What is eToro?

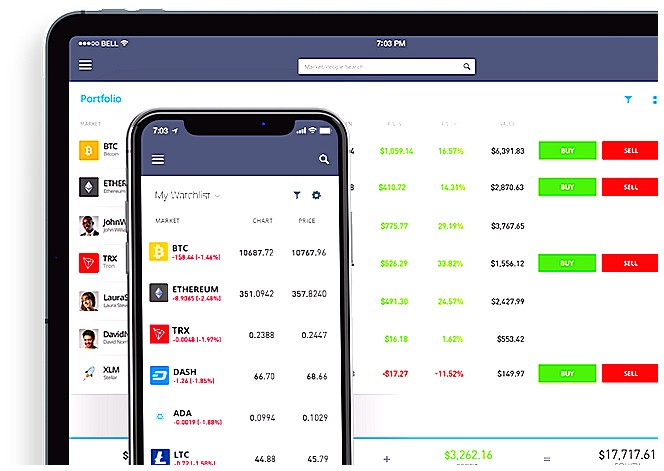

eToro is an online trading and investing platform that allows users to trade a variety of financial assets, including stocks, commodities, currencies, indices and cryptocurrencies. It also provides users with access to copy trading features which allow them to follow the trades of experienced traders on the platform. eToro has become increasingly popular in Kenya due to its user-friendly interface and low fees for transactions. This guide will explore how Kenyans can use eToro to invest or trade various assets.

Advantages of Trading on eToro in Kenya

1. Low Fees: eToro offers some of the lowest fees in Kenya, making it an attractive option for investors and traders looking to maximize their profits.

-

Variety of Assets: With over 1,700 different assets available on eToro, Kenyan traders have access to a wide range of stocks, currencies, commodities and more – allowing them to diversify their portfolios with ease.

-

Easy Accessibility: Trading on eToro is incredibly easy due to its user-friendly platform which can be accessed from any device with an internet connection. This makes trading convenient and hassle-free for all users regardless of location or experience level.

-

CopyTrading Feature: The CopyTrading feature allows Kenyan traders to copy the trades made by experienced investors who are already successful in the market – helping newbies learn how the markets work without having to risk too much capital at once.

-

Social Trading Platforms: By connecting with other traders through social media platforms such as Twitter and Facebook, Kenyan traders can get advice from experienced professionals while also learning about upcoming trends in the markets before they happen – giving them a competitive edge when it comes time to trade or invest

Getting Started with eToro in Kenya

Are you looking to get started with eToro in Kenya? With its easy-to-use platform and access to global markets, eToro is a great choice for those interested in investing and trading. In this guide, we’ll explore the basics of using eToro in Kenya, from setting up an account to making your first trade. We’ll also discuss some of the features that make it a great option for Kenyan investors. So let’s dive right into exploring eToro in Kenya!

Opening an Account and Verifying Your Identity

eToro is a popular online trading platform that allows users to invest and trade in stocks, currencies, commodities, and more. If you’re looking to get started with eToro in Kenya, the first step is opening an account. Opening an account on eToro requires verifying your identity so that you can be sure your funds are secure. This article will explain how to open an account and verify your identity on eToro in Kenya.

The first step to opening an account on eToro is registering for one by providing basic information such as name, email address, phone number etc. Once registered, you will need to provide additional information about yourself such as date of birth and proof of residence before being able to access the full range of features available on the platform.

Once this initial registration process has been completed successfully, it’s time to verify your identity with eToro. To do this you’ll need two forms of identification: a valid government-issued ID (such as a passport or national ID card) and proof of residence (such as a utility bill). You’ll also need to upload these documents directly onto the website or app so they can be verified by their team quickly and securely.

Once all documents have been uploaded successfully and approved by their team then you’ll be ready start investing or trading through eToro! With these steps complete now it’s time for you take advantage of everything that this great platform has offer!

Understanding the Different Types of Assets Available to Trade on eToro in Kenya

eToro is a popular online trading platform that has recently become available in Kenya. With eToro, you can invest and trade in a variety of assets, including stocks, currencies, commodities, indices and cryptocurrencies. In this article we will explore the different types of assets available to trade on eToro in Kenya.

Stocks: Stocks are shares of ownership in publicly traded companies listed on stock exchanges such as the Nairobi Securities Exchange (NSE). When you buy stocks through eToro, you are buying actual shares from these companies and not just derivatives or contracts for difference (CFDs). This means that when the company does well your investment will also increase in value.

Currencies: Currencies are another asset class that can be traded on eToro. You can buy and sell foreign currencies against each other with leverage up to 30x your capital amount. This allows traders to take advantage of even small movements in exchange rates between two countries’ currencies by investing more than they have available upfront.

Commodities: Commodities include agricultural products such as coffee beans or sugar cane; energy sources like oil or natural gas; metals like gold or silver; and soft commodities like cocoa beans or cotton. On eToro you can invest directly into these markets without having to physically purchase them yourself – instead you use CFDs which allow you to speculate on price movements without actually owning any physical commodity at all!

Indices: Indices represent an average performance of multiple underlying securities within one market sector such as banking stocks, tech stocks etc., so they provide investors with exposure to entire sectors rather than individual companies alone. Trading indices gives investors access to larger markets which may otherwise be difficult for individuals to access due their size/costs associated with investing directly into them individually themselves.

Cryptocurrencies: Cryptocurrencies are digital coins created using blockchain technology which offer users anonymity when making transactions online – meaning no personal information is shared between parties involved! They have become increasingly popular over recent years due their potential for high returns but also come with higher levels of risk compared traditional investments such as stocks & bonds etc.. On eToro it is possible to buy & sell various cryptocurrencies including Bitcoin (BTC), Ethereum (ETH) & Litecoin (LTC).

In conclusion, there are many different types of assets available for trading on eToro in Kenya ranging from traditional investments such as stocks & bonds through alternative options like commodities & cryptos too! It’s important however before deciding what type(s) best suit your needs/goals that research is done first into each asset class so an informed decision can be made about where best place your money should go towards achieving desired outcomes successfully over time!

How to Fund Your Account and Start Investing/Trading on eToro in Kenya

eToro is a popular online trading platform that allows users to invest and trade in stocks, currencies, commodities, and other financial instruments. For those looking to explore eToro in Kenya, this guide will provide you with all the information you need to get started.

Funding Your Account:

Before you can start investing or trading on eToro in Kenya, you must first fund your account. This can be done by linking your bank account or credit/debit card directly to your eToro wallet. Alternatively, you can also use PayPal or Skrill as payment methods for funding your account. Once the funds have been successfully transferred into your wallet, they will appear as available balance for trading purposes on the platform.

Start Investing/Trading:

Once you’ve funded your account and are ready to start investing or trading on eToro in Kenya, there are several different options available depending on what type of asset class interests you most – such as stocks (including ETFs), cryptocurrencies (such as Bitcoin), commodities (like gold and oil) or forex pairs (like EUR/USD). You can then decide whether to buy assets outright or open a leveraged position using CFDs (Contracts for Difference). When opening a leveraged position with CFDs it is important to remember that losses may exceed deposits so please make sure that any trades taken are within acceptable risk levels for yourself.

Finally when making investments it is always wise practice to diversify across multiple asset classes and markets; this helps reduce overall portfolio risk while still allowing investors the opportunity of generating returns from their investments over time.

Strategies for Successful Investing/Trading on eToro in Kenya

1. Start Small: When starting out on eToro, it is important to start small and build up your portfolio gradually. This will help you get used to the platform and learn how to make successful trades without risking too much of your capital.

-

Diversify Your Portfolio: To reduce risk, it is important to diversify your investments across different asset classes such as stocks, commodities, currencies and indices. By spreading out your investments across multiple assets, you can reduce the impact of any losses from one particular investment or sector.

-

Research & Monitor Markets: Before investing in any asset class on eToro, it is essential that you do thorough research into the markets so that you understand what factors could affect its performance over time. Additionally, monitoring markets regularly can help ensure that you are aware of any changes which may influence your decision making when trading or investing on eToro in Kenya.

-

Utilize Leverage Wisely: Leverage allows traders to open larger positions than they would otherwise be able to with their own capital alone; however this also increases risk levels significantly if not managed properly so use leverage wisely when trading on eToro in Kenya!

-

Manage Risk Levels Appropriately: As with all types of trading and investing activities there are risks involved; therefore it is essential that these risks are managed appropriately by setting stop-loss orders or using other strategies such as hedging or diversification where appropriate for each individual trade/investment position taken on eToro in Kenya

Risks Involved with Trading/Investing on eToro in Kenya

eToro is a popular trading and investing platform in Kenya, offering users the opportunity to buy and sell stocks, commodities, currencies, indices and more. While eToro can be an excellent way to make money online, there are some risks involved with trading or investing on this platform.

-

Market Volatility: As with any type of investment or trading activity, market volatility can have a significant impact on your returns. Prices for assets may rise or fall quickly due to changing economic conditions or news events. This means that you could potentially lose money if you don’t pay close attention to the markets and react accordingly when needed.

-

Leverage Risk: eToro allows traders to use leverage when buying certain assets such as stocks and cryptocurrencies. Leverage magnifies both gains and losses which means that even small changes in price can lead to large profits or losses depending on how much leverage has been used by the trader. It is important for traders using leverage to understand the risks associated with it before they start trading so they can manage their risk appropriately while still taking advantage of potential opportunities in the markets.

-

Counterparty Risk: When using eToro you are entering into agreements with other parties (such as brokers) who provide services related to your trades/investments such as executing orders etc.. If these third-parties fail then it could result in delays in order execution or even loss of funds so it is important for investors/traders using eToro to do their due diligence before entering into any agreement with them so they know what kind of counterparty risk they are exposed too should something go wrong during their trade/investment process .

4 Regulatory Risks: Depending on where you live different regulations may apply when trading/investing through eToro which could limit your ability to access certain products offered by them such as cryptocurrency CFDs etc.. It is therefore important for users of this platform familiarize themselves with local laws regarding investments prior starting out on this platform so that they don’t run afoul of any regulations which could lead them into trouble down the line .

Tips for Beginners When Using the Platform

1. Start small and practice with a demo account before investing real money.

2. Familiarize yourself with the platform’s features, such as copy trading, social trading, and automated portfolio management tools.

3. Understand the different types of assets available to trade on eToro in Kenya (e.g., stocks, commodities, cryptocurrencies).

4. Research each asset you plan to invest in thoroughly before making any trades or investments.

5. Utilize risk management strategies like setting stop-loss orders and diversifying your portfolio across multiple assets classes for maximum protection against market volatility and losses from individual positions that may not perform as expected over time .

6. Monitor your investments regularly to ensure they are performing as expected and adjust accordingly if needed .

FAQs About Investing/Trading With eToro In Kenya

FAQs About Investing/Trading With eToro In Kenya

Q: Is it legal to invest and trade with eToro in Kenya?

A: Yes, it is legal to invest and trade with eToro in Kenya. The Central Bank of Kenya (CBK) has approved the use of digital assets for trading purposes. As such, investors can now buy and sell cryptocurrencies on eToro’s platform as long as they comply with local regulations.

Q: What are the fees associated with investing/trading on eToro?

A: The fees associated with investing/trading on eToro depend on the type of asset being traded or invested in. For example, there may be different spreads for stocks compared to cryptoassets. Additionally, there may also be other fees such as overnight financing charges or withdrawal fees depending on your account type. It is important to check the specific terms and conditions before making any trades or investments so that you understand all applicable costs beforehand.

Q: How do I open an account at eToro?

A: Opening an account at eToro is easy! All you need to do is go online and fill out a short registration form which will require some basic personal information like name, address etc., along with proof of identity documents such as a passport or national ID card. Once this process is complete, you will have access to start trading right away!

Q: Are there any risks involved when investing/trading through etoro?

A: Yes – just like any other investment opportunity, there are always risks involved when trading through etoro – especially if dealing in more volatile markets like cryptocurrency markets where prices can change quickly over time due to market volatility or news events affecting certain coins’ values negatively or positively respectively.. That said however; by using risk management tools available within etoro’s platform one can limit their exposure while still taking advantage of potential opportunities presented by these markets

| eToro vs. Other Investment Platforms |

|---|

| Feature |

| ———————————- |

| Cost of Trading |

| Types of Assets Available |

| Leverage |

What is the minimum amount of money required to start investing and trading on eToro in Kenya?

The minimum amount of money required to start investing and trading on eToro in Kenya is $200.

How does one open an account with eToro in Kenya?

To open an account with eToro in Kenya, you will need to visit the official website and register for a free account. Once registered, you can then log into your account and follow the instructions to complete the sign-up process. You may be required to provide additional documents such as proof of identity and address before being able to deposit funds into your eToro trading account.

Are there any fees associated with using eToro in Kenya?

Yes, there are fees associated with using eToro in Kenya. These include spreads, overnight financing charges and withdrawal fees. The exact amount of these fees depends on the type of account you have and the assets you are trading.

Is it possible to trade stocks, bonds, commodities or currencies through eToro in Kenya?

No, it is not possible to trade stocks, bonds, commodities or currencies through eToro in Kenya. eToro does not currently offer services in Kenya.

What type of support services are available for investors and traders using eToro in Kenya?

eToro provides customer support services for investors and traders in Kenya through their online platform. These services include live chat, email support, telephone support, and a dedicated team of customer service representatives available to answer any questions or concerns related to trading on the eToro platform. Additionally, eToro also offers educational resources such as webinars and tutorials that provide insight into the different aspects of investing and trading with eToro.

Does the platform offer any tools or resources that can help investors make informed decisions when trading on eToro in Kenya?

Yes, eToro offers a variety of tools and resources to help investors make informed decisions when trading on the platform in Kenya. These include market analysis tools such as charts and technical indicators, news feeds from financial publications, educational materials for new traders, and access to customer support. Additionally, eToro also provides an online community where users can discuss their trades with other experienced traders.

Are there any restrictions placed on investments made through the platform within Kenyan markets?

Yes, there are restrictions placed on investments made through the platform within Kenyan markets. These restrictions include limits on the amount of money that can be invested in certain securities and limits on the types of investments that can be made. Additionally, some exchanges may require investors to meet certain qualifications before they are allowed to invest.

What security measures are taken by eToro to protect investor funds while trading within Kenyan markets?

eToro takes a number of security measures to protect investor funds while trading within Kenyan markets. These include two-factor authentication, which requires users to enter both their username and password as well as an additional code sent via SMS or email before being able to access their account; secure encryption technology that encrypts all data transmissions between eToro and its servers; segregated accounts for each customer’s funds, ensuring that no other user can access them; and anti-money laundering (AML) checks on all transactions. Additionally, eToro is regulated by the Capital Markets Authority in Kenya, meaning it has been approved by the regulator to operate in the country.

05.05.2023 @ 13:43

in Kenya, offering a wide range of financial assets for investors and traders to trade. With over 1,700 different assets available on eToro, Kenyan traders have access to a variety of stocks, currencies, commodities, indices, and cryptocurrencies. This diversity of assets allows traders to diversify their portfolios with ease, reducing their risk exposure and increasing their chances of success. Additionally, eToro offers some of the lowest fees in Kenya, making it an attractive option for investors and traders looking to maximize their profits. The platforms user-friendly interface and easy accessibility from any device with an internet connection also make trading convenient and hassle-free for all users regardless of location or experience level. Furthermore, the CopyTrading feature allows Kenyan traders to follow the trades of experienced investors, helping newbies learn how the markets work without having to risk too much capital at once. By connecting with other traders through social media platforms such as Twitter and Facebook, Kenyan traders can also get advice from experienced professionals while also learning about upcoming trends in the markets before they happen. Overall, eToro is a great choice for those interested in investing and trading in Kenya, offering a range of features and benefits that can help traders achieve their financial goals.