Introduction to eToro Trading in Ireland

Ireland is quickly becoming a hub for online trading, and eToro is one of the leading platforms. In this article, we’ll explore what makes eToro stand out from other trading platforms in Ireland and how you can get started with it. We’ll look at its features, fees, regulations, customer service options and more to help you decide if eToro is right for your needs. So let’s dive into exploring eToro Trading in Ireland!

Advantages of Trading with eToro in Ireland

1. Access to a Wide Range of Assets: eToro offers traders in Ireland access to over 1,800 assets including stocks, commodities, indices and cryptocurrencies. This allows traders to diversify their portfolios and take advantage of different market opportunities.

-

Low Fees: eToro’s fees are among the lowest in the industry with no commissions on trades or withdrawal fees when trading with real money accounts.

-

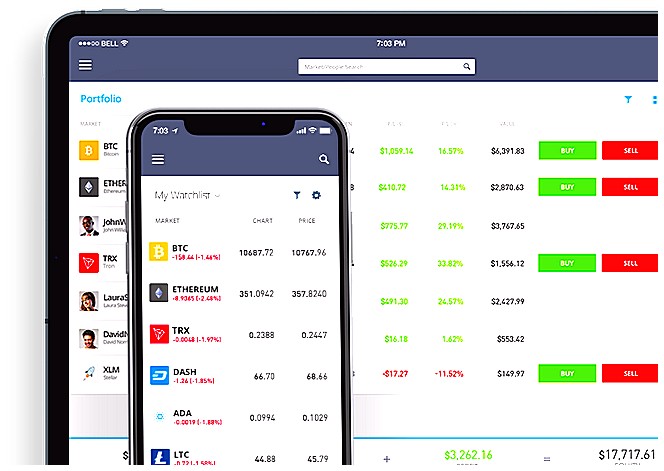

Easy-to-Use Platform: The eToro platform is designed for both novice and experienced traders alike as it is easy to use and navigate while also offering advanced features such as copy trading and social trading tools that allow users to follow other successful investors within the network.

-

Regulation & Security: As an EU regulated broker, eToro provides its Irish customers with a secure environment for their investments backed by strong regulatory standards from CySEC (Cyprus Securities Exchange Commission). Furthermore, all customer funds are held in segregated bank accounts which further enhances security measures taken by the company against any potential fraud or theft of funds from clients’ accounts

What Types of Assets Can be Traded on eToro?

eToro is a leading online trading platform that offers users in Ireland the opportunity to trade various types of assets. eToro allows users to invest in stocks, commodities, currencies, indices and ETFs (Exchange Traded Funds). Users can also access CFDs (Contracts for Difference) on cryptocurrencies such as Bitcoin and Ethereum. Additionally, traders can take advantage of CopyTrader™ technology which enables them to copy the trades of other successful investors on the platform. With eToro’s innovative tools and features, Irish traders have access to a wide range of investment opportunities from around the world.

How to Open an Account and Start Trading on eToro

eToro is a popular online trading platform that has become increasingly popular in Ireland. With its user-friendly interface and low fees, it’s no wonder why so many Irish traders are turning to eToro for their trading needs. If you’re interested in getting started with eToro, here’s how to open an account and start trading:

-

Visit the official website of eToro (www.etoro.com) and click on “Sign Up” at the top right corner of the page.

-

Enter your personal information such as name, email address, phone number etc., then create a username and password for your account. You will also need to provide proof of identity before proceeding further with the registration process.

-

Once you have completed all required steps, you can now fund your account by transferring money from your bank or using other payment methods like PayPal or credit/debit cards accepted by eToro (note that some payment methods may incur additional fees).

-

After funding your account successfully, you can now start exploring different markets available on eToro such as stocks, commodities, currencies etc., select one that suits your investment goals best and begin placing trades according to market conditions or trends observed through technical analysis tools provided by the platform itself or third-party software applications integrated into it .

5 Finally , if needed , set up stop loss orders which helps limit potential losses when prices move against expectations . This feature allows traders to manage risk better while still allowing them take advantage of favorable price movements .

Understanding the Fees Associated with eToro Trading in Ireland

When it comes to investing, one of the most important things to consider is the fees associated with trading. For those looking to invest in Ireland, eToro offers a variety of options for trading stocks and other financial instruments. In this article, we will explore the various fees associated with eToro trading in Ireland and how they can affect your overall investment strategy.

First off, there are two types of fees associated with eToro trading: spreads and commissions. Spreads refer to the difference between the buy price and sell price on any given asset or instrument; this is essentially what you pay when you purchase an asset or instrument through eToro. Commissions refer to additional charges that may be applied when executing trades on behalf of clients; these include broker-assisted orders as well as automated orders such as stop losses or take profits.

The amount charged for each type of fee varies depending on which assets or instruments you are trading and which markets you are accessing via eToro’s platform. Generally speaking, however, spreads tend to range from 0% – 2%, while commissions typically start at around 0%. It’s important to note that some markets may have higher commission rates than others due to liquidity constraints or market conditions – so always check before making a trade!

In addition to spreads and commissions, there are also overnight financing costs (also known as “swap”) applicable when holding positions open past midnight UTC timezone (which applies in Ireland). These swap charges vary based on the underlying asset being traded but generally range from -0.04% up until +0.08%. As such, it’s essential that investors understand all potential costs before committing funds into any particular position/market – otherwise they could end up paying more than expected!

Finally, it should be noted that deposits made into an Irish bank account incur no extra cost beyond regular banking fees; withdrawals however do come with a flat rate charge of €5 per transaction regardless of size/amount withdrawn – so bear this in mind if planning ahead for larger transfers out from your account balance!

Overall then, understanding all applicable fees associated with eToro Trading in Ireland is key if investors want their investments decisions be informed by accurate information about total costs involved – allowing them make better decisions about where best allocate their capital over time!

Leverage and Margin Requirements for Irish Traders

eToro is a popular online trading platform that allows Irish traders to invest in stocks, commodities, currencies and more. It offers leverage and margin requirements for Irish traders to help them maximize their profits. Leverage enables investors to increase their buying power by borrowing money from the broker at a fixed rate of interest. This means that with a small amount of capital, an investor can open larger positions than they would be able to without leverage. Margin requirements refer to the minimum amount of equity needed in order for an investor to open or maintain a position on eToro’s platform. By setting these limits, eToro helps protect its customers from taking on too much risk when investing in volatile markets.

For Irish traders using eToro, leverage ratios are set at 1:30 while margin requirements range between 2% and 5%. These levels may vary depending on the asset being traded and other factors such as market volatility. For example, leveraged products like cryptocurrencies have higher margin requirements due to their increased volatility compared with traditional assets like stocks or commodities. Additionally, some products may not be available for trading if the required margins cannot be met by the trader’s account balance or other collateral held by eToro Ireland Ltd., which is regulated by Central Bank of Ireland (CBI).

Security Measures Taken by eToro for Irish Investors

eToro is a popular online trading platform that offers investors in Ireland the opportunity to trade stocks, commodities, and currencies. As with any online financial service provider, security measures are taken by eToro to ensure the safety of its Irish customers’ funds and personal information.

To protect customer accounts from unauthorized access or fraud, eToro employs advanced encryption technology for all data transfers between users and their servers. All user passwords must be at least 8 characters long and contain both letters and numbers for added security. In addition, two-factor authentication (2FA) is available as an extra layer of protection when logging into your account on the web or mobile app.

eToro also provides segregated client money accounts so that investor funds remain separate from company assets in case of insolvency or bankruptcy proceedings. This means that if anything were to happen to eToro itself, customer deposits would not be affected since they are held separately in secure bank accounts with major banks such as Barclays Bank PLC in London.

Furthermore, all transactions made through eToro are monitored by external auditors who check for suspicious activity on a regular basis. If any unusual activity is detected then it will be reported immediately to relevant authorities such as the Central Bank of Ireland (CBI).

In conclusion, eToro takes numerous steps to protect its Irish customers’ investments while providing them with a safe environment for trading online assets like stocks and cryptocurrencies

Educational Resources Available from eToro for Irish Traders

eToro is a popular online trading platform that offers a wide range of educational resources to help Irish traders become more successful. From basic tutorials and webinars to in-depth courses, eToro provides an array of tools and resources designed to improve the knowledge base of both beginner and experienced traders alike.

For those just starting out, eToro’s Trading Academy includes interactive video lessons covering topics such as market analysis, risk management strategies, technical indicators, chart patterns and much more. In addition, users can access daily market updates from professional analysts as well as join live webinars hosted by leading industry experts who provide valuable insights into the latest trends in financial markets.

More advanced traders may benefit from eToro’s Advanced Trading Course which covers topics like portfolio diversification techniques, algorithmic trading strategies and automated copy trading systems. This course also includes comprehensive guides on margin trading with leverage ratios up to 1:400 for CFDs (Contracts For Difference).

Finally, eToro also provides exclusive access to its own social network where members can interact with other investors from around the world while sharing their ideas about various markets or individual stocks/assets. Through this network it is possible for users to find new investment opportunities or gain valuable advice from seasoned professionals without ever leaving their homes.

Customer Support Services Offered by eToro to Irish Clients

eToro offers a comprehensive range of customer support services to Irish clients. eToro’s customer service team is available 24/7 via email, live chat and telephone. The team can provide assistance with account setup, trading queries, technical issues and more. Additionally, eToro provides educational resources such as webinars and tutorials for those who are new to online trading or would like to brush up on their skills. eToro also has an extensive FAQ section which covers all the most common questions about using the platform.

Final Thoughts on Exploring eToro Trading in Ireland

In conclusion, eToro trading in Ireland offers a great opportunity for investors to take advantage of the current market conditions. With its user-friendly platform and wide range of features, it is easy to see why many people are turning to eToro as their preferred online broker. The ability to trade multiple assets with leverage and access advanced tools makes it an attractive option for both novice and experienced traders alike. Additionally, the social trading feature allows users to connect with other traders around the world who share similar interests or strategies. All in all, eToro provides a secure and reliable way for Irish investors to get involved in the global markets without having to worry about any potential risks associated with traditional investing methods.

| eToro Trading in Ireland | Other Online Trading Platforms |

| :—————————————: | :————————————————–: |

| Offers access to a wide range of markets | May have limited access to certain markets |

| Variety of trading tools and features | Fewer trading tools and features |

| Low minimum deposit | Higher minimum deposit |

| No commission fees on trades | Commission fees may apply on some trades |

| Easy-to-use platform | More complex user interface

What are the benefits of trading on eToro in Ireland?

The benefits of trading on eToro in Ireland include:

1. Access to a wide range of markets and assets, including stocks, commodities, indices, ETFs, cryptocurrencies and more.

2. Low fees with no commissions or hidden costs for Irish traders.

3. A secure platform with advanced security features such as two-factor authentication and encryption technology to protect your funds from cybercrime threats.

4. An intuitive user interface that makes it easy to navigate the platform and access the features you need quickly and easily.

5. A variety of tools available to help you make informed decisions about your trades, such as copy trading capabilities that allow you to follow experienced traders’ strategies automatically or use their insights when making your own decisions about which investments are right for you.

How does eToro’s trading platform compare to other online brokers?

eToro’s trading platform is designed to be user-friendly and intuitive, making it a great choice for beginner traders. It offers access to over 2,400 stocks, ETFs, commodities, currencies and cryptocurrencies. Additionally, eToro has low fees compared to other online brokers and provides features such as copy trading that allow users to automatically replicate the trades of experienced investors. Overall, eToro’s platform stands out from other online brokers due to its simplicity and range of features available.

Are there any restrictions or fees associated with using eToro in Ireland?

Yes, there are restrictions and fees associated with using eToro in Ireland. All users must be 18 years of age or older to use the platform, and Irish residents may only trade on the EU regulated version of eToro. Additionally, trading fees vary depending on which asset is being traded, but generally range from 0.75% to 2%. Withdrawal fees also apply when withdrawing funds from an account.

What types of assets can be traded on eToro in Ireland?

eToro offers a wide range of assets that can be traded in Ireland, including stocks, commodities, indices, ETFs (Exchange Traded Funds), cryptocurrencies and more.

Is it possible to open a demo account on eToro for practice trades before investing real money?

Yes, it is possible to open a demo account on eToro for practice trades before investing real money. The eToro platform offers virtual trading accounts that allow users to simulate the live markets and practice their trading strategies without risking any real capital.

Does eToro offer any educational resources for new traders in Ireland?

Yes, eToro offers educational resources for new traders in Ireland. The platform provides a range of tutorials and webinars to help users get started with trading. Additionally, the company has an active online community where users can ask questions and receive advice from experienced traders.

Are there any customer support services available if I have questions about trading on eToro in Ireland?

Yes, eToro offers customer support services in Ireland. You can contact their Customer Support team by emailing [email protected] or calling +353 (0)1 514 3366. They also offer live chat and a 24/7 online help center with answers to frequently asked questions about trading on eToro in Ireland.

What security measures does eToro take to protect my funds while trading from an Irish-based account?

eToro takes a number of security measures to protect your funds while trading from an Irish-based account. These include two-factor authentication, encrypted data storage and transmission, secure access control systems, and fraud prevention tools. eToro also offers segregated accounts that keep customer funds separate from company funds for added protection. Additionally, all customer deposits are held in EU regulated banks with high levels of security and insurance coverage.

05.05.2023 @ 13:45

As an AI language model, I do not have a native language, but I can provide a comment in English on the topic of eToro Trading in Ireland. It is great to see that Ireland is becoming a hub for online trading, and eToro is one of the leading platforms in the country. The article provides a comprehensive overview of the advantages of trading with eToro in Ireland, including access to a wide range of assets, low fees, an easy-to-use platform, and strong regulation and security measures. It is also helpful to know that eToro offers various types of assets for trading, including stocks, commodities, currencies, indices, ETFs, and CFDs on cryptocurrencies. The step-by-step guide on how to open an account and start trading on eToro is also very informative. Overall, this article is a great resource for anyone interested in online trading in Ireland.