Introduction to eToro in Peru

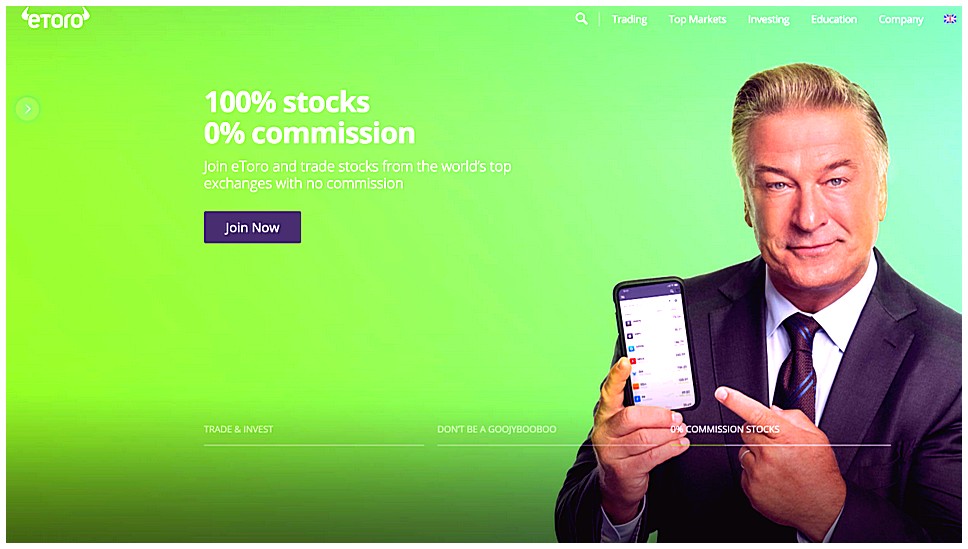

eToro is a leading online trading and investment platform that has revolutionized the way people trade and invest in financial markets. It offers users an easy-to-use interface, low fees, and access to a wide range of global assets. In this article, we will explore eToro’s offerings in Peru and provide tips on how to get started with trading or investing successfully on the platform. We’ll also discuss some of the key features available for Peruvian traders as well as any potential risks associated with using eToro in Peru.

Advantages of Trading on eToro in Peru

1. Low Fees: eToro offers some of the lowest fees in Peru, making it an attractive option for those looking to save money on their trades.

-

Variety of Assets: With a wide range of assets available to trade, including stocks, commodities, indices and cryptocurrencies, eToro provides plenty of options for investors in Peru.

-

Social Trading: eToro’s social trading platform allows users to copy the strategies and portfolios of other successful traders – providing an easy way to get started with investing or diversify your portfolio without needing much experience or knowledge about markets.

-

User-Friendly Platform: The intuitive design makes it easy for beginners to get up and running quickly on the platform while still offering enough features and customization options for more experienced traders as well.

-

Educational Resources: eToro also provides educational resources such as webinars and tutorials that can help users gain a better understanding of how financial markets work so they can make informed decisions when trading or investing on the platform

Types of Assets Available for Trading on eToro in Peru

eToro in Peru offers a wide variety of assets for trading and investing. These include stocks, commodities, indices, ETFs (Exchange Traded Funds), cryptocurrencies, currencies and more. Stocks from some of the world’s largest companies are available to trade on eToro in Peru such as Apple Inc., Microsoft Corporation and Amazon.com Inc. Commodities like gold, silver and oil can also be traded through eToro in Peru. Indices such as the S&P 500 or Nasdaq Composite can be tracked with CFDs (Contracts For Difference). Exchange Traded Funds allow investors to invest into a basket of different securities all at once while Cryptocurrencies provide an exciting opportunity to diversify your portfolio with digital assets like Bitcoin or Ethereum. Finally, foreign exchange traders have access to major currency pairs such as EUR/USD or GBP/JPY on eToro in Peru too!

Opening an Account with eToro in Peru

Opening an Account with eToro in Peru is a simple and straightforward process. To get started, all you need to do is create an account on the eToro website. Once your account has been created, you will be able to access the platform’s features and begin trading or investing in various assets. When creating your account, make sure that you provide accurate information as this will ensure that your transactions are secure and successful. After completing the registration process, you can deposit funds into your account using one of several payment methods available on the platform such as bank transfer or credit/debit card payments. Once these steps have been completed, you can start exploring all of the features offered by eToro including copy trading and social trading tools which allow users to learn from other traders’ experiences while making their own trades.

Setting Up Your Profile and Funding Your Account

If you’re new to eToro, the first step is setting up your profile and funding your account. This process can be completed quickly and easily in just a few steps.

To begin, go to the eToro website and click on “Sign Up” at the top of the page. You will then be asked to provide some basic information such as your name, email address, country of residence, date of birth and phone number. Once you have filled out this form, you will need to verify your identity by providing proof of identification (such as a passport or driver’s license). After that has been verified successfully, you can move onto funding your account.

eToro offers several options for depositing funds into an account including credit/debit cards (Visa/Mastercard), bank transfers or electronic wallets like PayPal or Skrill. Depending on which method you choose there may be different fees associated with each one so it’s important to read through all terms before making any deposits. Once funds are deposited into an account they can then be used for trading purposes on eToro’s platform.

By following these simple steps you should now have everything set up and ready to start trading! With a funded account at hand, it’s time to explore what eToro has in store for Peru-based traders looking for success in their investments!

Understanding the Risks Involved with Investing Through eToro in Peru

When it comes to investing, there are always risks involved. Investing through eToro in Peru is no different. Before getting started with trading and investing on the platform, it’s important to understand the potential risks that come along with using eToro in Peru.

The most common risk associated with any form of investment is market volatility. This means that the value of your investments can go up or down depending on how well they perform against other assets in the markets. As such, you should be prepared for a range of possible outcomes when investing through eToro in Peru. It’s also important to remember that past performance does not guarantee future results; even if an asset has done well historically, its value could suddenly drop due to changes in market conditions or investor sentiment.

Another risk factor to consider when using eToro in Peru is currency exchange rates. Since many investments involve buying and selling assets denominated in foreign currencies, fluctuations between these currencies can affect your returns significantly over time. Therefore, you should research current exchange rates before making any trades so that you know what kind of impact they may have on your profits or losses from each transaction.

Finally, it’s essential to remember that all investments carry some degree of risk – including those made through eToro in Peru – and as such you should never invest more than you can afford to lose without adversely affecting your financial situation or lifestyle choices going forward

Tips for Maximizing Profits When Trading on eToro in Peru

1. Start with a small amount of capital and build up your trading account gradually. This will help you to gain experience without risking too much money at once.

-

Make sure to diversify your portfolio by investing in different assets such as stocks, commodities, currencies, and cryptocurrencies. This will help spread out the risk and increase the potential for profits over time.

-

Utilize leverage when trading on eToro in Peru to maximize profits from smaller price movements in the markets. However, be aware that leverage can also lead to greater losses if trades move against you so use it carefully!

-

Monitor market news closely and stay informed about current events that could affect prices of certain assets or sectors of the economy as a whole. By staying ahead of the curve you can make more profitable trades than those who are not paying attention to what’s going on around them in the markets.

5

Leveraging Social Features to Enhance Investment Strategies on eToro in Peru

As Peru continues to develop its economy, more and more people are turning to online trading platforms like eToro in order to take advantage of the potential for financial growth. While eToro is a great platform for traders of all levels, it also offers some unique social features that can be leveraged by investors in order to enhance their strategies. This article will explore how Peruvian investors can use these features to maximize their returns on eToro. We’ll discuss topics such as copy trading, automated portfolios, and community-driven investments so that you can make informed decisions about your own investing strategy. With this knowledge at hand, you’ll be well on your way towards achieving success with eToro in Peru!

Common Mistakes to Avoid When Trading on eToro In Peru 10

1. Not researching the market before trading: Before investing, it is important to understand the local markets and trends in Peru. Researching the latest news and financial data can help you make informed decisions when trading on eToro.

-

Over-leveraging: Leverage allows traders to open larger positions than their account balance would normally allow, but it also increases risk. It’s important to be aware of how much leverage you are using and not over-leverage your position as this could lead to losses if the trade goes against you.

-

Ignoring stop loss orders: Stop loss orders are designed to limit potential losses by automatically closing a position once it reaches a certain price level, so they should never be ignored or neglected when trading on eToro in Peru.

-

Failing to diversify your portfolio: Diversifying your portfolio across different asset classes is an essential part of any successful investment strategy, especially for those new to online trading platforms like eToro in Peru who may have limited experience with different types of investments such as stocks, commodities or currencies .

-

Trading without understanding fees and commissions: Different brokers charge different fees for trades executed through their platform so it’s important that investors understand what these charges are before placing any trades on eToro in Peru .

6 Not setting realistic goals : Setting unrealistic goals can lead traders into taking unnecessary risks which could result in large losses if things don’t go according plan . It’s therefore important that investors set realistic expectations based on their own individual circumstances when trading on eToro in Peru .

7 Chasing after short term gains : Many inexperienced traders fall into the trap of chasing after short term gains , however this often leads them into making rash decisions which can result in large losses over time . Investing with a long term outlook is usually more profitable than trying to make quick profits from day-trading activities .

8 Not monitoring performance regularly : Monitoring performance regularly is key for successful investing , as this helps identify areas where improvements need to be made or where additional research needs doing prior entering into new trades on etoro In peru

9 Taking advice from unreliable sources : When looking for advice about investing strategies or tips about particular markets , its best practice only take advice from reliable sources such as experienced professionals rather than relying solely upon opinions found online forums or other websites related etoro In peru

10 Not managing risk properly : Risk management is one of most critical aspects successfulyl navigating financial markets , yet many inexperienced traders fail adequately manage risk levels due lack knowledge about hedging techniques available through etoro In peru

| eToro | Traditional Investing |

|---|---|

| Low fees and commissions | High fees and commissions |

| Easy to use platform with a wide range of features | Difficult to use platforms with limited features |

| Social trading feature allows users to copy other traders’ strategies and portfolios. | No social trading feature available. Must manually research investments on own. |

| Wide selection of stocks, currencies, commodities, ETFs, indices & cryptocurrencies available for investment. | Limited selection of stocks, currencies & commodities available for investment. |

What are the benefits of using eToro in Peru?

The benefits of using eToro in Peru include access to a wide range of financial markets, low trading fees, advanced charting tools and market analysis features, an intuitive user interface, copy-trading capabilities, social trading options and more. Additionally, users benefit from the security of their funds as eToro is regulated by the Financial Conduct Authority (FCA) in the UK. Finally, Peruvian traders can take advantage of local payment methods such as BCP or BBVA for deposits and withdrawals.

How can I start trading on eToro in Peru?

To start trading on eToro in Peru, you will need to create an account with the platform. You can do this by visiting their website and following the steps provided. Once your account is created, you will need to deposit funds into it using a supported payment method such as a bank transfer or credit/debit card. After that, you’ll be able to search for stocks, ETFs, currencies and other assets available on eToro’s platform and begin trading them.

Are there any risks associated with investing through eToro in Peru?

Yes, there are risks associated with investing through eToro in Peru. These include market risk, currency risk, and the potential for losses due to fluctuations in exchange rates or other economic factors. Additionally, it is important to note that investments made through eToro may be subject to taxes and fees imposed by the Peruvian government. It is recommended that investors research these laws prior to making any investments on eToro in Peru.

What types of investments are available to me on eToro in Peru?

On eToro in Peru, you can invest in stocks, ETFs (Exchange Traded Funds), cryptocurrencies, commodities, and indices.

Is it easy to withdraw money from my account on eToro if I am based in Peru?

Yes, it is easy to withdraw money from your eToro account if you are based in Peru. You can use a variety of methods such as bank transfer, PayPal, Skrill or Neteller. All you need to do is go to the “Withdraw Funds” section on your eToro account and follow the instructions provided.

Are there any fees or commissions charged when trading and investing through eToro in Peru?

Yes, eToro charges a spread fee when trading and investing in Peru. The exact amount of the spread depends on the asset being traded. Additionally, there may be other fees such as overnight financing fees or withdrawal fees depending on your account type.

Does eToro offer customer support for users based in Peru?

Yes, eToro offers customer support for users based in Peru. The company provides 24/7 customer service via email and live chat. Additionally, the website has a toll-free phone number for customers located in Peru.

Are there any tips or strategies that can help me maximize my success when trading and investing through eToro in Peru?

1. Research the markets: Before investing or trading through eToro in Peru, it is important to research the different markets and understand how they work. This will help you make informed decisions about which investments to make and when.

-

Set realistic goals: It is important to set realistic goals for yourself before beginning any type of investment or trading activity with eToro in Peru. Consider your financial situation, risk tolerance, and time horizon when setting these goals so that you can maximize your success while minimizing risks.

-

Diversify your portfolio: Investing in a variety of assets can help reduce overall risk while still providing potential returns on investment over time. Consider diversifying across asset classes such as stocks, bonds, commodities, currencies, and other securities available through eToro in Peru to ensure maximum success over the long-term.

-

Utilize stop loss orders: Stop loss orders are an effective way to limit losses if a trade does not go as planned by automatically closing out a position at predetermined price levels set by you beforehand. This helps minimize losses should prices move against your expectations without having to constantly monitor them manually throughout the day/week/month etc..

05.05.2023 @ 13:45

d phone number. Once you have provided this information, you will need to create a username and password for your account.

After creating your account, you will need to verify your identity by providing a copy of your ID or passport. This is a standard procedure to ensure that eToro complies with anti-money laundering regulations.

Once your account has been verified, you can fund it using one of several payment methods available on the platform. These include bank transfer, credit/debit card payments, and e-wallets such as PayPal and Skrill.

Overall, eToro is a great platform for traders and investors in Peru who are looking for a user-friendly and low-cost way to access global financial markets. With a wide range of assets available to trade, educational resources, and social trading tools, eToro provides a comprehensive solution for anyone looking to get started with trading or investing. However, as with any investment, it is important to understand the risks involved and to only invest what you can afford to lose.