Introduction to eToro Trading in Malaysia

eToro is a popular online trading platform that has been gaining traction in Malaysia. It provides users with an easy-to-use interface and access to a wide range of financial instruments, including stocks, commodities, currencies, indices and more. In this article we will explore the features of eToro Trading in Malaysia and how it can benefit traders from all levels of experience. We will also discuss some tips for getting started on the platform as well as some common mistakes to avoid when trading on eToro. Finally, we will provide an overview of the regulations surrounding eToro Trading in Malaysia so you can make informed decisions about your investments.

What is eToro?

eToro is an online trading platform that allows users to trade stocks, commodities, currencies and other financial instruments. It provides access to a wide range of markets and offers advanced features such as copy trading, social trading and automated investing. eToro also has its own cryptocurrency exchange which enables users to buy, sell and store digital assets like Bitcoin. In this article we will explore how eToro works in Malaysia and what you need to know before getting started with it.

Benefits of Using eToro for Malaysian Traders

eToro is a popular online trading platform that offers Malaysian traders the opportunity to trade in various financial markets. This article will explore the benefits of using eToro for Malaysian traders.

One of the main advantages of using eToro for Malaysian traders is its user-friendly interface. The platform has been designed with beginners in mind, making it easy to navigate and understand even for those who are new to trading. Additionally, eToro provides educational resources such as webinars and tutorials which can help novice traders learn more about different aspects of trading.

Another benefit of using eToro is its low fees structure compared to other platforms available in Malaysia. Traders can enjoy competitive spreads on their trades, as well as no commissions or hidden costs when they use this platform. This makes it an attractive option for both experienced and beginner investors alike looking to maximize their profits from their investments without having to pay excessive fees or commissions.

In addition, eToro also offers a variety of tools that make it easier for Malaysian traders to manage their portfolios effectively. These include advanced charting tools which allow users to analyze market trends and identify potential opportunities quickly; copy-trading features which enable them to follow successful strategies used by other investors; and social trading networks where they can connect with other like-minded individuals who share similar interests in investing and trading activities around the world.

Finally, another great advantage offered by eToro is its customer support team which is always available 24/7 via email or live chat should any issues arise while you’re trading on the platform. With these features combined together, there’s no doubt why many Malaysians have chosen this online broker over others when starting out with investing or engaging in active day-to-day trading activities!

How to Open an Account with eToro in Malaysia

Opening an account with eToro in Malaysia is a simple and straightforward process. All you need to do is visit the eToro website, click on “Sign Up” and fill out the registration form. Once your account has been created, you will be able to start trading right away.

To open an account with eToro in Malaysia, you must first provide some basic personal information such as your name, address, phone number and email address. You will also need to create a username and password for your new account. After completing this step, you will then be asked to choose between two different types of accounts: real money or virtual money (also known as practice accounts).

Once you have chosen which type of account best suits your needs, it’s time to make a deposit into your new eToro trading account. You can fund your new trading account by credit card or bank transfer from any Malaysian bank that supports international payments via SWIFT code or IBAN number. The minimum deposit amount required is $200 USD (or equivalent currency) per transaction; however larger deposits may qualify for additional bonuses or discounts depending on the current promotions offered by eToro at the time of opening an account.

After making a successful deposit into your new trading platform, you are now ready to start exploring all that eToro has to offer! With its intuitive user interface and advanced features like copy-trading capabilities and automated portfolio management tools – there’s no limit when it comes to what kind of success traders can achieve through their investments with this broker!

Understanding the Different Types of Assets Available on eToro

eToro is a popular online trading platform in Malaysia that offers investors access to stocks, commodities, currencies and more. With so many different types of assets available on eToro, it can be difficult for traders to understand the differences between them. In this article, we will explore the various asset classes available on eToro and discuss how they can be used to maximize profits.

Stocks are one of the most common asset classes traded on eToro. These include shares of companies listed on major stock exchanges such as Bursa Malaysia or the New York Stock Exchange (NYSE). When investing in stocks through eToro, you have access to a wide range of companies from around the world including blue-chip firms like Apple and Microsoft as well as smaller businesses like Tesla Motors or Alibaba Group Holding Ltd. Stocks offer traders potential for high returns but also come with higher risks than other asset classes due to their volatile nature.

Commodities are another type of asset class offered by eToro which includes physical goods such as oil, gold and silver among others. Commodity prices tend to fluctuate based on supply and demand dynamics which makes them an attractive option for those looking for short-term investments with potentially high returns if correctly timed trades are made. However, commodity markets can be highly unpredictable making them risky investments even when compared against stocks or other assets classes available on eToro.

Currencies are another type of asset class that can be traded through eToro’s platform in Malaysia with some examples being USD/MYR (US Dollar vs Malaysian Ringgit) or EUR/USD (Euro vs US Dollar). Currency pairs usually move within tight ranges over time but large fluctuations do occur due to political events or economic data releases from either country involved in the pair’s exchange rate calculation; these changes often provide opportunities for profit taking by savvy traders who correctly anticipate market movements before they happen.

Finally ETFs (Exchange Traded Funds) represent yet another type of investment vehicle offered by eToro which allow users access a basket full of different securities at once without having to purchase each security individually – this provides investors exposure across multiple markets while reducing risk since no single company is responsible for all gains or losses incurred during trading activities carried out using ETFs instead individual stocks/commodities etc.. ETFs also tend not require large amounts capital upfront unlike other forms investment meaning they may suitable those just starting out trading financial markets via platforms such as etoro .

In conclusion , understanding different types assets available etoro important part becoming successful trader malaysia . By familiarizing yourself with what’s offer , you’ll able make informed decisions about where invest your money order achieve desired results .

Strategies for Successful Trading on eToro Platforms

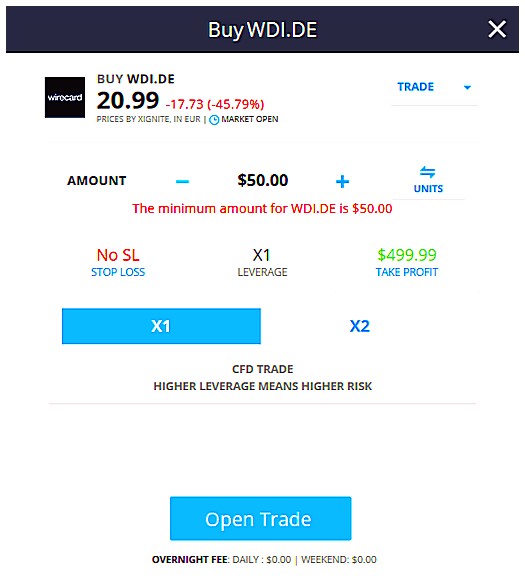

1. Start small: Before investing large amounts of money, it is important to start with a smaller amount and practice trading on the eToro platform. This will help you get familiar with the features and tools available, as well as give you an idea of how successful your trades may be.

-

Research thoroughly: Before making any trades, make sure to research different markets and assets in order to find those that are likely to provide good returns for your investment. Consider factors such as current market trends, economic news, company performance data and more when selecting investments for trading on eToro platforms.

-

Utilize copy trading feature: The copy trading feature allows traders to automatically follow other successful traders’ strategies by copying their trades in real-time or manually setting up a portfolio based on their preferred strategy. By utilizing this feature, traders can learn from experienced investors while also potentially increasing their profits over time through automated strategies that they may not have thought of themselves.

-

Manage risk appropriately: It is important to understand the risks associated with each trade before executing them so that losses can be minimized if things don’t go according to plan. Make sure you use stop loss orders when necessary and diversify your portfolio across multiple asset classes in order reduce overall risk exposure while still having potential for growth over time

Leveraging Social Features of the Platform for Maximum Returns

eToro trading is a popular online platform for traders in Malaysia, offering an easy-to-use interface and a wide range of features. In this article, we will explore how to maximize returns by leveraging the social features of eToro trading. We’ll discuss the benefits of using CopyTrader™ and Popular Investor programs, as well as tips on choosing the right stocks and strategies for successful trades. Finally, we’ll look at some of the risks associated with eToro trading in Malaysia so that you can make informed decisions about your investments. With these insights, you should be able to start making profitable trades on eToro quickly and easily!

Analyzing and Monitoring Your Trades Effectively with Tools Provided by eToro

eToro is a leading online trading platform that offers traders in Malaysia the opportunity to trade in multiple asset classes, including stocks, commodities, indices and currencies. With its user-friendly interface and wide range of tools, eToro makes it easy for Malaysian traders to access global markets. One of the key features of eToro is its ability to provide users with powerful analytical and monitoring tools which can help them make informed decisions when trading. In this article we will explore how these tools can be used effectively by Malaysian traders on eToro.

Analyzing Your Trades: The first step towards successful trading on eToro is analyzing your trades accurately. To do this you need access to reliable market data as well as technical analysis indicators such as moving averages or oscillators. Fortunately, eToro provides all these resources through their advanced charting package which allows you to customize charts according to your own preferences and view real-time price movements across different time frames. Additionally, they also offer a variety of built-in indicators which allow you to identify trends quickly and accurately so that you can take advantage of potential opportunities in the market more easily.

Monitoring Your Trades: Once you have identified an opportunity in the market it’s important that you monitor your trades closely so that any changes are picked up quickly before they become too costly for your portfolio. To do this effectively on eToro there are several options available including live alerts which notify users whenever certain conditions are met or exceeded; trailing stops which automatically adjust stop loss levels based on current prices; and limit orders which enable users to set predetermined entry/exit points at pre-determined prices without having manually monitor each position continuously throughout the day/week/month etc.. All these features combined make it much easier for Malaysian traders using eToro’s platform keep track of their open positions without having worry about missing out on any potentially profitable moves due missed notifications or lack of manual oversight during times when they cannot actively monitor their trades themselves

Advantages & Disadvantages of Trading With Etoro in Malaysia

Advantages of Trading With eToro in Malaysia:

1. Low fees and commissions – eToro offers some of the lowest trading fees and commissions compared to other online brokers, making it an attractive option for Malaysian traders.

2. Wide range of assets – eToro has a wide selection of assets available for trading, including stocks, commodities, indices, currencies and cryptocurrencies. This makes it easy to diversify your portfolio with different asset classes from around the world.

3. Easy-to-use platform – The user interface is intuitive and straightforward which makes it easy for even novice traders to get started quickly on their journey towards becoming successful investors.

4. CopyTrading feature – One unique feature that sets eToro apart from other brokers is its CopyTrading feature which allows users to copy the trades made by experienced traders automatically without having to manually monitor or manage their investments themselves.

Disadvantages of Trading With eToro in Malaysia:

- Limited customer support – While customer service is available via email or live chat during business hours (Monday through Friday), there are no phone lines available at this time which can be inconvenient if you need immediate assistance with a problem or query related to your account or investments on the platform..

- Lack of educational resources – Although there are some basic tutorials provided on how to use the platform as well as articles about investing strategies, these resources are limited compared to what’s offered by other brokers such as TD Ameritrade or Charles Schwab who have comprehensive educational materials covering various topics related to investing and financial markets analysis .

| Feature | eToro Trading | Other Trading Platforms |

|---|---|---|

| Cost of trading | Low cost compared to other platforms. | Varies depending on the platform. |

| User-friendly interface | Easy to use and understand for beginners. | May require more experience or technical knowledge. |

| Variety of assets available | Wide range of stocks, currencies, commodities, indices and ETFs available. | |

| Security features |

What is eToro and how does it work?

eToro is an online trading and investment platform that allows users to trade a variety of financial assets, including stocks, commodities, currencies, indices and cryptocurrencies. The platform provides access to global markets through its easy-to-use interface. It also offers social trading features which allow users to copy the trades of other successful traders on the platform. With eToro’s CopyTrader feature, users can replicate the strategies used by top investors in order to make more informed decisions about their own investments. Additionally, eToro provides educational resources such as webinars and tutorials for those who are new to investing or want to learn more about how it works.

How has the Malaysian economy been affected by eToro trading?

The Malaysian economy has been positively affected by eToro trading. The introduction of eToro’s online trading platform has allowed more Malaysians to access the global financial markets, allowing them to diversify their investments and take advantage of international opportunities. This increased investment activity has helped stimulate economic growth in Malaysia, as well as providing additional sources of revenue for the government through taxes on profits made from eToro trades. Additionally, the presence of a regulated and reliable online broker such as eToro in Malaysia has also attracted foreign investors into the country, further boosting economic growth.

Are there any risks associated with using eToro in Malaysia?

Yes, there are risks associated with using eToro in Malaysia. The most significant risk is that the Malaysian government does not regulate online trading platforms such as eToro, so it is possible to lose money if you do not understand how the platform works or if you make a mistake when investing. Additionally, since eToro operates outside of Malaysia’s jurisdiction, investors may be exposed to foreign exchange rate fluctuations and other market risks. Finally, it is important to remember that all investments involve some degree of risk and past performance is no guarantee of future results.

What types of assets can be traded on eToro in Malaysia?

eToro in Malaysia offers trading of a variety of assets, including stocks, commodities, indices, cryptocurrencies and ETFs.

Is there a minimum amount required to start trading on eToro in Malaysia?

Yes, the minimum amount required to start trading on eToro in Malaysia is $200.

What are some of the advantages of using eToro for trading in Malaysia?

Some of the advantages of using eToro for trading in Malaysia include:

1. Low fees – eToro charges a low commission on trades, making it an attractive option for those looking to save money on their investments.

2. User-friendly platform – The eToro platform is easy to use and navigate, allowing traders of all levels to quickly learn how to trade without having to invest too much time into learning the ropes.

3. Variety of markets – With access to over 2000 different assets from stocks, commodities, indices and more, traders can diversify their portfolios with ease and have plenty of options when it comes to investing strategies.

4. CopyTrader feature – This feature allows users to copy other successful traders’ strategies so they can start trading with confidence even if they are new or inexperienced investors.

Does the Malaysian government regulate or oversee activities related to eToro trading within its borders?

Yes, the Malaysian government does regulate and oversee activities related to eToro trading within its borders. The Securities Commission Malaysia (SC) is responsible for regulating all aspects of securities and derivatives markets in Malaysia, including eToro trading. All brokers offering services in Malaysia must be licensed by the SC before they can offer their services to Malaysian investors.

Are there any resources available to help investors understand how to use the platform effectively when engaging in trades through eToro in Malaysia?

Yes, there are resources available to help investors understand how to use the platform effectively when engaging in trades through eToro in Malaysia. eToro provides a comprehensive guide on its website that covers topics such as account setup, trading strategies, and more. Additionally, there are several online forums dedicated to discussing investing and trading with eToro in Malaysia where users can ask questions and get advice from experienced traders.

05.05.2023 @ 13:46

nt). If you’re new to trading, we recommend starting with a virtual money account to get a feel for the platform and practice your trading strategies before investing real money. Once you’re ready to start trading with real money, you can easily switch to a real money account by making a deposit using one of the available payment methods such as credit/debit card, bank transfer or e-wallet. It’s important to note that eToro is a regulated broker and as such, you will need to verify your identity and provide some additional documentation such as a copy of your ID or passport and proof of address before you can start trading with real money. Overall, opening an account with eToro in Malaysia is a quick and easy process that can be completed in just a few minutes. Whether you’re a beginner or an experienced trader, eToro offers a range of features and benefits that make it a great choice for anyone looking to invest in the financial markets.