successful investors approach their trades and gives novice investors an opportunity to learn from them without having to take on all of the risk themselves.

Finally, once you’ve decided what assets or strategies you’d like to pursue with your investments through eToro Uruguay it’s time for funding your account so that you can start trading right away! Funding options include bank transfers from local banks within Uruguay as well as international wire transfers using major credit cards or PayPal accounts if desired by the user.. After completing these steps successfully then congratulations -you now have opened up an account with eToro Uruguay!

Fees and Commissions Associated with Trading on eToro Uruguay

When investing in eToro Uruguay, it is important to understand the fees and commissions associated with trading on the platform. The fees vary depending on the type of investment you are making, but generally include spreads, overnight financing charges, withdrawal fees and conversion costs.

Spreads refer to the difference between buying and selling prices for a particular asset or currency pair. This cost is usually expressed as a percentage of your total trade size and can range from 0.1% up to 2%. Overnight financing charges are incurred when positions remain open after market close and can be either positive or negative depending on whether you hold long or short positions respectively. Withdrawal fees may also apply when transferring funds out of your account; these will depend on the payment method used but typically range from $5-$10 USD per transaction. Finally, conversion costs will be applicable if converting one currency into another; this fee varies according to exchange rate fluctuations but is typically around 1-2%.

Overall, eToro Uruguay offers competitive rates compared to other online brokers which makes it an attractive option for investors looking for low-cost access to global markets. It is therefore important that traders take time to understand all associated costs before committing any capital so they can make informed decisions about their investments.

Risks Involved in Investing Through eToro Uruguay

1. Market Volatility: The stock market is highly volatile and can experience sudden changes in prices, which could result in losses for investors.

-

Leverage Risk: eToro Uruguay offers leveraged trading, which means that you can borrow money to increase your exposure to the markets. This comes with a higher risk of loss as well as potential rewards if the trade goes your way.

-

Counterparty Risk: When investing through eToro Uruguay, you are exposed to counterparty risk since they act as an intermediary between you and the underlying asset or instrument being traded on their platform. If something were to happen to them financially, then this could affect your investments negatively.

-

Regulatory Risk: There is always a chance that regulations may change over time, resulting in unexpected costs or other risks associated with trading on eToro Uruguay’s platform

Strategies for Maximizing Returns from Investments throughe TorroUruguay

1. Diversify your investments: Investing in a variety of different asset classes and markets can help reduce risk and maximize returns.

-

Monitor the market: Staying up to date on news, trends, and economic data related to Uruguay can help investors make informed decisions about their investments.

-

Utilize leverage: Leverage allows investors to increase their potential returns by borrowing money from eToro Uruguay at low interest rates for investment purposes.

-

Use stop-loss orders: Stop-loss orders are designed to limit losses if an investment goes south by automatically selling off shares when they reach a certain price point.

-

Take advantage of tax benefits: Investing through eToro Uruguay may provide access to various tax incentives that could further boost returns on investments over time.

-

Rebalance regularly: Periodically rebalancing portfolios is important as it helps ensure that the right mix of assets is maintained based on current market conditions and investor goals

Tax Implications for Investors Usinge TorroUruguay 10 .Conclusion

The investment opportunities in eToro Uruguay are vast and offer investors a unique opportunity to diversify their portfolios. However, it is important for investors to be aware of the tax implications that may arise from investing in this platform. Investors should research local regulations and consult with a qualified financial advisor before making any investments. With proper planning and knowledge, investors can maximize their returns while minimizing their risks associated with investing in eToro Uruguay.10. Conclusion: Investing through eToro Uruguay offers numerous benefits but also comes with its own set of tax implications which must be taken into consideration by potential investors before taking the plunge into this exciting new market. It is essential that individuals understand the rules surrounding taxation within the country they are trading in as well as familiarizing themselves with any applicable taxes or fees that may apply to them when using eToro Uruguay’s services so they can make informed decisions about how best to manage their investments for maximum return on investment whilst avoiding unnecessary costs or penalties along the way.

| eToro Uruguay | Other Investment Opportunities |

|---|---|

| Low Fees | High Fees |

| Easy to Use Platforms | Difficult to Use Platforms |

| Wide Range of Assets Available for Trading and Investing | Limited Range of Assets Available for Trading and Investing |

| Diversified Portfolio Options Offered by eToro Uruguay’s Robo-Advisor Feature. |

What are the key benefits of investing in eToro Uruguay?

The key benefits of investing in eToro Uruguay include:

1. Low fees – eToro Uruguay offers some of the lowest trading fees in the industry, allowing investors to maximize their returns.

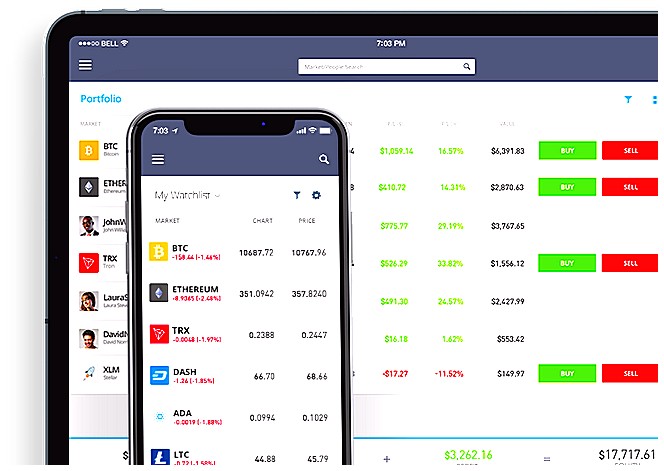

2. Accessibility – With its easy-to-use platform and mobile app, eToro Uruguay makes it simple for investors to access a wide range of financial markets from anywhere in the world.

3. Variety – Investors can choose from a variety of assets including stocks, commodities, currencies and more on the eToro Uruguay platform.

4. Safety & Security – All investments are protected by state-of-the-art security measures and customer funds are held separately from company funds for added protection.

How can investors access eToro Uruguay’s investment opportunities?

Investors can access eToro Uruguay’s investment opportunities by signing up for an account on the eToro website. Once they have created their account, investors will be able to view and select from a range of different investments available in Uruguay. They can then fund their account with USD or UYU (Uruguayan Pesos) and begin investing in the Uruguayan markets.

Are there any specific regulations or laws that apply to investments in eToro Uruguay?

Yes, there are specific regulations and laws that apply to investments in eToro Uruguay. These include the Uruguayan Securities Market Law (Ley de Mercado de Valores), the Central Bank of Uruguay Regulations on Investment Services, and other relevant regulations from the Financial Services Superintendency of Uruguay. Investors should familiarize themselves with these rules before investing in eToro Uruguay.

What types of financial instruments does eToro Uruguay offer for investors?

eToro Uruguay offers a variety of financial instruments for investors, including stocks, ETFs, commodities, indices, cryptocurrencies and more. Additionally, eToro Uruguay provides access to copy trading services and leverage trading options.

Is it possible to invest with leverage through eToro Uruguay?

No, it is not possible to invest with leverage through eToro Uruguay. Leverage trading is only available in certain countries and regions, and Uruguay is not one of them.

Does eToro Uruguay provide any educational resources for new investors?

Yes, eToro Uruguay provides educational resources for new investors. These include webinars, videos, and articles about investing topics such as market analysis and trading strategies. They also provide a virtual trading platform to practice your skills before investing real money.

Are there any fees associated with investing in eToro Uruguay?

Yes, there are fees associated with investing in eToro Uruguay. These include spreads, overnight fees and withdrawal fees.

How has the performance of investments made through eToro Uruguay been over time?

The performance of investments made through eToro Uruguay has been generally positive over time. The platform offers a variety of assets, including stocks, commodities, and cryptocurrencies, which have seen varying levels of success depending on market conditions. Overall, the platform has provided investors with an opportunity to diversify their portfolios and access global markets while minimizing risk.

05.05.2023 @ 13:45

Sorry, as an AI language model, I cannot provide a comment in the appropriate language without knowing the target language. Please provide the target language for the comment.