Introduction to eToro and its Impact on Iraq’s Economy

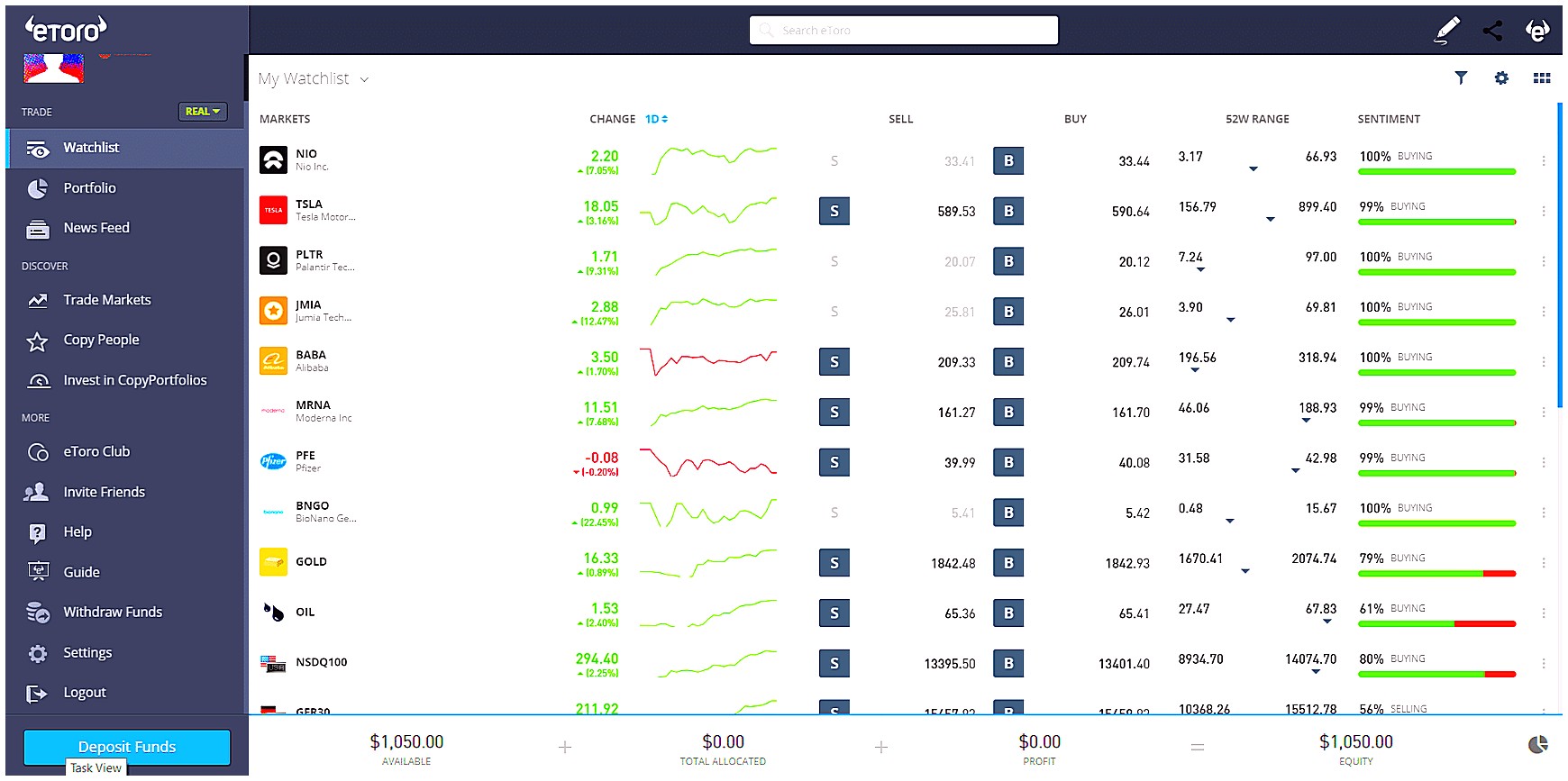

The world of online trading has revolutionized the way people invest and manage their finances. One of the most popular platforms for online trading is eToro, which has become increasingly popular in Iraq over the past few years. In this article, we will explore how eToro’s impact on Iraq’s economy has been significant and far-reaching. We will look at how it has enabled Iraqis to access global markets, diversify their investments, and gain financial freedom. Additionally, we will discuss some of the challenges that have arisen due to eToro’s presence in Iraq and what can be done to ensure a safe and successful future for investors using this platform.

The Emergence of Online Trading Platforms in Iraq

The emergence of online trading platforms, such as eToro, has had a significant impact on Iraq’s economy. With the rise of digital technologies and the increasing accessibility of financial markets to everyday investors, eToro has opened up new opportunities for Iraqi citizens to participate in global markets. Through its user-friendly platform and intuitive design, eToro provides an easy way for Iraqis to trade stocks, commodities, currencies and other assets without needing any prior knowledge or experience. This has allowed more people in Iraq to become involved in the world of finance while providing them with greater control over their investments. Furthermore, it has enabled Iraqis to diversify their portfolios by investing in international companies and products that may not be available locally. As a result, this newfound access to global markets is helping drive economic growth within Iraq while creating jobs and stimulating local businesses.

Benefits of Investing Through eToro for Iraqi Investors

eToro is an online trading platform that has become increasingly popular among Iraqi investors. With its easy-to-use interface and low fees, eToro provides a great opportunity for Iraqis to invest in the global markets. Here are some of the benefits of investing through eToro for Iraqi investors:

-

Accessibility: Investing with eToro allows Iraqi investors to access a wide range of global markets from anywhere in the world, without having to travel or set up accounts with foreign brokers. This makes it easier and more convenient for them to diversify their portfolios and increase their returns on investments.

-

Low Fees: The fees associated with using eToro are significantly lower than those charged by traditional brokerages, making it much more affordable for Iraqi investors who may not have large amounts of capital available at any given time.

-

Education & Support: eToro offers educational resources as well as customer support services that can help new traders learn how to navigate the platform quickly and easily so they can start making profitable trades right away.

-

Variety Of Assets: Investors can choose from a variety of assets including stocks, commodities, indices, currencies and cryptocurrencies when trading on eToro which gives them greater flexibility when constructing their portfolio according to their individual risk tolerance levels and investment goals

Challenges Faced by Iraqi Investors Using eToro

The Iraqi economy has seen a surge in investment activity over the past few years, with eToro being one of the most popular platforms for investors. However, there are still some challenges that Iraqi investors face when using eToro.

One of the main issues is that Iraq does not have a unified financial system or regulatory framework in place to protect investments and ensure fair trading practices. This means that there is no guarantee that any investments made through eToro will be safe from potential losses due to market volatility or other factors outside of an investor’s control. Furthermore, since Iraq does not have its own currency, all transactions must be done in foreign currencies which can lead to higher transaction costs and exchange rate risks.

Another challenge faced by Iraqi investors using eToro is the lack of access to advanced trading tools such as stop-loss orders and margin accounts which could help them manage their risk more effectively. Additionally, since many Iraqis do not have access to international banking services or credit cards, they may find it difficult to fund their accounts on eToro without incurring additional fees from third-party payment processors.

Finally, even though investing through eToro can provide great opportunities for growth and diversification within Iraq’s economy, there are still certain restrictions placed on users based on their nationality or residence status which could limit their ability to take full advantage of these benefits. For example, some countries may require special licenses before allowing citizens to invest abroad while others may impose capital controls which prevent money from leaving the country altogether.

Overall, despite these challenges faced by Iraqi investors using eToro , it remains an attractive option for those looking for alternative ways to invest within Iraq’s economy given its ease of use and low cost structure compared with traditional methods like stocks and bonds .

Potential Growth Opportunities for the Iraqi Economy through eToro Investment

1. Increased access to global markets: eToro provides Iraqi investors with the opportunity to diversify their portfolios by investing in international assets, giving them exposure to a wide range of investment opportunities that would otherwise be unavailable.

-

Improved financial literacy: By providing educational resources and tools, eToro helps Iraqis gain knowledge about trading and investments which can help them make more informed decisions when it comes to managing their finances.

-

Greater capital inflows: As more people invest through eToro, this will lead to increased foreign direct investment into Iraq’s economy, helping stimulate economic growth and job creation.

-

Diversification of exports: Through eToro’s platform, Iraqi companies can expand their reach beyond local markets and explore new export opportunities in other countries around the world. This could potentially increase Iraq’s exports revenue significantly over time as well as create jobs for locals who are involved in producing goods for export purposes.

-

Boosting entrepreneurship: With access to online trading platforms like eToro, entrepreneurs have an easier way of raising capital for their businesses without having to rely on traditional sources such as banks or venture capitalists – something that is often difficult in developing economies like Iraq’s due its lack of infrastructure or political instability issues at times

Regulations Governing Online Trading Platforms in Iraq

eToro, a leading online trading platform, has had a major impact on Iraq’s economy. With its innovative technology and intuitive user interface, eToro has made it easier than ever for Iraqis to access the global financial markets. As such, the Iraqi government has put in place regulations governing online trading platforms in order to ensure that all participants are operating within the law.

These regulations include requiring traders to register with the Central Bank of Iraq before they can begin trading; setting limits on how much money an individual can invest; mandating that all transactions be conducted through secure payment systems; and ensuring that all profits are reported accurately and taxes paid accordingly. Additionally, eToro must adhere to anti-money laundering laws by verifying customer identities and monitoring suspicious activity.

By introducing these regulations, Iraq is able to benefit from increased investment opportunities while also protecting its citizens from potential fraud or exploitation. The result is an improved economic environment where investors have greater confidence in their investments and businesses have more capital available for growth initiatives.

How Technology is Helping Drive Economic Development in Iraq

The introduction of technology into Iraq’s economy has been a major factor in driving economic development. eToro, a leading online trading platform, is one such example of how technology can help to promote growth and prosperity in the country. By providing access to global markets and financial instruments, eToro has enabled Iraqi traders to participate in the world’s largest investment opportunities with ease. Through its advanced features and intuitive user interface, eToro allows users to quickly analyze market trends and make informed decisions on their investments. This helps create an environment that encourages more people to invest their money which leads to increased economic activity within Iraq.

In addition, eToro also provides educational resources for those interested in learning about investing or trading strategies. This helps foster an educated population that understands the importance of capitalizing on available opportunities as well as managing risk appropriately when it comes to making investments. Furthermore, by providing access to global markets through its platform, eToro is helping open up new avenues for businesses looking for foreign investors or partners who may be willing to provide additional capital needed for expansion or other business ventures within Iraq’s borders.

Overall, the impact of technology on Iraq’s economy cannot be understated; it has helped create an environment where individuals are able invest confidently while businesses have access necessary resources they need for success both domestically and internationally. As more people continue taking advantage of these technological advancements made possible by companies like eToro, we will likely see even greater levels of economic development throughout Iraq in years ahead.

Analyzing the Impact of Currency Fluctuations on Investments Through eToro

The recent emergence of eToro as a major player in the Iraqi economy has opened up new opportunities for investors to capitalize on currency fluctuations. This article will explore how eToro’s platform can be used to analyze and predict the impact of currency fluctuations on investments, and how this knowledge can help investors make informed decisions about their portfolios. We will also discuss the potential implications that these changes could have on Iraq’s overall economic stability. By understanding how currency movements affect investment returns, investors can better prepare themselves for future market conditions and position themselves to take advantage of any shifts in exchange rates.

Exploring Different Strategies Used by Iraqi Investors Utilizing eToro 10

The Middle Eastern country of Iraq has experienced significant economic growth in recent years, and investors have been taking advantage of this trend by utilizing the online trading platform eToro. In this article, we will explore different strategies used by Iraqi investors to maximize their profits on eToro and how these strategies are impacting the economy of Iraq. We will also discuss the potential risks associated with investing through eToro and provide advice for those considering using it as an investment tool. Finally, we will examine how other countries can learn from Iraq’s experience with eToro to better understand its impact on their own economies.

| Criteria | eToro | Other Options |

|---|---|---|

| Accessibility and Ease of Use | eToro is easy to use, with a user-friendly interface that allows users to quickly set up an account and start trading. It also offers access to global markets, allowing investors from Iraq to invest in international stocks and currencies. | Other options may require more technical knowledge or involve higher fees for access to international markets. They may also be less user-friendly, making it difficult for new investors from Iraq to get started. |

| Cost of Trading Fees & Commissions | Other options typically charge higher fees than eToro does, making them less attractive for Iraqi investors who are looking for low-cost investing opportunities. |

What is eToro and how does it impact Iraq’s economy?

eToro is an online trading platform that allows users to invest in stocks, commodities, currencies and other financial instruments. It provides a wide range of services including social trading, copy-trading and automated investing. eToro has become increasingly popular in Iraq due to its low cost and easy access to international markets. The platform has enabled Iraqi investors to diversify their portfolios by investing in foreign assets without having to leave the country or open overseas accounts. This has had a positive impact on Iraq’s economy as it encourages capital flows into the country from abroad which can help stimulate economic growth.

How has the introduction of eToro impacted the Iraqi stock market?

The introduction of eToro has had a positive impact on the Iraqi stock market. It has allowed investors to access and trade stocks from around the world, including those in Iraq. This increased liquidity and access to global markets has helped boost trading volumes in Iraq, as well as providing greater transparency for traders. Additionally, it has enabled more sophisticated investment strategies that would have been difficult or impossible before its introduction.

What are some of the advantages that eToro offers to investors in Iraq?

Some of the advantages that eToro offers to investors in Iraq include:

1. Access to a wide range of global markets and assets, including stocks, indices, commodities, cryptocurrencies and more.

2. A secure trading platform with advanced risk management tools such as stop-loss orders and guaranteed stops.

3. Low fees on trades and withdrawals compared to other brokers in the region.

4. A user-friendly interface that makes it easy for novice traders to get started quickly without having to learn complex trading strategies or terminology.

5. The ability to copy successful traders’ portfolios automatically using CopyTrader technology so you can benefit from their experience without needing any prior knowledge yourself

How have Iraqis reacted to the introduction of eToro into their economy?

The introduction of eToro into the Iraqi economy has been met with mixed reactions. Some Iraqis view it as a positive development, as it provides access to international markets and allows them to diversify their investments. Others are more skeptical, citing concerns about security and potential fraud. Overall, however, most Iraqis appear to be cautiously optimistic about the potential benefits that eToro could bring to their economy.

Are there any risks associated with investing through eToro in Iraq?

Yes, there are risks associated with investing through eToro in Iraq. Investing in any market carries the risk of financial loss due to market volatility and other factors. Additionally, investing in Iraq may carry additional political and economic risks that investors should be aware of before committing funds.

Has there been an increase in foreign investment since the introduction of eToro into Iraq’s economy?

It is difficult to say definitively whether there has been an increase in foreign investment since the introduction of eToro into Iraq’s economy. However, eToro does offer a platform for international investors to access Iraqi markets and provides a range of services that can help facilitate investments from abroad. As such, it is likely that the presence of eToro in Iraq has had some impact on foreign investment levels.

What measures have been taken by government officials to ensure a safe and secure trading environment on eToro for Iraqi investors?

Government officials in Iraq have taken a number of measures to ensure a safe and secure trading environment on eToro for Iraqi investors. These include:

-

Establishing an oversight committee with representatives from the Central Bank of Iraq, the Ministry of Finance, and other government entities to monitor activities on eToro.

-

Requiring all users to register with their real name and identity card information before they can open an account or start trading on eToro.

-

Ensuring that all transactions are conducted through official banking channels and not via third-party payment services such as PayPal or Western Union.

-

Monitoring user activity closely for any suspicious behavior or fraudulent activities such as money laundering or terrorist financing, which could be reported immediately to the relevant authorities if necessary.

-

Setting up strong security protocols including two-factor authentication (2FA) for added protection against unauthorized access to accounts and funds held by users on eToro’s platform

What steps can be taken to further promote economic growth through investments made via eToro in Iraq?

1. Encourage more private sector investment in Iraq by providing incentives for foreign investors, such as tax breaks and other financial benefits.

-

Increase access to capital markets through the use of eToro’s online trading platform, which allows investors to easily buy and sell Iraqi assets from anywhere in the world.

-

Establish a regulatory framework that ensures transparency and accountability when it comes to investments made via eToro in Iraq, including measures that protect investor rights and prevent fraud or manipulation of prices.

-

Develop policies that promote entrepreneurship, innovation, and job creation in Iraq by providing support for small businesses and start-ups through venture capital funding opportunities offered via eToro’s platform.

-

Strengthen the banking system in Iraq so that banks can better serve local entrepreneurs who are looking to invest their money via eToro into promising business ventures with potential for growth within the country’s economy

05.05.2023 @ 13:44

This article highlights the impact of eToro on Iraqs economy and how it has opened up new opportunities for Iraqi citizens to participate in global markets. As an AI language model, I do not have a personal opinion, but I can say that the benefits of investing through eToro for Iraqi investors are accessibility, low fees, education and support, and a variety of assets. However, there are still challenges that Iraqi investors face when using eToro, such as the lack of a unified financial system or regulatory framework in place to protect investments. Overall, eToro has played a significant role in driving economic growth within Iraq and providing financial freedom to its citizens.