Introduction to eToro and Investing in Monaco

Investing in Monaco is an attractive prospect for many investors. With its strong economy, low taxes, and world-class infrastructure, it’s no wonder that the principality has become a popular destination for those looking to diversify their portfolios. One of the best ways to invest in Monaco is through eToro – an online trading platform that offers access to global markets with ease. In this article, we will explore the benefits of investing with eToro in Monaco and how you can get started today.

eToro is one of the most popular online brokers available today. It provides users with access to stocks, ETFs, commodities, indices and cryptocurrencies from around the world – all from a single account. The platform also allows users to copy other traders’ strategies or create their own portfolio using advanced tools such as CopyPortfolios™ and CopyTrading™. This makes it easy for novice investors to learn about different asset classes without having to manage each individual trade themselves.

When investing in Monaco through eToro there are several advantages that make it stand out from other platforms: Firstly, there are no commissions or hidden fees when trading on eToro; secondly, you have access to real-time market data which helps inform your decisions; thirdly, you can benefit from tight spreads on some assets; fourthly ,you can use leverage if desired; fifthly ,there are various risk management features available including stop losses and take profits; sixthly ,and finally customer service is provided 24/7 via live chat or email support should any issues arise during your trading experience .

In conclusion ,investing with eToro in Monaco offers numerous advantages over traditional methods of investment . From its user friendly interface ,to its wide range of asset classes offered and competitive pricing structure -eToro stands out as one of the leading providers for those wishing to invest within this region . So why not give it a try today ?

Understanding the Advantages of Trading with eToro

Investing in Monaco can be a great way to diversify your portfolio and take advantage of the many benefits that come with investing in this small European country. One of the most popular ways to invest in Monaco is through eToro, an online trading platform that allows you to buy and sell stocks, currencies, commodities, and other financial instruments. In this article we will explore some of the advantages of trading with eToro in Monaco.

One major benefit of using eToro for your investments is its user-friendly interface. The platform makes it easy for beginners as well as experienced traders to quickly understand how everything works. Additionally, it offers advanced tools such as charts and graphs which allow investors to make informed decisions about their trades. Furthermore, there are no commissions or fees associated with making trades on eToro which helps keep costs low when compared to traditional brokers or exchanges.

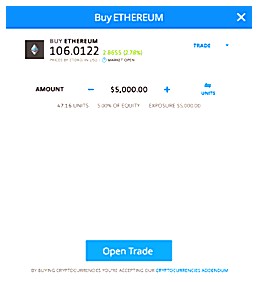

Another advantage of trading with eToro is its wide selection of assets available for purchase or sale including stocks from all over the world, cryptocurrencies like Bitcoin and Ethereum, indices such as S&P 500 index funds and ETFs (Exchange Traded Funds). This means investors have access to a much larger range than they would if they were only dealing with one particular exchange or broker. Additionally, since these markets are open 24 hours a day seven days a week there’s always something new happening which gives traders plenty of opportunities for profit regardless of market conditions at any given time.

Finally understanding the advantages offered by investing through eToro also requires looking at their customer service team who are available around the clock via email chat phone calls etc., providing help whenever needed so that users never feel alone during their investment journey . All these factors combine together making investing through etoro not just convenient but also profitable venture worth exploring .

The Benefits of Investing in Monaco

Investing in Monaco can be a great way to diversify your portfolio and take advantage of the country’s unique economic advantages. With eToro, you can access a wide range of investment opportunities in Monaco, from stocks and bonds to real estate and cryptocurrency. Here are some of the benefits that come with investing with eToro in Monaco:

-

Low Taxes: One of the main benefits of investing in Monaco is its low tax rate. As an investor, you will enjoy lower taxes than other countries on capital gains, dividends, and interest income. This makes it an attractive option for those looking to minimize their tax burden while still taking advantage of potential returns on investments.

-

Accessibility: Investing through eToro gives investors easy access to markets around the world including Monaco’s stock exchange as well as international exchanges like NYSE Euronext Paris or London Stock Exchange (LSE). This allows investors to quickly diversify their portfolios across different asset classes without having to worry about complicated paperwork or lengthy processes associated with opening accounts at multiple brokers or exchanges abroad.

-

Security: The government-backed security measures implemented by both eToro and Monaco ensure that all investments made through this platform are safe from fraudsters or hackers who may try to steal money from unsuspecting traders online. Investors also benefit from secure trading platforms provided by eToro which make sure that trades are executed correctly each time they are placed on the market regardless if they occur during regular trading hours or after-hours sessions when most other brokers close shop for the day/night/weekend etc..

-

Supportive Regulatory Environment: The government authorities in charge of regulating financial activities within Monaco have created a supportive environment for foreign investors interested in making investments there via companies such as eToro which provide them with tools needed for successful trading strategies implementation over long term periods without any major issues arising along the way due their strict compliance policies enforced throughout entire process chain starting right away when new account is opened up until final withdrawal request gets processed accordingly towards end user satisfaction level being achieved successfully every single time no matter what type assets chosen beforehand by particular trader himself/herself respectively .

Low Taxes and Fees for Investors in Monaco

Monaco is an ideal destination for investors looking to take advantage of low taxes and fees. With eToro, investors can enjoy some of the lowest tax rates in Europe while still enjoying access to a wide range of investment opportunities. Additionally, Monaco has no capital gains or wealth taxes on investments held through eToro, making it an attractive option for those looking to maximize their returns. Furthermore, eToro offers competitive fees that are significantly lower than traditional brokerages and banks. All these factors make investing with eToro in Monaco a great choice for those seeking maximum returns with minimal costs.

Regulations Governing Investment Activities in Monaco

Monaco is an ideal destination for investors looking to capitalize on the benefits of investing with eToro. The principality offers a wide range of investment opportunities, from stocks and bonds to commodities and cryptocurrencies. However, before you can begin trading with eToro in Monaco, it’s important to understand the regulations governing investment activities in the country.

The Government of Monaco has established several laws that govern investments within its borders. These include:

- The Investment Services Law (Law 1.338), which sets out requirements for financial intermediaries operating in Monaco;

- The Collective Investment Scheme Law (Law 1.333), which regulates collective investment schemes such as mutual funds;

- The Market Abuse Regulation (MAR), which establishes rules regarding insider trading and market manipulation;

- The Prospectus Directive, which requires companies issuing securities to provide potential investors with certain information about their offering; and

- MiFID II/MiFIR, which sets standards for investor protection when dealing with financial instruments traded across multiple jurisdictions within Europe.

In addition to these regulations, all investors must comply with anti-money laundering legislation when making investments through eToro in Monaco or any other jurisdiction around the world. This includes verifying your identity using documents such as a passport or driver’s license before being allowed to trade on the platform. Furthermore, all transactions must be reported according to applicable laws and taxes paid accordingly depending on your residency status in Monaco or elsewhere.

Accessibility to International Markets through eToro’s Platforms

Investing with eToro in Monaco provides investors with a number of benefits, including access to international markets through its platforms. With the ability to trade on multiple global exchanges, eToro’s platform allows investors to diversify their portfolios and gain exposure to different asset classes from around the world. Through its user-friendly interface, traders can easily monitor market movements and take advantage of opportunities as they arise. Furthermore, by leveraging eToro’s social trading network, investors can benefit from insights shared by experienced traders who have already made successful investments in various markets. As such, investing with eToro in Monaco offers an excellent opportunity for those looking to maximize their returns while minimizing risk.

Diversifying Your Portfolio with a Range of Assets on Offer from eToro

Investing in Monaco can be a great way to diversify your portfolio and take advantage of the wide range of assets on offer from eToro. With an array of stocks, commodities, indices, cryptocurrencies and more available for trading, you can create a balanced portfolio that is tailored to meet your individual needs. From blue-chip companies to emerging markets, eToro provides investors with access to global markets at competitive prices. Plus, with their intuitive platform and advanced tools such as copy trading and automated portfolios, it’s easy to manage your investments without needing any prior experience or knowledge. By investing with eToro in Monaco you have the potential to generate returns while reducing risk through diversification – something that is key when building a successful investment strategy.

How to Get Started with Investing Through eToro in Monaco

Investing in Monaco can be a great way to grow your wealth and secure your financial future. eToro is one of the leading online investment platforms, offering an easy-to-use interface and access to global markets. Here’s how you can get started with investing through eToro in Monaco:

-

Create an Account: The first step is to create an account on the eToro platform. You will need to provide some personal information, such as your name, address, date of birth and phone number. Once you have completed this process, you will be able to log into your account and start exploring the different investment options available on the platform.

-

Fund Your Account: Before you can begin investing with eToro in Monaco, you must fund your account by transferring money from a bank or credit card into it. This process usually takes only a few minutes and allows for quick access to funds when needed for trading purposes.

-

Choose Your Investment Strategy: Once your account has been funded, it’s time to decide which type of investments are right for you based on factors like risk tolerance level and desired return rate over time period chosen (short term vs long term). For example, if you want steady returns over longer periods of time then stocks may be more suitable than commodities or currencies; whereas if higher volatility is acceptable then cryptocurrencies might be worth considering instead of traditional assets like bonds or mutual funds etc..

4 . Start Investing: After deciding which asset class best suits your needs/goals – it’s now time to start making trades! With eToro’s intuitive platform navigation tools & features like copy trading – even novice investors should find themselves comfortable navigating around their dashboard & executing orders quickly & efficiently within just minutes after signing up!

5 . Monitor Performance : Finally , once all trades have been placed – don’t forget about monitoring performance regularly so that any necessary adjustments can be made along the way depending on market conditions at hand ! Keeping track of portfolio activity helps ensure that goals are being met & also gives insight into potential areas where improvements could potentially take place down line !

Maximizing Returns on Investments Through Smart Strategies With eToro

Investing in Monaco can be a great way to maximize returns on investments, and eToro is the perfect platform for doing so. With its smart strategies and innovative tools, eToro makes it easy to explore the benefits of investing with them in Monaco. From portfolio diversification to automated trading options, this article will explain how investors can use eToro’s features to maximize their returns on investments through smart strategies. We’ll also discuss some of the risks associated with investing in Monaco and how eToro helps protect against them. Finally, we’ll provide an overview of why investing with eToro in Monaco is a wise choice for any investor looking to get the most out of their money.

Conclusion: Unlocking the Potential of Investment Opportunities With eToro

Conclusion: eToro provides investors in Monaco with a unique opportunity to access global markets and take advantage of the potential investment opportunities available. With its intuitive platform, comprehensive range of products, and low fees, eToro is an ideal choice for those looking to diversify their portfolio or begin investing. By unlocking the potential of these investment opportunities through eToro, investors can make informed decisions that will help them reach their financial goals.

| eToro | Other Investment Platforms in Monaco |

|---|---|

| Low Fees | High Fees |

| User-Friendly Interface and Tools | Complex Interface and Tools |

| Social Trading Features for Experienced Investors to Copy Trades of Top Traders on the Platform. | No Such Feature Available. |

| Variety of Assets to Invest In, Including Cryptocurrencies, Stocks, ETFs and More. |

What are the main advantages of investing with eToro in Monaco?

The main advantages of investing with eToro in Monaco include:

1. Access to a wide range of global markets, including stocks, indices, commodities and cryptocurrencies.

2. Low trading fees and commissions on trades.

3. A user-friendly platform with advanced charting tools and research capabilities.

4. A secure environment for traders to make investments in digital assets such as Bitcoin, Ethereum, Litecoin and more.

5. Regulatory compliance from the Financial Services Commission (FSC) of Monaco that ensures investor protection when making investments through eToro’s platform in Monaco

How does eToro’s platform make it easier to invest in Monaco?

eToro’s platform makes it easier to invest in Monaco by providing a range of tools and features that make investing simple and straightforward. These include an intuitive user interface, advanced charting capabilities, access to real-time market data, the ability to copy other traders’ strategies, and low fees. Additionally, eToro provides educational resources such as tutorials and webinars on how to get started with investing in Monaco.

What types of investments can be made through eToro in Monaco?

eToro in Monaco offers a variety of investments, including stocks, ETFs, cryptocurrencies, commodities, indices and copy trading.

Are there any risks associated with investing through eToro in Monaco?

Yes, there are risks associated with investing through eToro in Monaco. These include market risk, liquidity risk, currency exchange rate risk and counterparty risk. Additionally, investors should be aware of the regulatory environment in Monaco as it may differ from other jurisdictions. Investors should also consider their own financial situation before making any investments.

Does eToro offer any special features or services for investors based in Monaco?

Yes, eToro offers special features and services for investors based in Monaco. These include access to a dedicated customer service team, the ability to open an account with local currency (EUR), exclusive promotions and bonuses, as well as tailored investment advice from experienced traders.

Is there a minimum amount required to start investing with eToro in Monaco?

No, there is no minimum amount required to start investing with eToro in Monaco. You can open an account and begin trading with any amount you choose.

Are there any fees associated with using the eToro platform for investment purposes in Monaco?

Yes, there are fees associated with using the eToro platform for investment purposes in Monaco. These include a commission fee of 0.09% and an overnight fee that varies depending on the asset being traded. Additionally, users may be subject to currency conversion fees when trading international markets or assets denominated in different currencies.

How secure is my money when I use the eToro platform to invest from within Monaco?

The security of your money when using the eToro platform to invest from within Monaco is highly secure. The platform utilizes advanced encryption technology and other security measures to protect user funds, including two-factor authentication and Know Your Customer (KYC) procedures. Additionally, all customer deposits are held in segregated accounts with top-tier banks for extra protection.

05.05.2023 @ 13:45

investir à Monaco est une perspective attrayante pour de nombreux investisseurs. Avec son économie solide, ses faibles taxes et son infrastructure de classe mondiale, il nest pas étonnant que la principauté soit devenue une destination populaire pour ceux qui cherchent à diversifier leurs portefeuilles. Lun des meilleurs moyens dinvestir à Monaco est par le biais deToro – une plateforme de trading en ligne qui offre un accès facile aux marchés mondiaux. Dans cet article, nous explorerons les avantages dinvestir avec eToro à Monaco et comment vous pouvez commencer dès aujourdhui.

eToro est lun des courtiers en ligne les plus populaires disponibles aujourdhui. Il offre aux utilisateurs un accès aux actions, ETF, matières premières, indices et crypto-monnaies du monde entier – le tout à partir dun seul compte. La plateforme permet également aux utilisateurs de copier les stratégies dautres traders ou de créer leur propre portefeuille en utilisant des outils avancés tels que CopyPortfolios™ et CopyTrading™. Cela facilite lapprentissage des différents types dactifs pour les investisseurs novices sans avoir à gérer chaque transaction individuellement.

Lorsque vous investissez à Monaco via eToro, il y a plusieurs avantages qui le distinguent des autres plateformes : premièrement, il ny a pas de commissions ou de frais cachés lors de la négociation sur eToro ; deuxièmement, vous avez accès à des données de marché en temps réel qui aident à informer vos décisions ; troisièmement, vous pouvez bénéficier de spreads serrés sur certains actifs ; quatrièmement, vous pouvez utiliser leffet de levier si vous le souhaitez ; cinquièmement, il existe diverses fonctionnalités de gestion des risques disponibles, notamment les stop-loss et les take-profits ; sixièmement, enfin, le service client est disponible 24/7 via le chat en direct ou le support par e-mail en cas de problèmes pendant votre expérience de trading.

En conclusion, investir avec eToro à Monaco offre de nombreux avantages par rapport aux méthodes tradition