Introduction to eToro Trading Platform

The eToro trading platform is a popular online investment and trading platform that has been gaining traction in Saudi Arabia. With its intuitive user interface, advanced tools, and comprehensive educational resources, it’s no wonder why so many investors are turning to the eToro platform for their investments. In this article, we will explore the features of the eToro trading platform in Saudi Arabia and how you can use it to your advantage. We will discuss topics such as account types available on the platform, fees associated with using it, how to open an account and more. By the end of this article you should have a better understanding of what makes eToro stand out from other platforms in Saudi Arabia.

Overview of the Saudi Arabian Market

This article explores the eToro trading platform and its potential for investors in Saudi Arabia. The eToro platform is a global social trading network that allows users to invest in stocks, commodities, currencies, and other financial instruments. In addition to providing access to international markets, the platform also offers educational resources and tools designed specifically for novice traders. This article will provide an overview of the Saudi Arabian market as well as how investors can use the eToro platform to their advantage when investing in this region. It will discuss topics such as market regulations, taxation policies, currency exchange rates, available investment products and more. Finally it will provide some tips on how to make successful trades using the eToro platform while taking into account regional considerations such as cultural norms and religious beliefs.

Benefits of Using eToro in Saudi Arabia

1. Easy Accessibility: eToro is an online trading platform that can be accessed from anywhere in Saudi Arabia with an internet connection, making it a convenient and accessible option for traders.

-

Low Fees: eToro has some of the lowest fees on the market, which makes it a great choice for investors who are looking to maximize their profits while minimizing their costs.

-

Wide Range of Assets: eToro offers a wide range of assets including stocks, commodities, indices, cryptocurrencies and more – allowing users to diversify their portfolios and access different markets around the world without having to open multiple accounts or use different brokers.

-

Copy Trading Feature: The copy trading feature allows users to automatically replicate other successful traders’ strategies by copying them directly into their own portfolio – eliminating the need for manual research and analysis when investing in unfamiliar markets or asset classes.

-

Advanced Trading Tools: With advanced charting tools and real-time data feeds available on its platform, eToro provides users with all the necessary information they need to make informed decisions about their investments quickly and accurately – enabling them to take advantage of short-term opportunities as soon as they arise in any given market

How to Get Started with eToro in Saudi Arabia

eToro is a popular online trading platform that has become increasingly popular in Saudi Arabia. With its user-friendly interface and wide range of features, it’s easy to see why traders from all over the world are turning to eToro for their trading needs. If you’re looking to get started with eToro in Saudi Arabia, here’s what you need to know:

-

Sign Up: The first step is signing up for an account on the eToro website. You will be asked to provide some basic information such as your name, email address and phone number. Once this is done, you can start exploring the platform and familiarizing yourself with its features.

-

Deposit Funds: To begin trading on eToro, you must deposit funds into your account using one of several accepted payment methods including credit/debit cards or bank transfers. It’s important to note that there may be fees associated with certain payment methods so make sure you read through all terms before making a deposit.

-

Choose Your Assets: Once your funds have been deposited into your account, it’s time to choose which assets you want to trade in (such as stocks, commodities or currencies). There are hundreds of different options available so take some time researching each asset before deciding which ones are right for you based on risk tolerance and goals .

4 Start Trading: Now that everything is set up and ready go ,you can start trading! Make sure that when placing trades ,you consider factors such as market volatility ,news events and technical analysis . Also remember not invest more than what can afford lose !

5 Monitor Performance : Finally , don’t forget monitor performance of trades by tracking them real-time . This way ,you’ll able stay informed about any changes in prices or trends happening within markets .

By following these steps ,you should now have a better understanding how get started with eToro in Saudi Arabia !

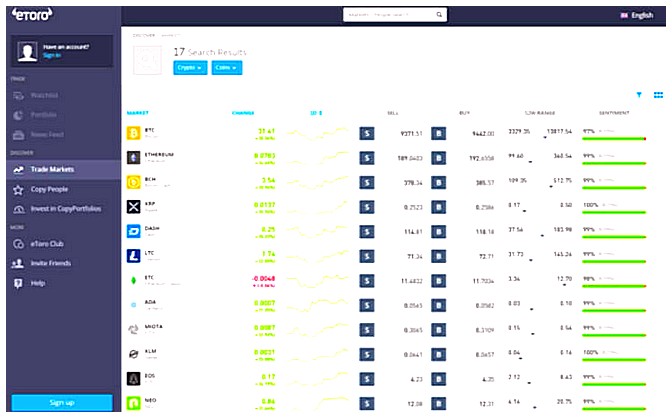

Understanding the Different Types of Assets Available on eToro

eToro is one of the most popular online trading platforms in Saudi Arabia. With its easy-to-use interface and wide range of assets, it has become a favorite among traders in the region. But before you start trading on eToro, it’s important to understand the different types of assets available on the platform. This article will explore some of these asset classes and explain how they can be used to make profitable trades.

The first type of asset available on eToro is stocks. Stocks are shares in publicly traded companies that represent ownership in those companies. By buying stocks, investors can gain exposure to various industries or sectors and benefit from their growth potential over time. On eToro, users can trade stocks from all major global exchanges including NASDAQ, NYSE, London Stock Exchange (LSE), Tokyo Stock Exchange (TSE) and more.

Another popular asset class offered by eToro is cryptocurrencies such as Bitcoin and Ethereum. Cryptocurrencies are digital currencies that use cryptography for security purposes which makes them attractive investments due to their high volatility and potential for quick gains or losses depending on market conditions at any given time. Investors should be aware that cryptocurrencies carry a higher risk than other asset classes so caution should always be taken when investing in this area regardless if using an online broker like eToro or not .

In addition to stocks and cryptocurrencies, there are also commodities such as gold, silver, oil etc., indices which track stock market performance across multiple countries/regions simultaneously; ETFs which allow investors to diversify into multiple markets with one single investment; forex currency pairs; options contracts; copy portfolios created by experienced traders; social trading where users can follow other successful traders’ strategies; plus much more!

By understanding the different types of assets available through eToro’s platform , Saudi Arabian investors have access to a world-class online trading experience with great opportunities for success .

Exploring Social and Copy Trading Features on eToro

The eToro trading platform is becoming increasingly popular in Saudi Arabia, and for good reason. With its wide range of features, it offers traders a unique way to invest in the markets. One of the most attractive aspects of this platform is its social and copy trading features. In this article, we will explore how these features work and why they are so beneficial for traders in Saudi Arabia.

Social trading allows users to follow experienced traders on the platform who have proven success with their strategies. This enables users to benefit from the experience and knowledge of more experienced investors without having to do all the research themselves. Copy trading takes things one step further by allowing users to automatically replicate another trader’s trades on their own account, thus benefiting from that trader’s strategy without having any prior knowledge or expertise about investing themselves.

These two features make eToro an ideal choice for novice investors looking to learn more about investing while still being able to participate in real-time market movements. By following successful traders on the platform, users can gain insight into different investment strategies as well as receive guidance on when it may be best to enter or exit certain positions within a portfolio. Additionally, copy trading provides an easy way for inexperienced investors who lack confidence or time constraints due to other commitments such as work or family life -to still be able take part in investments with minimal effort required from them directly..

Overall, eToro’s social and copy trading capabilities provide great opportunities for those looking get involved with investments but don’t necessarily have much experience doing so yet – making it an excellent choice for newbie investors based out of Saudi Arabia!

Leverage and Margin Requirements for Traders in Saudi Arabia

eToro is a popular online trading platform that has recently become available in Saudi Arabia. It offers traders the ability to trade stocks, currencies, commodities and more with ease. In this article, we will explore the leverage and margin requirements for traders in Saudi Arabia when using eToro.

Leverage allows traders to increase their potential returns by allowing them to open larger positions than they would be able to without it. Leverage can also amplify losses if trades go against you, so it’s important to understand how much leverage you are taking on before entering any position. On eToro, leverage is offered up to 1:30 for non-professional clients from Saudi Arabia on major currency pairs such as EUR/USD and GBP/USD. For other asset classes such as cryptocurrencies or indices, maximum leverage may vary depending on the instrument being traded.

In addition to understanding your maximum allowable leverage level, it’s also important for traders in Saudi Arabia who use eToro know about margin requirements which determine how much of your own capital must be used when opening a position with leveraged funds provided by the broker (also known as “margin”). Margin requirements vary based on the asset class being traded but generally range between 2% – 5%. For example, if you were trading gold with a 1:10 leveraged account at 4%, then you would need $400 of your own money (4% x 10) in order for your trade size of $4 000 ($400 x 10)to be opened successfully.

Overall, understanding both leverage and margin requirements is essential for successful trading with eToro in Saudi Arabia or anywhere else around the world!

Depositing Funds into an eToro Account from a Bank in Saudi Arabia

The eToro trading platform is a great way to invest in the financial markets, and it is especially popular among traders in Saudi Arabia. For those looking to deposit funds into their eToro account from a bank in Saudi Arabia, there are several options available. Depending on the type of bank account you have, you may be able to use online banking services or credit/debit cards for quick deposits. Alternatively, some banks offer wire transfers as an option for depositing funds into your eToro account. Regardless of which method you choose, it’s important to ensure that all information provided is accurate and up-to-date before submitting any payments. Additionally, make sure that your bank has sufficient funds available for the transaction prior to initiating it. Once completed successfully, your deposited funds should appear in your eToro wallet within minutes or hours depending on the payment method used.

Withdrawing Profits from an eToro Account to a Bank in Saudi Arabia

The eToro trading platform is a great way to make profits in Saudi Arabia. Withdrawing those profits from an eToro account to a bank in Saudi Arabia is simple and straightforward. This article will explore the steps necessary for withdrawing profits from an eToro account to a bank in Saudi Arabia, including what information you need, how long it takes, and any fees associated with the transaction. We’ll also discuss other important topics such as security measures taken by eToro and advice on choosing the right payment method for your withdrawal. By the end of this article, you should have all the knowledge needed to withdraw your profits safely and securely from an eToro account into your own personal bank account in Saudi Arabia.

Conclusion: Is the eToro Trading Platform Right for You?

Conclusion: After exploring the eToro trading platform in Saudi Arabia, it is clear that this platform offers a variety of features and tools to help traders make informed decisions. With its user-friendly interface, low fees, and wide range of asset classes available for trading, eToro is an excellent choice for those looking to get started with online trading in Saudi Arabia. Whether you are a beginner or experienced trader, the eToro platform can provide you with all the necessary tools and resources to make successful trades. Ultimately, whether or not the eToro Trading Platform is right for you depends on your individual needs and preferences as a trader.

| Feature | eToro Trading Platform | Other Trading Platforms |

|---|---|---|

| Cost of trading | Low | Varies |

| Variety of assets available | Wide | Limited |

| Ease of use | Easy to use | Difficult |

| User interface | Intuitive |

What advantages does the eToro trading platform offer to Saudi Arabian traders?

eToro offers a variety of advantages to Saudi Arabian traders, including:

1. Access to global markets and instruments – eToro provides access to over 2,400 stocks from around the world as well as cryptocurrencies, commodities, indices and ETFs.

2. Low fees – eToro has some of the lowest trading fees in the industry with no commission on stock trades or withdrawal fees for funds held in an account.

3. User-friendly platform – eToro’s web-based platform is designed for both beginner and experienced traders alike with features such as copy trading which allows users to automatically replicate other successful trader’s portfolios without having to manually manage their own investments.

4. Advanced charting tools – The platform also offers advanced charting tools that allow traders to analyze price movements more effectively when making decisions about their investments.

5. Customer support – In addition, they offer 24/7 customer service via phone or email so that any questions can be answered quickly and efficiently

How is the user experience of eToro different from other online trading platforms?

eToro offers a unique user experience compared to other online trading platforms. It has an intuitive, easy-to-use interface that makes it simple for new traders to get started and understand the basics of investing. Additionally, eToro offers features such as copy trading, which allows users to automatically copy the trades of experienced investors, and social trading tools that allow users to interact with each other and discuss strategies. These features make eToro stand out from other online trading platforms by providing a more interactive experience for its users.

Is there a minimum deposit required to open an account on eToro in Saudi Arabia?

Yes, there is a minimum deposit required to open an account on eToro in Saudi Arabia. The minimum deposit amount is 200 SAR (Saudi Riyal).

Are there any restrictions or limitations for Saudi Arabian traders using the eToro platform?

Yes, there are restrictions and limitations for Saudi Arabian traders using the eToro platform. All trading activities must comply with Sharia law, which prohibits any form of speculation or gambling. Additionally, Saudi Arabian traders may not be able to access certain features on the platform such as copy trading or leverage due to local regulations.

Does the eToro platform provide any educational resources for new traders in Saudi Arabia?

Yes, the eToro platform provides educational resources for new traders in Saudi Arabia. These include webinars, trading tutorials, and a range of market analysis tools. Additionally, the platform offers an Arabic language version to make it easier for traders from Saudi Arabia to access its services.

Are there any fees associated with using the eToro trading platform in Saudi Arabia?

Yes, there are fees associated with using the eToro trading platform in Saudi Arabia. These include spreads, overnight financing charges and withdrawal fees.

What types of assets can be traded on the eToro platform in Saudi Arabia?

eToro offers a variety of assets for trading in Saudi Arabia, including stocks, commodities, indices, ETFs (Exchange Traded Funds), cryptocurrencies and more.

Does the eToro trading platform offer customer support services specifically tailored to users based in Saudi Arabia?

Yes, the eToro trading platform does offer customer support services specifically tailored to users based in Saudi Arabia. The company has a dedicated team of customer service representatives who are available 24/7 to answer any questions or concerns that users may have. Additionally, they also provide localized language support for customers in Saudi Arabia.

05.05.2023 @ 13:45

es associated with certain payment methods, so be sure to check before making a deposit. Choose an Account Type: eToro offers several different account types, each with its own set of features and benefits. Choose the one that best suits your trading needs and goals. Start Trading: Once you have deposited funds and chosen an account type, you can start trading on the eToro platform. Be sure to take advantage of the educational resources and tools available on the platform to help you make informed trading decisions. In conclusion, eToro is a great option for investors in Saudi Arabia who are looking for a user-friendly and accessible trading platform with low fees and a wide range of assets. By following the steps outlined above, you can get started with eToro and begin taking advantage of its many features and benefits.