What is eToro?

eToro is an online trading and investing platform that enables users to trade a variety of financial assets, including stocks, currencies, commodities, indices and cryptocurrencies. It provides access to global markets with the help of its proprietary technology which allows users to copy successful traders or invest in CopyPortfolios™. eToro also offers social trading features such as news feeds and discussion forums where users can discuss their trades with other investors.

Advantages of Trading on eToro in Thailand

1. Access to Global Markets: eToro provides access to a wide range of global markets, allowing Thai traders to diversify their portfolios and invest in assets from around the world.

-

Low Fees: eToro offers competitive fees for trading and investing activities, making it an attractive option for those looking to maximize their returns on investments.

-

Variety of Investment Options: eToro offers a variety of investment options, including stocks, ETFs, commodities, indices and cryptocurrencies that can be traded with ease on its platform.

-

Advanced Trading Tools: With advanced tools such as CopyTrader™ and CopyPortfolios™ available on the platform, Thai traders can easily manage their investments without having any prior experience or knowledge about trading or investing in financial markets.

-

User-Friendly Platform: The user-friendly interface makes it easy for even beginners to navigate through the different features offered by eToro’s platform with ease and confidence while trading or investing online in Thailand

Disadvantages of Trading on eToro in Thailand

1. Limited Range of Assets: eToro offers a limited range of assets available for trading in Thailand, which can limit the potential returns that investors can make.

-

Regulatory Restrictions: The Thai government has placed certain restrictions on online trading platforms such as eToro, which may prevent some users from being able to access certain features or products offered by the platform.

-

High Fees and Commissions: Trading on eToro in Thailand often comes with high fees and commissions, which can eat into profits made from successful trades.

-

Lack of Support Services: As a relatively new platform in Thailand, eToro does not yet offer any dedicated customer support services for its users in the country, making it difficult to get help when needed.

How to Open an Account with eToro in Thailand

Opening an account with eToro in Thailand is a simple process. All you need to do is visit the official website, click on “Sign Up” and fill out the registration form. You will be asked to provide your name, email address, phone number and other personal information. Once you have completed the registration form, you will be able to log into your account and start trading or investing.

To get started with eToro in Thailand, you must first fund your account by transferring money from a Thai bank account or using one of their supported payment methods such as PayPal or Skrill. Once funds are transferred into your eToro wallet, you can begin trading immediately by selecting assets from their extensive range of stocks, commodities and cryptocurrencies.

eToro also offers a wide range of tools for traders including charts and analysis tools that allow users to monitor market movements more closely. Additionally they offer copy-trading which allows investors to automatically copy successful trades made by experienced traders on the platform – allowing them to benefit from these successful strategies without having any prior knowledge about trading themselves!

Overall opening an account with eToro in Thailand is straightforward but it’s important that all users understand how investments work before getting started so make sure you read up on everything related to online trading before taking part!

Types of Assets Available for Trading and Investing on eToro in Thailand

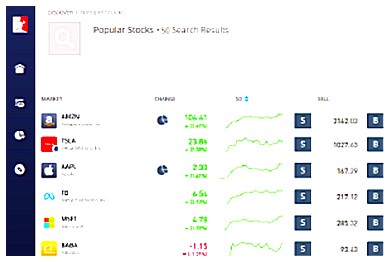

eToro in Thailand offers a wide range of assets for trading and investing. These include stocks, commodities, indices, cryptocurrencies, ETFs (Exchange Traded Funds), and CFDs (Contracts For Difference). Stocks from the Thai Stock Exchange are available as well as major global exchanges such as the New York Stock Exchange and NASDAQ. Commodities including gold, silver, oil and gas can be traded on eToro in Thailand. Indices like S&P 500 or FTSE 100 are also available to trade. Cryptocurrencies such as Bitcoin (BTC) Ethereum (ETH) Ripple (XRP) Litecoin (LTC) Dash (DASH), Monero(XMR), Zcash(ZEC), NEO(NEO), EOS(EOS)and many more can be bought or sold on eToro in Thailand. Additionally ETFs provide access to a basket of securities that track an index while CFDs allow traders to speculate on price movements without owning the underlying asset itself.

Fees and Commissions Associated with Trading and Investing on eToro in Thailand

When trading and investing on eToro in Thailand, it is important to understand the fees and commissions associated with your trades. The platform charges a commission for each trade you make, as well as spreads on certain assets. Additionally, there are overnight financing costs that may apply when holding positions open overnight or over weekends. These fees vary depending on the asset being traded and can be found in detail within the ‘Fees’ section of eToro’s website. It is also important to note that deposits made via bank transfer incur a fee of 0.5% of the deposit amount (minimum THB50). Finally, withdrawals from an eToro account will incur a fee of $25 USD per withdrawal request regardless of payment method used.

Strategies for Successful Investing Using the CopyTrader Feature of eToro in Thailand

1. Start small: Before investing a large amount of money, start with smaller amounts and practice using the CopyTrader feature to get familiar with it. This will help you understand how the feature works and how to use it effectively for successful investing.

-

Choose your traders wisely: When selecting which traders to copy, make sure you research their trading history and strategy before committing any funds. Consider factors such as risk tolerance, past performance, experience level, and more when making your decision.

-

Monitor your investments regularly: Keep an eye on your investments by checking in periodically throughout the day or week to see how they are performing and adjust accordingly if needed. The CopyTrader feature allows you to easily monitor all of your investments in one place so that you can stay up-to-date on their progress without having to manually check each one individually.

-

Diversify your portfolio: Don’t put all of your eggs in one basket – diversifying is key when it comes to successful investing! Spread out the risk by copying multiple traders at once instead of relying solely on one trader’s strategy or market predictions alone for success.

-

Utilize stop loss orders: Stop loss orders allow investors to set predetermined limits for losses so that they don’t suffer major financial losses due unexpected market fluctuations or other unforeseen events beyond their control while trading online with eToro in Thailand

Leverage Options Available When Trading or Investing Through eToro In Thailand

eToro is a great platform for traders and investors in Thailand, offering a wide range of options to leverage their investments. These include the ability to copy other successful traders, invest in stocks and ETFs, trade cryptocurrencies such as Bitcoin and Ethereum, and even access the CopyPortfolios feature which allows users to diversify their portfolios with ease. eToro also offers risk management tools like Stop Loss orders that can help protect your capital from unexpected market movements. With all these features available at your fingertips, you can be sure that eToro has something for everyone looking to take advantage of the trading opportunities available in Thailand.

Risk Management Tips for Investors Using the Platforms Offered bye ToroinThailand

1. Research the platform thoroughly before investing. Make sure you understand all of the risks associated with eToro and other platforms offered in Thailand, including fees, commissions, and any other costs that may be incurred when trading or investing.

-

Set realistic expectations for your investments on eToro or other platforms in Thailand. Understand that no investment is guaranteed to make a profit and losses are always possible.

-

Diversify your portfolio by investing in different asset classes such as stocks, commodities, currencies, and indices to reduce risk exposure from market volatility or individual stock performance issues.

-

Monitor your investments regularly to stay up-to-date on their performance and take action if needed (e.g., selling an underperforming asset). This will help you manage risk more effectively over time as markets change and evolve quickly these days due to news events or economic conditions around the world impacting prices daily basis .

5

Best Practices when Utilizing Social Investment Network Features One ToroinThailand

1. Utilize the copy trading feature to follow and replicate the strategies of successful traders on eToro.

2. Research each trader you are considering copying, including their past performance and risk profile before investing your money with them.

3. Monitor your investments regularly to ensure that they remain in line with your investment goals and objectives.

4. Diversify your portfolio by investing in a variety of assets, including stocks, commodities, currencies, indices, ETFs and cryptocurrencies offered on eToro Thailand’s platform .

5. Take advantage of leverage to maximize returns but be aware of the risks associated with it as well as any applicable fees or charges for using this feature on eToro Thailand’s platform .

6. Use stop-loss orders to protect yourself from sudden market downturns or large losses due to leveraged positions taken by other investors who may be copying you on eToro Thailand’s platform .

7. Consider utilizing social features such as chat rooms and forums available through eToro Thailand’s network so that you can interact with other traders and gain insights into different markets or strategies being used successfully by others on the network

| eToro Features | Advantages | Disadvantages |

|---|---|---|

| CopyTrader Tool | Allows users to copy the trades of experienced traders. | Difficult to monitor all copied trades and keep track of performance. |

| Low Fees | Low trading fees compared to other brokers. | Not available in all countries, including Thailand. |

| Variety of Assets | Offers a wide variety of assets for trading and investing, including stocks, commodities, cryptocurrencies, ETFs and more. |

What types of assets can be traded on eToro in Thailand?

eToro offers a wide range of assets that can be traded in Thailand, including stocks, ETFs, indices, commodities, cryptocurrencies and more.

How does the trading process work on eToro?

The trading process on eToro is relatively straightforward. First, users must create an account and deposit funds into their eToro wallet. Once the funds are available, users can browse the markets and select assets to trade. When a user selects an asset to trade, they will be presented with various options for setting up the trade such as selecting leverage levels or stop-loss orders. After all of these settings have been configured, the user can then place their order which will be executed in real time according to market conditions. Finally, once the order has been completed, profits (or losses) will be credited/debited from their account balance accordingly.

Are there any fees associated with using eToro in Thailand?

Yes, there are fees associated with using eToro in Thailand. These include spreads, overnight fees and withdrawal fees.

What are the benefits of investing through eToro compared to other platforms?

The main benefits of investing through eToro compared to other platforms are:

1. Low fees – eToro has some of the lowest trading fees in the industry, making it an attractive option for investors looking to maximize their returns.

2. Easy-to-use platform – eToro’s user interface is intuitive and easy to use, allowing even novice traders to quickly get up and running with their investments.

3. Variety of investment options – eToro offers a wide range of asset classes, including stocks, commodities, cryptocurrencies, ETFs and more. This allows investors to diversify their portfolios across multiple markets and asset types without having to open multiple accounts or switch between different platforms.

4. Copy Trading – With its CopyTrader feature, users can copy successful traders on the platform and benefit from their strategies without needing any prior knowledge or experience in trading themselves.

Does eToro offer a mobile app for trading and investing in Thailand?

Yes, eToro does offer a mobile app for trading and investing in Thailand. The app is available on both iOS and Android devices.

Is it possible to use leverage when trading on eToro in Thailand?

Yes, it is possible to use leverage when trading on eToro in Thailand. Leverage allows traders to open larger positions than their available capital would otherwise allow, and can be used for both long and short trades. However, the amount of leverage offered may vary depending on the country you are trading from.

Are there any special features or tools available for traders and investors on eToro in Thailand?

Yes, eToro offers a variety of special features and tools for traders and investors in Thailand. These include CopyTrader™, which allows users to copy the trades of other successful traders on the platform; CopyPortfolios™, which allow users to invest in professionally managed portfolios; Virtual Trading (paper trading), which enables users to practice their strategies with virtual money before investing real funds; Market Alerts, which provide notifications when certain market conditions are met; and more.

Is customer support available for users of the platform based in Thailand?

Yes, customer support is available for users of the platform based in Thailand. The company may have a dedicated team to provide assistance to customers from that region or they may offer support through an online chat system or by phone.

05.05.2023 @ 13:45

Thai language:

eToro เป็นแพลตฟอร์มการซื้อขายและลงทุนออนไลน์ที่ช่วยให้ผู้ใช้ซื้อขายหลายสินทรัพย์ทางการเงิน เช่น หุ้น สกุลเงิน สินค้า ดัชนี และสกุลเงินดิจิตอล และยังมีการเข้าถึงตลาดโลกด้วยเทคโนโลยีที่เป็นเอกลักษณ์ของตนเองซึ่งช่วยให้ผู้ใช้สามารถคัดลอกผู้ซื้อขายที่ประสบความสำเร็จหรือลงทุนใน CopyPortfolios™ ได้ นอกจากนี้ eToro ยังมีคุณสมบัติการซื้อขายทางสังคม เช่น ฟีดข่าวและฟอรั่มการอภิปรายที่ผู้ใช้สามารถพูดคุยเกี่ยวกับการซื้อขายของพวกเขากับนักลงทุนคนอื่น ๆ

ข้อดีของการซื้อขายบน eToro ในประเทศไทย

1. เข้าถึงตลาดโลก: eToro มีการเข้าถึงตลาดโลกที่หลากหลาย ทำใ