Introduction to eToro in Greece

Greece is a country with a long and rich history of trading and investing. With the advent of digital technology, online trading platforms such as eToro have become increasingly popular in Greece. This article provides an introduction to eToro in Greece, including its features, advantages, and how to get started with investing or trading on the platform. We will also discuss some tips for successful investing and trading on eToro in Greece. Finally, we will provide an overview of some of the most popular assets available on eToro for Greek investors.

Benefits of Investing and Trading with eToro

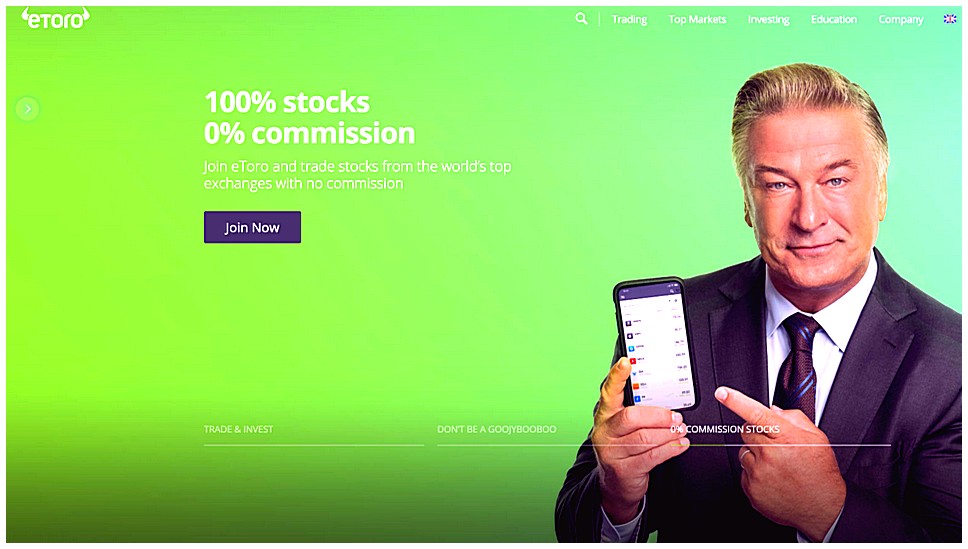

eToro is a popular online trading platform that has become increasingly popular in Greece. With eToro, users can invest and trade in stocks, currencies, commodities, indices and more. This guide will explore the benefits of investing and trading with eToro in Greece.

One of the main advantages of using eToro for investments and trades is its user-friendly interface. The platform provides an intuitive experience to traders regardless of their level of expertise or familiarity with financial markets. Additionally, it offers a range of features such as copy trading which allows users to automatically copy successful traders’ strategies without having to do any manual research or analysis themselves.

Another benefit associated with investing and trading on eToro is its low fees structure compared to other platforms available in Greece. It also offers competitive spreads on assets traded through the platform which helps reduce costs for investors who are looking to make profits from their trades over time rather than short-term gains only. Furthermore, there are no commissions charged when making deposits or withdrawals from your account so you don’t have to worry about additional charges eating into your profits.

In addition to these cost savings benefits, eToro also provides access to a wide range of markets including Forex pairs as well as cryptocurrencies like Bitcoin (BTC) and Ethereum (ETH). This gives traders plenty of options when deciding what type of asset they want to invest or trade in depending on their risk appetite and investment goals at any given time.

Finally, another advantage offered by eToro is its customer support team which can be contacted via email or live chat if you ever need help understanding how the platform works or resolving technical issues related to your account setup process etc.. They provide prompt responses ensuring that all queries are addressed quickly allowing you get back up running again quickly so you don’t miss out on potential opportunities due delays caused by technical problems etc..

Overall, investing and trading with eToro comes with many advantages for Greek investors looking for an easy way into financial markets without having incur high costs associated with traditional brokers services etc.. From its user friendly interface through low fees structure right down customer support service – it’s clear why this online broker has become one most popular choices amongst those seeking take advantage market movements while minimizing risks involved along way!

How to Open an Account on eToro

Opening an account on eToro is a simple process. All you need to do is visit the website and click “Sign Up” at the top right of the page. You will then be asked to provide some basic information such as your name, email address, and country of residence. Once you have completed this step, you will be taken to a page where you can select your preferred payment method (e.g., credit card or bank transfer). After completing this step, you will receive an email with instructions on how to complete your registration and activate your account.

Once your account has been activated, it’s time to start investing! To begin trading on eToro in Greece, simply go to the "Markets" tab located at the top of the screen and select which assets you would like to trade (e.g., stocks or currencies). From there, just follow the prompts provided by eToro’s user-friendly platform in order to place trades and manage your portfolio accordingly.

Understanding the Different Types of Assets Available on eToro

When it comes to investing and trading in Greece, eToro is one of the most popular platforms. With its user-friendly interface and wide range of assets available, eToro makes it easy for traders to get started. But before you start trading on eToro, it’s important to understand the different types of assets that are available. In this article, we will explore the various asset classes that can be traded on eToro in Greece.

Stocks: Stocks are shares of ownership in a company and can be bought or sold through an exchange like the Athens Stock Exchange (ASE). On eToro, investors can buy stocks from major companies such as National Bank of Greece (NBG), Hellenic Telecommunications Organization (OTE) and Public Power Corporation (PPC). Investors should note that stock prices may fluctuate significantly depending on market conditions so they should do their research before investing.

Commodities: Commodities are physical goods such as oil, gold or wheat which can be traded on exchanges like the London Metal Exchange or Chicago Mercantile Exchange. On eToro, investors have access to commodities such as crude oil futures contracts and precious metals including gold and silver spot prices. As with stocks, commodity prices may also fluctuate significantly due to market conditions so investors should take caution when making investments in these markets.

Cryptocurrencies: Cryptocurrencies are digital currencies created using blockchain technology which allow users to securely transfer funds without relying on banks or other third parties for verification purposes. Popular cryptocurrencies include Bitcoin (BTC), Ethereum (ETH) and Litecoin (LTC). On eToro, users have access to over 15 different cryptocurrencies including Ripple XRP/USD pairings which offer low spreads compared with other cryptocurrency exchanges making them attractive options for traders looking for fast trades at competitive rates .

ETFs: ETFs are baskets of securities representing a variety of asset classes including stocks bonds commodities real estate etc.. They provide diversification benefits by allowing investors exposure across multiple sectors while reducing risk associated with single stock holdings . On etoro there is a selection of ETFs from leading providers covering global equity indices US tech sector Japanese small caps emerging markets etc… These instruments provide an ideal way for novice traders who want broad portfolio exposure but don’t have time resources knowledge required manage individual positions .

CFDs : CFDs Contracts For Difference allow traders speculate price movements underlying financial instrument without actually owning said instrument itself … This means trader able take long short positions based speculation future direction market .. example if believe certain currency pair rise value then open long position benefit rising values conversely open short position benefit falling values .. EToro offers extensive selection CFD products ranging forex pairs indices commodities energy sources even cryptoassets ….

By understanding each type of asset class available on etoro Greek traders can make informed decisions about how best allocate capital maximize returns minimize risks … It’s always recommended consult financial advisor ensure investment strategy appropriate individual circumstances ….

Exploring Popular Investment Strategies for Greek Investors

The world of investing and trading can be intimidating for those who are new to the market. For Greek investors, eToro provides a platform that is user-friendly and offers an array of popular investment strategies. In this article, we will explore some of the most popular investment strategies available on eToro in Greece and how they can help you make informed decisions when it comes to your investments. We will also discuss the benefits of using eToro as a broker in Greece, including its low fees and wide selection of assets. Finally, we’ll look at how to get started with eToro so you can begin building your portfolio today!

Leveraging Social Trading Tools on eToro

Greece is a great place to invest and trade, and eToro offers an excellent platform for doing so. One of the most exciting features of eToro is its social trading tools, which allow users to follow experienced traders and copy their trades automatically. This can be a great way for novice investors in Greece to get started with investing without having to learn all the ins-and-outs themselves. In this article, we’ll explore how you can leverage these social trading tools on eToro when investing or trading in Greece.

Diversifying Your Portfolio with CopyPortfolios™

Greece is home to one of the world’s most vibrant and active financial markets. With its strong economy, well-developed infrastructure, and growing investor base, Greece offers a great opportunity for investors looking to diversify their portfolios. eToro has become an increasingly popular platform for investing in Greek stocks and other assets due to its user-friendly interface and low fees. But what many people don’t know is that eToro also offers CopyPortfolios™ – a unique way of diversifying your portfolio with pre-built portfolios based on different strategies or themes. In this article we’ll explore how you can use CopyPortfolios™ to diversify your investments in Greece through eToro. We’ll look at the different types of CopyPortfolios™ available, as well as some tips on choosing the right one for you. Finally, we’ll discuss some key considerations when trading with eToro in Greece so that you can make informed decisions about your investments.

Managing Risk Through Automated Stop Losses and Take Profits

eToro is a popular online trading platform that allows users to invest and trade in the financial markets. For those looking to get started with eToro in Greece, it is important to understand how risk can be managed through automated stop losses and take profits. Stop losses are designed to limit potential losses on a position by automatically closing out the position when it reaches a certain level of loss. Take profits, on the other hand, allow traders to set predetermined levels at which they will exit their positions if they reach or exceed these levels. By using both stop losses and take profits together, investors can better manage their risk while still taking advantage of potentially profitable trades. In this article we will explore how eToro’s automated stop loss and take profit features work in Greece as well as some tips for managing risk through these tools.

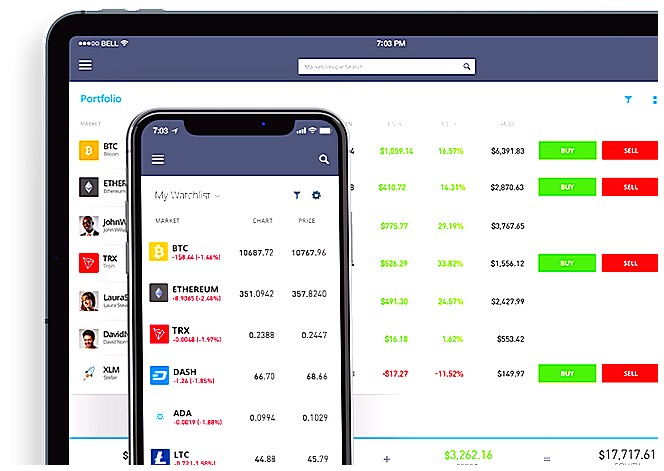

Utilizing the Mobile App for On-the-Go Trading & Investing

Greece is a great place to invest and trade, and eToro makes it even easier with their mobile app. With the eToro app, you can take your investments on-the-go and make trades anytime, anywhere. Utilizing the mobile app for on-the-go trading & investing allows users to access their accounts from any device with an internet connection, giving them more flexibility in managing their portfolio. The user interface of the app is designed to be intuitive and easy to use so that anyone can get started quickly. Additionally, there are plenty of educational resources available within the platform which provide useful information about different types of investments as well as tips for successful trading strategies. With all these features combined, eToro provides an excellent way for investors in Greece to manage their portfolios efficiently while still having full control over their finances.

Staying Up To Date With Market News & Analysis

Investing and trading in the financial markets can be a daunting task, especially for those who are new to the world of finance. To make informed decisions when investing or trading, it is important to stay up-to-date with market news and analysis. eToro provides its users with access to real-time news feeds from trusted sources, as well as comprehensive research reports on stocks, indices, commodities and more. This allows traders in Greece to remain informed about what’s happening in the markets so they can make educated decisions when buying or selling assets. Additionally, eToro offers a range of educational resources that provide insight into how different types of investments work and strategies for successful trading. By taking advantage of these resources, investors in Greece can gain an understanding of the risks associated with different asset classes before making any trades.

| eToro | Other Brokers |

|---|---|

| 0% commission on stocks and ETFs | Varying commissions depending on broker |

| Low spreads for currency pairs and commodities trading | Higher spreads than eToro for currency pairs and commodities trading |

| Social Trading platform to copy other traders’ strategies, or get copied yourself to earn extra income. | No social trading platform available. Limited options for copying other traders’ strategies. |

| User-friendly interface with intuitive charts and analysis tools. | Less user-friendly interfaces with limited charting features. Analysis tools may be difficult to use or unavailable altogether. |

What types of investments and trading are available on eToro in Greece?

On eToro in Greece, traders can invest in a variety of assets including stocks, ETFs, cryptocurrencies, commodities and indices. Additionally, traders can access copy trading services which allow them to automatically replicate the trades of other successful investors on the platform.

Are there any fees associated with using eToro in Greece?

Yes, there are fees associated with using eToro in Greece. These include a spread fee of 0.75% on all trades, as well as overnight and weekend fees for positions held open for more than 24 hours or over the weekend. There may also be additional fees depending on the payment method used to fund your account.

How does the Greek government regulate investing and trading through eToro?

The Greek government regulates investing and trading through eToro by requiring all investors to obtain a license from the Hellenic Capital Market Commission (HCMC). The HCMC also requires that all transactions are conducted in accordance with applicable laws, regulations, and directives. Additionally, eToro must comply with the provisions of the European Union’s Markets in Financial Instruments Directive (MiFID) which sets out rules for investment firms providing services across EU member states.

Is it possible to open an account with eToro from outside of Greece?

Yes, it is possible to open an account with eToro from outside of Greece. eToro is available in over 140 countries worldwide and offers its services in multiple languages.

Does eToro offer customer support services for users based in Greece?

Yes, eToro offers customer support services for users based in Greece. They have a dedicated Greek-speaking customer service team that can be contacted via email or live chat.

Are there any special features or tools available to investors and traders on the platform that are unique to the Greek market?

Yes, there are special features and tools available to investors and traders on the Greek market that are unique to this market. These include access to real-time data from the Athens Stock Exchange (ASE), a range of technical analysis tools, advanced charting capabilities, and research reports. Additionally, many brokers offer additional services such as margin trading, portfolio management tools, educational resources for new investors or traders, and customer support in both English and Greek.

How secure is user data when investing or trading through eToro in Greece?

User data is highly secure when investing or trading through eToro in Greece. All user information and funds are protected by advanced encryption technology, two-factor authentication, and other security measures. Additionally, eToro is regulated by the Hellenic Capital Market Commission (HCMC) which ensures that all users’ investments are kept safe and secure.

What advice would you give to someone who is new to investing and trading on the platform in this region?

My advice to someone new to investing and trading in this region would be to start small. Don’t invest more than you can afford to lose, and don’t make any trades without doing your research first. Make sure you understand the risks associated with each investment before committing your money. Additionally, it’s important to diversify your investments so that if one fails, you won’t suffer too much of a loss overall. Finally, keep track of all your investments and monitor them regularly so that you can make informed decisions about when is the best time to buy or sell.

05.05.2023 @ 13:44

d select the asset you want to trade or invest in. You can then use the platform’s various tools and features to analyze the market and make informed decisions about your trades. Remember to always do your research and never invest more than you can afford to lose. With eToro’s user-friendly interface, low fees, and wide range of assets, investing and trading in Greece has never been easier. Happy trading!