Introduction to eToro and its Financial Opportunities in Luxembourg

Luxembourg is one of the most dynamic financial hubs in Europe, and it has become a hotbed for innovative investment opportunities. One such opportunity is eToro, an online trading platform that offers investors access to a wide range of markets from around the world. In this article, we will explore the financial opportunities available through eToro in Luxembourg and how you can get started investing with them. We will also discuss some of the key features that make eToro stand out from other online trading platforms. Finally, we will look at some tips on how to maximize your returns when using eToro in Luxembourg.

Overview of the Luxembourg Financial Market

Luxembourg is a small country located in the heart of Europe, but it has one of the most advanced and sophisticated financial markets in the world. Luxembourg’s financial market offers a wide range of investment opportunities for both domestic and international investors. The country is home to some of the largest banks in Europe, as well as many innovative fintech companies that are driving innovation within the sector. With its strong regulatory framework and access to European capital markets, Luxembourg provides an attractive environment for those looking to invest their money or start a business. In this article, we will explore how eToro can be used by investors based in Luxembourg to take advantage of these financial opportunities.

Benefits of Investing with eToro in Luxembourg

Luxembourg is an attractive destination for investors due to its favorable tax regime and robust financial infrastructure. eToro, a leading global investment platform, offers Luxembourg-based investors the opportunity to take advantage of this environment by investing in stocks, commodities, currencies and more. Here are some of the benefits that come with investing through eToro in Luxembourg:

-

Low Fees: eToro charges competitive fees on trades and investments which makes it an attractive option for those looking to maximize their returns.

-

Wide Range of Investment Options: With access to over 2,400 different assets from around the world including stocks, ETFs, cryptocurrencies and commodities you can diversify your portfolio across multiple asset classes without having to switch brokers or platforms.

-

Regulatory Compliance: All investments made through eToro are regulated by local authorities ensuring that all transactions comply with relevant laws and regulations protecting investor funds at all times.

-

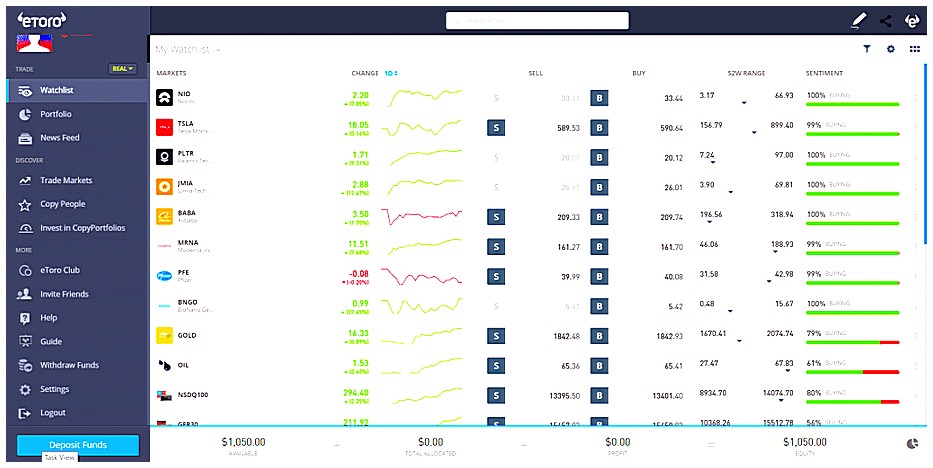

Innovative Trading Platforms: The intuitive trading platforms offered by eToro make it easy for beginners as well as experienced traders alike to manage their portfolios quickly and efficiently while taking advantage of real-time market data analysis tools such as charts and technical indicators enabling them to make informed decisions when trading or investing online.

Types of Assets Available on eToro for Investment in Luxembourg

eToro is a leading online trading platform that offers investors in Luxembourg access to a wide range of assets. On eToro, you can invest in stocks, commodities, currencies, indices and ETFs (Exchange Traded Funds). You can also trade cryptocurrencies such as Bitcoin and Ethereum. Additionally, you can diversify your portfolio by investing in copy portfolios or create your own with the CopyTrader feature.

Regulations and Fees Associated with Trading on eToro in Luxembourg

eToro is a popular online trading platform that allows users to trade in stocks, commodities, currencies and more. It has become increasingly popular in Luxembourg due to its user-friendly interface and competitive fees. In this article, we will explore the regulations and fees associated with trading on eToro in Luxembourg.

In order to use eToro for financial transactions within Luxembourg, traders must first register with the Commission de Surveillance du Secteur Financier (CSSF). This registration process involves submitting personal information such as name, address and date of birth along with proof of identity documents. Once registered, traders can begin using eToro’s services which include stock trading, CFD trading and cryptocurrency trading.

The fee structure for trades on eToro varies depending on the type of asset being traded but generally speaking it is quite competitive compared to other platforms available in Luxembourg. For example, when buying or selling stocks there is a 0% commission fee while CFDs have an average spread cost between 0.75%-1%. Cryptocurrency trades are subject to a 1% commission fee plus spreads which range from 0%-2%.

It is important for traders using eToro in Luxembourg to be aware of all applicable regulations regarding their investments before engaging in any kind of financial transaction through the platform. These regulations may include minimum capital requirements as well as limits on leverage ratios and margin levels set by the CSSF. Traders should also be aware that some assets may not be allowed for investment purposes under local laws or international agreements such as those related to anti-money laundering activities or sanctions imposed by certain countries against others.

In conclusion, investors looking into taking advantage of the financial opportunities offered by eToro should familiarize themselves with both its fees structure as well as any applicable regulations before engaging in any kind of transaction through this platform while based out of Luxembourg

How to Open an Account with eToro for Investment Purposes in Luxembourg

eToro is a popular online trading platform that offers investors in Luxembourg the opportunity to invest in stocks, commodities, currencies and other financial instruments. Opening an account with eToro is simple and straightforward. Here are the steps you need to take:

-

Visit the eToro website (www.etoro.com) and click on “Sign Up” at the top right corner of the page.

-

Enter your personal information such as name, address, email address and phone number into the form provided by eToro. You will also be asked to create a username and password for your account which you should keep secure at all times.

-

Select “Luxembourg” from the list of countries when prompted during registration process so that your account can be set up correctly for investment purposes in Luxembourg according to local regulations there..

-

Verify your identity by uploading a copy of an official government-issued ID such as passport or driver’s license along with proof of residence like utility bill or bank statement dated within 3 months prior to opening an account with eToro .

5 . Fund your new account using one of several payment methods available including credit/debit cards , PayPal , wire transfer etc . Once funds have been successfully transferred into your newly opened trading account , you are ready to start investing!

Tips for Successful Investing through eToro in Luxembourg

1. Start small and diversify your portfolio: Investing in a variety of different assets can help to spread risk and increase the potential for returns.

-

Research thoroughly before investing: It is important to research the asset you are interested in, including its past performance, market trends, and any associated risks.

-

Set realistic goals: Before investing it is important to set realistic expectations about what you hope to achieve from your investments over time.

-

Monitor your investments regularly: Regularly monitoring your investments will help you stay on top of changes in the markets that could affect their value or performance over time.

-

Consider using stop-loss orders: Stop-loss orders allow investors to limit losses by automatically selling an asset when it reaches a certain price point, helping protect against sudden market downturns or other unexpected events that could negatively impact investment values quickly.

-

Use leverage carefully: Leverage allows investors to amplify their gains but also amplifies losses as well; use caution when leveraging positions as this can lead to significant financial losses if not managed properly

Potential Risks Involved When Using eToro for Investments In Luxemburg

1. Market volatility: The markets are always changing and there is no guarantee that investments made through eToro will be profitable.

-

Leverage risk: Trading with leverage can increase the potential for profits, but it also increases the risk of losses if the market moves against you.

-

Regulatory risks: Luxembourg has a number of regulations in place to protect investors, but they may not apply to all investments made through eToro or other similar platforms.

-

Counterparty risk: When trading on an online platform like eToro, you must trust that your counterparty (the person or entity you are trading with) will act in good faith and honor their obligations under the contract.

-

Liquidity risk: If there is not enough liquidity in a particular asset class or instrument, it could become difficult to exit a position at an acceptable price level without incurring significant losses

Strategies to Maximize Profits from Trading on etoro In Luxemburg

1. Utilize Leverage: Using leverage allows traders to control larger positions with a smaller amount of capital, allowing them to maximize their profits from trading on eToro in Luxembourg.

-

Monitor Market Trends: Keeping up-to-date with the latest market trends can help traders make informed decisions and capitalize on profitable opportunities when they arise.

-

Diversify Your Portfolio: Investing in multiple assets can help spread risk and ensure that your portfolio is not too heavily exposed to any one asset class or sector, thus increasing the chances of making profits from trading on eToro in Luxembourg.

-

Set Stop Losses: Setting stop losses helps protect against potential losses by automatically closing out trades once they reach a certain level of loss or profit, helping traders minimize risks while maximizing returns from trading on eToro in Luxembourg.

-

Take Advantage of Copy Trading Features: The copy trading feature available on eToro allows users to follow experienced traders and mirror their strategies for greater success when trading on eToro in Luxembourg

Conclusion: Exploring the Financial Opportunities of etoro In Luxemburg

In conclusion, eToro offers a great opportunity for investors in Luxembourg to diversify their portfolios and access global markets. With its user-friendly platform, competitive fees, and wide range of assets available to trade, eToro is an attractive option for both experienced traders and those just starting out. Furthermore, the social trading feature allows users to copy the trades of other successful traders on the platform. All these features make eToro an ideal choice for anyone looking to take advantage of financial opportunities in Luxembourg.

| eToro | Other Financial Opportunities in Luxembourg |

|---|---|

| Easy to use platform for beginners and experienced traders alike. | Complex trading platforms with a steep learning curve. |

| Low minimum deposit requirement. | High minimum deposit requirements. |

| Variety of assets available to trade, including stocks, cryptocurrencies, commodities and indices. | Limited selection of assets available to trade. |

| Ability to copy successful traders’ strategies with CopyTrader feature. |

What types of financial opportunities does eToro offer in Luxembourg?

eToro offers a range of financial opportunities in Luxembourg, including the ability to invest in stocks, ETFs, commodities, indices and cryptocurrencies. Additionally, eToro also provides users with access to copy trading services which allow them to replicate the strategies of experienced traders. Finally, eToro also offers an array of tools and features such as market analysis and risk management tools.

How do the fees associated with eToro compare to other investment platforms?

The fees associated with eToro vary depending on the type of investment. Generally, eToro has lower trading fees than other investment platforms. For example, stocks and ETFs have no commission fee when traded on eToro while most other platforms charge a commission fee for these trades. Additionally, cryptocurrency trading is free on eToro while some other platforms may charge a small fee per trade. Finally, overnight financing fees are also lower on eToro compared to many other investment platforms.

Are there any restrictions on who can use eToro in Luxembourg?

Yes, there are restrictions on who can use eToro in Luxembourg. According to the official website, only individuals aged 18 or over with a valid residence in Luxembourg may open an account and use eToro services. Additionally, users must have sufficient knowledge and experience of trading financial instruments to understand the risks associated with trading them.

Does eToro provide any educational resources for investors in Luxembourg?

Yes, eToro provides educational resources for investors in Luxembourg. The company offers a range of online courses and webinars that cover topics such as trading strategies, market analysis, risk management and more. Additionally, the platform also has an extensive library of articles on investing and financial markets to help users gain knowledge about different aspects of trading.

What are the advantages and disadvantages of using eToro compared to other investment options available in Luxembourg?

Advantages of using eToro compared to other investment options available in Luxembourg:

1. Easy and convenient access to global markets – eToro allows users to invest in a wide range of assets, including stocks, ETFs, commodities, indices and cryptocurrencies from around the world. This gives investors more choice when it comes to diversifying their portfolios.

2. Low fees – Compared with traditional brokers or banks, eToro offers competitive fees for trading and investing on its platform.

3. CopyTrading feature – With this feature users can copy the trades of experienced traders automatically which helps them gain knowledge about different strategies without having to do all the research themselves.

4. Variety of payment methods – Users have multiple options when it comes to depositing funds into their accounts such as credit/debit cards, bank transfers or even PayPal if they prefer not to use traditional banking services.

Disadvantages of using eToro compared to other investment options available in Luxembourg:

- Limited asset selection – While eToro does offer a variety of assets for trading and investing there are still some that are not available on the platform such as mutual funds or bonds which may be found at other brokers or banks in Luxembourg instead..

- High minimum deposit requirement – The minimum deposit required by eToro is $200 USD which may be too high for some investors who would like smaller investments with lower risk levels associated with them . 3) Leverage restrictions – In order comply with regulations set by European regulators, leverage offered by Etoro is limited up 1:30 depending on what type asset you are trading .

Is it possible to open a joint account on eToro with another person from outside of Luxembourg?

Yes, it is possible to open a joint account on eToro with another person from outside of Luxembourg. eToro allows users to open joint accounts with up to five people, regardless of their location.

Does eToro have any special features or tools that make investing easier for people based in Luxembourg?

Yes, eToro has a range of special features and tools that make investing easier for people based in Luxembourg. These include the ability to access real-time market data from over 200 markets worldwide, as well as advanced charting tools and research materials. Additionally, users can take advantage of low spreads on popular assets such as stocks, indices, commodities and cryptocurrencies. eToro also offers 24/7 customer support in multiple languages including French which is spoken by many Luxembourgers.

Are there any risks associated with investing through eToro that investors should be aware of before signing up for an account?

Yes, there are risks associated with investing through eToro that investors should be aware of before signing up for an account. These include the risk of market volatility, the potential for loss of capital due to trading errors or poor decisions, and counterparty risk (the possibility that a third party will not fulfill their obligations). Additionally, eToro charges fees on trades which can reduce returns. It is important to research any platform thoroughly before committing funds.

05.05.2023 @ 13:44

ance du Secteur Financier (CSSF), which is the regulatory body responsible for overseeing financial activities in the country. This ensures that all transactions made through eToro are compliant with local laws and regulations.

As for fees, eToro charges a spread fee on trades, which is the difference between the buy and sell price of an asset. This fee varies depending on the asset being traded, but it is generally competitive compared to other online trading platforms. Additionally, eToro charges a withdrawal fee of $5 for each withdrawal made from the platform.

Overall, eToro offers investors in Luxembourg a wide range of financial opportunities with low fees, regulatory compliance, and innovative trading platforms. By diversifying your portfolio across multiple asset classes, you can maximize your returns and take advantage of the dynamic financial market in Luxembourg.