Introduction to eToro in Togo

Togo is an exciting country to explore, and now it’s even more so with the introduction of eToro. This innovative online trading platform has made its way into Togo, offering investors a new way to invest in stocks, commodities, currencies and other financial instruments. In this article we’ll take a look at what eToro offers in Togo and how you can get started investing on the platform. We’ll also discuss some of the risks associated with investing on eToro as well as some tips for success. So if you’re interested in exploring the world of online trading in Togo, read on!

Overview of the eToro Platform

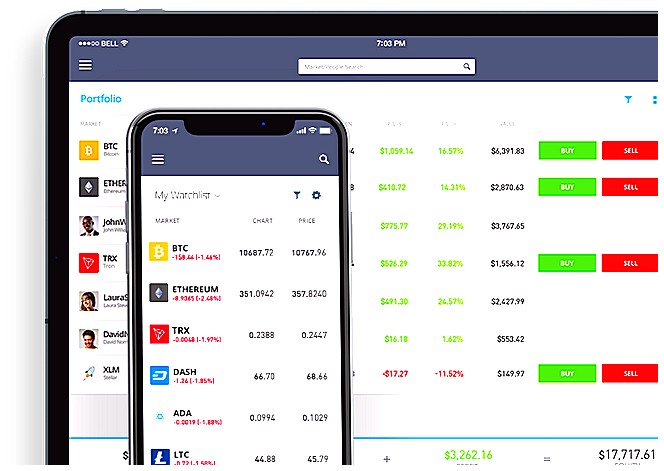

eToro is an online trading platform that allows users to trade stocks, currencies, commodities and indices. It provides a simple and intuitive interface for beginners as well as advanced traders. eToro offers access to markets from around the world with low fees and tight spreads. With its CopyTrader feature, users can copy the trades of experienced investors on the platform in order to learn how to trade more effectively. The platform also has a variety of tools such as charting software, news feeds and market analysis which help traders make informed decisions about their investments. eToro is available in Togo and many other countries worldwide, making it an ideal choice for those looking to get started in online trading.

Benefits of Investing with eToro in Togo

eToro is an innovative online trading platform that offers investors in Togo a range of advantages. Here are some of the key benefits of investing with eToro in Togo:

-

Access to global markets: With eToro, you can easily access and trade stocks, indices, commodities, currencies and more from all around the world. This means you have access to a much wider range of investment opportunities than if you were limited to just the local market.

-

Low fees: Compared to traditional brokerages, eToro’s fees are extremely competitive and low cost for traders in Togo – making it easier for investors to get started without breaking the bank.

-

Easy-to-use platform: The user interface on eToro is intuitive and easy-to-navigate – even if you’re new to trading or investing online! You can quickly find what you need with just a few clicks or taps on your device’s screen.

-

Social features: One unique feature offered by eToro is its social aspect which allows users from around the world to connect with each other through their profiles as well as share tips and strategies about investments they have made or plan on making soon! This makes it easy for beginners who may not know much about investing yet but want guidance from experienced traders who already understand how markets work and where potential profits lie within them!

How to Open an Account on eToro

Opening an account on eToro is a simple process that can be completed in just a few steps. To get started, visit the official website of eToro and click “Sign Up” at the top right corner of the page. You will then be prompted to enter your personal information such as name, email address, phone number and country of residence. Once you have filled out all the required fields, click “Create Account” to complete your registration.

Once you have registered for an account with eToro, you will need to deposit funds into it before you can start trading. This can be done by clicking on “Deposit Funds” from within your account dashboard or via one of their supported payment methods such as bank transfer or credit/debit card payments. After making a successful deposit, you are now ready to explore all that eToro has to offer!

Understanding the Fees and Charges Associated with Trading on eToro in Togo

When it comes to trading on eToro in Togo, understanding the fees and charges associated with each trade is essential. In this article, we will explore the different types of fees and charges that you may encounter when trading on eToro in Togo.

First off, there are two main types of fees that you should be aware of: commissions and spreads. Commissions are a fee charged by eToro for each trade executed through their platform; these can range from 0% up to 2%. Spreads refer to the difference between the buy price and sell price of an asset; they typically range from 0-2 pips (percentage in points).

In addition to these two main fees, there are also other costs associated with trading on eToro such as overnight financing rates which apply if you hold positions open for more than one day. These rates vary depending on your account type but generally start at around 3%. There is also a currency conversion fee applied when converting currencies during trades; this rate varies based on market conditions but usually ranges from 0%-0.5%. Finally, some assets may incur additional stamp duty or tax charges depending upon where they are traded so it’s important to check local regulations before investing.

By understanding all of the different fees and charges associated with trading on eToro in Togo, investors can make informed decisions about their investments while minimizing potential losses due to unexpected costs or taxes.

Exploring the Different Investment Options Available on eToro in Togo

Togo is a small West African country with a population of approximately 8 million people. Despite its size, Togo has seen an increase in the number of investors looking to capitalize on the potential offered by the nation’s growing economy. One popular platform for investing in Togo is eToro, which offers users access to a wide range of financial instruments and markets. In this article, we will explore some of the different investment options available on eToro in Togo and how they can be used to maximize returns.

One option that many investors use when trading on eToro is CFDs (Contracts for Difference). These are derivatives that allow traders to speculate on price movements without actually owning any underlying assets. CFDs offer high leverage, meaning you can open larger positions than your capital would normally allow. However, it should be noted that these products carry higher risks due to their leveraged nature and may not be suitable for all investors.

Another popular choice among traders using eToro in Togo is Copy Trading – a feature which allows users to copy other successful traders’ strategies automatically into their own portfolio at no extra cost or effort from them. This makes it easier for newbies who lack experience but still want exposure to more experienced traders’ portfolios without having to learn about trading themselves first-hand.

For those interested in traditional investments such as stocks and ETFs (Exchange Traded Funds), there are plenty of opportunities available through eToro too! Investors can choose from thousands of stocks listed across multiple exchanges around the world including those based in Africa like Nigeria Stock Exchange or Johannesburg Stock Exchange as well as global giants like NASDAQ or NYSE Euronext Paris Bourse etc., depending upon their risk appetite and desired asset class allocation strategy. Similarly, ETFs provide access to various sectors such as technology, energy or healthcare with just one click away!

Finally, cryptocurrency enthusiasts have plenty of options when trading with eToro too! With over 10 digital currencies supported by the platform including Bitcoin (BTC), Ethereum (ETH) and Litecoin (LTC), crypto fans have plenty of choices when it comes time decide what coins they want invest in via this online broker service provider .

In conclusion ,eToro provides numerous investment opportunities for both novice and experienced investors alike regardless if they’re based out from Togo or elsewhere . Whether you’re looking for low-risk investments such as stocks & ETFs , high-leverage trades via CFD’s ,or even cryptocurrencies – there’s something here everyone !

Tips for Maximizing Returns when Trading with eToro in Togo

1. Utilize the CopyTrader feature to copy successful traders and diversify your portfolio.

2. Set stop-loss orders to limit losses on trades and protect your capital.

3. Take advantage of leverage to increase returns, but use it responsibly as it can also amplify losses if not used correctly.

4. Manage risk by investing in different asset classes such as stocks, commodities, currencies, indices and ETFs (Exchange Traded Funds).

5. Research the markets before trading and keep up with news related to them so you are aware of any changes that may affect prices or market sentiment towards a particular asset class or currency pair etc..

6. Monitor your positions regularly and adjust accordingly when needed in order to maximize profits while minimizing risks associated with trading online via eToro in Togo

The Risks Involved When Using the eToro Platform In Togo

When using the eToro platform in Togo, there are certain risks that should be taken into consideration. These include market volatility, leverage risk, and counterparty risk.

Market volatility is a major factor when trading on the eToro platform. Prices can fluctuate quickly and dramatically due to news events or other factors outside of your control. This means that you could potentially lose money if you don’t pay close attention to market movements.

Leverage risk is another potential issue when using the eToro platform in Togo. Leverage allows traders to trade with more capital than they have available by borrowing from their broker or another third party lender. While this can increase profits if used correctly, it also increases losses if not managed properly as it amplifies both gains and losses significantly compared to trading without leverage.

Finally, counterparty risk is something that all traders need to consider when using the eToro platform in Togo. Counterparty risk refers to the possibility of one party defaulting on its obligations under a contract between two parties (eToro being one). As such, it’s important for traders to ensure they understand any contracts they enter into with eToro before committing funds or entering trades so as not to be exposed financially should anything go wrong with either party involved in a transaction

Security Measures Implemented by etoro To Protect Investors In Togo 10

1. Multi-factor authentication: eToro requires users to verify their identity with two-factor authentication, which adds an extra layer of security when logging in and transferring funds.

2. Encrypted data transmission: All communication between eToro’s servers and the user’s device is encrypted using secure sockets layer (SSL) technology, ensuring that all personal information remains private and secure.

3. Segregated accounts: Client funds are held in segregated bank accounts separate from eToro’s own money, providing additional protection for investors against fraud or misappropriation of funds by the company itself.

4. Regulatory compliance: eToro is regulated by several financial authorities around the world, including CySEC in Europe and FCA in the UK, ensuring that it adheres to strict rules regarding investor protection and market integrity.

5. Negative balance protection: This feature prevents traders from losing more than they have invested on a single trade by automatically closing out positions if their account balance drops below zero.

6. Stop loss orders: These allow traders to set limits on how much they can lose on any given trade before it is automatically closed out at a predetermined price level – protecting them from large losses due to sudden market movements or other unforeseen events beyond their control .

7 . Investment portfolio diversification : By investing across multiple asset classes , users can spread risk across different markets while still achieving potential returns . 8 . Risk management tools : eToro offers various risk management tools such as leverage caps , stop loss limits , trailing stops , guaranteed stop losses etc., allowing traders to better manage their trading activity according to their individual risk appetite . 9 . Automated copy trading : With this feature , experienced traders can share strategies with less experienced ones who may not be able to execute trades themselves but want exposure to certain markets or assets without having direct involvement in decision making process 10 Financial education resources : To help new investors understand how financial markets work , etoro provides educational materials such as videos tutorials , webinars etc., covering topics like fundamental analysis & technical analysis

| Feature | eToro | Other Trading Platforms |

|---|---|---|

| User Interface | Easy to use, intuitive design. Can be used on desktop and mobile devices. | Varied user interfaces depending on the platform. Some may require more technical knowledge than others. |

| Fees & Commissions | Low fees and commissions compared to other platforms. | Varying fees and commissions depending on the platform chosen. Generally higher than those of eToro’s. |

| Range of Assets Available | Wide range of assets available for trading including stocks, commodities, indices, currencies and cryptocurrencies . | Limited selection of assets available for trading; usually limited to stocks or forex pairs only. |

What types of investments are available on eToro in Togo?

eToro does not currently offer investments in Togo.

How does the process of opening an account with eToro work in Togo?

The process of opening an account with eToro in Togo is relatively straightforward. First, you will need to create a profile on the platform and provide your personal information such as name, address, phone number, email address and date of birth. Once your profile has been created, you can then proceed to deposit funds into your account using one of the available payment methods (such as bank transfer or credit/debit card). After that is done, you can start trading on the platform.

Are there any fees associated with using eToro in Togo?

No, there are no fees associated with using eToro in Togo.

Is it possible to trade stocks and other financial instruments through eToro in Togo?

No, it is not possible to trade stocks and other financial instruments through eToro in Togo. eToro does not currently offer its services in Togo.

Does eToro offer customer support services for users based in Togo?

No, eToro does not offer customer support services for users based in Togo.

What security measures have been put into place to protect user data when trading on eToro from within Togo?

eToro has implemented a number of security measures to protect user data when trading from within Togo. These include two-factor authentication, secure encryption technology, and the use of Secure Socket Layer (SSL) certificates for all communication between eToro and its users. Additionally, eToro also provides 24/7 customer support in case any issues arise with user accounts or transactions.

Are there any restrictions or limitations placed upon users who open accounts with eToro from within Togo?

Yes, there are restrictions and limitations placed upon users who open accounts with eToro from within Togo. These include a minimum deposit requirement of $200 USD, as well as a maximum leverage limit of 1:30 for Forex trading. Additionally, certain CFDs may not be available to traders in Togo due to local regulations.

How do currency exchange rates affect trades made through the platform while using it from withinTogolese territory ?

Currency exchange rates can have a significant impact on trades made through the platform while using it from within Togolese territory. The value of the currency in which transactions are conducted will affect the cost of goods and services, as well as any fees associated with making trades or payments. If the local currency is weak compared to other currencies, then traders may find that their profits are reduced due to unfavorable exchange rates. Additionally, if there is a large difference between two currencies being exchanged, then traders may be exposed to greater risks when trading on margin or taking out loans denominated in different currencies.

05.05.2023 @ 13:46

Togo. eToro is an innovative online trading platform that offers low fees and tight spreads for traders in Togo. Compared to traditional brokerages, eToro’s fees are extremely competitive, making it easier for investors to get started without breaking the bank. It is important to note that there are fees associated with trading on eToro, such as spreads, overnight fees, and withdrawal fees. However, these fees are clearly outlined on the platform and can be easily calculated before making a trade. It is important to understand these fees and charges before investing on eToro in Togo to ensure that you are making informed decisions about your investments. Overall, eToro is a great platform for those looking to explore the world of online trading in Togo, offering access to global markets, low fees, and an easy-to-use platform.