Introduction to eToro Trading Platform

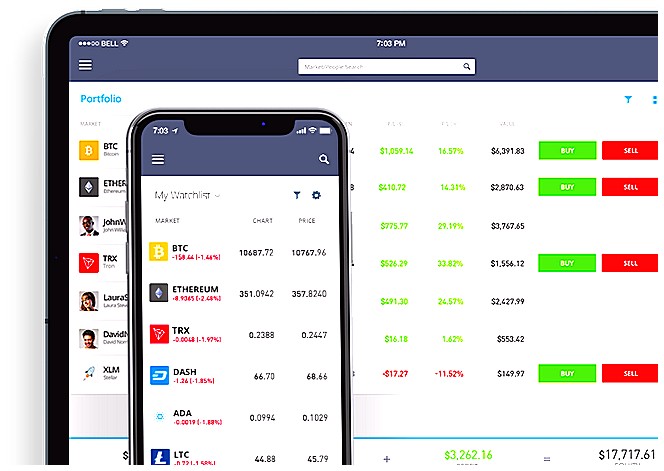

The eToro trading platform is a powerful and innovative tool for traders of all levels. It provides users with an intuitive interface, advanced charting capabilities, and the ability to trade in multiple markets around the world. In this article, we will explore how Chilean traders can benefit from using eToro’s services and features. We will discuss its advantages over traditional trading platforms, its fees structure, as well as provide some tips on getting started with the platform. By the end of this article you should have a better understanding of what makes eToro so attractive to Chilean investors.

What is the eToro Trading Platform?

eToro is an online trading platform that allows users to trade a variety of financial instruments, including stocks, commodities, currencies and cryptocurrencies. It offers traders the ability to copy other successful traders on the platform as well as providing them with access to educational resources and tools. eToro has become increasingly popular in Chile due to its user-friendly interface and low fees. In this article we will explore the features of the eToro Trading Platform in more detail and how it can be used by Chilean investors.

Advantages of Using the eToro Trading Platform in Chile

1. Easy to Use: eToro is designed with a user-friendly interface that makes it easy for even beginner traders to navigate and use the platform.

2. Low Fees: eToro charges low fees compared to other trading platforms, making it an attractive option for those looking to save money on their trades.

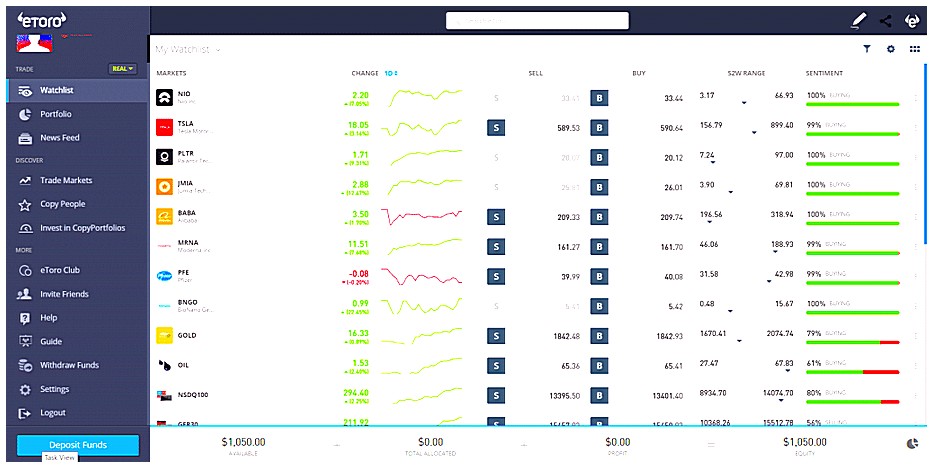

3. Wide Range of Assets: With over 1,500 assets available for trading, users have access to a wide range of stocks, currencies, commodities and more from around the world.

4. Variety of Trading Tools: The platform offers several tools such as charts and indicators which can help traders make informed decisions when placing orders or analyzing markets trends in Chile and beyond.

5. Social Trading Feature: This feature allows users to follow experienced traders’ strategies or copy their trades directly into their own accounts without having any prior knowledge about the market or asset being traded in Chile .

Features and Benefits of the eToro Trading Platform in Chile

eToro is a popular online trading platform in Chile, offering users the opportunity to trade stocks, commodities, and currencies. Here are some of the features and benefits that make eToro an attractive option for traders in Chile:

Features:

• Easy-to-use interface with intuitive navigation tools

• Access to real-time market data and news updates

• Comprehensive charting capabilities with technical indicators

• Ability to copy successful trades from other experienced traders on the platform

Benefits:

• Low fees compared to traditional brokers – no commission or hidden costs associated with trading activities.

• Wide range of assets available for trading including cryptocurrencies like Bitcoin and Ethereum.

• Leverage up to 1:400 allowing traders to open larger positions than their account balance would normally allow. • Social trading network allows users to connect with other investors around the world, share strategies, and gain valuable insights into markets they may not be familiar with.

How to Get Started with the eToro Trading Platform in Chile

Getting started with the eToro trading platform in Chile is easy and straightforward. All you need to do is sign up for an account on the eToro website, provide your personal information, verify your identity and fund your account.

Once you have created an account and funded it, you can start trading right away. The eToro platform offers a wide range of assets including stocks, commodities, indices, ETFs and cryptocurrencies that are available for trading in Chile. You can also access educational resources such as webinars and tutorials to help you learn more about how to trade successfully on the platform.

To get started with trading on the eToro platform in Chile, first select which asset class or market sector you would like to invest in. Once selected, click ‘Trade’ at the top of the page then choose whether you want to open a long or short position (buy or sell). Enter all relevant details regarding your order such as size (amount), leverage (if applicable) and stop loss/take profit levels before clicking ‘Open Trade’ when ready.

You will be able to monitor all open positions from within your portfolio page where updates will be displayed automatically throughout each day’s session. Additionally, if needed users can close their trades manually by selecting ‘Close’ from within their portfolio page or set up automated closing orders using Stop Loss/Take Profit settings prior to opening any trades.

Finally it should be noted that while there are no fees associated with creating an account on eToro nor making deposits into one’s account; standard spreads apply when placing trades so make sure these are factored into any calculations made prior to entering any positions!

Understanding Different Types of Trades on the eToro Platform

The eToro trading platform is an increasingly popular choice for Chilean traders. With its intuitive user interface and comprehensive range of features, it’s easy to see why so many investors are turning to this platform for their investments. But what types of trades can you make on the eToro platform? In this article, we’ll explore the different types of trades available on the eToro trading platform in Chile.

One type of trade that is available on the eToro trading platform is stock market investing. This involves buying and selling stocks in companies listed on major exchanges such as NASDAQ or NYSE. On the eToro platform, users can access real-time quotes from these exchanges and use advanced tools such as charting software to analyze potential investments before making a decision.

Another type of trade offered by the eToro trading platform is Forex (foreign exchange) trading. This involves exchanging one currency for another at current exchange rates in order to profit from fluctuations in currency values over time. The eToro Forex Trading Platform offers access to multiple markets around the world with competitive spreads and leveraged positions up to 1:400 depending on your account size and risk appetite.

Finally, CFD (contracts for difference) trading is also possible through the eToro Trading Platform in Chile. CFDs allow traders to speculate on price movements without actually owning any underlying assets such as stocks or commodities; instead they take out a contract with a broker which pays out if prices move according to their prediction within a certain timeframe set by them when entering into a position . By using leverage, CFD traders can potentially magnify profits but also increase losses should prices move against them so caution must be exercised when engaging in this type of activity..

In conclusion, there are several different types of trades available through the eToro Trading Platform in Chile including stock market investing, forex trading and contracts for difference (CFDs). Each has its own advantages and disadvantages so it’s important that investors understand all aspects before deciding which option best suits their needs

Security Measures Taken by the eToro Trading Platform for Chilean Users

The eToro trading platform takes security very seriously, and has implemented a number of measures to ensure the safety of its Chilean users. All user data is encrypted with SSL technology, which prevents unauthorized access. Additionally, two-factor authentication (2FA) is available for added protection against malicious actors. Furthermore, all deposits are held in segregated accounts that are insured by the Financial Services Compensation Scheme (FSCS). Lastly, eToro complies with Anti Money Laundering regulations to protect against financial crime.

Fees Associated with Using Thee Torro Trading Platfomr in Chile

Chilean traders looking to use the eToro trading platform should be aware of the fees associated with using this platform. The most common fee is a spread, which is the difference between the buy and sell price of an asset. This can range from 0.75% for stocks to 2% for cryptocurrencies. Additionally, there may be overnight fees when holding positions open after market close or weekend fees if trades are held over weekends or holidays. Finally, traders should also take into account any commissions that may apply when making deposits and withdrawals on their accounts.

Customer Support Services Available Through Thee Torro In Chile

The eToro trading platform in Chile offers a wide range of customer support services to help users get the most out of their experience. These include 24/7 live chat support, email assistance, and phone support for any questions or issues that may arise. The team is available to answer any queries related to account setup, technical problems, deposits and withdrawals, order placement and more. Additionally, eToro also provides educational resources such as tutorials on how to use the platform and market analysis reports from experts. With these helpful features at your disposal, you can rest assured that you will have all the necessary information needed to make informed decisions when trading with eToro in Chile.

Final Thoughts on Exploring Thee Torro’s Offering In Chile

Overall, eToro is a great platform for those looking to trade in Chile. It offers an easy-to-use interface and a wide range of assets to choose from. Additionally, its low fees make it an attractive option for traders on a budget. The social trading feature also allows users to copy the trades of experienced investors, which can be especially helpful for novice traders. With all these features combined, eToro is definitely worth considering if you’re looking to get into trading in Chile.

| Feature | eToro | Other Trading Platforms in Chile |

|---|---|---|

| Fees and Commissions | Low fees and commissions, with no hidden costs. Can be as low as 0.75% for stock trading. | Varying fees and commissions depending on the platform used, often higher than those of eToro. Hidden costs may apply to some platforms. |

| Variety of Assets Available for Trading | Wide variety of assets available for trading including stocks, ETFs, commodities, indices, cryptocurrencies and more. | Limited selection of assets available depending on the platform used; usually limited to stocks or a few other asset classes such as commodities or indices. Cryptocurrencies are not always supported by all platforms in Chile. |

| Security Features | High-level security features such as two-factor authentication (2FA) available to protect user accounts from unauthorized access attempts or fraudsters trying to steal funds from users’ accounts |

What features does the eToro trading platform offer to Chilean traders?

eToro offers Chilean traders a variety of features, including:

-Access to over 1,800 markets and assets from around the world.

-Real-time market data and analysis tools.

-CopyTrader technology that allows users to copy the trades of other successful traders on the platform.

-A range of trading instruments such as stocks, ETFs, cryptocurrencies, commodities, indices and more.

-The ability to create customized portfolios with multiple asset classes for diversification purposes.

-Robo advisor services that provide automated portfolio management solutions tailored to individual risk profiles.

-Secure payment methods such as bank transfers and eWallets like PayPal or Skrill for deposits and withdrawals in Chilean Pesos (CLP).

How easy is it for a beginner trader in Chile to get started with eToro?

It is relatively easy for a beginner trader in Chile to get started with eToro. All you need to do is create an account, deposit funds, and then start trading. eToro also offers helpful resources such as tutorials and webinars that can help new traders understand the platform better. Additionally, they offer customer support 24/7 so any questions or concerns can be addressed quickly.

Are there any restrictions on which types of assets can be traded through the eToro platform in Chile?

Yes, there are restrictions on which types of assets can be traded through the eToro platform in Chile. Currently, only stocks and ETFs listed on the Santiago Stock Exchange (BCS) can be traded through eToro in Chile.

Does the eToro trading platform provide access to international markets as well as local ones?

Yes, the eToro trading platform provides access to international markets as well as local ones. It offers a wide range of stocks, indices, commodities and currencies from around the world.

Is customer support available in Spanish or other languages spoken in Chile?

Yes, customer support is available in Spanish and other languages spoken in Chile. Depending on the company, they may offer customer support services in English as well.

What fees and commissions are associated with using the eToro trading platform in Chile?

The fees and commissions associated with using the eToro trading platform in Chile depend on the type of account that is opened. Generally, eToro charges a spread fee for each trade made on its platform. The spreads vary depending on the asset being traded and can range from 0.75% to 3%. Additionally, there may be overnight financing fees charged when positions are held open past market close or other administrative costs such as withdrawal fees.

Are there any additional tools or resources that Chilean traders can use when using the eToro trading platform?

Yes, Chilean traders can use additional tools and resources when using the eToro trading platform. These include access to a variety of market analysis tools such as charts, technical indicators, news feeds, economic calendars and more. Additionally, eToro offers its own copy-trading feature which allows users to automatically copy the trades of other successful traders on the platform. Finally, eToro also provides educational materials such as webinars and tutorials for those who want to learn more about trading in general or specific strategies.

How secure is user data when using the eToro trading platform in Chile?

The eToro trading platform is highly secure and takes measures to protect user data. All information stored on the platform is encrypted using industry-standard encryption technology, which ensures that only authorized personnel can access it. Additionally, all transactions are monitored for suspicious activity and any potential security breaches are addressed quickly and effectively. Furthermore, users in Chile have the option of enabling two-factor authentication (2FA) for an extra layer of protection when logging into their accounts.

05.05.2023 @ 13:46

Spanish:

El artículo presenta la plataforma de trading eToro, una herramienta innovadora y poderosa para traders de todos los niveles. La plataforma ofrece una interfaz intuitiva, capacidades avanzadas de gráficos y la posibilidad de operar en múltiples mercados en todo el mundo. En este artículo, se exploran las ventajas que los traders chilenos pueden obtener al utilizar los servicios y características de eToro. Se discuten las ventajas sobre las plataformas de trading tradicionales, su estructura de tarifas y se proporcionan algunos consejos para comenzar con la plataforma. Al final del artículo, los lectores tendrán una mejor comprensión de lo que hace que eToro sea tan atractivo para los inversores chilenos.

eToro es una plataforma de trading en línea que permite a los usuarios operar una variedad de instrumentos financieros, incluyendo acciones, materias primas, divisas y criptomonedas. Ofrece a los traders la capacidad de copiar a otros traders exitosos en la plataforma, así como acceso a recursos educativos y herramientas. eToro se ha vuelto cada vez más popular en Chile debido a su interfaz fácil de usar y sus tarifas bajas. En este artículo, se exploran las características de la plataforma de trading eToro con más detalle y cómo puede ser utilizada por los inversores chilenos.

Entre las ventajas de utilizar la plataforma de trading eToro en Chile se encuentran su facilidad de uso, tarifas bajas, amplia gama de activos, variedad de herramientas de trading y su función de trading social. La plataforma ofrece una interfaz fácil de usar con herramientas de navegación intuitivas, acceso a datos de mercado en tiempo real y actualizaciones de noticias, capacidades de gráficos completas con indicadores técnicos, y la posibilidad de copiar trades exitosos de otros traders experimentados en la plataforma.

Además, eToro ofrece tarifas bajas en comparación con los corredores tradicionales, una amplia gama de activos disponibles para operar, incluyendo criptomonedas como Bitcoin y Ethereum, apalancamiento de hasta 1:400, lo que permite a los traders abrir posiciones más grandes de lo que normalmente permitir