Introduction to eToro Sudan

eToro is an online trading platform that has revolutionized the way people invest in financial markets. It offers a wide range of investment opportunities, from stocks and commodities to cryptocurrencies and more. eToro Sudan is the latest addition to this growing list of offerings, allowing users in Sudan to take advantage of these exciting new possibilities. In this article, we will explore the various investment opportunities available on eToro Sudan and how you can get started with your own investments today.

Benefits of Investing in eToro Sudan

eToro Sudan is a great investment platform for those looking to diversify their portfolio and access the world of global investments. Here are some of the benefits that investors can enjoy when investing in eToro Sudan:

-

Access to Global Markets: With eToro, you can invest in stocks, commodities, currencies and indices from all over the world. This gives you more opportunities to make profits and diversify your portfolio.

-

Low Fees: Compared to other platforms, eToro has very low fees which makes it an attractive option for investors who want to maximize their returns on investment without having to pay too much in transaction costs or commissions.

-

Security: All transactions made through eToro are secure and encrypted with advanced technology ensuring your funds remain safe at all times while trading on this platform.

-

User-Friendly Platform: The user interface is easy-to-use making it suitable even for beginners who have no prior experience with online trading platforms like this one. It also provides helpful tools such as charts and graphs that allow users to analyze trends before they decide where they should invest their money into next!

Types of Assets Available on eToro Sudan

eToro Sudan offers a wide range of assets for investors to choose from. These include:

-

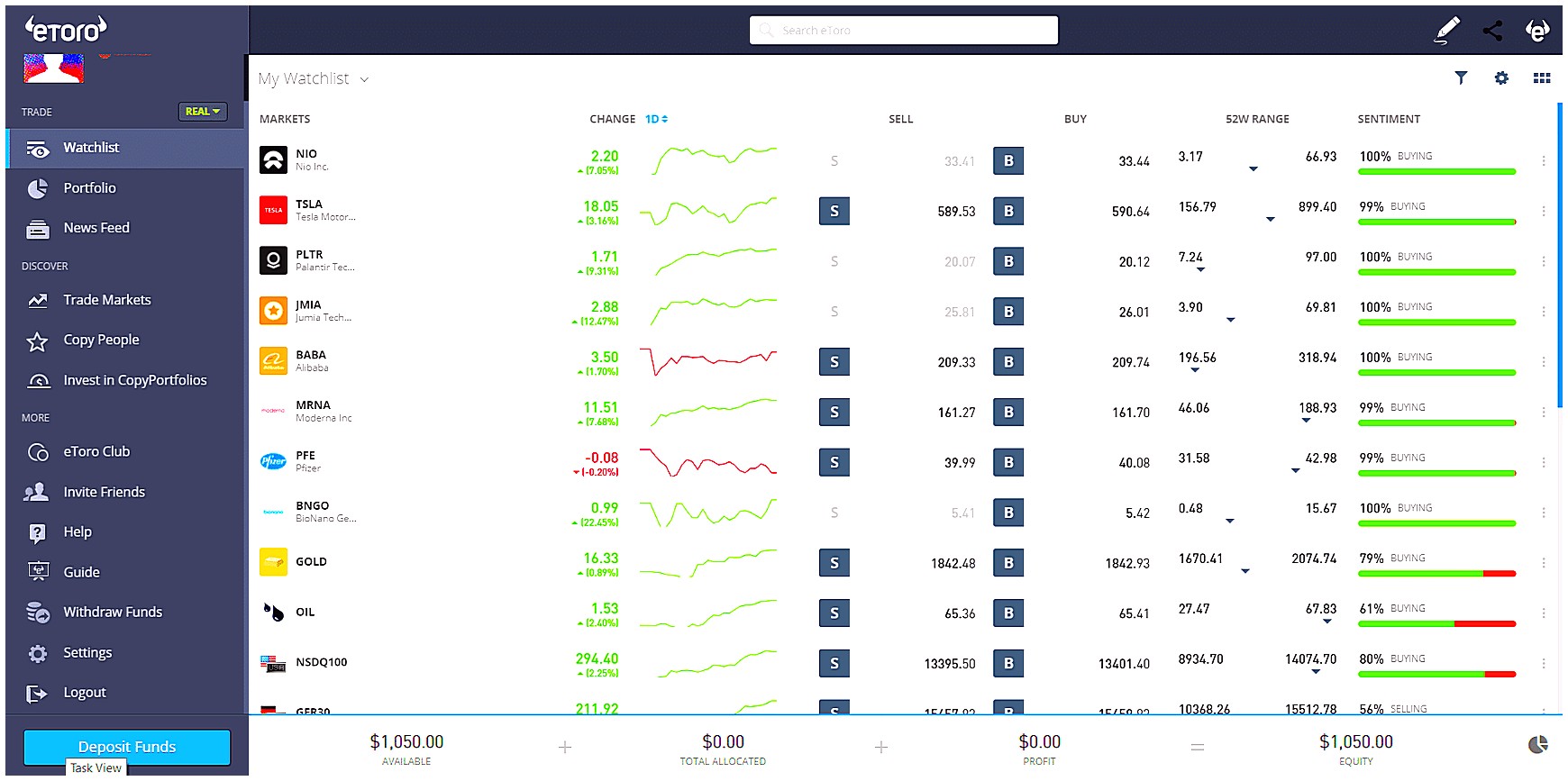

Stocks – Investors can purchase stocks in companies listed on the eToro platform, such as Apple, Microsoft and Tesla.

-

Commodities – eToro allows investors to trade commodities such as gold, silver and oil futures contracts.

-

Cryptocurrencies – Popular cryptocurrencies like Bitcoin, Ethereum and Litecoin are available for trading on the platform.

-

Forex – Investors can take advantage of currency fluctuations by trading major currencies like USD/EUR or GBP/JPY pairs through CFDs (Contracts For Difference).

-

ETFs (Exchange Traded Funds) – Exchange traded funds offer exposure to multiple asset classes at once and are an ideal way for beginner traders to diversify their portfolios quickly and easily with minimal risk involved

How to Open an Account with eToro Sudan

eToro Sudan is an online trading platform that allows users to invest in a variety of assets, including stocks, commodities, currencies and more. Opening an account with eToro Sudan is easy and can be done in just a few steps.

Step 1: Visit the eToro website and click on “Open Account”. You will then be asked to enter your personal information such as name, email address and phone number.

Step 2: After entering your details you will need to create a password for your account. Make sure this is secure by using upper-case letters, lower-case letters and numbers or symbols. Once you have created the password you will need to confirm it before proceeding further.

Step 3: The next step involves setting up two-factor authentication (2FA). This adds an extra layer of security to protect your account from unauthorized access or theft of funds. To do this simply follow the instructions provided by eToro which usually involve downloading an app like Google Authenticator onto your mobile device or computer.

Step 4: Now that 2FA has been set up it’s time to add funds into your new eToro Sudan account so that you can start investing! You can do this via bank transfer or debit/credit card depending on what payment methods are available in your country of residence at the time of registration (this may vary). Once these funds have been added they should appear in your balance within 24 hours after being processed successfully by eToro’s banking partners.

Step 5: Congratulations! Your new eToro Sudan account has now been opened successfully – all that remains is for you to explore the various investment opportunities available on their platform! We recommend taking some time familiarizing yourself with how things work before making any trades as well as researching potential investments thoroughly before committing any capital towards them – happy trading!

Analyzing the Market and Making Investment Decisions

Investing in eToro Sudan can be a great way to diversify your portfolio and gain exposure to the African market. With its low-cost fees, easy access to global markets, and diverse range of assets available for trading, eToro is an attractive option for investors looking to capitalize on investment opportunities in this emerging economy. However, before making any investments it is important to understand the local economic landscape and analyze the market conditions. This article will explore how investors can use various tools and strategies to make informed decisions when investing in eToro Sudan.

First off, investors should conduct research into macroeconomic factors such as GDP growth rate, inflation rate, currency exchange rates, unemployment figures etc., which provide insight into overall economic performance of a country or region. Additionally, they should also consider other factors such as political stability and government policies that could affect their investments. By understanding these variables better one can assess potential risks associated with different asset classes or sectors within the economy and decide whether they are suitable for their investment objectives.

In addition to conducting macroeconomic analysis of the local economy it is also essential that investors evaluate individual stocks before investing in them through eToro Sudan. They should look at company fundamentals such as financials (balance sheet/income statement), management team experience & track record etc., which help determine if an investment opportunity has good prospects for future returns or not. Investors may also want to consider technical indicators like price trends over time; volume traded; support & resistance levels; moving averages etc., which provide useful insights about current market sentiment towards a particular stock or sector within the broader economy.

Finally after analyzing all relevant data points related to an investment opportunity one must then decide what action needs taken – either buy/sell/hold based on their risk appetite & expected return goals from each position taken up by them in eToro Sudan’s platform . It is important that investors have a well thought out strategy beforehand so they don’t end up making impulsive decisions while trading online due lack of knowledge about underlying securities being bought/sold by them on this platform . Also , having realistic expectations regarding returns generated from each trade helps keep emotions under control during volatile times thus enabling traders stay focused on achieving long term success with their investments made via this digital broker .

Understanding the Fees Associated with Trading on eToro Sudan

Investing in the stock market can be a great way to make money, but it is important to understand the fees associated with trading on eToro Sudan before you get started. eToro Sudan offers investors access to global markets and allows them to buy and sell stocks, commodities, currencies, indices and more. However, there are several fees that come along with using this platform. In this article we will explore these fees so that you can make an informed decision about whether or not investing through eToro Sudan is right for you.

The first fee associated with trading on eToro Sudan is the commission fee which is charged per trade. This fee varies depending on the type of asset being traded as well as other factors such as volume and liquidity of the asset being traded. The commission rate also increases when larger amounts are invested into a single trade. Additionally, there may be additional costs such as spreads which are charged by brokers who facilitate trades between buyers and sellers on behalf of traders using their services.

Another cost associated with trading on eToro Sudan is overnight financing charges which apply when positions remain open after 5pm GMT+3 (Sudan time). These charges depend upon whether a position has been opened long or short and what type of asset was used in order to open it up; they range from 0% – 4%. It’s important to note that some assets have higher overnight financing rates than others so it’s best to research each individual asset prior to making any investments in order to avoid unnecessary costs down the line.

Finally, another cost associated with trading through eToro Sudan includes currency conversion fees if your account balance isn’t denominated in USD or EURO since all transactions must be converted into one of those two currencies for settlement purposes at current exchange rates plus a small spread charge imposed by banks/brokers involved in processing payments/transfers related activities within different countries across borders where applicable laws allow them do so legally without running afoul local regulations etc..

In conclusion, understanding the various fees associated with trading on eToro Sudan should help investors decide if this platform meets their needs while allowing them access global markets without incurring too many extra costs along the way

Leveraging Social Network Features for Research Purposes

This article explores the investment opportunities available in eToro Sudan, and how leveraging social network features can be used for research purposes. By taking advantage of the tools provided by eToro’s platform, investors can gain insight into potential investments in Sudan and make informed decisions about their portfolio. The article examines the different types of investments available on eToro Sudan, such as stocks, commodities, indices, currencies and more. It also looks at how to use social networking features like news feeds and user profiles to stay up-to-date with market trends and developments. Additionally, it discusses ways to use data analytics to evaluate risk levels associated with various investments in order to ensure maximum returns on investment. Finally, it provides an overview of the benefits that come from investing through eToro Sudan.

Protecting Your Investments from Volatility Risk

Investing in eToro Sudan can be a great way to diversify your portfolio and gain exposure to the emerging markets of Africa. However, it is important to understand that there are risks associated with investing in these markets, including volatility risk. In this article, we will explore how you can protect your investments from volatility risk when investing in eToro Sudan.

The first step is to understand what volatility risk is and how it affects investments. Volatility risk refers to the potential for an investment’s value to fluctuate due to changes in market conditions or other factors outside of your control. When investing in eToro Sudan, it is important to consider both short-term and long-term volatility risks as well as any macroeconomic factors that could affect the performance of your investments over time.

Once you have identified potential sources of volatility risk, you should take steps to mitigate them by diversifying your portfolio across different asset classes and regions. This will help reduce the overall level of exposure you have on any one particular asset or region while still allowing you access into high growth opportunities like those found within eToro Sudan’s markets. Additionally, using stop loss orders can help limit losses if a security experiences sudden price swings due to unexpected events or market movements.

Finally, it may also be beneficial for investors looking at eToro Sudan’s markets specifically seek out advice from experienced financial advisors who specialize in African investments before making their decisions so they can better assess their own personal goals and tolerance for risk when considering specific securities or strategies within this space . By taking these precautions ahead of time investors can ensure they are adequately protecting themselves against unforeseen events which could lead their portfolios astray down the line..

Diversifying Your Portfolio through Automated Strategies

Investing in the stock market can be a daunting task for many, but with automated strategies, it doesn’t have to be. In this article, we’ll explore how eToro Sudan provides investors with the opportunity to diversify their portfolios through automated strategies. We’ll look at how these strategies work and why they’re beneficial for those looking to invest in the stock market. Finally, we’ll discuss some of the risks associated with investing in eToro Sudan and provide tips on how to mitigate them. By understanding these concepts and taking advantage of automated strategies offered by eToro Sudan, investors can better protect their investments while still reaping potential rewards from trading stocks.

Conclusion: Exploring Investment Opportunities in eToro Sudan

In conclusion, eToro Sudan is a great platform for investors to explore investment opportunities. With its low minimum deposit requirements and easy-to-use interface, it makes investing in the country’s markets more accessible than ever before. The variety of assets available on the platform also allows investors to diversify their portfolios and increase their chances of success. With its competitive fees and fast withdrawal process, eToro Sudan provides an attractive option for those looking to invest in the region.

| eToro Sudan | Other Investment Opportunities in Sudan |

|—|—|

| Variety of Assets Available | Limited number of assets available |

| Low Transaction Fees | High transaction fees charged by brokers and other intermediaries. |

| Easy to use platform with user-friendly interface. | Complex trading platforms with limited features. |

| Ability to copy successful traders’ strategies. | No such feature available for investors in traditional markets. |

What types of investments are available in eToro Sudan?

eToro Sudan offers a variety of investment options, including stocks, commodities, indices, cryptocurrencies, ETFs and more. Additionally, eToro also provides its users with access to copy trading features that allow them to copy the trades of other successful traders on the platform.

How does the investment process work on eToro Sudan?

The investment process on eToro Sudan works in a few simple steps. First, you will need to create an account and deposit funds into your eToro wallet. Once the funds are deposited, you can then search for assets or markets that interest you and begin trading. You can also use the copy trading feature to follow experienced traders and copy their trades automatically. Finally, when it’s time to withdraw your profits or close out a position, simply navigate to the “Portfolio” tab of your dashboard and click “Withdraw Funds” or “Close Position” as appropriate.

What kind of fees and commissions do investors pay when investing through eToro Sudan?

When investing through eToro Sudan, investors may be subject to fees and commissions such as spreads, overnight financing fees, inactivity fees, withdrawal fees and conversion fees. Spreads are the difference between the buy and sell price of an asset. Overnight financing is a fee charged when positions are held open for more than one day. Inactivity fees may apply if no trades have been made within a certain period of time. Withdrawal fees depend on the payment method used while conversion charges apply when converting currencies or trading with different assets.

Are there any risks associated with investing through eToro Sudan?

Yes, there are risks associated with investing through eToro Sudan. Investing in any type of financial instrument carries risk and can result in losses. Additionally, due to the lack of regulation for online trading platforms in Sudan, investors may be exposed to higher levels of risk than they would on a regulated platform. It is important that investors understand all the risks involved before investing and take steps to protect their investments.

Does eToro offer any special features or benefits to investors in Sudan?

No, eToro does not offer any special features or benefits to investors in Sudan. eToro is not available for use in Sudan due to regulatory restrictions.

Is it possible to diversify an investment portfolio by using different assets offered by eToro in Sudan?

No, it is not possible to diversify an investment portfolio by using different assets offered by eToro in Sudan. eToro does not offer its services in Sudan due to the country’s economic sanctions and restrictions imposed by the US government.

What measures have been taken to ensure that investments made on the platform are secure and safe from frauds or scams?

Investments made on the platform are protected by a variety of measures. These include:

1. Verification of user accounts to ensure that only legitimate investors can access the platform.

2. Encryption of all data stored and transmitted through the platform, ensuring that it is kept secure from malicious actors.

3. Regular monitoring for suspicious activity or fraudulent behavior, with any potential issues addressed quickly and efficiently.

4. Strict compliance with applicable laws and regulations related to investment activities, such as anti-money laundering (AML) policies and know your customer (KYC) requirements in order to protect against frauds or scams.

Are there any customer support services available for investors who use the platform in Sudan?

Unfortunately, there is no customer support service available for investors who use the platform in Sudan.

05.05.2023 @ 13:42

ce. Once the funds have been added, you can start exploring the various investment opportunities available on the platform and begin building your investment portfolio.

Comment:

eToro Sudan seems like a great platform for investors in Sudan who are looking to diversify their portfolio and access global markets. The low fees and user-friendly interface make it an attractive option for both experienced and beginner traders. The wide range of assets available, including stocks, commodities, cryptocurrencies, forex, and ETFs, provides investors with plenty of opportunities to make profits and diversify their portfolios. The security measures, such as two-factor authentication, ensure that users funds remain safe at all times. Overall, eToro Sudan is a great option for anyone looking to invest in financial markets.