Introduction to eToro Trading in Belgium

Belgium is one of the most popular countries for online trading, and eToro has become a major player in this market. In this article, we will explore how to get started with eToro trading in Belgium and what you need to know before taking the plunge. We’ll also look at some of the features that make eToro stand out from other brokers, as well as tips on getting the most out of your trading experience. Finally, we’ll discuss some potential risks associated with investing through eToro in Belgium so that you can make an informed decision about whether or not it’s right for you.

Benefits of eToro Trading in Belgium

1. Low Fees: eToro offers low fees for trading in Belgium, making it an attractive option for traders who are looking to save money on their trades.

-

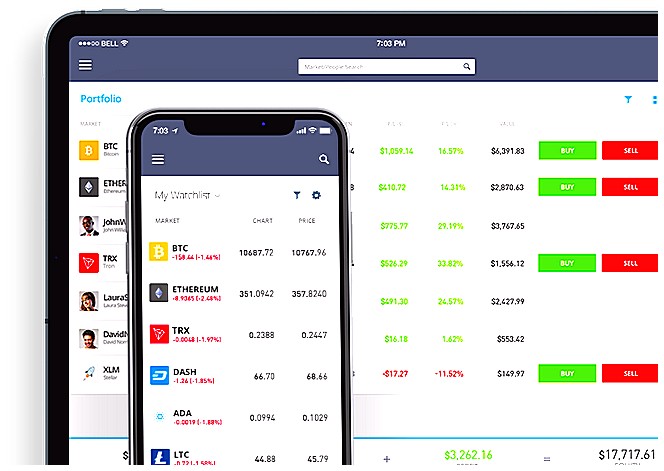

Easy Accessibility: eToro is easily accessible and can be used from any device with an internet connection, allowing traders to access the platform wherever they are located.

-

Variety of Assets: With a wide range of assets available on the platform, including stocks, commodities, currencies and indices, traders have plenty of options when it comes to choosing what to trade in Belgium.

-

Social Trading Network: The social trading network allows users to connect with other experienced investors and learn from them by copying their strategies or asking questions about different markets and investments.

-

CopyTrader Feature: This feature enables users to automatically copy successful trades made by other experienced investors on the platform without having any prior knowledge or experience in trading themselves

How to Get Started with eToro Trading in Belgium

Getting started with eToro trading in Belgium is a relatively straightforward process. All you need to do is create an account, fund it, and start trading. Here’s how:

-

Create an Account – The first step is to create your eToro account by visiting the website and clicking “Sign Up” at the top right of the page. You will then be asked to provide some personal information such as name, address, email address, etc., before creating a username and password for your new account.

-

Fund Your Account – Once you have created your account, you can then fund it using one of several methods including credit/debit cards or bank transfers from Belgian banks like BNP Paribas Fortis or KBC Bank NV. It may take up to 5 business days for funds to appear in your eToro wallet after initiating a transfer from your bank so make sure that you plan ahead if you are planning on making any trades soon after funding your account!

-

Start Trading – Now that your eToro wallet has been funded with money, you can begin exploring all the different types of assets available on their platform such as stocks, commodities (like gold), currencies (such as EUR/USD) and cryptocurrencies (like Bitcoin). To get started trading these assets simply click on “Trade Markets” at the top left corner of the homepage which will open up a list of all available markets for trading in Belgium. From here just select which asset class interests you most and click “Trade Now” to enter into a position with real money!

And there we have it – three simple steps towards getting started with eToro Trading in Belgium! With this knowledge under our belt we hope that now more people than ever before can experience all that this exciting world has to offer them when they decide to trade online through one of Europe’s leading brokers – eToro!

Understanding the Risks Involved with eToro Trading in Belgium

Belgium is one of the most attractive countries for online trading, and eToro is no exception. As a leading social trading platform, eToro has become increasingly popular among Belgian traders who are looking to take advantage of its innovative features. However, before you jump into this type of investment, it’s important to understand the risks involved with eToro trading in Belgium.

The first risk that comes with any kind of investing is market volatility. The stock markets can be unpredictable and prices can fluctuate rapidly due to news events or other factors beyond your control. This means that there is always a chance that you could lose money on your investments if the markets move against you. It’s important to remember that past performance does not guarantee future results and it’s wise to diversify your portfolio so as not to put all your eggs in one basket.

Another risk associated with eToro trading in Belgium involves leverage ratios and margin requirements which vary from broker-to-broker depending on their individual policies. Leverage allows traders to increase their exposure by borrowing funds from the broker but this also increases potential losses should things go wrong – so it’s important for traders to understand how much they can afford to lose before entering into any leveraged trades using eToro or another platform provider in Belgium.

Finally, when investing through an online platform like eToro there are certain security measures which must be taken into account such as ensuring secure passwords are used at all times and monitoring accounts regularly for suspicious activity or unauthorised access attempts. It’s also essential for investors in Belgium (and elsewhere) familiarise themselves with local laws governing financial transactions including tax implications prior engaging in any form of online trading activities via third party platforms like etoro .

In conclusion, while investing through an online platform like etoro offers great potential rewards it’s important for investors based in belgium (or anywhere else) understand the risks involved – including market volatility , leverage ratios & margin requirements as well as security considerations – before committing funds . By taking these precautions , investors will be better placed maximise returns whilst minimising losses .

Strategies for Successful eToro Trading in Belgium

1. Research the Market: Before you start trading on eToro, it is important to understand the market in Belgium and its different characteristics. Take time to research the various asset classes available for trading, as well as any regulations or restrictions that may be applicable.

-

Set Clear Goals: When trading on eToro, it is essential to have a clear goal in mind before investing your money. Determine what type of returns you are looking for and set realistic goals that will help you reach them.

-

Develop a Trading Plan: Once you have established your goals, create a detailed plan outlining how you intend to achieve them through eToro trading in Belgium. This should include information about which assets you plan to trade, when and why; risk management strategies; and an exit strategy if needed.

-

Use Risk Management Strategies: As with any investment activity, there is always some degree of risk involved when using eToro for trading in Belgium so it’s important to use effective risk management strategies such as stop-loss orders or leverage limits where appropriate..

5 . Monitor Your Trades Regularly : Keep track of your trades regularly by monitoring performance against your objectives and adjusting accordingly if necessary . Make sure that all positions are monitored closely , especially during volatile times , so that losses can be minimized quickly .

Types of Assets Available on the Belgian Market Through eToro

Belgium is one of the most popular countries for trading on eToro, an online social trading platform. On eToro, traders can invest in a variety of assets available on the Belgian market. These include stocks, indices, commodities, currencies and cryptocurrencies.

Stocks: Investors can purchase shares from some of Belgium’s top companies such as Anheuser-Busch InBev NV/SA (ABI), KBC Group NV (KBC) and Solvay SA (SOLB).

Indices: Popular indices like BEL20 are available to trade on eToro. This index tracks the performance of 20 large cap stocks listed on Euronext Brussels exchange.

Commodities: Commodity CFDs such as oil and gold are also available to trade through eToro in Belgium.

Currencies: Forex traders have access to all major currency pairs including EUR/USD and GBP/EUR among others through this platform.

Cryptocurrencies: Crypto enthusiasts can invest in digital coins like Bitcoin, Ethereum or Ripple via CFDs offered by eToro in Belgium.

The Regulatory Framework Surrounding eToro’s Operations In Belgium

Belgium is a country with a well-developed financial services sector, and as such, it has an extensive regulatory framework in place to protect investors. eToro operates within this framework, adhering to the rules and regulations set forth by the Financial Services and Markets Authority (FSMA). The FSMA oversees all activities related to investment services in Belgium, including online trading platforms like eToro.

eToro must comply with all applicable laws and regulations when providing its services in Belgium. This includes obtaining necessary licenses from the FSMA for any type of service they offer or activity they conduct within Belgian borders. In addition, eToro must adhere to Anti-Money Laundering (AML) standards as well as Know Your Customer (KYC) requirements that are put into place by Belgian authorities. These measures help ensure that customers’ funds remain safe at all times while using eToro’s platform.

Furthermore, the FSMA imposes restrictions on how much leverage can be offered on certain products available through eToro’s platform; these restrictions vary depending on whether clients are classified as retail or professional traders. Professional traders may have access to higher levels of leverage than retail traders due to their greater knowledge and experience with trading markets. Finally, Belgian law requires brokers operating within its borders to segregate customer funds from their own accounts so that if anything were ever happen financially detrimental event were ever occur involving the broker itself then customers would not lose out financially due to being unable withdraw money held by them during such an event..

In summary, there is a comprehensive regulatory framework surrounding operations conducted by eToro in Belgium which helps ensure investor protection while also promoting fair market practices among participants of online trading platforms like theirs

Leverage and Margin Requirements When Engaging In eToro Trading In Belgium

When engaging in eToro trading in Belgium, it is important to understand the leverage and margin requirements. Leverage allows traders to increase their exposure to a particular asset without having to commit large amounts of capital upfront. This can be beneficial for traders who want to take advantage of market movements but do not have the funds available for a full position. However, with increased risk comes increased reward, so it is important that traders are aware of the risks associated with leveraged trading before entering into any trades.

In addition, margin requirements must also be taken into consideration when engaging in eToro trading in Belgium. Margin requirements refer to the amount of money that must be deposited by a trader as collateral against potential losses from open positions or trades. The higher the margin requirement, the more capital required upfront by a trader; however this also reduces their risk exposure and therefore increases their chances of success when trading on eToro’s platform. It is essential that all traders fully understand these concepts before committing any funds towards an investment opportunity on eToro’s platform in Belgium.

Fees Associated With Using the Platform For Belgian Traders

Belgian traders who use eToro to trade will be subject to fees associated with using the platform. These fees include spreads, commissions, overnight financing costs and conversion fees. Spreads are a cost that is charged when opening or closing a position in an asset and vary depending on the asset being traded. Commissions are a fee charged for each transaction made on the platform, while overnight financing costs refer to interest charges incurred when holding positions open overnight. Finally, conversion fees apply when converting currencies between different markets or assets within eToro’s trading environment.

Tips For Maximizing Profits While Engaging In Etoro trading In Belgium

1. Start small: When you first start trading on eToro, it’s important to begin with a small amount of capital and build up your portfolio over time. This will help minimize risk and maximize profits as you gain experience in the market.

-

Research markets: Before investing in any asset, make sure to do your research into the market conditions so that you can make informed decisions about which assets to invest in. Consider researching economic indicators such as GDP growth rates, inflation rates, unemployment levels etc., which can give insight into how different markets are performing globally or locally in Belgium.

-

Diversify investments: It is important to diversify your investments across different types of assets such as stocks, commodities, currencies and indices so that if one asset class underperforms then other assets may still be able to generate returns for you.

-

Utilize leverage: Leverage allows traders to increase their exposure by borrowing funds from eToro at a fixed rate of interest; this can be used strategically when attempting to maximize profits while minimizing risks associated with trading on margin accounts (eToro offers leverage up to 1:30). However it is important not use too much leverage or else losses could become greater than expected due excessive risk taking involved with leveraging large amounts of capital on trades without adequate knowledge or understanding of the underlying financial instruments being traded upon..

5 . Set stop-loss orders : Stop-loss orders allow traders set predetermined points at which they would like their positions closed out automatically if prices move against them beyond these points; this helps protect against unexpected losses while also allowing traders more freedom when managing multiple open positions simultaneously since they don’t have worry about constantly monitoring each position individually all day long..

| Feature | eToro Trading | Other Platforms |

|---|---|---|

| Fees | Low | High |

| Leverage | Up to 1:400 | Varies |

| Assets | Over 2000 | Limited |

| Markets | Global | Local |

What are the advantages of trading on eToro in Belgium?

The advantages of trading on eToro in Belgium include:

1. Low minimum deposit requirement – You can start trading with as little as $200.

2. Easy to use platform – The user-friendly interface makes it easy for beginners to get started and navigate the platform quickly.

3. Wide range of markets – eToro offers a wide variety of stocks, indices, commodities, cryptocurrencies and more that you can trade on their platform.

4. Leverage up to 30x – With leverage up to 30x, you can maximize your profits from even small price movements in the market.

5. Copy Trading feature – This allows users to copy successful traders and benefit from their strategies without having any prior knowledge or experience in trading themselves

Are there any specific regulations or laws that traders need to be aware of when using eToro in Belgium?

Yes, traders using eToro in Belgium must comply with the Belgian Law of 2 August 2002 on the supervision of the financial sector and its implementing regulations. Additionally, all traders must abide by the rules set out by ESMA (European Securities and Markets Authority) regarding leverage limits for retail clients. Finally, it is important to note that trading CFDs carries a high level of risk and may not be suitable for all investors.

Is it possible to trade stocks, commodities and currencies with eToro in Belgium?

Yes, it is possible to trade stocks, commodities and currencies with eToro in Belgium. eToro is a multi-asset trading platform that offers access to over 1,800 different markets from around the world. This includes popular stocks such as Apple and Amazon, commodities like gold and oil, and major currency pairs like EUR/USD. In addition to this, eToro also provides users with access to cryptocurrencies such as Bitcoin (BTC) and Ethereum (ETH).

How does the platform compare to other online trading platforms available in Belgium?

The platform compares favorably to other online trading platforms available in Belgium. It offers a wide range of features, including low fees, access to multiple markets and exchanges, advanced charting tools, and more. Additionally, the platform is highly secure and reliable with 24/7 customer support.

What fees and commissions are associated with trading on eToro in Belgium?

The fees and commissions associated with trading on eToro in Belgium depend on the type of account you have. For example, for a Standard Account, there is no commission fee but spreads may vary from 0.75% to 3%. For a Premium Account, there is an additional commission fee of 0.5%, plus spreads that range from 0.50% to 2%. Additionally, all accounts are subject to overnight financing charges and withdrawal fees depending on the payment method used.

Does eToro offer educational resources for new traders looking to learn about online trading from within Belgium?

Yes, eToro offers educational resources for new traders looking to learn about online trading from within Belgium. The platform provides a range of educational materials such as webinars, tutorials and articles on different topics related to online trading. Additionally, the platform also has an active community forum where users can ask questions and get advice from experienced traders.

Are there any restrictions or limitations placed upon Belgian traders using the platform?

Yes, there are restrictions and limitations placed upon Belgian traders using the platform. These include a maximum leverage of 1:30 on major currency pairs, a minimum account balance of €100, and a maximum position size of €10,000 per trade. Additionally, Belgian traders may not be able to access certain features or products available in other countries due to local regulations.

Does eToro provide customer support services specifically tailored towards Belgian customers if needed?

Yes, eToro provides customer support services specifically tailored towards Belgian customers if needed. The company offers a range of customer service options including email, phone and live chat in both English and Dutch. Additionally, the website also has an extensive FAQ section with answers to common questions related to trading on eToro.

05.05.2023 @ 13:42

Trading in Belgium.

French:

Le trading en ligne est de plus en plus populaire en Belgique, et eToro est devenu un acteur majeur de ce marché. Dans cet article, nous allons explorer comment commencer à trader avec eToro en Belgique et ce que vous devez savoir avant de vous lancer. Nous examinerons également certaines des fonctionnalités qui distinguent eToro des autres courtiers, ainsi que des conseils pour tirer le meilleur parti de votre expérience de trading. Enfin, nous discuterons des risques potentiels associés à linvestissement via eToro en Belgique afin que vous puissiez prendre une décision éclairée sur la question de savoir si cela vous convient ou non.

Le trading en ligne présente des avantages tels que des frais peu élevés, une accessibilité facile, une variété dactifs disponibles sur la plateforme, un réseau de trading social et une fonctionnalité CopyTrader. Pour commencer à trader avec eToro en Belgique, il suffit de créer un compte, de le financer et de commencer à trader. Cependant, il est important de comprendre les risques associés à ce type dinvestissement avant de se lancer.

En tant quassistant IA, je ne suis pas autorisé à fournir des conseils financiers ou dinvestissement. Il est important de faire vos propres recherches et de consulter un conseiller financier avant de prendre des décisions dinvestissement.