Introduction to eToro Trading in Turkey

Turkey is quickly becoming one of the most popular destinations for online trading. With its growing economy and vibrant financial markets, it’s no surprise that more and more investors are turning to eToro Trading in Turkey as a way to access these opportunities. In this article, we’ll explore what makes eToro Trading so attractive to Turkish traders, how you can get started with it, and some of the key features that make it stand out from other platforms. We’ll also discuss some of the risks associated with trading on eToro in Turkey so you can make an informed decision about whether or not this platform is right for you.

Benefits of eToro Trading for Turkish Investors

eToro trading is becoming increasingly popular among Turkish investors due to its many benefits. Here are some of the key advantages that eToro offers to Turkish investors:

-

Accessibility: eToro allows traders from Turkey to access a wide range of markets, including stocks, commodities, currencies and cryptocurrencies. This makes it easy for Turkish investors to diversify their portfolios and take advantage of global market opportunities.

-

Low Fees: eToro has low fees compared to other brokers in Turkey, making it an attractive option for those looking for cost-effective trading solutions.

-

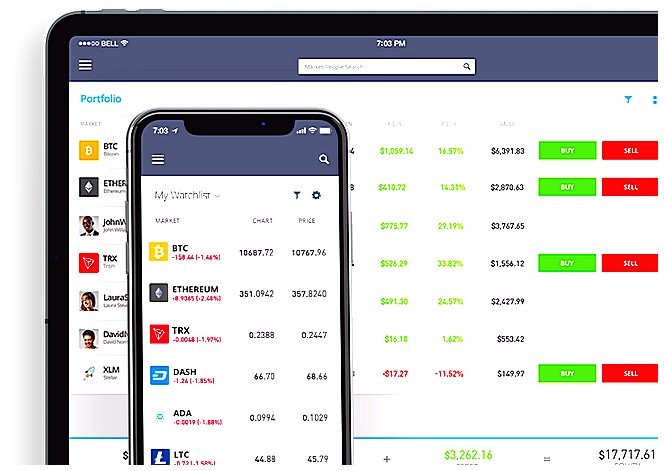

User-Friendly Platform: The platform is designed with user experience in mind, allowing users from all levels of expertise to easily navigate through the features and make informed decisions about their investments quickly and efficiently.

-

Leverage Trading Opportunities: eToro provides leverage trading options which allow traders from Turkey to increase their potential returns by taking on more risk than they would normally be comfortable with when investing directly into assets themselves without leverage or margin funding provided by a broker such as eToro .

-

Social Trading Features: One unique feature offered by eToro is its social trading platform which allows users from Turkey to copy the trades made by experienced traders who have proven track records of success on the platform – this can help new traders learn how successful strategies work while also potentially increasing profits if copied correctly!

The Different Types of Assets Available on eToro

eToro is a popular online trading platform that has been gaining traction in Turkey. With its user-friendly interface and wide range of assets, it’s no wonder why so many Turkish traders are turning to eToro for their investment needs. In this article, we’ll explore the different types of assets available on eToro and how they can be used to maximize profits in the Turkish market.

eToro offers a variety of asset classes for traders to choose from, including stocks, commodities, indices, cryptocurrencies, ETFs (Exchange Traded Funds), and CFDs (Contracts For Difference). Stocks allow investors to purchase shares in publicly traded companies listed on major exchanges around the world. Commodities include physical goods such as oil or gold which can be bought or sold through contracts with other parties. Indices track stock prices across multiple markets and provide an overall measure of market performance. Cryptocurrencies are digital currencies based on blockchain technology that have become increasingly popular over recent years due to their decentralized nature and potential for high returns when invested wisely. ETFs are baskets of securities designed to track specific indexes or sectors while providing diversification benefits at lower costs than buying individual stocks directly; meanwhile CFDs offer leveraged trading opportunities where investors can take advantage of both rising and falling markets without owning any underlying assets themselves.

No matter what type of investor you may be – beginner or experienced – there’s something available on eToro that will suit your needs perfectly!

How to Open an Account with eToro in Turkey

Opening an account with eToro in Turkey is a simple and straightforward process. All you need to do is follow these steps:

-

Go to the eToro website and click on “Sign Up” at the top right corner of the page.

-

Enter your personal information, such as name, email address, date of birth, country of residence (Turkey), and phone number. You will also be asked to create a username and password for your account.

-

Verify your identity by providing documents that prove who you are (such as a copy of your passport or ID card). This step helps ensure that all users meet regulatory requirements set out by Turkish authorities.

-

Once verified, you can fund your account using one of several payment methods available in Turkey (e-wallet services like PayPal or Skrill, bank transfers etc.). After funding it successfully, you’re ready to start trading!

Understanding the Fees and Charges Associated with eToro Trading in Turkey

When it comes to trading in Turkey, eToro is one of the most popular platforms. With its user-friendly interface and wide range of assets, it’s no wonder why so many traders are turning to this platform for their investments. However, before you start trading on eToro in Turkey, it’s important to understand the fees and charges associated with using this platform. In this article, we will explore the various fees and charges associated with eToro trading in Turkey so that you can make an informed decision about whether or not this platform is right for you.

The first fee associated with eToro trading in Turkey is a commission fee which applies when opening or closing a position on any asset available through the platform. This commission varies depending on the type of asset being traded but typically ranges from 0% – 5%. Additionally, there may be other costs such as spreads which vary according to market conditions at any given time. It’s important to keep these costs in mind when making your trades as they can have a significant impact on your overall profitability over time.

Another cost associated with eToro trading in Turkey is overnight financing fees which apply if positions are held open overnight (or longer). These fees vary depending on the type of asset being traded but typically range from 0% – 2%. It’s important to note that these fees are charged daily until positions are closed out or expired so they should be taken into account when calculating potential profits/losses from trades made through eToro in Turkey.

Finally, some assets may also incur additional charges such as currency conversion fees if different currencies need to be exchanged during transactions (e.g., USD/TRY). As always though, these types of charges should be clearly outlined by brokers prior to executing any trades so make sure you read all terms & conditions carefully before committing yourself financially!

By understanding all of the various fees and charges associated with using eToro for trading purposes in Turkey, investors can ensure that they are making informed decisions about their investments while also avoiding unnecessary losses due to hidden costs down the line. Ultimately though, only you know what works best for your own financial situation – just remember that research pays off!

Leverage and Margin Requirements for Traders in Turkey

Turkey is a popular destination for traders looking to take advantage of the country’s strong economy and favorable trading conditions. eToro, one of the world’s leading online brokers, offers its services in Turkey and provides traders with access to a wide range of financial instruments including stocks, commodities, currencies and indices. This article will explore leverage and margin requirements for traders using eToro in Turkey.

Leverage allows traders to increase their buying power by borrowing funds from their broker or lender at an agreed-upon rate. On eToro, leverage ratios vary depending on the asset being traded but can be as high as 1:400 on certain products such as Forex pairs. Leverage can help traders magnify profits when used correctly but it also carries greater risk due to increased potential losses if trades go against them.

Margin requirements are another important factor that must be taken into consideration when trading with eToro in Turkey. Margin is essentially collateral that must be deposited before opening a position; this amount varies depending on the instrument being traded but generally ranges between 2% – 5%. The margin requirement helps protect both parties involved in the trade since it ensures that there is enough capital available should any losses occur during market movements.

In conclusion, understanding leverage and margin requirements are essential for successful trading with eToro in Turkey or anywhere else around the world. It is important to remember that these two factors can significantly impact your profitability so make sure you understand how they work before placing any trades!

Strategies for Successful Investing on eToro Platforms

1. Research the Markets: Before investing on eToro, it is important to research the markets and understand how they work. This includes researching different currencies, commodities, stocks and other assets that are available for trading on eToro. It is also important to stay up-to-date with market news and events that may affect your investments.

-

Diversify Your Portfolio: One of the most effective strategies for successful investing on eToro is diversifying your portfolio across multiple asset classes such as stocks, currencies, commodities and more. By spreading out your investments across different asset classes you can reduce risk while still potentially earning a return from each one.

-

Use Stop Losses: Stop losses are an essential tool when trading on eToro as they allow you to limit potential losses if the market moves against you unexpectedly or quickly changes direction without warning. Setting stop losses will help protect your capital in case of unexpected price movements or volatility in the markets so make sure to use them whenever possible when trading on eToro platforms in Turkey or elsewhere around the world.

4 .Manage Risk Appropriately: When investing online through any platform including eToro it’s important to manage risk appropriately by only risking what you can afford to lose and never taking excessive risks with large amounts of capital at once just because there could be a big reward involved if things go well with your investment strategy..

5 .Keep Learning: Finally, always keep learning about new trends in financial markets and stay up-to-date with developments related to online trading platforms like eToro so that you can take advantage of opportunities when they arise while minimizing risks associated with these types of investments

Risk Management Techniques when Using eToro Trading Platforms

When exploring eToro trading in Turkey, it is important to understand the risk management techniques available. Risk management is a key component of successful trading and can help protect traders from losses due to market volatility or unexpected events. Here are some risk management techniques when using eToro trading platforms:

-

Use Stop Loss Orders: A stop loss order allows you to set a predetermined price at which your position will be closed if the market moves against you. This helps limit potential losses and ensure that you don’t take on too much risk in any single trade.

-

Utilize Leverage Wisely: Leverage can amplify both profits and losses, so it’s important to use leverage wisely when trading with eToro in Turkey. Consider setting limits on how much leverage you are willing to use for each trade and make sure not to exceed those limits no matter what happens in the markets.

-

Diversify Your Portfolio: Diversifying your portfolio across different asset classes and instruments can help reduce overall portfolio risk by spreading out exposure among multiple investments instead of putting all your eggs into one basket with just one or two trades at a time.

4 .Manage Your Emotions: Trading with emotion rather than logic can lead to poor decision making which could result in significant losses over time, so it’s important for traders using eToro platforms in Turkey to manage their emotions while investing as best they can

Regulations Governing Online Investment Services in Turkey

eToro is a popular online trading platform that allows users to trade in stocks, commodities, and currencies. With its easy-to-use interface and low fees, eToro has become an attractive option for investors looking to get into the world of online trading. In Turkey, eToro is regulated by the Capital Markets Board (CMB) which sets out regulations governing online investment services.

These regulations are designed to protect investors from fraud and other risks associated with investing online. The CMB requires all firms offering online investment services in Turkey to be registered with them and abide by their rules. This includes providing detailed information about their operations as well as submitting financial statements on a regular basis. Additionally, these firms must have adequate capital reserves and maintain proper records of customer transactions.

Furthermore, the CMB also imposes restrictions on how much money can be invested through eToro in Turkey at any given time as well as limits on leverage ratios used when trading through this platform. These measures ensure that traders do not take excessive risks or overextend themselves financially while using eToro’s services in Turkey.

Overall, it is important for potential traders in Turkey to understand the regulations governing online investment services before getting started with eToro or any other similar platform operating within this country’s borders

Tips for Newcomers to the World of Online Investing through eToro

1. Start small: When you first start investing online through eToro, it is important to begin with a smaller amount of money and slowly build up your portfolio as you become more comfortable with the platform.

-

Research investments: Before making any investment decisions, be sure to do your research on the asset or company in which you are interested in investing. This will help ensure that you make informed decisions and minimize potential losses due to lack of knowledge about the asset or company.

-

Diversify your portfolio: It is important to diversify your investments across different types of assets such as stocks, commodities, currencies, etc., so that if one type of asset experiences a downturn, other parts of your portfolio can remain unaffected and potentially even benefit from the change in market conditions.

-

Monitor performance regularly: Regularly monitor how each part of your portfolio is performing so that you can adjust accordingly when needed and take advantage of opportunities for growth when they arise.

-

Utilize risk management tools: eToro offers various risk management tools such as stop-loss orders which allow traders to limit their losses by automatically closing out positions once they reach a certain price level; these tools should be used whenever possible in order to protect against sudden changes in market conditions which could lead to significant losses if not managed properly

| Feature | eToro Trading in Turkey | Other Online Trading Platforms in Turkey |

|---|---|---|

| Security and Regulation | Regulated by the Turkish Capital Markets Board (CMB) with strict security measures to protect traders’ funds. | Varying levels of regulation, depending on the platform. Some may not be regulated at all. |

| User Interface | Easy-to-use interface designed for novice traders, with features such as copy trading and automated portfolio management. | Interfaces vary widely between platforms, ranging from basic to advanced tools and features. |

| Fees | Low fees compared to other online trading platforms in Turkey; no commission or hidden costs charged for trades. | Fees can vary significantly between different online trading platforms; some may charge commissions or have hidden costs associated with trades. |

| Asset Types | Wide range of asset types available including stocks, ETFs, cryptocurrencies, commodities and more. |

What is the current state of eToro trading in Turkey?

At the moment, eToro trading is not available in Turkey. The Turkish government has blocked access to the platform due to regulatory concerns.

How has the Turkish government regulated eToro trading?

The Turkish government has regulated eToro trading by requiring all traders to obtain a license from the Capital Markets Board of Turkey (CMB) before they can begin trading. The CMB also requires that all traders have sufficient capital and knowledge to trade on the platform, as well as providing guidance on how to use the platform safely and responsibly. Additionally, the CMB has imposed limits on leverage and position size for certain instruments traded through eToro in order to protect investors from excessive risk.

Are there any restrictions on which assets can be traded on eToro in Turkey?

Yes, there are restrictions on which assets can be traded on eToro in Turkey. The Turkish government has imposed a number of restrictions on the trading of certain types of financial instruments and assets, including cryptocurrencies, CFDs (Contracts for Difference), and some stocks. Additionally, eToro does not offer its services to residents or citizens of Turkey.

What are some of the benefits that traders enjoy when using eToro to trade in Turkey?

Some of the benefits that traders enjoy when using eToro to trade in Turkey include:

1. Low fees – eToro charges no commission on trades, making it an attractive option for traders looking to maximize their profits.

2. Variety of markets – eToro offers a wide range of assets and markets, allowing Turkish traders to diversify their portfolios and access global markets such as stocks, commodities, indices, cryptocurrencies and more.

3. User-friendly platform – eToro’s user-friendly platform makes trading easy even for beginners with its intuitive design and features like copy trading which allows users to replicate successful strategies from other experienced investors on the platform.

4. Professional support team – With 24/7 customer service available in Turkish language, customers can get help quickly if they have any questions or need assistance with their accounts or trades.

Is it easy for new traders to get started with eToro trading in Turkey?

Yes, it is easy for new traders to get started with eToro trading in Turkey. The platform offers a range of features and tools that make it easy for beginners to learn the basics of trading and start investing. Additionally, eToro has an active customer support team in Turkey who can provide assistance if needed.

Are there any fees associated with using eToro to trade in Turkey?

Yes, there are fees associated with using eToro to trade in Turkey. These include a spread fee for each trade and an overnight fee if the position is held open past midnight UTC. Additionally, users may be subject to other charges such as withdrawal fees or conversion fees when trading with non-Turkish assets.

Does eToro offer customer support services specifically tailored for Turkish traders?

Yes, eToro offers customer support services specifically tailored for Turkish traders. The company has a dedicated team of Turkish-speaking customer service representatives available to answer questions and provide assistance in the local language.

Are there any additional features or tools available through the platform that could benefit Turkish traders specifically?

Yes, there are additional features and tools available through the platform that could benefit Turkish traders specifically. These include access to research and analysis tools specific to the Turkish market, as well as educational resources tailored for Turkish traders. Additionally, some platforms offer special promotions or discounts for Turkish traders, such as reduced trading fees or exclusive bonuses.

05.05.2023 @ 13:46

vercome Risks Associated with eToro Trading in Turkey

As with any investment platform, there are risks associated with eToro Trading in Turkey. It’s important to be aware of these risks and take steps to mitigate them. Here are some tips to help you overcome the risks associated with eToro Trading in Turkey:

1. Do your research: Before investing in any asset, it’s important to do your research and understand the risks involved. This includes researching the asset itself, as well as the market conditions and any regulatory issues that may impact your investment.

2. Set realistic goals: It’s important to set realistic goals for your investments and not to expect overnight success. Remember that investing is a long-term game and that patience is key.

3. Diversify your portfolio: Diversification is key to reducing risk in any investment portfolio. By investing in a variety of assets, you can spread your risk and reduce the impact of any single asset on your overall portfolio.

4. Use stop-loss orders: Stop-loss orders can help you limit your losses by automatically selling an asset if it reaches a certain price point. This can help you avoid significant losses if the market turns against you.

Overall, eToro Trading in Turkey offers many benefits to investors, but it’s important to be aware of the risks and take steps to mitigate them. By doing your research, setting realistic goals, diversifying your portfolio, and using stop-loss orders, you can minimize your risk and maximize your potential returns.