Introduction to eToro and Its Expansion into Russia

eToro is a global investment platform that has been rapidly gaining popularity around the world. Founded in 2007, eToro offers users access to a variety of financial markets including stocks, commodities, indices and cryptocurrencies. In recent years, eToro has made significant strides in expanding its presence into new countries and regions. One such region is Russia where eToro recently launched its services for Russian investors. This article will explore the details of eToro’s expansion into Russia and how it could benefit both existing and potential investors in the country.

The Benefits of Investing with eToro in Russia

As one of the world’s leading online trading platforms, eToro has recently expanded its services to Russia. This move provides Russian investors with access to a wide range of investment opportunities and the ability to trade in global markets. Here are some of the benefits that come with investing through eToro in Russia:

-

Access to Global Markets: With eToro, Russian investors can now access global markets such as stocks, commodities, currencies and indices from around the world. This allows them to diversify their portfolios and gain exposure to different asset classes.

-

Low Fees: Investing through eToro is relatively inexpensive compared to other brokers due to its low fees structure for both deposits and withdrawals. Additionally, there are no hidden charges or commissions when trading on the platform which makes it an attractive option for those looking for cost-effective investments in Russia.

-

User-Friendly Platform: The user interface of eToro is designed with simplicity in mind making it easy for new users who may not have prior experience with online trading platforms understand how it works quickly without any hassle or confusion.

-

Comprehensive Research Tools: To help traders make informed decisions about their investments, eToro offers comprehensive research tools such as market analysis reports and real-time data feeds which allow them stay up-to-date on market movements so they can make more profitable trades over time

Regulations and Restrictions on Trading in Russia

Russia is one of the largest and most populous countries in the world, and it has become a major destination for online trading. As such, eToro has recently expanded its services to Russia, allowing Russian traders to access global markets through their platform. However, there are some regulations and restrictions that traders should be aware of before they begin trading on eToro in Russia.

First off, all financial transactions must comply with local laws and regulations set by the Central Bank of Russia (CBR). This includes ensuring that all deposits into an account must come from a bank or other approved financial institution within Russia itself. Furthermore, withdrawals from accounts can only be made back to these same institutions as well.

In addition to this requirement, any profits earned from trading activities must also be reported to the CBR under applicable tax laws. The taxes levied will depend on both the type of instrument being traded as well as any gains or losses incurred during each transaction. Finally, all trades conducted on eToro’s platform must adhere to margin requirements established by the CBR in order for them to remain compliant with local regulations.

Overall, while there are some restrictions when it comes to trading on eToro in Russia due to local laws and regulations imposed by the CBR, these rules are not overly burdensome for experienced traders who understand how they work and what needs to be done in order stay compliant with them at all times.

eToro’s Russian Platform: Features and Advantages

eToro’s Russian platform is a great way for investors to access the global markets. It offers users a range of features and advantages that make it an attractive option for those looking to diversify their portfolio or invest in international stocks.

One of the key features of eToro’s Russian platform is its easy-to-use interface, which allows traders to quickly get up and running with minimal effort. The platform also provides users with access to real-time market data, including quotes from over 800 different exchanges around the world. This gives investors an opportunity to stay informed about global events and trends, allowing them to make better decisions when investing in foreign markets.

In addition, eToro’s Russian platform has low trading fees compared to other platforms on the market. This makes it more affordable for smaller investors who may not have as much capital available for investments as larger ones do. Furthermore, eToro also offers several tools designed specifically for novice traders such as educational resources and copy trading capabilities which allow experienced traders’ strategies be replicated automatically by newbies on the platform.

Finally, one of the biggest advantages offered by eToro’s Russian Platform is its secure environment which ensures all transactions are protected from potential fraud or theft attempts through advanced encryption technology and two-factor authentication protocols used across all devices connected with your account . Additionally , customer support staff can provide assistance 24/7 via phone , email , chat or social media if any issues arise while using their services .

Overall , eToro’s expansion into Russia brings many benefits both experienced and beginner traders alike should take advantage of when considering investing in foreign markets .

How to Get Started with eToro in Russia

eToro, the world’s leading social trading and investment platform, has recently announced its expansion into Russia. This move is part of eToro’s mission to make investing accessible to everyone around the world. If you’re a Russian investor looking to get started with eToro, here are some steps you can take:

-

Create an Account: The first step in getting started with eToro in Russia is creating an account on their website or mobile app. You’ll need to provide your personal information such as name, address and phone number for verification purposes. Once your account is created, you’ll be able to access all of eToro’s features including their copy-trading feature which allows users to automatically copy the trades of other successful traders on the platform.

-

Fund Your Account: After setting up your account, you’ll need to fund it before you can start trading or copying other traders’ portfolios. To do this, simply click “Deposit Funds” from within your dashboard and choose one of several payment methods available including bank transfer and credit/debit cards (Visa/Mastercard).

-

Start Trading: Once your funds have been added successfully, it’s time for you to start trading! You can either manually select stocks or ETFs that interest you or use the CopyTrader feature mentioned earlier if you want someone else’s portfolio copied into yours automatically without having any prior knowledge about stock markets yourself!

4 . Monitor Your Portfolio: Lastly but most importantly – monitor your portfolio regularly so that any changes in market conditions don’t catch you off guard! Make sure that whatever investments decisions made are well thought out beforehand by researching thoroughly about them first before executing them live on the platform itself!

Popular Assets Available for Investment on the Russian Platform

1. Russian Stocks: Investors can purchase stocks from some of Russia’s largest companies, such as Gazprom, Sberbank and Lukoil.

-

Exchange Traded Funds (ETFs): ETFs provide investors with a low-cost way to gain exposure to the entire Russian stock market or specific sectors within it.

-

Cryptocurrencies: eToro offers access to popular cryptocurrencies like Bitcoin, Ethereum and Litecoin on its platform in Russia.

-

Commodities: Investors can trade commodities such as oil, gold and silver on the eToro platform in Russia.

Security Measures Implemented by eToro for Investors in Russia

eToro has taken several steps to ensure the security of its investors in Russia. The company has implemented a two-factor authentication process, which requires users to provide additional information when logging into their accounts. Additionally, eToro uses an encryption system that ensures all data sent and received is secure. Furthermore, the platform offers segregated accounts for each investor’s funds, ensuring that customer funds are kept separate from those of the broker or other customers. Lastly, eToro employs a team of dedicated fraud analysts who monitor user activity on the platform and investigate any suspicious transactions or behavior. These measures have been put in place to ensure maximum security for investors in Russia and around the world.

Customer Support Services Offered by eToro in Russia

eToro is a leading online trading platform that has recently expanded its services into Russia. eToro offers a wide range of customer support services to Russian customers, including 24/7 live chat support, phone and email assistance, as well as an extensive FAQ section on their website. Customers can also access helpful tutorials and videos to help them get started with trading on the platform. Additionally, eToro provides Russian-speaking customer service representatives who are available to answer any questions or concerns about using the platform in Russia. With these comprehensive customer support services offered by eToro in Russia, users can feel confident that they will have all the help they need when navigating the world of online trading.

Fees Associated With Trading on the Russian Platform

eToro is expanding its services into Russia, offering a platform for traders to buy and sell stocks, ETFs, commodities, and cryptocurrencies. As with any trading platform, there are fees associated with trading on the Russian platform.

The main fee associated with eToro’s Russian platform is the spread – the difference between the buy and sell price of an asset. The spread varies depending on the asset being traded but generally ranges from 0.09% to 1%. Additionally, overnight financing charges may apply when positions are held open after market close.

In addition to spreads and overnight financing charges, eToro also charges a withdrawal fee when funds are taken out of an account in order to cover processing costs incurred by banks or payment providers involved in completing transactions. This fee is usually around $5 USD per transaction but can vary depending on currency conversion rates at the time of withdrawal.

Finally, eToro may charge additional fees such as commission-based trading fees for certain products or services offered through their Russian platform. It’s important that users familiarize themselves with all applicable fees before they begin trading so that they understand how much it will cost them in total to use this service

Conclusion: Exploring the Opportunities Provided by eToro’s Expansion Into Russia

In conclusion, eToro’s expansion into Russia provides a unique opportunity for traders to access the world of digital trading and investing. With its low fees, advanced technology, and secure platform, eToro is well-positioned to become one of the leading online brokers in Russia. The company’s commitment to providing excellent customer service and support will also be an important factor in its success. By leveraging these advantages, eToro can create a strong presence in the Russian market and establish itself as a leader in digital trading and investing.

| eToro’s Expansion into Russia | Other Investment Platforms in Russia |

|---|---|

| Brokerage and Trading Services | Brokerage and Trading Services |

| Regulatory Compliance | Regulatory Compliance |

| Financial Education Resources | Financial Education Resources |

| Unique User Interface | Unique User Interface |

| Multi-Asset Portfolio Management | Multi-Asset Portfolio Management |

What motivated eToro to expand into Russia?

eToro was motivated to expand into Russia due to the large and growing population of retail investors in the country. With its innovative trading platform, eToro is well-positioned to capitalize on this opportunity by providing Russian traders with access to global markets and a wide range of investment products. Additionally, eToro’s expansion into Russia will allow it to tap into the country’s rapidly developing financial technology sector.

How has the Russian market responded to eToro’s presence?

The Russian market has responded positively to eToro’s presence. The company has seen strong growth in the region, with more than 1 million users joining its platform since it launched in Russia in 2023. Additionally, eToro is one of the most popular social trading platforms among Russian traders and investors. According to research from Statista, eToro was the third-most popular online broker among Russians in 2023, behind only Alpari and Olymp Trade.

What services does eToro offer in Russia?

eToro offers a range of services in Russia, including CFD trading on stocks, indices, commodities and cryptocurrencies. Additionally, eToro provides access to copy trading and portfolio management tools.

Are there any unique features of the Russian version of eToro compared to other markets?

Yes, the Russian version of eToro has some unique features compared to other markets. For example, it offers a wide range of instruments such as stocks, ETFs, commodities and cryptocurrencies. Additionally, users can access advanced trading tools like copy trading and algorithmic trading strategies. Furthermore, the platform also provides market analysis and educational resources in both English and Russian languages.

How have local regulations impacted the development and growth of eToro in Russia?

Local regulations have had a significant impact on the development and growth of eToro in Russia. The Russian government has imposed strict capital controls, which limit the amount of money that can be transferred from Russia to other countries. This has made it difficult for eToro to offer its services in Russia, as they rely heavily on international transfers for their operations. Additionally, there are restrictions on foreign investments and trading activities within the country, making it difficult for investors to access global markets through eToro’s platform. As a result, many potential customers may be deterred from using eToro due to these restrictions.

What challenges has eToro faced while expanding into this new market?

eToro has faced a number of challenges while expanding into new markets. These include regulatory issues, language barriers, cultural differences, and competition from established players in the market. Additionally, eToro may face difficulties in adapting its product offering to local customer needs and preferences. Finally, eToro must also ensure that it meets all relevant compliance requirements for each market it enters.

Does eToro plan on further expansion within Russia or other countries in the region?

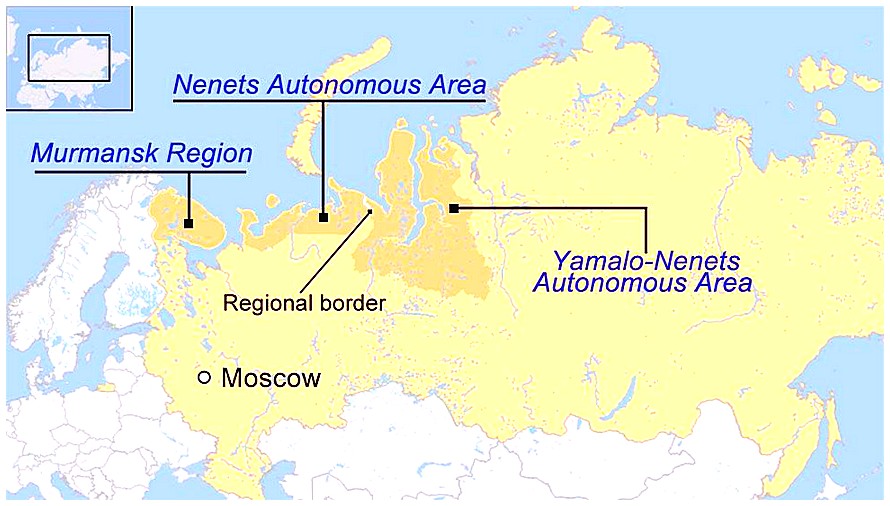

Yes, eToro plans to further expand its presence in Russia and other countries in the region. The company has already established a partnership with Sberbank, one of the largest banks in Russia, which allows customers to open an account and deposit funds directly from their bank accounts. Additionally, eToro is actively working on expanding its services into other countries such as Kazakhstan and Belarus.

Is there anything else that sets apart this particular expansion from others that have been done by eToro before?

Yes, this particular expansion sets itself apart from other expansions done by eToro in several ways. For example, it is the first time that eToro has offered its services to customers in the United States and Canada. Additionally, this expansion includes new features such as copy trading and a mobile app for Android and iOS devices. Finally, eToro has also introduced an education center to help users learn more about investing on their platform.

05.05.2023 @ 13:44

r those looking to invest in Russia. One of the main advantages of eToro’s platform is its user-friendly interface, which makes it easy for new users to navigate and understand how to trade. Additionally, the platform offers comprehensive research tools that allow traders to stay up-to-date on market movements and make informed decisions about their investments. Another advantage of eToro’s platform is its low fees structure, which makes it an affordable option for those looking to invest in Russia. However, it is important to note that there are regulations and restrictions that traders must adhere to when trading on eToro in Russia, such as complying with local laws and regulations set by the Central Bank of Russia. Overall, eToro’s expansion into Russia provides investors with access to a wide range of investment opportunities and the ability to trade in global markets, making it a valuable addition to the country’s financial landscape.