Introduction to eToro in Switzerland

Switzerland is known for its strong economy and financial stability, making it an ideal destination for those looking to explore the world of online trading. eToro is a popular platform that allows users to trade in stocks, commodities, currencies, indices and more. In this article we will take a look at how eToro works in Switzerland and what advantages it offers investors from the country. We’ll also discuss some of the key features that make eToro so attractive to Swiss traders. Finally, we’ll provide tips on how best to get started with eToro in Switzerland.

Overview of the Swiss Financial Market

This article explores the financial markets of eToro in Switzerland. It provides an overview of the Swiss financial market, its features and benefits, as well as how to get started trading on eToro in Switzerland. The Swiss financial market is one of the most developed and secure markets in Europe. With a strong banking system, low taxes, and a stable political environment, it has become an attractive destination for investors looking to diversify their portfolios. Additionally, due to its advanced technology infrastructure and regulatory framework, traders can benefit from high liquidity levels and competitive spreads when trading on eToro’s platform. This article will provide insight into what makes the Swiss financial market so attractive for investors and traders alike.

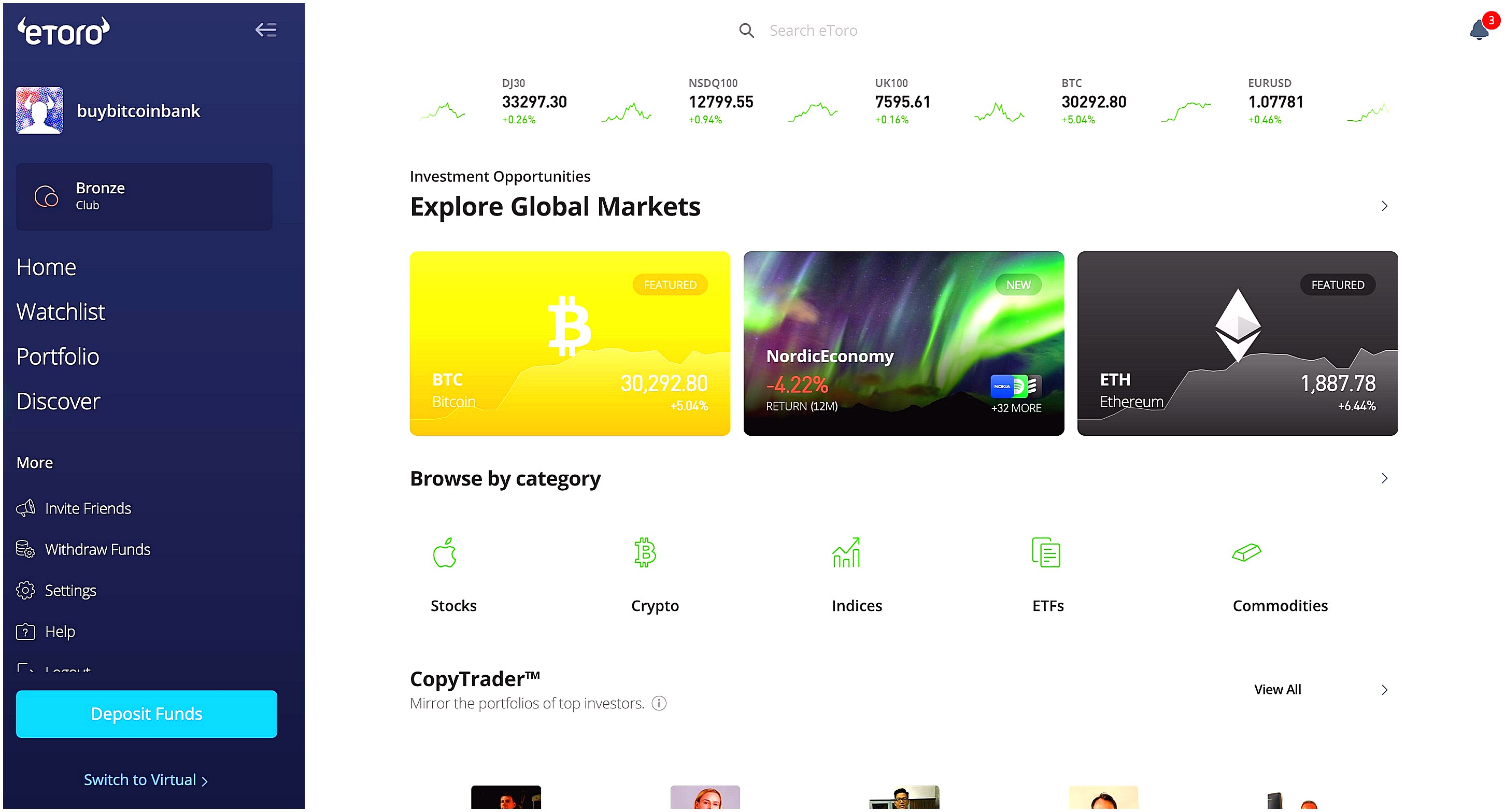

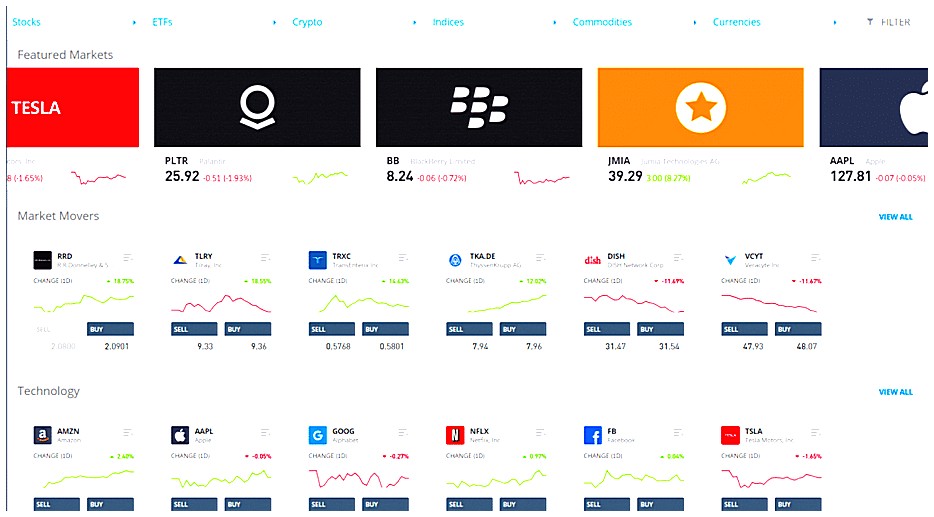

Types of Assets Available on eToro

eToro is a popular online trading platform that allows users to invest in the financial markets of Switzerland. With eToro, investors can access a wide range of assets including stocks, indices, commodities, cryptocurrencies and more. Here are some of the types of assets available on eToro:

-

Stocks – Investors can buy and sell shares from Swiss companies listed on the SIX Swiss Exchange or other exchanges around the world.

-

Indices – Traders can speculate on movements in global stock market indices such as the SMI or SPI Indexes which track blue-chip stocks traded on the SIX Swiss Exchange.

-

Commodities – Popular commodities like gold, silver and oil are also available for trading with eToro’s CFD products allowing traders to go long or short depending on their outlook for these markets.

-

Cryptocurrencies – In addition to traditional asset classes, investors can also trade digital currencies such as Bitcoin (BTC), Ethereum (ETH) and Litecoin (LTC).

-

ETFs – Exchange Traded Funds provide exposure to multiple underlying assets at once making them an ideal choice for diversifying your portfolio without having to buy each individual asset separately

Understanding the Different Trading Strategies Used by Investors

eToro is a popular online trading platform in Switzerland that allows users to trade stocks, commodities, currencies and more. With its user-friendly interface and wide range of features, eToro has become a go-to choice for many investors looking to diversify their portfolios. But before investing your hard-earned money into the financial markets of eToro, it’s important to understand the different trading strategies used by investors. In this article we will explore some of the most common trading strategies employed by successful traders on eToro.

Day Trading: Day trading involves taking advantage of short term price movements in order to make quick profits. This strategy requires careful analysis of market trends and technical indicators in order to identify potential opportunities for buying or selling assets within a single day’s time frame. It can be risky but also very rewarding if done correctly as there are often large gains made from small investments when day trading successfully on eToro.

Swing Trading: Swing traders look at longer time frames than day traders do – typically several days or weeks – in order to capture larger price movements with less risk involved than day trading offers. This strategy is best suited for those who have an understanding of how markets move over time and can identify support/resistance levels which may signal an opportunity for entry or exit points during swings in prices between highs and lows throughout the week or month depending on your chosen timeframe .

Position Trading: Position traders take a longer view than swing traders do, typically holding onto positions anywhere from several months up to multiple years at a time depending on their investment goals and objectives with each position they take up. Position traders rely heavily upon fundamental analysis such as economic data releases, news events etc., rather than technical indicators like chart patterns which swing trades use extensively due to their shorter term outlooks compared with position trades’ long term ones .

Scalping: Scalpers seek out tiny profits from frequent trades usually lasting no more than minutes instead of hours like other strategies mentioned above might involve . They employ high frequency automated systems that allow them access liquidity pools quickly enough so they can enter & exit positions rapidly while making sure they don’t get stuck holding onto losing positions too long either – all while seeking out small gains here & there along the way which add up over time if done correctly .

As you can see there are many different ways one could approach investing through eToro’s financial markets; however it is important that you understand each strategy thoroughly before deciding which one works best for you based off your own individual needs & goals as an investor!

Leverage and Margin Requirements for Trading on eToro in Switzerland

eToro is a popular online trading platform that allows users to trade stocks, commodities, currencies and other financial instruments. The platform is available in Switzerland, allowing Swiss traders to access the global markets with ease. However, before beginning to trade on eToro in Switzerland it’s important for investors to understand the leverage and margin requirements associated with their trades.

Leverage allows traders to increase their buying power by borrowing money from eToro at an agreed rate of interest. Leverage can be used to open larger positions than would otherwise be possible using only the trader’s own capital. On eToro in Switzerland, leverage ratios range from 1:2 up to 1:400 depending on the asset being traded and account type held by the investor.

In addition to leveraging their positions, traders must also meet certain margin requirements when trading on eToro in Switzerland. Margin refers to a deposit of funds required by eToro as collateral against potential losses incurred while trading leveraged products such as CFDs or forex pairs. The amount of margin required depends upon several factors including account type and size of position taken but generally ranges between 2% – 5%.

By understanding both leverage and margin requirements associated with trading on eToro in Switzerland investors will be better equipped for success when entering into financial markets worldwide through this popular online broker

Benefits of Investing with eToro in Switzerland

Investing with eToro in Switzerland offers a variety of benefits to investors. Here are some of the advantages that come with investing through this platform:

-

Low Fees: eToro charges low fees for trading and managing investments, making it an attractive option for those looking to save money on their investments.

-

Variety of Investment Options: With eToro, you can invest in stocks, ETFs, cryptocurrencies, commodities and more – giving you access to a wide range of investment opportunities.

-

Easy Accessibility: The user-friendly interface makes it easy for anyone to start investing without needing prior knowledge or experience in the financial markets.

-

Social Trading Platform: With its CopyTrader feature, users can copy successful traders’ strategies and benefit from their expertise without having to do any research themselves. This allows beginners as well as experienced investors alike to take advantage of market trends quickly and easily.

5 . Safety & Security : All funds deposited into your account are protected by Swiss banking regulations which ensures your money is safe at all times .

The Risks Involved When Trading on eToro in Switzerland

Trading on eToro in Switzerland can be a great way to access the financial markets, but it is important to understand the risks involved. As with any type of investment, there are potential risks associated with trading on eToro. These include market volatility, liquidity risk and counterparty risk.

Market volatility refers to the fluctuations in prices that occur due to changes in supply and demand for an asset or security. This means that when you trade on eToro, your investments may increase or decrease in value quickly and without warning. It is important to be aware of this before investing as losses can occur rapidly if the market moves against you.

Liquidity risk occurs when there is not enough buying or selling interest for a particular asset or security at any given time which makes it difficult for traders to enter or exit positions quickly and easily. This could lead to large spreads between bid/ask prices which could result in significant losses if trades are executed at unfavorable prices.

Counterparty risk occurs when one party does not fulfill their obligations under a contract such as failing to deliver assets purchased by another party within agreed upon timelines. If this happens while trading on eToro, investors may incur significant losses depending on how much they have invested into the position prior to defaulting by the other party involved in the transaction.

It is essential that all traders understand these risks before engaging in trading activities through eToro Switzerland so they can make informed decisions about their investments and manage their portfolios accordingly

Analyzing the Volatility of Markets Traded Through eToro

The financial markets of eToro in Switzerland are a great way to gain exposure to the global economy. With access to stocks, commodities, currencies and more, investors can diversify their portfolios and take advantage of market movements. In this article we will explore how volatility affects these markets traded through eToro and what strategies traders can use to manage risk. We will analyze historical data from the Swiss stock exchange as well as other major exchanges around the world to assess levels of volatility over time. Additionally, we will discuss some tips for mitigating risk when trading on eToro’s platform. By understanding how volatility works in these markets, investors can make better informed decisions about their investments and maximize returns while minimizing losses.

Regulations Governing Investments through eToro in Switzerland

Switzerland is known for its financial stability and the quality of its banking system, making it an attractive destination for investors looking to diversify their portfolios. eToro, a leading online trading platform, offers users access to a wide range of global markets including stocks, commodities, indices and currencies. In this article we will explore the regulations governing investments through eToro in Switzerland.

The Swiss Financial Market Supervisory Authority (FINMA) is responsible for regulating all financial services providers operating in Switzerland. FINMA has set out specific rules that must be followed by those investing with eToro in Switzerland. These include:

- All clients must have a valid Swiss bank account and provide proof of identity before they can open an account with eToro;

- Clients are required to meet certain minimum capital requirements;

- All transactions must comply with anti-money laundering laws;

- The maximum leverage available on trades is limited to 1:50;

- Trading activity should not exceed 25% of total assets held at any one time; 6) Margin calls may be issued if positions become too large or losses exceed predetermined thresholds; 7) Clients are prohibited from engaging in short selling activities unless specifically authorized by FINMA; 8 )Clients must also adhere to other general investment guidelines as outlined by FINMA.

By adhering to these regulations, investors can ensure that their investments through eToro remain secure and compliant with Swiss law.

Conclusion: Exploring the Financial Markets of eToro in Switzerland

In conclusion, exploring the financial markets of eToro in Switzerland can be a great way to diversify one’s portfolio and take advantage of new opportunities. The platform offers a wide range of assets, including stocks, commodities, indices, ETFs and more. Furthermore, the user-friendly interface makes it easy for anyone to get started trading with confidence. With its competitive fees and customer support services available 24/7, eToro is an excellent choice for those looking to expand their investments into the Swiss market.

| Feature | eToro | Other Financial Markets in Switzerland |

|---|---|---|

| Trading Platforms | Web, Mobile & Desktop Apps | Mostly Online with some Brokerage Firms Offering Offline Services |

| Assets Traded | Stocks, Cryptocurrencies, Commodities & Forex | Stocks, Bonds, Mutual Funds and ETFs |

| Fees | Low Spreads & No Commission Fees | High Commission Fees for Stock Trading |

| Leverage | Up to 400:1 Leverage | Lower Leverages Depending on the Asset Type |

What types of financial markets are available on eToro in Switzerland?

eToro offers a variety of financial markets in Switzerland, including stocks, ETFs, commodities, indices, cryptocurrencies and more. Additionally, eToro also provides access to copy trading and social trading features.

How does the platform facilitate trading activities for investors in Switzerland?

The platform facilitates trading activities for investors in Switzerland by providing a secure and efficient way to access the Swiss stock market. It offers a wide range of features such as real-time quotes, advanced charting tools, customizable watchlists, portfolio tracking, and more. Additionally, it provides direct access to brokers and custodians for fast execution of trades with low fees. The platform also offers educational resources such as tutorials on investing strategies and risk management tools that help investors make informed decisions about their investments.

Are there any special regulations or restrictions that apply to traders using eToro in Switzerland?

Yes, there are special regulations and restrictions that apply to traders using eToro in Switzerland. Swiss residents must open a separate account with the Swiss subsidiary of eToro, as well as meet certain criteria such as minimum capital requirements and other investor protection measures. Additionally, trading on leveraged products is not allowed for Swiss residents.

What kind of customer support is provided by eToro for its Swiss customers?

eToro provides Swiss customers with a range of customer support options, including live chat, email and telephone support. Customers can also access the eToro Help Center for self-service solutions to common queries. Additionally, Swiss customers can access the eToro Community Forum to ask questions and receive advice from other users.

Is it possible to open a Swiss bank account through eToro’s platform?

No, it is not possible to open a Swiss bank account through eToro’s platform.

Does the platform offer any tools or resources to help investors better understand the financial markets of Switzerland?

Yes, the platform does offer tools and resources to help investors better understand the financial markets of Switzerland. These include market news, analysis, charts, research reports, and other educational materials. Additionally, many brokerages provide their own specialized resources for Swiss investments such as trading platforms with integrated research tools.

How secure is the data and funds stored on eToro’s servers located in Switzerland?

eToro’s servers located in Switzerland are highly secure. All data and funds stored on their servers are protected by state-of-the-art security measures, including encryption, firewalls, and physical security protocols. Additionally, eToro has a dedicated team of experts who monitor the system 24/7 to ensure that all customer information is kept safe from unauthorized access or manipulation.

Are there any fees associated with trading on eToro’s Swiss marketplaces?

Yes, there are fees associated with trading on eToro’s Swiss marketplaces. These include a commission fee for each trade and a spread fee that is applied to the price of the asset being traded. Additionally, some assets may have additional fees such as overnight financing charges or inactivity fees.

05.05.2023 @ 13:44

ategy involves analyzing market trends and technical indicators to identify potential opportunities for buying or selling assets over a longer period of time. It requires patience and discipline, but can be a good option for those who dont want to constantly monitor the markets. Position Trading: Position trading involves holding onto assets for a longer period of time, typically months or even years. This strategy is based on fundamental analysis of the underlying assets and their long-term potential for growth. It requires a strong understanding of the market and the ability to withstand short-term fluctuations in price. Ultimately, the key to successful trading on eToro is to find a strategy that works for you and stick to it. With its wide range of assets and user-friendly interface, eToro is a great platform for investors looking to explore the world of online trading in Switzerland.