Introduction to eToro

Introduction to eToro:

eToro is an online trading and investing platform that has become increasingly popular in Serbia. It allows users to trade a variety of assets, including stocks, commodities, currencies, indices and cryptocurrencies. With its user-friendly interface and low fees, it’s no wonder why so many people are turning to eToro for their investment needs. In this guide we will explore the features of eToro in Serbia and provide you with tips on how to get started with your investments.

Benefits of Investing with eToro in Serbia

Serbia is a great place to invest and trade with eToro, an online trading platform. With its easy-to-use interface and wide range of assets, eToro makes it simple for anyone to get started investing in Serbia. Here are some of the benefits that come with investing through eToro in Serbia:

-

Low Fees: One of the biggest advantages of using eToro in Serbia is that you can benefit from low fees when compared to other brokers. This means more money stays in your pocket rather than going towards broker fees.

-

Variety of Assets: With over 1,700 different assets available on the platform, investors have plenty of options when it comes to diversifying their portfolios or finding new opportunities for growth.

-

Easy Accessibility: You don’t need any prior experience or knowledge about trading or investing before getting started with eToro; all you need is a computer and internet connection! The user-friendly interface makes navigating the platform straightforward so you can start trading quickly and easily without any hassle at all!

-

Security & Regulation: When choosing an online broker, security should be one of your top priorities – luckily, this isn’t something you have to worry about when using eToro as they are regulated by both local Serbian authorities as well as international ones such as CySEC (Cyprus Securities Exchange Commission). This ensures that your funds are safe while also providing peace of mind knowing that everything is done according to industry standards and regulations!

Setting Up an Account on eToro

eToro is a popular online trading platform that has become increasingly popular in Serbia. This guide will provide an overview of how to set up an account on eToro and begin investing or trading with the platform.

The first step to setting up an account on eToro is to visit their website and click “Sign Up” at the top right corner of the page. You will then be asked for your name, email address, and password before being taken to a page where you can choose between two types of accounts: Real Money Account or Practice Account. If you are new to investing or trading, it is recommended that you start with a Practice Account so that you can get familiar with the platform without risking any real money.

Once you have chosen which type of account best suits your needs, it’s time to fill out some additional information about yourself such as date of birth, country of residence, and phone number. After this step is complete, eToro will ask for verification documents such as government-issued ID (passport/ID card) and proof of address (utility bill). Once these documents have been submitted successfully they will be reviewed by eToro staff within 48 hours after which your account should be approved and ready for use!

Now that your account has been set up on eToro all that’s left is deciding what kind of investments or trades you want to make – happy investing!

Navigating the Platform: Understanding Key Features

eToro is a popular online trading platform that has become increasingly popular in Serbia. It allows users to trade stocks, commodities, currencies and other financial instruments with ease. In this article, we will provide an overview of eToro’s key features and how to navigate the platform. We’ll also discuss some tips for investing and trading on eToro in Serbia.

Navigating the Platform: Understanding Key Features

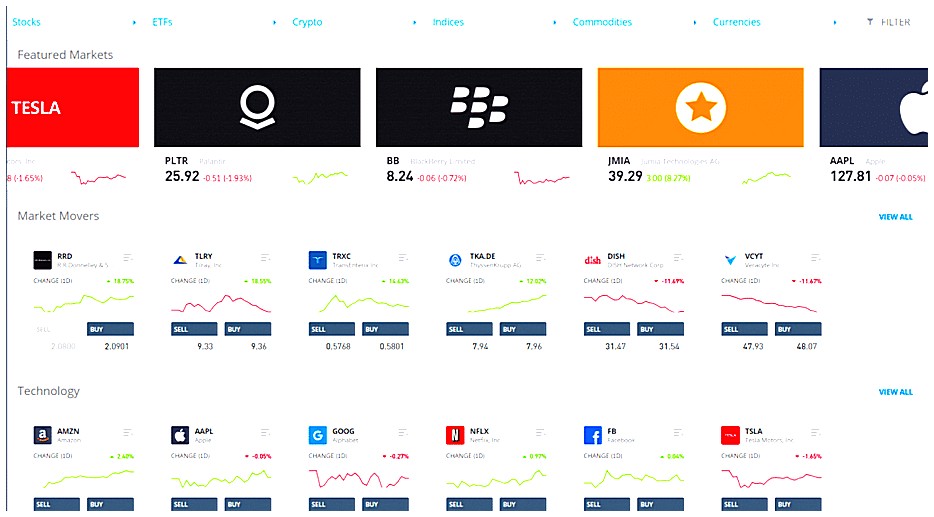

The first step when navigating eToro is understanding its key features. The platform offers a range of tools designed to help traders make informed decisions about their investments. These include charts, news feeds, watchlists and more. Additionally, users can access market data from over 100 exchanges around the world as well as real-time quotes from major indices such as NASDAQ or FTSE100 index.

Once you have familiarized yourself with these features, it’s time to start exploring the different markets available on eToro. Users can choose between stocks (including ETFs), cryptocurrencies (such as Bitcoin), commodities (like gold) or currencies (forex). Each asset class comes with its own set of rules and regulations so it’s important to do your research before making any trades or investments on the platform.

In addition to traditional assets like stocks and forex pairs, users can also explore copy trading opportunities offered by experienced traders on eToro’s CopyTrader feature which enables them to replicate another user’s portfolio automatically without having any prior knowledge of trading themselves! This makes it easy for beginners who want exposure into various markets but don’t necessarily have enough experience yet in order to make their own decisions regarding what they should invest in or not..

Exploring Trading Opportunities on eToro

The world of online trading has opened up a wealth of opportunities for investors in Serbia. With the emergence of eToro, a leading social trading platform, traders can now explore new markets and strategies to maximize their returns. In this article, we will provide an overview of eToro’s services and how they can be used to capitalize on investing and trading opportunities in Serbia. We’ll also discuss some key features that make it an attractive option for Serbian traders looking to expand their portfolios. Finally, we’ll offer some tips on getting started with eToro in Serbia so you can begin exploring the exciting possibilities it offers today!

Diversifying Your Portfolio with CopyTrading™

Investing and trading can be a great way to diversify your portfolio and make the most of your money. With eToro, you have access to one of the world’s leading online trading platforms, which offers a range of tools for traders and investors alike. One such tool is CopyTrading™, which allows users to copy other successful traders on the platform in order to achieve similar results. This makes it easier than ever before for novice traders or those with limited experience in investing and trading to get involved in this exciting market. In this guide, we will explore how you can use eToro in Serbia as well as how CopyTrading™ can help you diversify your portfolio with minimal effort.

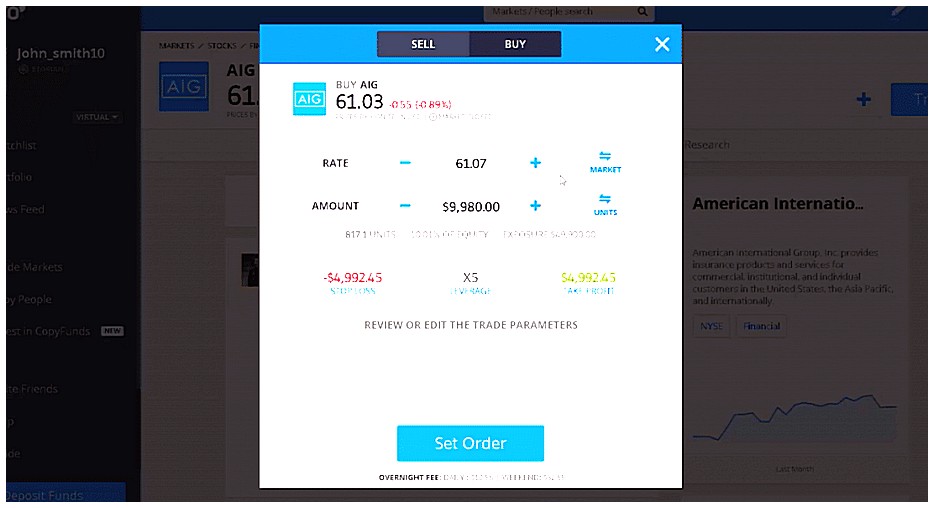

Maximizing Returns Through Leveraged Trading

eToro is an online trading platform that allows users to invest and trade in a variety of markets. In Serbia, eToro offers investors the opportunity to maximize their returns through leveraged trading. Leveraged trading enables traders to increase their potential profits by using borrowed funds from eToro’s partner brokers. This article will explore how investors can use eToro in Serbia to take advantage of this powerful tool and maximize their returns. We will discuss the benefits of leveraged trading, as well as strategies for managing risk and maximizing profits with leverage. Finally, we will provide some tips on how best to get started with investing and trading on eToro in Serbia.

Managing Risk and Security Considerations

When investing and trading with eToro in Serbia, it is important to consider the risks associated with such activities. Managing risk and security considerations should be at the forefront of any investor’s mind when considering using eToro. It is important to understand the potential losses that could occur due to market volatility or other factors. Additionally, investors should ensure they are familiar with all relevant regulations and laws regarding investments in Serbia before engaging in any activity on eToro. Furthermore, it is essential for investors to protect their accounts by utilizing strong passwords and two-factor authentication whenever possible. By understanding these risks and taking appropriate steps to manage them, investors can maximize their chances of success while minimizing potential losses on eToro.

Withdrawing Funds from Your Account

eToro is a popular online trading platform that allows users to buy and sell stocks, commodities, currencies, and other financial instruments. In Serbia, eToro has become increasingly popular as an easy way for investors to access the global markets. This guide will provide an overview of how to use eToro in Serbia and explore some of its features.

One important feature of eToro is the ability to withdraw funds from your account. Withdrawing funds from your account can be done quickly and easily through several different methods including bank transfer or credit/debit card payments. To initiate a withdrawal request on eToro, you will need to enter the amount you wish to withdraw along with any relevant information such as your bank details or payment method information. Once this is completed, you should receive confirmation within 1-2 business days that your withdrawal request has been processed successfully. It’s important to note that depending on the payment method used there may be additional fees associated with withdrawing funds from your account so it’s best practice to check these before initiating a withdrawal request.

Conclusion: Unlocking Investment Potential in Serbia with eToro

Conclusion: eToro is an innovative and user-friendly platform that provides investors in Serbia with a great opportunity to unlock their investment potential. With its intuitive interface, low fees, and access to global markets, eToro makes it easy for anyone to start investing or trading in Serbia. Whether you are looking for long-term investments or short-term trades, eToro has something for everyone. By taking advantage of the features available on this platform, investors can maximize their returns while minimizing risk. Investing through eToro is a smart way to take control of your financial future and make the most out of your money in Serbia.

| eToro in Serbia | Other Investment Platforms |

|---|---|

| Easy to use platform | Difficult to use platforms |

| Low minimum deposit requirement | High minimum deposit requirement |

| Access to global markets and stocks | Limited access to global markets and stocks |

| Variety of trading options available | Fewer trading options available |

What types of investments and trading are available on eToro in Serbia?

eToro offers a wide range of investments and trading options in Serbia, including stocks, ETFs, commodities, cryptocurrencies, indices and currencies. All of these assets can be traded on the eToro platform with access to real-time prices and market news. Additionally, users have the ability to copy other traders or create their own portfolio for diversified exposure.

How can I open an account with eToro in Serbia?

To open an account with eToro in Serbia, you will need to visit the eToro website and click on the “Sign Up” button. You will then be asked to provide some personal information such as your name, email address, phone number, and date of birth. Once you have completed this step, you will be required to verify your identity by providing a valid form of identification such as a passport or driver’s license. After completing these steps, you can begin trading with eToro in Serbia.

Are there any fees associated with investing or trading on eToro in Serbia?

Yes, there are fees associated with investing or trading on eToro in Serbia. These include spreads, overnight financing fees and withdrawal fees.

What is the minimum deposit required to start investing or trading on eToro in Serbia?

The minimum deposit required to start investing or trading on eToro in Serbia is $200.

Does eToro offer any tools, such as charts and analysis, to help me make informed decisions when investing or trading?

Yes, eToro offers a variety of tools to help you make informed decisions when investing or trading. These include charts and analysis, news feeds, market data and insights from the eToro community. Additionally, eToro’s CopyTrader feature allows users to copy successful traders’ portfolios for automated investment strategies.

Are there any risks associated with using eToro for investing and trading in Serbia?

Yes, there are risks associated with using eToro for investing and trading in Serbia. These include market volatility, liquidity risk, counterparty risk, and regulatory risk. Additionally, as with any online platform or broker service provider that is not regulated by the Serbian Financial Supervision Authority (SFSA), investors should be aware of the potential for fraud or other illegal activities. Investors should always research a company before investing and ensure they understand all associated risks.

Is customer support available if I have questions about my investments or trades on eToro in Serbia?

Yes, customer support is available for eToro users in Serbia. You can contact the eToro team by email or phone to get help with any questions you may have about your investments or trades on the platform.

What resources does eToro provide to help educate users about investing and trading strategies before they begin using the platform?

eToro provides a range of resources to help educate users about investing and trading strategies before they begin using the platform. These include educational videos, webinars, tutorials, e-books, market analysis reports and more. Additionally, eToro has an extensive FAQ section on its website which covers topics such as account opening procedures, deposits/withdrawals and other important information related to the platform. Finally, there is also a live chat feature available for users who have any questions or need assistance with their investments.

05.05.2023 @ 13:42

tform: Understanding Key Features

eToro је онлајн трговачка и инвестициона платформа која је постала изузетно популарна у Србији. Омогућава корисницима да тргују различитим активима, укључујући акције, робе, валуте, индексе и криптовалуте. Са његовим кориснички пријатним интерфејсом и ниским таксама, не чуди што се толико људи окреће еТороу за своје инвестиционе потребе.

У овом водичу ћемо истражити могућности еТороа у Србији и дати вам савете о томе како започети са вашим инвестицијама. Србија је одлично место за инвестирање и трговање путем еТороа, онлајн трговачке платформе. ЕТоро омогућава лак приступ и широк спектар актива, што олакшава почетак инвестиција у Србији.

Ево неких од предности које долазе са инвестирањем преко еТороа у Србији:

– Ниске таксе: Једна од највећих предности коришћења еТороа у Србији је то што можете да користите ниске таксе у пор