What is eToro?

eToro is an online trading and investment platform that allows users to trade a variety of financial assets, including stocks, commodities, currencies, indices and cryptocurrencies. It also provides users with the ability to copy the trades of other successful traders on its social trading network. eToro has become increasingly popular in Latvia due to its user-friendly interface and range of features designed to help investors make informed decisions when it comes to investing their money. This guide will provide you with all the information you need about eToro in Latvia so that you can start your journey towards successful investing and trading.

Why Invest in Latvia?

Latvia is an attractive destination for investors and traders due to its strong economic growth, low taxes, and access to the European Union. The country has a well-developed financial sector with a range of investment options available. Latvia also offers great opportunities for foreign direct investments (FDI) as it has one of the lowest corporate tax rates in Europe at 15%. Additionally, the country’s political stability and modern infrastructure make it an ideal place to invest. With eToro’s user-friendly platform, investors can easily access stocks, ETFs, commodities, currencies and more from around the world without worrying about exchange rate fluctuations or high transaction costs. Furthermore, eToro provides educational resources such as market analysis tools and tutorials that help users understand how to trade successfully in Latvia. Investing in Latvia through eToro can be beneficial for both novice and experienced traders alike due to its ease of use combined with competitive fees.

How to Get Started with eToro in Latvia

Getting started with eToro in Latvia is easy and straightforward. All you need to do is create an account, deposit funds, and start trading. Here’s a step-by-step guide on how to get started:

-

Create an Account – To open an account with eToro in Latvia, you will need to provide some personal information such as your name, address, phone number, email address and date of birth. You will also be asked to choose a username and password for your account.

-

Deposit Funds – Once your account has been created, you can make deposits using bank transfers or credit/debit cards (Visa or Mastercard). The minimum deposit amount is $200 USD equivalent per transaction (or the equivalent in EUR).

-

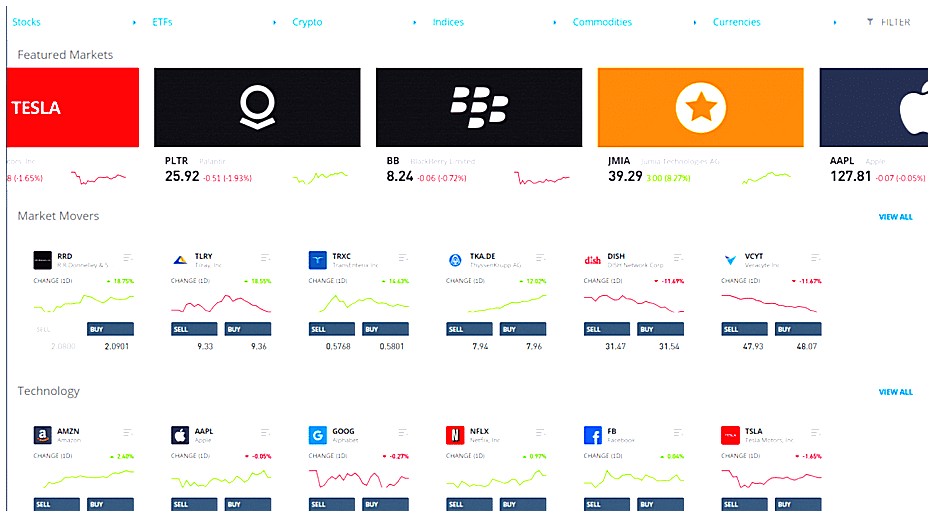

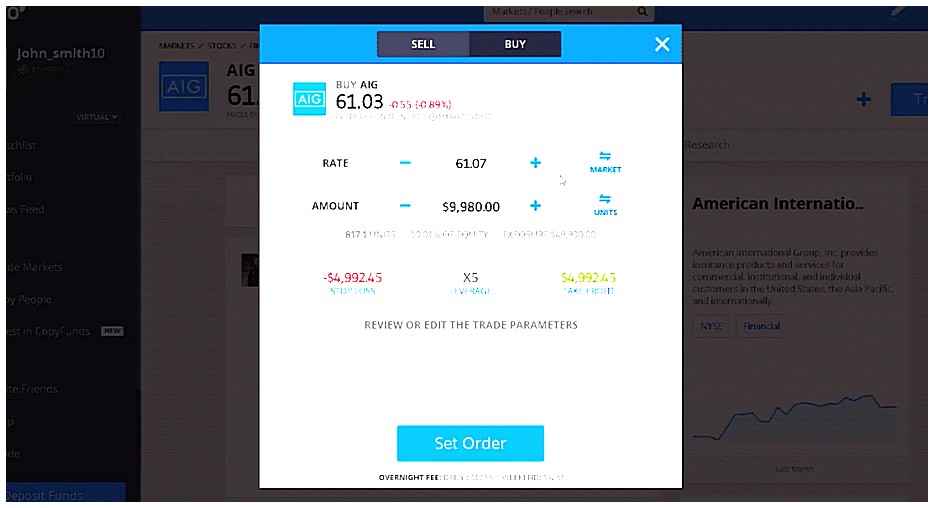

Start Trading – After making a deposit into your eToro wallet, you are ready to start trading! You can access the platform from any device by logging into your eToro profile page or through their mobile app which is available for both iOS and Android devices. On the platform itself there are several tools that allow users to analyse markets including charts and technical indicators which help them make informed decisions when placing trades.

-

Withdraw Funds – When it comes time to withdraw funds from your eToro wallet simply click “Withdraw” on the top right corner of the screen then follow the instructions provided by eToro’s customer service team who will assist with processing withdrawals quickly and securely back into either a bank transfer or credit/debit card depending on what method was used initially for depositing funds into one’s wallet

Understanding the Different Types of Trading on eToro

eToro is a popular online trading platform that allows users to trade stocks, commodities, currencies and other financial instruments. It has become increasingly popular in Latvia due to its ease of use and wide range of investment options. This guide will explore the different types of trading available on eToro and provide tips for successful investing and trading in Latvia.

One of the most attractive features of eToro is its variety of trading options. Traders can choose from traditional stock market investments such as buying shares or ETFs (Exchange Traded Funds), or they can opt for more exotic investments such as cryptocurrencies, CFDs (Contracts For Difference) or even copy-trading strategies. Each type offers unique advantages depending on your goals and risk tolerance level.

Traditional stock market investments are probably the most familiar form of investing on eToro. By purchasing shares or ETFs you are essentially buying into a company’s future performance which could result in significant returns over time if done correctly. You should research each company thoroughly before making any decisions as there are no guarantees with this type of investment strategy.

CFDs offer an alternative way to invest without actually owning any underlying assets like stocks or commodities directly; instead you enter into a contract with another party who agrees to pay out based on changes in the price movements between two points in time – usually within minutes or hours rather than days/weeks/months like traditional stock markets do . CFD traders need to be aware that these contracts come with additional risks including leverage which means your losses can exceed your initial deposit if not managed properly so it’s important to understand how these work before getting involved .

Cryptocurrencies have become increasingly popular over recent years thanks largely due their potential for high returns but also because they allow investors access to decentralized digital currencies outside government control – something that was previously impossible until recently . Trading cryptocurrencies involves speculating on their value against other fiat currencies , meaning profits can be made when prices go up but also losses incurred when prices fall too far below what was initially invested . As always it’s important not take unnecessary risks when dealing with volatile assets like crypto so make sure you understand all aspects before entering into any trades here !

Finally, Copy-Trading is one way people new to investing can get started quickly by copying experienced traders who have already achieved success through their own strategies – allowing them access knowledge & expertise without having had prior experience themselves! This option does require some trust however as users must select someone else’s portfolio & strategy blindly so caution should still be taken here too!

In conclusion, eToro provides Latvian investors with a wealth of opportunities across various asset classes including stocks, commodities, currencies and more – all accessible via an easy-to-use interface at competitive rates compared elsewhere! Understanding the different types available is key though; whether it’s traditional stock market investments , CFDs , cryptos or copy-trading – ensure you know exactly what you’re getting yourself into first then start exploring today !

Tips for Successful Investing and Trading on eToro in Latvia

1. Research the markets: Before investing or trading on eToro in Latvia, it is important to research the market and understand what you are getting into. Make sure to read up on the different asset classes available and their associated risks before making any decisions.

-

Set realistic goals: When investing or trading with eToro in Latvia, make sure to set realistic goals for yourself that are achievable within your risk tolerance level. This will help ensure that you don’t overextend yourself financially and can stay focused on achieving success over time.

-

Diversify your portfolio: It is important to diversify your investments when using eToro in Latvia so as not to put all of your eggs in one basket and increase your chances of success over time by reducing risk exposure across multiple asset classes such as stocks, bonds, commodities, currencies etc..

-

Utilize copy-trading features: One great feature offered by eToro is its copy-trading functionality which allows users to follow successful traders and replicate their trades automatically without having to do any manual work themselves – this can be a great way for beginners who may not have much experience with trading yet but still want to get involved with minimal effort required from them!

-

Monitor performance regularly: Finally, it is important that investors monitor their portfolios regularly so they can identify potential opportunities or take action if needed (e.g., adjusting stop losses). This will help ensure that you remain up-to-date with market movements and make informed decisions about when/where/how much money should be invested or traded at any given moment

Leveraging Social Trading Tools on eToro

eToro is one of the most popular online trading platforms in Latvia, and it offers a variety of features that make investing and trading easier. One such feature is its social trading tools, which allow users to copy successful traders’ strategies and benefit from their knowledge. In this article, we will explore how you can leverage these social trading tools on eToro to maximize your chances for success when investing or trading in Latvia. We will discuss topics such as finding the right traders to follow, setting up automated trades with CopyTrader™, and more. By the end of this guide, you should have a better understanding of how to use eToro’s social trading tools to become a successful investor or trader in Latvia.

Making the Most of CopyTrading Features on eToro

CopyTrading is one of the most popular features on eToro, and it’s easy to see why. With CopyTrading, you can copy the trades of experienced traders in real-time and benefit from their expertise without having to do any research or analysis yourself. This makes investing with eToro a great option for those who are new to trading or don’t have the time or resources to do extensive research. In this article, we’ll explore how you can make the most out of CopyTrading features on eToro in Latvia so that you can start investing successfully.

First off, it’s important to understand what CopyTrading actually is and how it works. Essentially, when you use CopyTrading on eToro, you’re able to automatically copy the trades of other investors who have proven track records of success in their own investments. You’ll be able to choose which traders’ portfolios you want to follow based on criteria such as risk tolerance level and past performance history. Once your portfolio has been set up according to your preferences, all future trades made by these selected traders will be copied into your account automatically at no extra cost – meaning that even if they lose money due to market volatility or poor decisions, yours won’t suffer as a result!

Another great feature offered by eToro is its social trading platform where users can interact with each other through forums and chat rooms dedicated specifically for discussing investment strategies and ideas related topics like stocks and cryptocurrencies. This allows novice investors access valuable insights from more experienced ones while also providing an opportunity for them network with others who share similar interests – making it easier than ever before for anyone interested in learning about financial markets!

Finally, there are plenty of tools available within eToro’s platform that allow users customize their experience even further; from setting stop losses limits (which help minimize potential losses) monitoring individual asset prices over time via charts & graphs etc., these features make sure everyone has access necessary information needed make informed decisions about their investments quickly easily!

Overall then there’s no doubt that using Copy Trading features provided by etoro gives Latvian investors access some powerful tools which could potentially lead profitable returns long term – but remember always keep an eye out risks associated any type investment activity too!

The Benefits of Using an Automated Portfolio Builder Tool on eToro

eToro is an online trading platform that has become increasingly popular in Latvia due to its user-friendly interface and automated portfolio builder tool. This tool allows users to quickly create a diversified portfolio of stocks, ETFs, commodities, and cryptocurrencies without having to manually research each asset. In this article, we will explore the benefits of using eToro’s automated portfolio builder tool in Latvia.

One of the primary advantages of using an automated portfolio builder on eToro is that it eliminates the need for manual research into individual assets. Instead, users can simply select their desired risk profile and let the algorithm do all the work for them. The algorithm takes into account various factors such as market volatility and correlations between different assets when constructing a well-balanced portfolio tailored to each investor’s needs. This makes investing much easier and less time consuming than traditional methods which require extensive research before making any decisions about what assets to invest in.

Another benefit of using an automated portfolio builder on eToro is that it helps investors manage their risk more effectively by automatically rebalancing portfolios according to changes in market conditions or personal preferences over time. By doing so, investors are able to maintain a consistent level of risk while still taking advantage of potential opportunities as they arise without having to constantly monitor their investments themselves.

Finally, with an automated portfolio builder on eToro you have access to expert advice from experienced traders who understand how markets move and can provide valuable insights into current trends or potential risks associated with certain investments at any given moment. This type of guidance can be invaluable for novice investors looking for assistance when making important investment decisions but don’t yet have enough experience themselves yet..

In conclusion, there are many benefits associated with using an automated portfolio builder tool on eToro in Latvia including eliminating manual research requirements; managing risk more effectively; and gaining access expert advice from experienced traders whenever needed

Learning from Professional Traders Through CopyPortfolios Feature

eToro is a popular online trading platform that offers users the opportunity to trade in a variety of markets, including stocks, commodities, currencies and indices. One of the unique features of eToro is its CopyPortfolios feature which allows users to learn from professional traders by copying their trades. This can be an invaluable tool for those looking to get started with investing or trading successfully in Latvia. By following experienced traders who have already achieved success in the markets, users can gain valuable insights into how they should approach their own investments and strategies. With CopyPortfolios, users can also track the performance of these traders over time so they can make informed decisions about whether or not to continue following them. Additionally, eToro provides educational resources such as webinars and tutorials that are designed to help new investors become more familiar with the platform’s features and develop successful trading strategies. With all these tools at your disposal, you will be well on your way towards achieving success when it comes to investing or trading on eToro in Latvia!

Key Considerations When Choosing a Brokerage Platform

1. Fees: Make sure to research the fees associated with using eToro in Latvia, including trading commissions and account maintenance fees.

-

Investment Options: Consider what types of investments are available on eToro in Latvia, such as stocks, ETFs, mutual funds, commodities and more.

-

Platform Features: Evaluate the features offered by eToro in Latvia such as charting tools, technical analysis indicators and other advanced features that can help you make informed decisions when investing or trading online.

-

Research Tools: Ensure that the platform offers comprehensive research tools so you can stay up-to-date on market trends and analyze potential investments before making a decision to buy or sell securities.

-

Customer Service & Support: Look for a brokerage platform that provides excellent customer service and support so you can get assistance quickly if needed while trading or investing online with eToro in Latvia

| eToro in Latvia | Other Trading Platforms |

|---|---|

| Low Fees | Higher Fees |

| Easy to Use | More Complex |

| Variety of Assets Available | Limited Asset Selection |

What is the minimum amount of money needed to start investing in eToro?

The minimum amount of money needed to start investing in eToro is $200.

How can I use eToro to trade stocks and other financial instruments?

eToro is an online trading platform that allows users to trade stocks, currencies, commodities, indices and other financial instruments. To use eToro for stock trading, you need to open a free account on the website. Once your account is set up, you can search for the stocks or other financial instruments you want to invest in and place buy or sell orders with just a few clicks. You can also monitor the performance of your investments through eToro’s user-friendly charts and graphs. Additionally, eToro offers copy trading which allows traders to automatically copy successful strategies from experienced investors on the platform.

Are there any fees associated with using eToro in Latvia?

Yes, there are fees associated with using eToro in Latvia. These include spreads, overnight fees, and withdrawal fees.

What types of investments are available on eToro for Latvian traders?

Latvian traders on eToro can invest in a variety of assets, including stocks, ETFs, commodities, indices, cryptocurrencies and more. They also have access to copy trading and social trading features.

Is it possible to withdraw funds from my account quickly and securely through eToro?

Yes, it is possible to withdraw funds from your account quickly and securely through eToro. The withdrawal process is simple and straightforward, allowing you to transfer money directly into your bank account or other payment methods in a matter of minutes. All withdrawals are also protected by the latest security measures, ensuring that your funds remain safe at all times.

Does eToro offer customer support services for Latvian users?

Yes, eToro offers customer support services for Latvian users. The company has a dedicated customer service team that can be contacted via email or live chat in both English and Latvian.

Are there any risks involved when trading on the platform in Latvia?

Yes, there are risks involved when trading on any platform in Latvia. These include the risk of financial loss due to market volatility, liquidity risk, counterparty risk, and operational risk. Additionally, traders should be aware of the legal and regulatory environment in which they are operating as well as any potential restrictions or limitations that may apply to their activities.

Are there any restrictions or limitations that apply specifically to Latvian traders on the platform?

Yes, there are restrictions and limitations that apply specifically to Latvian traders on the platform. These include limits on leverage, minimum deposit amounts, trading hours, and more. Additionally, some products may not be available to Latvian traders due to local regulations or other reasons.

05.05.2023 @ 13:46

Russian:

eToro – это онлайн-платформа для торговли и инвестирования, которая позволяет пользователям торговать различными финансовыми активами, включая акции, товары, валюты, индексы и криптовалюты. Она также предоставляет пользователям возможность копировать сделки других успешных трейдеров на своей социальной торговой сети. eToro стала все более популярной в Латвии благодаря своему удобному интерфейсу и набору функций, предназначенных для помощи инвесторам в принятии обоснованных решений при инвестировании своих денег. Это руководство предоставит вам всю необходимую информацию о eToro в Латвии, чтобы вы могли начать свой путь к успешному инвестированию и торговле.

Инвестирование в Латвию является привлекательным направлением для инвесторов и трейдеров благодаря ее сильному экономическому росту, низким налогам и доступу к Европейскому союзу. В стране развита финансовая сфера с широким спектром инвестиционных возможностей. Латвия также предлагает отличные возможности для прямых иностранных инвестиций (ПИИ), так как у нее одна из самых низких ставок налога на прибыль корпораций в Европе – 15%. Кроме того, политическая стаб