What is eToro Trading?

eToro Trading is an online social trading and multi-asset brokerage platform that allows users to trade a variety of financial assets, including stocks, currencies, commodities, indices and cryptocurrencies. It offers a wide range of features such as copy trading, market analysis tools and access to the global markets. eToro also provides educational resources for traders in Singapore who are interested in learning more about the world of investing.

Advantages of Trading on eToro in Singapore

1. Low Fees: eToro offers some of the lowest fees in Singapore for trading stocks, ETFs, and cryptocurrencies.

-

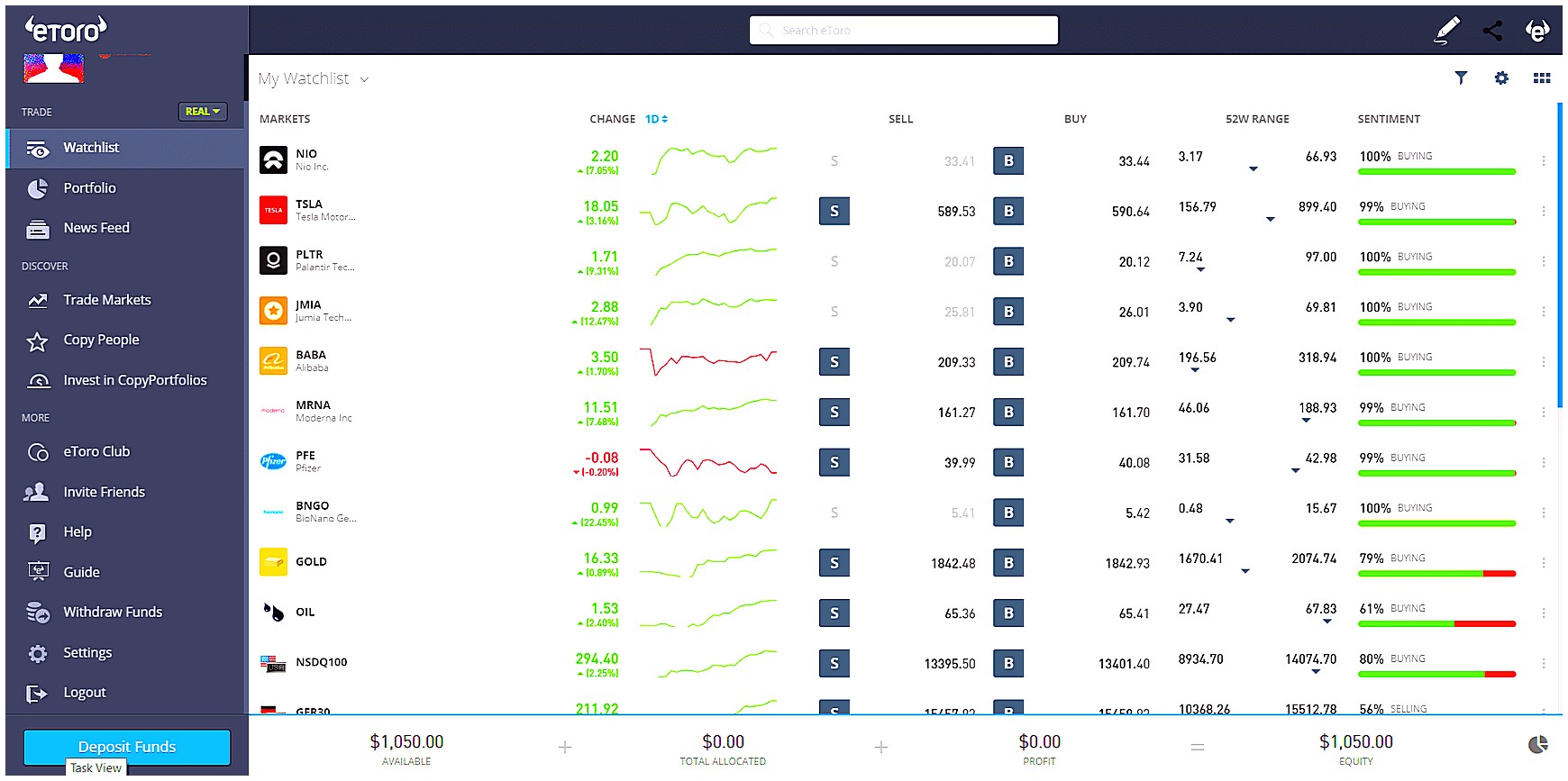

User-Friendly Platform: eToro’s platform is designed to be easy to use and navigate for traders of all levels. It also features a variety of tools and charts that can help you make informed decisions about your trades.

-

Accessibility: With eToro, you can access markets from anywhere in the world with an internet connection – making it ideal for those who travel frequently or are looking to diversify their investments globally.

-

Variety of Assets: On eToro, you can trade a wide range of assets including stocks, ETFs, commodities, indices and cryptocurrencies such as Bitcoin (BTC), Ethereum (ETH) and Litecoin (LTC).

-

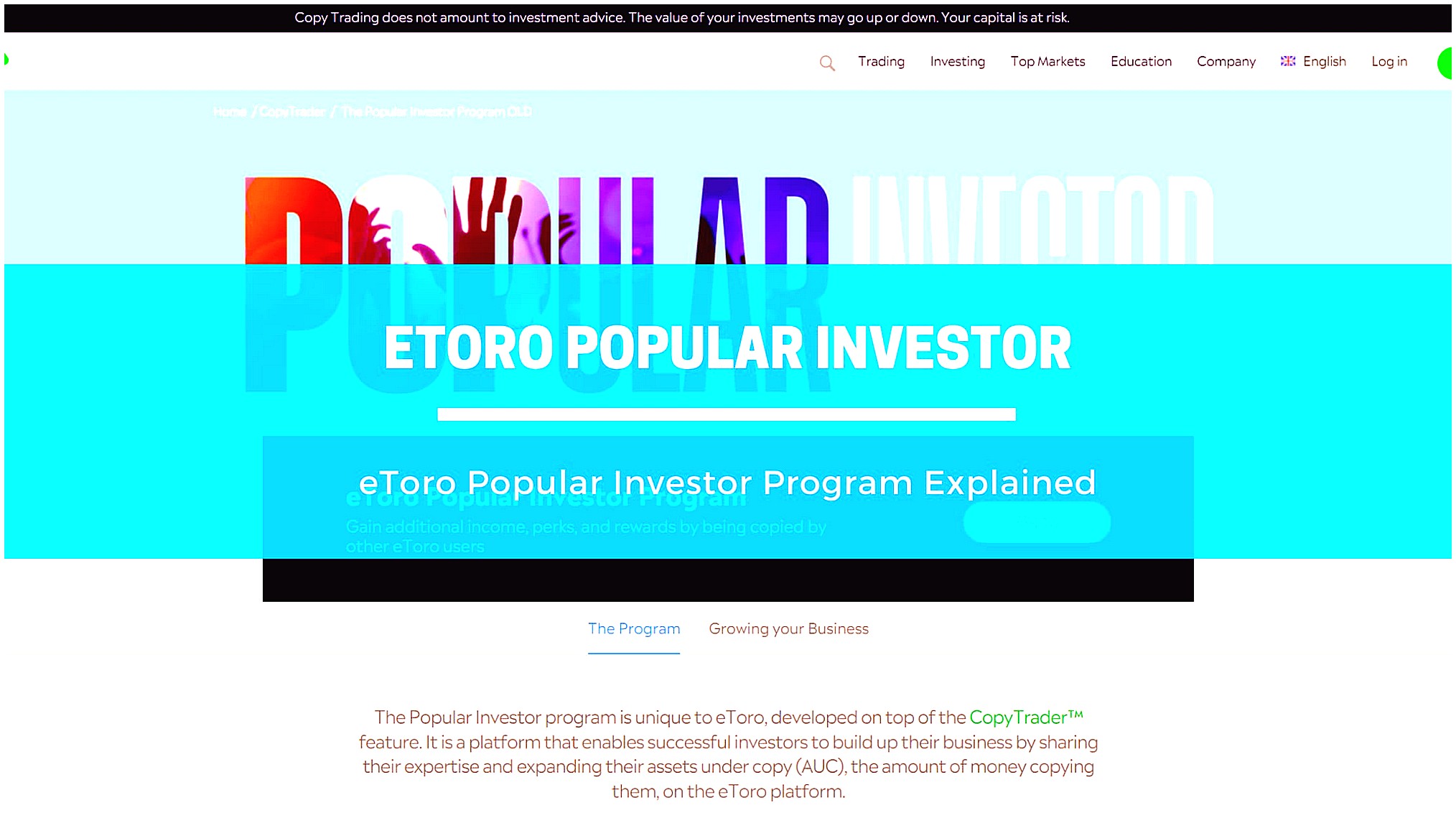

Copy Trading Feature: The copy trading feature on eToro allows users to automatically replicate other successful traders’ portfolios without having to manually manage each individual trade themselves – making it easier for new investors who don’t have much experience in trading yet but still want to benefit from experienced traders’ success

Disadvantages of Trading on eToro in Singapore

1. High Fees: eToro charges a high fee for trading, which can be up to 0.75% of the total trade value. This makes it difficult for traders with small capital to make a profit from their trades.

-

Limited Assets: The range of assets available on eToro in Singapore is limited compared to other online brokers and exchanges, meaning that traders may not have access to all the markets they would like to trade in.

-

Low Leverage: The maximum leverage offered by eToro in Singapore is only 1:50, which is lower than many other online brokers and exchanges offering higher levels of leverage such as 1:200 or even 1:500. This means that traders will need more capital if they want to take advantage of larger price movements when trading with eToro in Singapore.

-

Lack of Education Resources: There are very few educational resources available on the platform, making it difficult for new traders who don’t have much experience with financial markets or trading strategies to get started on the platform successfully without any guidance or support from experienced professionals

How to Get Started with eToro Trading in Singapore

eToro is an online trading platform that has become increasingly popular in Singapore. With its user-friendly interface and low fees, it’s no wonder why so many people are interested in using eToro to trade stocks, currencies, commodities, and more. If you’re new to the world of online trading or just curious about what eToro can offer you as a trader in Singapore, this article will provide you with all the information you need to get started.

Getting started with eToro Trading in Singapore is easy! First off, you’ll need to create an account on their website by providing your personal details such as name and email address. Once your account is created, it’s time to fund it with money from your bank account or credit card. After funding your account successfully, you can start exploring the different markets available on eToro such as stocks and cryptocurrencies.

When selecting which asset class to invest in on eToro there are two main options: copy traders or manual trading. Copy traders allow users to replicate other successful investors’ strategies while manual trading allows users more control over their investments by allowing them to set up orders manually without relying on automated algorithms like copy traders do. It’s important for beginners who are just starting out investing with eToro that they understand how each option works before making any decisions regarding which one they want to use for their trades.

Once you have chosen which asset class(es)you would like to invest in and have decided whether or not copy traders or manual trading is right for you; it’s time for some research! Before investing any money into a particular market be sure that you understand how the market works and what risks may be associated with it so that when placing trades through eToro everything goes smoothly without any surprises along the way! Additionally make sure that whatever investment strategy/style suits best fits within your risk tolerance level too – don’t forget this part!

Finally once everything else has been taken care of – start small! Don’t go throwing large sums of money into markets until after gaining some experience first; remember practice makes perfect (or at least close enough!). With these tips now under your belt getting started with etoro Trading should be much easier than ever before – happy investing everyone!

Understanding the Fees and Costs Associated with eToro Trading in Singapore

When it comes to trading in Singapore, eToro is one of the most popular platforms for investors. With its user-friendly interface and wide range of assets, it’s no wonder why so many people are turning to eToro as their go-to platform for trading. However, before you jump into the world of online investing with eToro, it’s important to understand the fees and costs associated with trading on this platform. In this article, we will explore some of the key fees and costs that come along with using eToro in Singapore.

First off, let’s take a look at what kind of commission rates you can expect when trading on eToro in Singapore. Generally speaking, there are two types of commissions: fixed rate commissions and variable rate commissions. Fixed rate commissions are charged based on a flat fee per trade regardless of how much money is invested or traded; whereas variable rate commissions vary depending on the amount being traded or invested. On average, traders can expect to pay between 0% – 2% commission per trade when using eToro in Singapore.

In addition to these basic commission rates, there may also be other fees associated with using an online broker such as withdrawal fees or currency conversion charges if you’re dealing with foreign currencies (e.g., USD). It’s important to keep these additional costs in mind when budgeting your trades so that you don’t end up spending more than expected due to hidden charges or unexpected expenses down the line!

Finally, while not necessarily a cost associated directly with using an online broker like eToro in Singapore – another factor worth considering is taxes related to any profits made from your investments/trades through this platform (or any other). As always – please consult a qualified tax professional for advice specific to your situation before making any decisions about taxes related to your investments/trades!

Overall understanding all the potential fees and costs associated with trading through an online broker like etoro is essential for anyone looking get started investing their hard earned money! By taking time upfront do research into all possible expenses involved – investors can ensure they have enough funds available make profitable trades without running risk incurring large unexpected losses due unforeseen circumstances beyond their control!

Analyzing Risk Management Strategies for eToro Traders in Singapore

Singapore is an attractive destination for traders looking to take advantage of the country’s strong economic growth and access to global markets. eToro, a leading online trading platform, offers Singaporean traders the opportunity to invest in stocks, currencies, commodities and indices from around the world. In this article we will explore how eToro can help Singaporean traders manage their risk while trading on its platform. We will analyze various risk management strategies available on eToro such as stop-loss orders, leverage limits and portfolio diversification. We will also discuss how these strategies can be used by Singaporean traders to minimize their risks while maximizing returns. Finally, we will provide some tips on how best to use these strategies when trading with eToro in Singapore.

Exploring Different Types of Assets Available Through eToro In Singapore

eToro is a popular online trading platform that has become increasingly popular in Singapore. It offers users the ability to trade a variety of assets, including stocks, commodities, indices and currencies. In this article, we will explore the different types of assets available through eToro in Singapore and how they can be used for successful trading.

Stocks are one of the most common asset classes traded on eToro in Singapore. Stocks represent ownership shares in publicly-traded companies and allow traders to benefit from their growth or decline over time. On eToro, you can buy or sell individual stocks from companies listed on major exchanges such as the SGX (Singapore Exchange). You can also access global markets by investing in ETFs (Exchange Traded Funds) which track stock indices such as the S&P 500 or NASDAQ Composite Indexes.

Commodities are another type of asset class available through eToro’s platform in Singapore. Commodities refer to physical goods like oil, gold and silver which have an intrinsic value due to their limited supply and demand dynamics within markets worldwide. Trading commodities requires an understanding of market fundamentals such as supply/demand forces and geopolitical events that could influence prices significantly over short periods of time.

Indices are baskets of securities that represent a particular sector or region’s performance over time; they provide investors with diversified exposure across multiple underlying components at once rather than having to purchase each security individually – making them ideal for those who wish to gain broad exposure without taking too much risk at once! Popular index options include FTSE 100 (UK), Hang Seng Index (Hong Kong) & Dow Jones Industrial Average (USA).

Finally, currency pairs are also available through eToro’s platform for traders looking to speculate on exchange rate movements between two countries’ currencies – known as Forex trading . This form of trading involves buying one currency while simultaneously selling another; it allows traders to capitalize on changes between these two currencies relative values against each other over time – making it an attractive option for those looking for higher potential returns but greater levels of risk compared with traditional investments like stocks or bonds!

Learning About Leverage and Margin Requirements for Trades On The Platform In SG

eToro is a popular online trading platform in Singapore, offering users the ability to trade stocks, currencies, indices and commodities. For those new to trading on eToro, it is important to understand leverage and margin requirements for trades on the platform. Leverage allows traders to increase their potential profits by borrowing money from the broker. This means that traders can take larger positions than they would be able to with just their own capital. However, this also increases risk as losses are magnified when using leverage. Margin requirements refer to how much of your own funds you must deposit into your account before opening a position on eToro. Knowing these two concepts will help you make informed decisions when trading on eToro in Singapore. In this article we will explore what leverage and margin requirements are and how they work on eToro’s platform in Singapore.

Discovering Tools And Resources For Successful Investing With Etoro In SG

Investing in the stock market can be a daunting task, especially for those who are new to it. With eToro, Singaporeans now have access to an online trading platform that makes investing easier and more accessible than ever before. In this article, we will explore how eToro works and what tools and resources are available to help investors succeed with their investments in Singapore. We will also discuss the benefits of using eToro over traditional methods of investing. By the end of this article, you should have a better understanding of how to use eToro as part of your investment strategy in Singapore.

Examining Customer Support Options For Etoro Traders In SG

As an eToro trader in Singapore, it is important to understand the customer support options available. In this article, we will explore the various customer support services offered by eToro and how they can help traders make informed decisions when trading on the platform. We will also look at some of the common questions asked by traders in Singapore and how best to get answers from eToro’s customer service team. Finally, we will discuss some tips for making sure you get the most out of your trading experience with eToro.

| Feature | eToro Trading | Other Platforms |

|---|---|---|

| User Interface | Intuitive and user-friendly | Difficult to navigate or outdated UI |

| Account Types | Variety of account types available, including demo accounts | Limited selection of account types or no demo accounts available |

| Fees & Commissions | Low fees and commissions No hidden charges or additional costs for deposits/withdrawals Lower spreads than most competitors Higher leverage than other platforms in Singapore Competitive overnight financing rates Tradable assets include stocks, ETFs, commodities, cryptocurrencies and more. All trading instruments are commission-free. |

What are the advantages of trading on eToro in Singapore?

The advantages of trading on eToro in Singapore include:

1. Low fees and commissions – eToro offers some of the lowest fees and commissions for traders in Singapore, making it an attractive option for those looking to maximize their profits.

2. Variety of assets – eToro offers a wide range of assets to trade, including stocks, indices, commodities, cryptocurrencies and more. This allows traders to diversify their portfolios across different asset classes.

3. Easy-to-use platform – The eToro platform is designed with user experience in mind, allowing even novice traders to easily navigate the interface and begin trading quickly without any prior knowledge or experience required.

4. Copy Trading Feature – With its copy trading feature, users can automatically copy trades from experienced investors on the platform which helps them learn faster while also taking advantage of profitable opportunities as they arise.

How does eToro compare to other online trading platforms available in Singapore?

eToro is a popular online trading platform available in Singapore that offers a wide range of features and benefits. It has low fees, no minimum deposit requirements, access to global markets, and an easy-to-use interface. Compared to other online trading platforms available in Singapore, eToro stands out for its user-friendly design and comprehensive educational resources. Additionally, it offers social trading capabilities which allow users to follow the trades of experienced traders or copy their strategies automatically.

Are there any restrictions or limitations when it comes to trading on eToro in Singapore?

Yes, there are restrictions and limitations when it comes to trading on eToro in Singapore. These include: a minimum account balance of $200; a maximum leverage of 1:30 for retail clients; the use of CFDs is not allowed; no hedging or scalping strategies can be used; and all transactions must be conducted through SGD. Additionally, some products may not be available in Singapore due to local regulations.

What types of assets can be traded through eToro in Singapore?

eToro in Singapore offers the ability to trade a variety of assets, including stocks, commodities, indices, cryptocurrencies and ETFs.

Does eToro offer a mobile app for traders based in Singapore?

Yes, eToro offers a mobile app for traders based in Singapore. The app is available on both iOS and Android devices and provides access to all of the features available on the desktop platform.

Is there a minimum deposit required to start trading with eToro in Singapore?

Yes, there is a minimum deposit required to start trading with eToro in Singapore. The minimum deposit amount is $200 SGD.

Are there any fees associated with using the platform for trades based out of Singapore?

Yes, there are fees associated with using the platform for trades based out of Singapore. These fees vary depending on the type of trade and may include brokerage commissions, exchange fees, clearing fees, and other related costs.

Does the platform provide educational resources and support services for new traders from Singapore?

Yes, the platform does provide educational resources and support services for new traders from Singapore. These include tutorials, webinars, trading tools, and customer service.

05.05.2023 @ 13:45

Spanish:

eToro Trading es una plataforma de corretaje y trading social en línea que permite a los usuarios operar una variedad de activos financieros, incluyendo acciones, divisas, materias primas, índices y criptomonedas. Ofrece una amplia gama de características como el copy trading, herramientas de análisis de mercado y acceso a los mercados globales. eToro también proporciona recursos educativos para los traders en Singapur que estén interesados en aprender más sobre el mundo de la inversión.

Entre las ventajas de operar en eToro en Singapur se encuentran las bajas comisiones, la plataforma fácil de usar, la accesibilidad desde cualquier lugar del mundo, la variedad de activos disponibles y la función de copy trading. Sin embargo, también hay desventajas como las altas comisiones, la limitación de activos, el bajo apalancamiento y la falta de recursos educativos.

Para empezar a operar en eToro en Singapur, es necesario crear una cuenta en su sitio web y financiarla con dinero de una cuenta bancaria o tarjeta de crédito. Luego, se puede explorar los diferentes mercados disponibles y elegir entre el copy trading o el trading manual. En general, eToro es una plataforma popular y accesible para los traders en Singapur que buscan diversificar sus inversiones y aprender más sobre el mundo del trading.