Introduction to eToro in New Zealand

eToro is a leading global investment and trading platform that has become increasingly popular in New Zealand. It offers users the opportunity to invest in stocks, commodities, currencies, indices and cryptocurrencies from around the world. This guide will provide an introduction to eToro in New Zealand, including how it works, what types of investments are available and tips for getting started. We’ll also look at some of the risks associated with investing on eToro so you can make informed decisions about your finances.

What is eToro?

eToro is an online trading and investing platform that allows users to buy and sell a variety of financial assets, including stocks, currencies, commodities, indices, ETFs and cryptocurrencies. It offers a range of features such as copy-trading which allows traders to automatically copy the trades of experienced investors on the platform. eToro also provides access to research tools such as market news updates and analysis from professional traders. This guide will explore how New Zealanders can use eToro for their investments or trading activities.

Benefits of Trading with eToro in New Zealand

eToro is a popular online trading platform that has been gaining traction in New Zealand. It offers users access to a variety of markets, including stocks, indices, commodities and cryptocurrencies. This guide will explore the benefits of trading with eToro in New Zealand and how you can get started.

One of the major benefits of using eToro for investing and trading in New Zealand is its user-friendly interface. The platform’s intuitive design makes it easy to navigate even for novice traders or investors who are just getting started with their financial journey. With features such as copy trading, which allows users to replicate successful strategies from other traders on the platform, anyone can start building an investment portfolio without having prior knowledge or experience in the market.

Another advantage offered by eToro is its low fees compared to traditional brokers or banks. Users pay no commission when buying stocks through eToro – only spreads – making it one of the most cost-effective ways to invest money into different markets around the world. Additionally, there are no minimum deposits required when opening an account so users can start investing with whatever amount they feel comfortable with initially before increasing their capital later on if desired.

Finally, another benefit that comes with using eToro is its customer support team which provides 24/7 assistance via email or live chat should any issues arise while navigating through the platform’s features and functions. Furthermore, educational resources such as webinars and tutorials are available onsite so users can learn more about different aspects related to investing before putting their hard earned money at risk in volatile markets like cryptocurrency or forex trading

Setting Up an Account on eToro

eToro is a popular online trading platform that has recently become available in New Zealand. It offers users the opportunity to invest and trade stocks, currencies, commodities, and more. Setting up an account on eToro is easy and straightforward. In this article, we will walk you through the steps of setting up an account on eToro in New Zealand.

The first step is to visit the official website for eToro in New Zealand at www.etoro.com/nz/. From there, click “Sign Up” located at the top right corner of the page to begin creating your account. You will be asked to provide some basic information such as your name, email address, country of residence (New Zealand), date of birth and phone number before proceeding with registration process.

Once you have provided all required information correctly, you can move onto verifying your identity by providing proof of identification such as passport or driver’s license details along with a selfie photo holding your ID card next to your face for verification purposes only (this step may vary depending on where you are from). Once verified successfully, you can now deposit funds into your new eToro account using one of their supported payment methods which include bank transfer or credit/debit cards like Visa or Mastercard among others; however it’s important to note that certain payment methods may not be available depending on where you live so make sure to check out their FAQ section for more details about this matter if needed before making any deposits into your newly created account!

Finally once all these steps have been completed successfully – congratulations! You now have a fully functioning eToro trading account ready for use in New Zealand! Now it’s time to start exploring what this great platform has to offer including its wide range of investment options ranging from cryptocurrencies like Bitcoin & Ethereum all way down traditional stocks & forex markets too – so get started today and good luck investing!

Types of Assets Available for Trading on eToro NZ

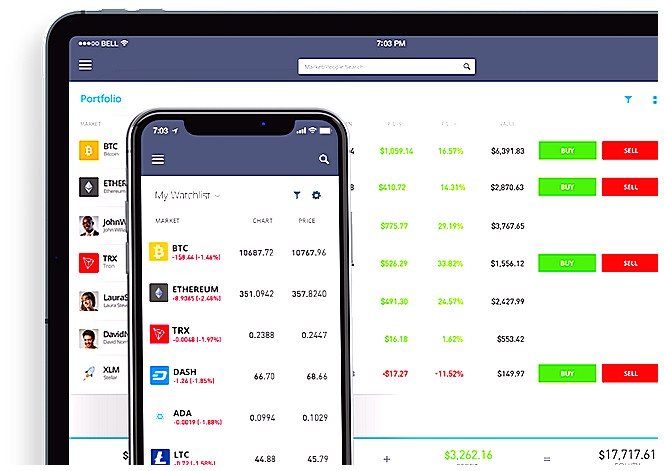

eToro is a great platform for investing and trading in New Zealand. With eToro, you can access a wide range of assets available for trading including stocks, indices, commodities, currencies (forex), ETFs and cryptocurrencies.

Stocks: You can trade stocks from the NZX as well as international exchanges such as the NYSE and NASDAQ.

Indices: Trade popular indices like S&P 500, Dow Jones Industrial Average (DJIA) or FTSE 100.

Commodities: Invest in gold, silver or oil with CFDs on commodities markets.

Currencies (Forex): Access global currency pairs to speculate on exchange rate movements between two different currencies.

ETFs: Exchange-traded funds are baskets of securities that track an index or sector – allowing you to invest in multiple assets at once without having to buy them individually.

Cryptocurrencies: Get exposure to digital coins such as Bitcoin and Ethereum by trading crypto CFDs on eToro’s platform.

Understanding the Different Fees and Charges Involved with Investing and Trading on eToro NZ

When it comes to investing and trading on eToro NZ, there are a variety of fees and charges that you should be aware of. These include spreads, overnight financing costs, commission fees, withdrawal fees and conversion rates. Understanding these different types of fees can help you make informed decisions about your investments and trades.

Spreads refer to the difference between the buying price (the ‘ask’) and the selling price (the ‘bid’). When trading on eToro NZ, you will typically pay a spread for each trade. The size of this spread varies depending on which asset class or instrument is being traded.

Overnight financing costs refer to any interest that may be charged when positions are held open overnight or over weekends/holidays. This cost will vary depending on whether you hold long or short positions in certain assets as well as market conditions at the time of holding them open.

Commission fees are applicable when making trades with certain instruments such as stocks or ETFs (Exchange Traded Funds). Commission is calculated based upon the total value of your trade order so it’s important to consider this before placing an order with eToro NZ.

Withdrawal fees apply whenever funds are withdrawn from your account into another bank account outside New Zealand dollars (NZD). Depending on where you’re withdrawing money from, there may also be additional currency conversion rates involved which could further increase these costs if not taken into consideration beforehand.

Finally, currency conversion rates come into play when converting currencies within your portfolio such as USD/EUR pairs etc.. Different exchange rate providers offer varying exchange rates so it’s worth shopping around for competitive prices before making any conversions through eToro NZ’s platform

Exploring the Features and Tools Offered by eToro NZ

eToro is a popular online trading platform that has been gaining traction in New Zealand. It offers a range of features and tools to help investors make informed decisions about their investments. In this article, we will explore the features and tools offered by eToro NZ, so you can get an idea of what it has to offer for those looking to invest or trade in New Zealand.

First off, eToro provides access to more than 2,400 stocks from all over the world including some of the most popular companies such as Apple Inc., Amazon.com Inc., Microsoft Corporation and Alphabet Inc (Google). This means that you can diversify your portfolio with different asset classes from around the globe without having to open multiple accounts on different platforms.

In addition, eToro also allows users to trade CFDs (Contracts For Difference) which are derivatives contracts allowing traders and investors to speculate on price movements without actually owning any underlying assets like stocks or commodities. With CFDs you can take advantage of both rising and falling markets with leverage up to 1:30 depending on your country’s regulations.

Moreover, eToro also offers several other useful features such as CopyTrader™ which allows users to copy successful traders’ portfolios automatically; Social Trading where users can follow experienced traders’ trades in real-time; Stop Loss orders which allow users set limits for losses they are willing accept; Take Profit orders which let them lock profits when prices reach certain levels; Trailing Stops which enable automatic adjustments based on market conditions; Market Alerts notifications informing about important events happening across global markets etc.. All these features give investors more control over their investments while reducing risk at the same time – something not available through traditional stockbrokers or exchanges alone.

Finally, if you want even more control over your investments then there is always option of using Expert Advisors (EAs) – automated trading systems designed specifically for MetaTrader 4 platform that allow anyone create their own strategies according current market conditions without need for manual intervention every time there is change in trend direction or volatility level etc.. EAs are great way increase efficiency when it comes managing large amounts capital since they automate processes like opening/closing positions entering/exiting trades setting stop loss/take profit levels etc..

Overall, eToro NZ provides a wide range of options for those who want get into investing or trading no matter what type experience they have – whether beginner intermediate advanced trader investor alike! So if you’re interested learning more about how use this platform successfully then be sure check out our guide exploring etoro new zealand!

How to Make Money from Investing or Trading on eToro NZ

eToro is a popular online trading platform that has become increasingly popular in New Zealand. It offers investors and traders the opportunity to buy and sell stocks, currencies, commodities, indices, ETFs and more from around the world. With its easy-to-use interface and low fees, eToro makes it possible for anyone to start investing or trading with little capital. In this article we will explore how you can make money from investing or trading on eToro NZ.

The first step to making money on eToro is to open an account with them. You will need to provide some basic information such as your name, address and email address before you can begin trading or investing. Once your account is set up you can then deposit funds into it via bank transfer or credit/debit card payment methods. After that you are ready to start buying and selling assets on the platform.

When choosing which asset class(es) to invest in there are several factors that should be taken into consideration such as risk tolerance level, time horizon (how long do you plan on holding onto investments), diversification strategy etcetera). Depending on these factors different strategies may be employed when selecting which assets one should purchase; whether they be stocks, currencies etcetera).

Once an investor has chosen their desired asset class(es) they must decide how much of each asset they would like to buy/sell at any given time – this decision will depend largely upon their own personal financial goals & objectives as well as current market conditions (such as volatility levels). For example if someone wanted a high return but was also willing accept higher risks then they might choose a more aggressive approach by purchasing larger amounts of risky assets such as penny stocks whereas if someone had lower risk tolerance then perhaps smaller amounts of safer assets such blue chip companies would be better suited for them instead .

Finally once all decisions have been made regarding what type & amount of assets one wishes purchase/sell – it’s important not forget about stop loss orders! Stop losses help protect against large losses by automatically closing out positions when prices reach predetermined levels – thus helping limit potential damage caused by volatile markets .

In conclusion , with careful research & planning anyone can make money from investing or trading through eToro NZ – provided they take the necessary steps outlined above !

Tips for Beginner Traders Using eToro in New Zealand

1. Start small: Before investing a large amount of money, start with smaller investments and get familiar with the platform.

-

Research before trading: Do your research on different assets available to trade in New Zealand and decide which ones you want to invest in.

-

Set realistic goals: Set realistic expectations for yourself when it comes to trading and make sure that you understand the risks associated with each asset class before investing.

-

Monitor your portfolio regularly: Make sure that you monitor your portfolio regularly so that you can identify any changes or trends in the market quickly and adjust accordingly if needed.

-

Use stop-loss orders: Utilize stop-loss orders to protect yourself from sudden losses due to unexpected market movements or events, as well as limit potential losses on trades gone wrong.

Summary: The Advantages of Choosing to Trade with etoro in New Zealand

eToro is a popular online trading platform that offers New Zealanders an easy and convenient way to invest in the financial markets. The platform provides users with access to a wide range of assets, including stocks, indices, commodities, cryptocurrencies and more. eToro also offers competitive fees and spreads on trades as well as advanced tools for technical analysis. Additionally, the platform’s social trading feature allows traders to copy other successful investors’ strategies or share their own ideas with others. In summary, choosing to trade with eToro in New Zealand can provide many advantages such as access to multiple asset classes at competitive rates, powerful tools for analysis and the ability to learn from experienced traders through its social trading feature.

| eToro | Other Investment Platforms |

|---|---|

| Low minimum deposit requirement | Higher minimum deposit requirements |

| Easy to use platform with user-friendly interface and features such as copy trading, portfolio diversification and social trading. | Less user-friendly interfaces and fewer features available. |

| Offers a wide range of asset classes including stocks, ETFs, cryptocurrencies, commodities and indices. | Limited selection of asset classes offered. |

What are the advantages of using eToro in New Zealand?

The advantages of using eToro in New Zealand include:

1. Access to a wide range of global markets, including stocks, indices, commodities and currencies.

2. Easy-to-use trading platform with advanced features such as copy trading and CopyPortfolios™ for automated investing.

3. Low fees and competitive spreads on all assets traded through the platform.

4. A safe and secure environment for online trading with regulatory oversight from the Financial Markets Authority (FMA).

5. Professional customer support available 24/7 via phone, email or live chat in multiple languages including English, Spanish and Chinese Mandarin

Are there any restrictions or limitations when trading with eToro in New Zealand?

Yes, there are restrictions and limitations when trading with eToro in New Zealand. These include a maximum leverage of 1:30 on major currency pairs, a minimum deposit of $200 NZD, and the inability to open short positions on certain assets. Additionally, some CFDs may not be available for trading in New Zealand due to local regulations.

How easy is it to open an account and start investing with eToro in New Zealand?

It is very easy to open an account and start investing with eToro in New Zealand. All you need to do is create an account on the eToro website, provide your personal information, deposit funds into your account, and then you can begin trading. You can also use a variety of payment methods such as bank transfer or credit/debit card.

What types of assets can be traded on eToro in New Zealand?

eToro in New Zealand offers trading of a variety of assets, including stocks, ETFs, indices, commodities, cryptocurrencies and currencies.

Does eToro offer any educational resources for investors and traders based in New Zealand?

Yes, eToro offers educational resources for investors and traders based in New Zealand. These include webinars, tutorials, market analysis reports, and a comprehensive online trading academy. Additionally, eToro also provides access to its social trading platform which allows users to connect with other experienced traders from around the world.

Are there any fees associated with using eToro in New Zealand?

Yes, there are fees associated with using eToro in New Zealand. These include spreads (the difference between the buy and sell price of an asset), overnight fees for positions held open after market close, withdrawal fees, and conversion fees when converting currencies.

Is customer support available from within the country for users of the platform who are based in NZ?

Yes, customer support is available from within New Zealand for users of the platform who are based in NZ.

Does the platform provide a mobile app for users located within NZ, and if so, what features does it include?

Yes, the platform does provide a mobile app for users located within New Zealand. The features included in the app are: access to all of the platform’s services, real-time notifications and alerts, ability to manage accounts and payments, and access to customer support.

05.05.2023 @ 13:42

ith a selfie. This is a necessary step to ensure the security of your account and prevent fraud. After completing the verification process, you can then fund your account using a variety of payment methods such as credit/debit cards, bank transfers, or e-wallets. Once your account is funded, you can start exploring the platform’s features and start investing or trading in different markets. Overall, setting up an account on eToro in New Zealand is a simple and straightforward process that can be completed in just a few minutes.