Introduction to eToro and the Spanish Financial Markets

The financial markets of Spain are a fascinating and complex landscape, offering investors the opportunity to explore a wide range of investment opportunities. In recent years, eToro has become one of the most popular online trading platforms in Spain for both retail and institutional investors. This article will provide an introduction to eToro and its services as well as discuss some of the unique features that make it an attractive option for Spanish traders. Additionally, we will look at some of the key aspects of investing in Spanish financial markets such as taxation rules, regulations, and market conditions. Finally, we will offer some tips on how to get started with trading on eToro in Spain.

Overview of the Popularity of eToro in Spain

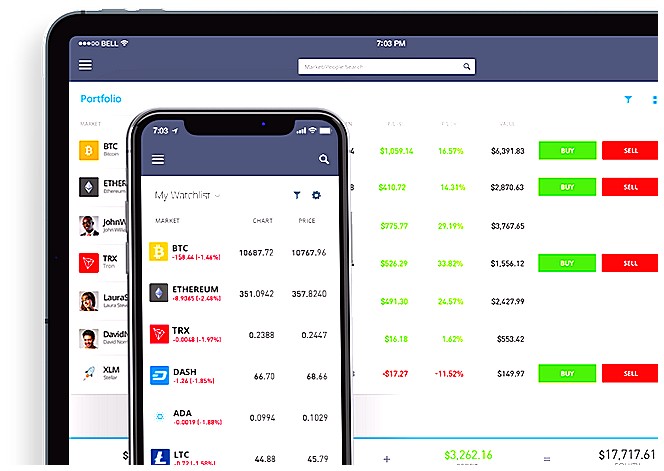

eToro is a popular online trading platform that has seen an increase in popularity among Spanish traders. With its user-friendly interface and low fees, eToro makes it easy for investors to access the financial markets of Spain. The platform offers a wide range of products, including stocks, commodities, currencies, indices and ETFs. Additionally, eToro provides educational resources such as tutorials and webinars to help new users get started with their investments. As more people become aware of the benefits of investing through eToro in Spain, its popularity continues to grow rapidly throughout the country.

The Benefits of Investing Through eToro in Spain

Investing through eToro in Spain offers a number of benefits to investors. For starters, the platform is easy to use and provides access to a wide range of financial markets. This makes it an ideal choice for both experienced and novice investors alike. Additionally, the platform also offers competitive fees, low commissions, and a variety of trading tools that can help you make informed decisions about your investments.

eToro also provides its users with access to real-time market data from around the world which allows them to stay up-to-date on global trends in the financial markets. Furthermore, eToro’s social trading feature enables traders to connect with other traders and share their experiences as well as insights into different strategies they may be using or considering using when investing in Spain’s financial markets.

Another benefit of investing through eToro is that it has been regulated by multiple regulatory bodies including CySEC (Cyprus Securities & Exchange Commission) and MiFID (Markets in Financial Instruments Directive). This ensures that all trades are conducted safely and securely while providing peace of mind for investors who are looking for reliable platforms on which they can invest their money without worrying about potential scams or frauds.

Finally, eToro also provides its users with customer support 24/7 so any questions or concerns regarding their investment experience can be addressed quickly and efficiently allowing them to focus more time on making sound investments rather than dealing with technical issues or customer service inquiries.

In conclusion, investing through eToro in Spain offers numerous advantages such as ease of use, competitive fees & commissions, real-time market data from around the world, regulation by multiple regulatory bodies & 24/7 customer support – making it an ideal choice for those looking at exploring Spain’s financial markets!

Types of Financial Instruments Available on eToro in Spain

The financial markets of eToro in Spain offer a wide range of different types of financial instruments for investors to choose from. These include stocks, ETFs, indices, commodities, currencies and cryptocurrencies. Additionally, traders can also access copy trading services which allow them to replicate the strategies used by other successful traders on the platform. This allows novice traders to benefit from the experience and knowledge of more experienced investors without having to invest large amounts of capital upfront.

How to Open an Account with eToro in Spain

Opening an account with eToro in Spain is a simple and straightforward process. All you need to do is follow these steps:

-

Visit the eToro website and click on “Sign Up”.

-

Enter your personal information, such as name, email address, date of birth, etc., into the form provided. You will also be asked to choose a username and password for your account.

-

Once you have completed the registration form, you will be asked to verify your identity by providing documents such as a passport or driver’s license. This step helps ensure that only legitimate users can open accounts with eToro in Spain.

-

After verifying your identity, you will be able to deposit funds into your new account using one of several methods available on the platform (such as credit card or bank transfer).

5 Finally, once all of this is done, you are ready to start trading! You can use the platform’s intuitive interface to search for stocks and other financial instruments that interest you and begin investing right away!

Regulations and Security Measures for Investors Using eToro in Spain

The financial markets of eToro in Spain offer investors a great opportunity to diversify their portfolios and access new investment opportunities. However, it is important for investors to be aware of the regulations and security measures that are in place when using eToro in Spain.

In order to protect investor funds, all investments made through eToro must comply with Spanish law. This includes having an appropriate level of risk management and ensuring that any transactions are conducted within the legal framework set out by the Financial Markets Authority (FMA). Additionally, all customer deposits must be held separately from company assets and protected against fraud or misappropriation.

Investors should also take steps to ensure their own safety when trading on eToro. It is recommended that users use strong passwords and two-factor authentication whenever possible. Furthermore, users should always verify the identity of anyone they interact with online before making any trades or transfers of funds.

Finally, investors should be aware that some products offered by eToro may not be suitable for everyone due to their complexity or risk levels involved. Therefore, it is important for individuals to understand how these products work before investing any money into them so as not to expose themselves unnecessarily to potential losses.

By following these regulations and security measures, investors can rest assured knowing that they are taking reasonable steps towards protecting themselves while trading on the financial markets of eToro in Spain

Strategies for Successful Trading on the Spanish Market with eToro

1. Research the Spanish Market: Before trading on the Spanish market with eToro, it is important to do your research and understand how the financial markets in Spain work. This includes understanding local regulations, tax laws, and other factors that could affect your trades.

-

Set Realistic Goals: When trading on any market, it is important to set realistic goals for yourself and be aware of potential risks associated with each trade. Be sure to have a plan in place before you start investing so that you can maximize profits while minimizing losses.

-

Utilize Social Trading Tools: eToro offers a variety of social trading tools such as CopyTrader which allows users to copy successful traders’ strategies or use their own strategies when trading on the Spanish market with eToro. This feature can help new traders learn from experienced ones while still allowing them to make their own decisions about what trades they want to make.

-

Monitor Your Trades Closely: It is important to keep an eye on your investments at all times so that you can react quickly if something unexpected happens in the markets or if one of your trades isn’t performing as expected. Monitoring your trades closely will also allow you to take advantage of any opportunities that may arise during volatile periods in the markets without taking too much risk at once.

5 . Diversify Your Portfolio: As with any investment strategy, diversifying your portfolio across different asset classes and regions will help reduce overall risk exposure while still allowing for potential gains over time from multiple sources of income streams

Fees Associated With Trading on the Spanish Market with eToro

When trading on the Spanish market with eToro, there are a few fees associated that traders should be aware of. The most common fee is the spread, which is the difference between the buy and sell price of an asset. This fee varies depending on the asset being traded and can range from 0.5% to 2%. In addition to this, overnight financing charges may apply if positions are held open for more than one day. These charges vary based on leverage used and can range from -0.0250% to 0.0499%. Lastly, there may also be withdrawal fees when withdrawing funds from your account or inactivity fees if you do not trade for a certain period of time.

Customer Support Services Offered bye Torro In Spain

eToro is a popular online trading platform that offers customers in Spain access to the financial markets. With eToro, Spanish traders can invest in stocks, ETFs, commodities, cryptocurrencies and more. As well as providing its users with an easy-to-use platform for investing, eToro also provides excellent customer support services. These include 24/7 live chat support from experienced professionals who are available to answer any questions or concerns about the platform and its features. Additionally, eToro has dedicated phone lines for Spanish customers so they can get help quickly if needed. The company also provides educational resources such as webinars and tutorials which provide valuable insights into how to make successful investments on the platform. Finally, eToro’s customer service team is always ready to assist with any account issues or technical problems that may arise while using their services.

| Feature | eToro | Other Financial Markets in Spain |

|---|---|---|

| Trading Platforms Available | Web, mobile app and desktop platform. | Varies by broker. |

| Tradable Assets | Forex, stocks, commodities, indices and cryptocurrencies. | Varies by broker. |

| Fees | Low spreads with no commission fees on most trades. | Varies by broker; may include commissions or other fees. |

What types of financial markets are available on eToro in Spain?

eToro offers a wide range of financial markets in Spain, including stocks, commodities, indices, ETFs, cryptocurrencies and currencies.

How does the trading process work on eToro in Spain?

The trading process on eToro in Spain is relatively straightforward. First, users must create an account and deposit funds into their account. Once the funds are deposited, users can then search for assets to trade and place orders to buy or sell them. When a user places an order, it will be matched with another user’s order of the same type (buy/sell) at the current market price. The transaction will then be executed automatically by eToro’s system, and the profits or losses from the trade will be credited to each user’s account balance accordingly.

What fees and commissions are associated with using eToro in Spain?

The fees and commissions associated with using eToro in Spain depend on the type of account you open. For a basic trading account, there is no commission fee for stock trades but there is a 0.09% spread fee applied to each trade. There are also overnight financing fees charged when positions are held overnight, as well as withdrawal fees and currency conversion fees if applicable.

Are there any restrictions or regulations when trading through eToro in Spain?

Yes, there are restrictions and regulations when trading through eToro in Spain. These include the following:

– All traders must be at least 18 years old.

– Spanish citizens can only trade CFDs on Forex, indices, commodities and stocks with leverage up to 1:30.

– Cryptoassets are not available for trading by Spanish citizens.

– A minimum deposit of €200 is required before opening a live account with eToro in Spain.

– Professional clients have access to higher levels of leverage (up to 1:400).

Is it possible to use leverage when trading through eToro in Spain?

Yes, it is possible to use leverage when trading through eToro in Spain. Leverage allows traders to open larger positions than they would be able to with their own capital alone, and can help increase potential profits or losses. eToro offers up to 30:1 leverage for retail clients in Spain, depending on the asset being traded.

Does the platform offer any educational resources for traders based in Spain?

Yes, the platform does offer educational resources for traders based in Spain. These resources include webinars, tutorials, and other materials to help traders learn more about trading and how to use the platform. Additionally, many brokers offer customer support services in Spanish so that traders can get assistance with any questions they may have.

Are there any special features that make trading through eToro more advantageous than other platforms for Spanish traders?

Yes, eToro offers a number of features that make it more advantageous for Spanish traders than other platforms. These include the ability to trade in multiple currencies, access to real-time market data and news updates, an intuitive user interface designed specifically for Spanish traders, and low fees. Additionally, eToro provides a range of educational resources and tools such as webinars and tutorials to help Spanish traders become more successful.

What customer support options are available to users of the platform located within Spain?

The customer support options available to users of the platform located within Spain depend on the specific platform. Generally, most platforms offer a variety of customer support options such as email, phone, live chat, and social media. Additionally, some platforms may also offer in-person or online workshops and seminars for customers located in Spain.

05.05.2023 @ 13:42

tors, while also providing an opportunity for experienced traders to earn additional income by sharing their strategies with others. Overall, eToro provides a comprehensive range of financial instruments that cater to the diverse needs of investors in Spain. Its user-friendly interface, low fees, and educational resources make it an attractive option for both novice and experienced traders looking to explore the financial markets of Spain. Additionally, its regulation by multiple regulatory bodies and 24/7 customer support provide peace of mind for investors who are looking for a reliable and secure platform on which to invest their money.