Introduction to eToro Trading Platform

The eToro trading platform is a popular online investment and trading platform that has been gaining traction in France. This article will explore the features of the eToro platform, as well as how it can be used to trade stocks, currencies, commodities, indices and more. We’ll also discuss the advantages of using this powerful tool for French traders. Finally, we’ll look at some tips on getting started with eToro in France. So if you’re looking to get into investing or trading in France, read on to learn more about this exciting new platform!

Overview of the French Market for Online Trading

This article explores the eToro trading platform in France, a leading online trading platform that has been gaining traction among French traders. The article examines the features of the platform and how it can be used to trade various financial instruments, including stocks, currencies, commodities and indices. It also looks at some of the advantages offered by eToro compared to other platforms available in France. Finally, it provides an overview of the French market for online trading and its potential opportunities for investors.

Benefits of Using eToro in France

1. Access to Global Markets: eToro provides access to a wide range of global markets, allowing French traders to diversify their portfolios and take advantage of international opportunities.

-

Easy-to-Use Platform: eToro’s user-friendly platform makes it easy for beginners and experienced traders alike to get started with trading in France. The intuitive interface allows users to quickly learn the basics of trading without having any prior experience or knowledge.

-

Low Fees: With low fees on trades, deposits, and withdrawals, eToro offers one of the most competitive pricing structures in the industry which can help French traders save money when investing or trading online.

-

Copy Trading Feature: One of the unique features offered by eToro is its copy trading feature which allows users to automatically copy successful trades from other investors on the platform – making it easier for new traders in France to start profiting from day one without needing extensive market knowledge or expertise in order to be successful.

-

Social Networking Features: In addition to providing an excellent trading platform, eToro also offers social networking features that allow users in France connect with other investors around the world and share ideas about potential investments or strategies they are considering implementing into their own portfolios

Features and Tools Offered by eToro in France

eToro is a popular online trading platform that offers traders in France an array of features and tools to help them succeed. These include:

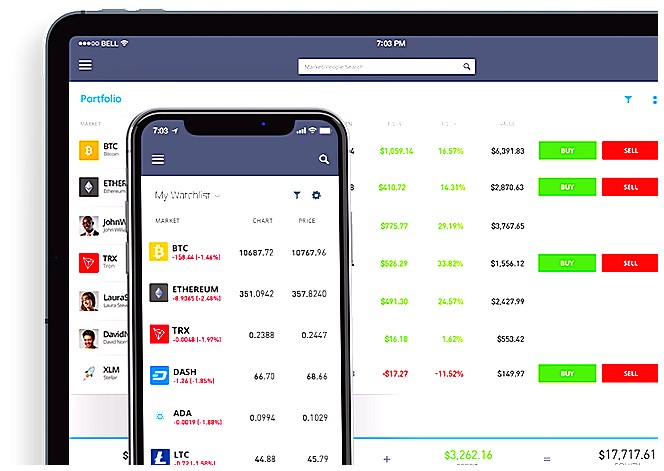

• A powerful web-based platform with real-time market data, charting capabilities, and advanced order types.

• An intuitive mobile app for Android and iOS devices, which allows users to trade on the go.

• CopyTrader technology, which enables users to copy successful traders’ strategies automatically.

• Virtual Trading feature that allows users to practice their trading skills without risking any capital.

• A wide range of assets including stocks, ETFs, indices, commodities, cryptocurrencies and more.

• 24/7 customer support from experienced professionals who can provide guidance on all aspects of trading with eToro.

Account Types Available on eToro in France

eToro offers a variety of account types to its French customers, including:

1. Real Money Account – This is the standard type of account that allows users to invest in stocks, ETFs, currencies and other assets with real money.

2. Virtual Money Account – This type of account is perfect for those who want to practice their trading skills without risking any capital. It uses virtual funds instead of real money so traders can experiment with different strategies before investing their own money.

3. Professional Account – For experienced traders looking for more advanced features such as higher leverage ratios and access to exclusive products, eToro offers a professional account option which requires additional verification from the user’s end before being approved by eToro’s team.

Security Measures Taken by eToro in France

eToro is committed to providing its customers with a secure trading experience. In France, eToro has implemented several security measures to ensure the safety of users’ funds and personal information.

First, all customer deposits are held in segregated accounts at top-tier banks located within the European Economic Area (EEA). This ensures that user funds remain separate from those of eToro and cannot be used for any other purpose than executing trades on behalf of customers.

Second, eToro uses advanced encryption technology to protect user data when it is transmitted over the internet. All communications between users and eToro servers are encrypted using Secure Socket Layer (SSL) protocol with 256-bit keys. This helps prevent unauthorized access or interception by third parties.

Third, eToro requires two-factor authentication for all logins and withdrawals from customer accounts. Users must enter their username and password as well as a one-time code sent via SMS or email before they can access their account or make a withdrawal request. This additional layer of security makes it more difficult for hackers to gain access to user accounts even if they have obtained login credentials through phishing attacks or other malicious activities.

Finally, eToro employs sophisticated fraud detection systems which monitor activity on customer accounts 24/7 in order to detect suspicious behavior such as large transfers or unusual patterns of trading activity that could indicate fraudulent activity taking place on an account

Fees Associated with Trading on the Platform in France

eToro is a popular online trading platform that allows users to trade in stocks, currencies, commodities and more. It is available in France and offers a range of features for French traders. However, it is important to be aware of the fees associated with trading on the platform before getting started.

The most common fee charged by eToro when trading in France is the spread. This refers to the difference between the buy and sell prices of an asset being traded on eToro’s platform. The spread can vary depending on market conditions but typically ranges from 0-2%. Additionally, there may also be overnight financing charges if positions are held open past certain time periods which can range from 0-3% per annum depending on your account type.

Other fees that may apply include withdrawal fees (typically 1%), conversion fees (up to 2%) and deposit/withdrawal limits ($50 minimum). There may also be additional costs such as commission or other taxes levied by local authorities so it’s important to check these before making any trades.

Overall, while there are some costs associated with using eToro in France they are relatively small compared to other platforms and should not deter you from exploring this great opportunity for investing online!

Regulations Governing Online Trading Platforms in France

The eToro trading platform is a popular online trading platform in France. It offers users the ability to trade stocks, commodities, currencies and other financial instruments with ease. However, it is important for traders to understand the regulations governing online trading platforms in France before using eToro or any other similar service.

In France, all online trading platforms must be authorized by the Autorité des Marchés Financiers (AMF). The AMF ensures that these services comply with applicable laws and regulations related to investor protection and market integrity. Additionally, they must adhere to rules regarding customer information security and privacy as well as anti-money laundering measures.

Furthermore, all French brokers offering online services are required to register with the Commission de Surveillance du Secteur Financier (CSSF). This registration process includes providing proof of their financial stability and demonstrating compliance with EU regulations such as MiFID II (Markets in Financial Instruments Directive).

Finally, it is important for investors on eToro or any other similar platform operating in France to ensure that they fully understand the risks associated with investing in financial markets before engaging in any transactions. They should also be aware of their rights under French law if something goes wrong during a transaction or if there are issues concerning their account balance or withdrawal requests.

Customer Support Services Provided by eToro for French Users

eToro offre une gamme complète de services d’assistance client pour les utilisateurs français. Les clients peuvent contacter le service client par téléphone, e-mail ou chat en direct. Des conseillers professionnels sont disponibles 24 heures sur 24 et 7 jours sur 7 pour répondre à toutes vos questions et préoccupations concernant l’utilisation du plateforme de trading eToro. De plus, des tutoriels en ligne sont également disponibles afin que les utilisateurs puissent apprendre à naviguer sur la plateforme et comprendre comment elle fonctionne. Enfin, un forum communautaire est mis à disposition des membres afin qu’ils puissent partager leurs expériences avec d’autres traders et obtenir des conseils utiles.

Summary and Conclusion

This article explored the eToro trading platform in France. It discussed how this platform is a great option for those who want to trade stocks, currencies, commodities and indices without having to worry about complex financial instruments or regulations. The article also highlighted some of the features that make eToro stand out from other platforms, such as its user-friendly interface and social trading capabilities. Additionally, it outlined the benefits of using eToro in France including lower fees than traditional brokers and access to global markets. Finally, it provided an overview of how users can get started with eToro in France.

In summary, this article demonstrated why eToro is a great choice for French traders looking for an easy-to-use online trading platform with low fees and access to global markets. With its user-friendly interface and social trading capabilities, it provides a great opportunity for anyone interested in getting into investing or expanding their portfolio beyond local exchanges.

| eToro Trading Platform | Other Trading Platforms |

|---|---|

| Low minimum deposit requirement ($50) | Varies by platform, may be higher than $50 |

| User-friendly interface and easy to navigate website layout. | Varies by platform, some may not have a user-friendly interface or easy to navigate website layout. |

| Ability to copy other traders’ strategies and portfolios. | Not available on all platforms; varies by platform. |

| Variety of trading instruments including stocks, commodities, indices, cryptocurrencies etc. | Varies by platform; some platforms may offer fewer trading instruments than eToro does. |

What features does the eToro trading platform offer to French traders?

eToro offers French traders a range of features, including:

•A wide selection of markets to trade in, such as stocks, indices, commodities and cryptocurrencies.

•The ability to copy the trades of experienced traders.

•Real-time market data and news updates.

•Secure deposits and withdrawals with multiple payment methods available.

•Robust customer support services via email or live chat.

How easy is it for French traders to open an account with eToro?

It is relatively easy for French traders to open an account with eToro. All that is required is a valid email address, proof of identity and residence, and a payment method. Once these requirements are met, the account can be opened in just a few minutes.

Are there any restrictions on what types of assets can be traded through the eToro platform in France?

Yes, there are restrictions on what types of assets can be traded through the eToro platform in France. These include restrictions on trading cryptocurrencies, CFDs and other derivatives products. In addition, French law requires that all trades must take place within the European Economic Area (EEA).

Does the eToro trading platform provide access to international markets for French traders?

Yes, the eToro trading platform provides access to international markets for French traders. The platform offers over 2,400 stocks from 16 different stock exchanges across Europe, the US and Asia. Additionally, traders can access a range of CFDs including forex pairs and cryptocurrencies.

Is customer support available in French on the eToro trading platform?

Yes, customer support is available in French on the eToro trading platform. The eToro team provides multilingual customer service and support in English, Spanish, French, German, Italian and Dutch.

What are some of the advantages and disadvantages of using the eToro trading platform compared to other platforms in France?

Advantages:

– eToro is a regulated platform, which means that users can trust the security of their funds and personal information.

– It offers competitive fees for trading stocks, ETFs, commodities and cryptocurrencies.

– The platform has an intuitive user interface with easy to use tools such as copy trading and portfolio building.

– eToro also provides educational resources to help traders improve their skills.

Disadvantages:

– The platform does not offer direct access to traditional markets like France’s CAC 40 index or other French stock exchanges.

– There are limited options for advanced traders who want more control over their trades and strategies.

– Some features may be restricted in certain countries due to local regulations or laws.

Are there any fees associated with using the eToro trading platform in France?

Yes, there are fees associated with using the eToro trading platform in France. These include spreads, overnight financing charges, and withdrawal fees.

What security measures are taken by eToro to protect its customers’ funds when they trade on their platform in France?

eToro takes a number of security measures to protect its customers’ funds when they trade on their platform in France. These include:

-

Client Funds Segregation – eToro segregates customer funds from the company’s own money, ensuring that clients’ money is kept safe and secure at all times.

-

Secure Data Encryption – All data exchanged between eToro’s servers and customers is encrypted using industry-standard encryption protocols, protecting sensitive information from malicious actors.

-

Two-Factor Authentication (2FA) – eToro requires two-factor authentication for all logins, adding an extra layer of security to user accounts and helping prevent unauthorized access to customer funds.

-

Anti Money Laundering & KYC Procedures – To comply with French anti-money laundering regulations, eToro performs strict Know Your Customer (KYC) procedures on all new customers before allowing them to deposit or withdraw funds from their account.

05.05.2023 @ 13:42

our Account – This account is designed for professional traders in France who require advanced trading tools and features. It offers higher leverage and access to more markets than the standard account. Overall, eToro is a great platform for French traders who are looking for a user-friendly and affordable way to invest and trade online. With its wide range of features and tools, as well as its low fees and copy trading feature, eToro is definitely worth considering for anyone who wants to get started with online trading in France.