Introduction to eToro Trading in India

eToro is a leading online trading platform that has revolutionized the way people trade in India. It offers an easy-to-use, user-friendly interface and allows users to buy and sell stocks, currencies, commodities, indices and more with just a few clicks of the mouse. With its advanced features such as copy trading, social trading and portfolio management tools, eToro makes it easier for traders to manage their investments in real time. In this article we will explore eToro Trading in India – how it works and what benefits it can offer Indian traders.

Benefits of eToro Trading for Indian Investors

eToro trading is becoming increasingly popular among Indian investors, and for good reason. With its user-friendly platform, low fees, and wide range of assets to choose from, eToro offers a number of benefits that make it an attractive option for Indian traders. Here are some of the key benefits of eToro trading for Indian investors:

-

Low Fees: One of the main advantages that eToro offers is its low fees structure. Unlike other brokers who charge high commissions on trades, eToro only charges a small spread fee which makes it more affordable for Indian traders.

-

Wide Range Of Assets: Another great benefit of using eToro is the wide variety of assets available to trade with including stocks, ETFs, cryptocurrencies and commodities like gold and oil. This gives Indian investors access to global markets without having to open multiple accounts with different brokers or exchanges in order to do so.

-

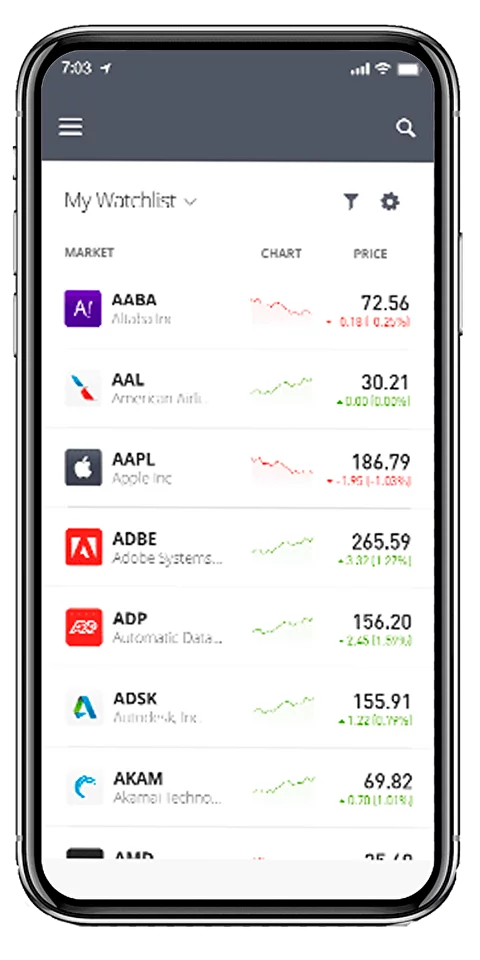

User Friendly Platform: The platform offered by eToro is extremely user friendly making it easy even for beginners to start trading quickly without needing any prior experience or knowledge about financial markets or investing strategies . Additionally , they offer educational resources such as webinars , tutorials , market analysis tools etc., which can help new traders get up to speed quickly .

4 Social Trading Feature : One unique feature offered by etoro is their social trading feature where users can follow experienced traders and copy their trades automatically into their own account . This allows newbie’s access to expert advice while also allowing them learn how professional traders approach the markets in real time .

Understanding the Different Types of eToro Accounts

eToro is a popular online trading platform that has become increasingly popular in India. With its user-friendly interface and wide range of features, it’s no wonder why so many traders are turning to eToro for their trading needs. However, before you start trading on eToro, it’s important to understand the different types of accounts available and how they can benefit your trading strategy.

The most basic type of account offered by eToro is the Standard Account. This account offers access to all major markets including stocks, indices, commodities and cryptocurrencies with leverage up to 1:30. The minimum deposit required for this account is $200 USD or equivalent in other currencies. It also includes an educational center which provides useful resources such as webinars and tutorials about different aspects of trading on eToro.

For those looking for more advanced features, there’s the Premium Account which requires a minimum deposit of $2 000 USD or equivalent in other currencies. This account allows users to trade with higher leverage up to 1:400 as well as access additional features such as CopyTrader™ technology which enables them to copy successful traders’ strategies automatically into their own portfolio; Virtual Trading feature where users can practice without risking real money; and exclusive market analysis from professional analysts at eToroX Research Center.

Finally, there’s the Islamic Account designed specifically for Muslim traders who wish to comply with Sharia law while still enjoying all the benefits that come with using eToro platform such as low fees and high security standards . This account does not allow any form of interest rate payments or charges related activities but still allows full access to all markets including cryptocurrency assets . The minimum deposit required for this type of account is also $200 USD or equivalent in other currencies .

In conclusion , understanding these different types of accounts offered by eToro will help you choose one that best suits your needs when exploring Etorro Trading in India .

Advantages and Disadvantages of Investing with eToro in India

Advantages of Investing with eToro in India:

1. Low minimum deposit requirement – eToro requires a low minimum deposit amount, making it an ideal platform for beginner investors who are just starting out.

2. Wide range of assets to choose from – eToro offers a wide selection of stocks, indices, commodities and currencies that can be traded on the platform.

3. Easy-to-use interface – The user interface is intuitive and easy to use, allowing even novice traders to quickly get up and running with trading on the platform.

4. Social trading features – With its social trading features, users can follow other successful traders and copy their trades automatically if they wish to do so. This allows users to learn from more experienced traders without having to manually monitor their investments all the time.

5. Leverage options available – Investors have access to leverage when using eToro which allows them to increase their potential returns by taking larger positions than what would normally be possible with their own capital alone .

Disadvantages of Investing with eToro in India:

- High fees – Trading fees are relatively high compared to some other online brokers which may make it difficult for some investors looking for lower cost alternatives .

2

The Process of Opening an Account on eToro Platform

eToro is a popular online trading platform that has become increasingly popular in India. This article will explore the process of opening an account on eToro and how to start trading with it.

The first step to open an account on eToro is to create a username and password. Once you have created your login credentials, you can then fill out the registration form which includes basic personal information such as name, address, phone number etc. After completing this step, you will need to verify your identity by providing documents such as a passport or driver’s license. Once verified, you are ready to deposit funds into your new eToro account via bank transfer or credit/debit card payment methods.

Once the funds have been deposited into your account, you can begin exploring the various features available on eToro such as copy-trading and social trading tools which allow users to follow other traders’ strategies and copy their trades automatically if desired. You can also browse through different markets including stocks, commodities, indices and currencies in order to find potential investments that match your risk profile and goals for investing.

Finally once all of these steps are completed successfully, you will be able to access all of the features available on eToro’s platform so that you can start trading right away!

Features and Tools Available on the Platform for Indian Traders

eToro is a popular online trading platform for Indian traders. It offers a range of features and tools to help users make informed decisions about their investments. Here are some of the features and tools available on eToro for Indian traders:

-

CopyTrader™: This feature allows users to copy the trades of other successful investors, helping them learn from experienced traders while diversifying their portfolio.

-

CopyPortfolios™: This tool enables users to invest in professionally managed portfolios with low minimum deposits and fees, making it easier for beginners to get started with investing without having to do all the research themselves.

-

Market Data & Analysis: eToro provides up-to-date market data and analysis so that users can stay informed about current trends in the markets they’re interested in investing in.

-

Social Trading Network: With its social trading network, eToro allows users to connect with other investors around the world who share similar interests or strategies as well as follow top performing investors on its platform by copying their trades automatically or manually through CopyTrader™ or CopyPortfolios™ respectively .

-

Customer Support: The customer support team at eToro is always available 24/7 via email, phone, chatbot or live chat so that customers can get quick answers when they need help navigating the platform or have any questions related to their investments

Popular Assets Traded Through the Platform in India

eToro is a popular online trading platform in India that offers investors the opportunity to trade various assets. Popular assets traded through the platform in India include stocks, commodities, indices, cryptocurrencies and ETFs. Stocks from major Indian companies such as Reliance Industries Ltd., Tata Motors Ltd., HDFC Bank Ltd., Infosys Ltd. and ICICI Bank are available for trading on eToro. Commodities like gold, silver and crude oil can also be traded through the platform. In addition to these traditional asset classes, eToro also allows traders to invest in global indices such as S&P 500 Index (USA), FTSE 100 Index (UK) and Nifty 50 Index (India). Moreover, cryptocurrency enthusiasts can buy Bitcoin or Ethereum directly on eToro with their local currency INR. Finally, Exchange Traded Funds (ETFs) provide an easy way for investors to diversify their portfolios by investing in multiple underlying securities at once; some of the most popular ETFs available on eToro include Vanguard Total World Stock ETF and iShares MSCI Emerging Markets ETF among others.

Fees, Charges & Commissions Applicable to Indian Traders

eToro is a popular online trading platform that allows Indian traders to buy and sell stocks, commodities, currencies, indices and more. While the platform offers many advantages for Indian traders, it also comes with certain fees, charges and commissions applicable to them.

The most common fee charged by eToro is the spread fee which is calculated as a percentage of the total trade value. This fee can range from 0.09% to 1%. Additionally, there may be other costs associated with each transaction such as commission fees or overnight financing rates.

In addition to these fees, eToro also charges an inactivity fee if you do not log into your account for at least 12 months or if you have no open trades on your account for at least three consecutive months. The amount of this inactivity fee depends on your country of residence but generally ranges between $10-$20 per month depending on how much money you have invested in your portfolio.

Finally, when trading with eToro India there are taxes that need to be taken into consideration including capital gains tax (CGT) and securities transaction tax (STT). These taxes vary based on individual circumstances so it’s important to consult a financial advisor before making any decisions about investing through eToro India.

Security Measures Taken by eToro for its Indian Clients

eToro is a popular online trading platform that offers its services to Indian clients. As with any financial service, security is of utmost importance for eToro and they have taken several measures to ensure the safety of their customers’ funds and data.

First, all customer accounts are protected by two-factor authentication (2FA). This requires users to provide both a username and password as well as an additional form of identification such as a one-time code sent via SMS or email before being able to access their account. Additionally, all communication between eToro’s servers and its customers’ devices is encrypted using industry standard SSL technology.

eToro also has strict anti-money laundering policies in place which require clients to verify their identity when signing up for an account. This includes providing proof of address, photo ID, bank statements or other documents depending on the user’s country of residence. All these documents are securely stored in accordance with GDPR regulations and only used for verification purposes.

Finally, eToro has implemented various risk management tools such as stop loss orders which allow traders to limit losses if the market moves against them unexpectedly. These features help protect investors from making large losses due to unforeseen market movements while still allowing them to take advantage of potential profits from successful trades.

Conclusion: Is Investing With eToro Worth It?

In conclusion, investing with eToro is worth it for Indian traders looking to take advantage of the platform’s low fees and user-friendly interface. With its wide range of assets, advanced trading tools, and educational resources, eToro provides a great opportunity for investors to diversify their portfolios and gain access to global markets. Additionally, its customer service team is available 24/7 to provide support when needed. For these reasons, investing with eToro can be an attractive option for Indian traders who are looking for a reliable online broker.

| Feature | eToro Trading in India | Other Trading Platforms in India |

|---|---|---|

| Account Opening Process | Easy and quick online registration process with no paperwork required. Can be done through the mobile app or website. Verification of identity is also simple and fast. | Difficult and lengthy account opening process with lots of paperwork involved. May require physical visits to branches for verification purposes. |

| Fees & Charges | Low fees compared to other trading platforms, especially for high-volume traders. No hidden charges or additional costs associated with trades made on the platform. | High fees compared to eToro, especially for high-volume traders. Additional costs may be associated with certain types of trades made on the platform such as margin calls or short selling transactions etc.. |

| Security & Regulation | Regulated by SEBI (Securities Exchange Board of India) which ensures that all customer funds are safe and secure from any kind of fraud or theft attempts by third parties. | Not regulated by SEBI so there is a risk that customer funds could be exposed to potential fraud or theft attempts by third parties not monitored by SEBI regulations . |

What are the benefits of trading on eToro in India?

The benefits of trading on eToro in India include:

1. Access to a wide range of markets – eToro provides access to stocks, commodities, indices, ETFs and cryptocurrencies from all over the world.

2. Low fees – eToro charges no commission for trades and has competitive spreads on most assets.

3. User-friendly platform – The platform is easy to use with an intuitive design that makes it simple for traders of any experience level to get started quickly.

4. Copy Trading feature – This allows users to copy the trades of experienced traders automatically so they can benefit from their expertise without having to do all the research themselves.

5. Social trading network – With its social trading network, users can connect with other traders around the world and share ideas or follow successful strategies used by others in real time.

Are there any restrictions or regulations that Indian traders should be aware of when using eToro?

Yes, Indian traders should be aware of the following restrictions and regulations when using eToro:

1. Trading in certain instruments may not be available to Indian traders due to regulatory restrictions.

2. All deposits must originate from a bank account held in India with an Indian financial institution or a payment service provider authorized by the Reserve Bank of India (RBI).

3. Leverage trading is prohibited for all clients resident in India under RBI guidelines.

4. Margin trading is also prohibited for all clients resident in India under RBI guidelines, except those who have obtained prior approval from the Securities and Exchange Board of India (SEBI).

5. Withdrawals can only be made to bank accounts held with an Indian financial institution or a payment service provider authorized by the Reserve Bank of India (RBI).

How easy is it to open an account and start trading on eToro in India?

It is very easy to open an account and start trading on eToro in India. All you need to do is visit the website, fill out a registration form, provide proof of identity and address, and make a deposit. Once your account has been verified, you can begin trading right away.

Does eToro offer any special features for Indian traders?

Yes, eToro offers special features for Indian traders. These include the ability to trade in Indian Rupees (INR), access to local customer support, and a range of educational resources tailored specifically for Indian investors. Additionally, eToro has partnered with several leading banks in India to provide seamless deposit and withdrawal options for its users.

What types of assets can be traded on eToro in India?

On eToro in India, users can trade a variety of assets including stocks, commodities, currencies (forex), indices and cryptocurrencies.

Is there a minimum deposit requirement for opening an account with eToro in India?

Yes, there is a minimum deposit requirement for opening an account with eToro in India. The minimum deposit amount is ₹10,000.

How secure is trading with eToro in India compared to other platforms?

The security of trading with eToro in India is comparable to other platforms. eToro uses the latest encryption technology and follows strict financial regulations to ensure that all customer funds are secure. Additionally, it offers two-factor authentication for extra protection against unauthorized access. All transactions are monitored by a dedicated team of professionals who make sure that no suspicious activity takes place on the platform.

Are there any fees associated with trading on the platform, and if so, what are they?

Yes, there are fees associated with trading on the platform. These fees vary depending on the type of trade and may include commission fees, exchange fees, margin interest rates, overnight financing charges, and other costs associated with each trade.

05.05.2023 @ 13:45

ईटोरो ट्रेडिंग का परिचय भारत में ईटोरो एक अग्रणी ऑनलाइन ट्रेडिंग प्लेटफॉर्म है जो भारत में लोगों की ट्रेडिंग करने के तरीके को क्रांतिकारी बनाया है। यह एक आसान उपयोग, उपयोगकर्ता के अनुकूल इंटरफ़ेस प्रदान करता है और कुछ क्लिक के साथ उपयोगकर्ताओं को स्टॉक, मुद्रा, कमोडिटीज, इंडेक्स और अधिक खरीदने और बेचने की अनुमति देता है। इसके उन्नत फीचर जैसे कॉपी ट्रेडिंग, सोशल ट्रेडिंग और पोर्टफोलियो प्रबंधन उपकरणों के साथ, ईटोरो ट्रेडरों को अपने निवेशों को वास्तविक समय में प्रबंधित करना आसान बनाता है। इस ल