Introduction to eToro in Estonia

Estonia is quickly becoming a hub for innovative financial technology, and eToro is at the forefront of this trend. eToro is an online trading platform that allows users to invest in stocks, currencies, commodities, indices and other assets from around the world. This article will provide an introduction to eToro in Estonia and explore how it can be used successfully for investing and trading. We’ll discuss topics such as account setup, navigating the platform’s features, understanding fees and taxes associated with trading on eToro in Estonia, and more. By the end of this guide you should have a better understanding of how to use eToro in Estonia to achieve your investment goals.

Understanding the Basics of Investing and Trading on eToro

Investing and trading on eToro can be a great way to diversify your portfolio, but it’s important to understand the basics before you get started. This guide will help you understand the fundamentals of investing and trading on eToro in Estonia, including how to open an account, what types of investments are available, and how to make successful trades. With this knowledge in hand, you’ll be well-equipped for success when exploring the world of eToro.

Setting Up an Account with eToro

eToro is a popular online trading platform that has become increasingly popular in Estonia. With its easy-to-use interface and wide range of features, it’s no wonder why so many people are turning to eToro for their investing and trading needs. In this guide, we’ll walk you through the process of setting up an account with eToro so you can start taking advantage of all the great features they offer.

The first step in setting up your account is to visit the eToro website and click on “Sign Up” at the top right corner of the page. You will then be prompted to enter some basic information such as your name, email address, country of residence, and date of birth. Once these details have been entered correctly, you will be asked to choose a username and password for your new account. Make sure these are secure but also easy enough for you to remember!

Next, you will need to provide additional information about yourself such as employment status or income level before being able to access more advanced features like margin trading or copy trading. Depending on which country you live in, there may also be other requirements such as submitting documents proving your identity or address before continuing with setup.

Once all required steps have been completed successfully, it’s time to fund your account by transferring money from another bank account or using one of several accepted payment methods (such as credit cards). Once funds have been added successfully into your balance sheet within eToro’s system – congratulations! You now officially own an active eToro investment/trading portfolio that can be used immediately after logging into the site again using your username and password credentials created earlier during signup process completion phase..

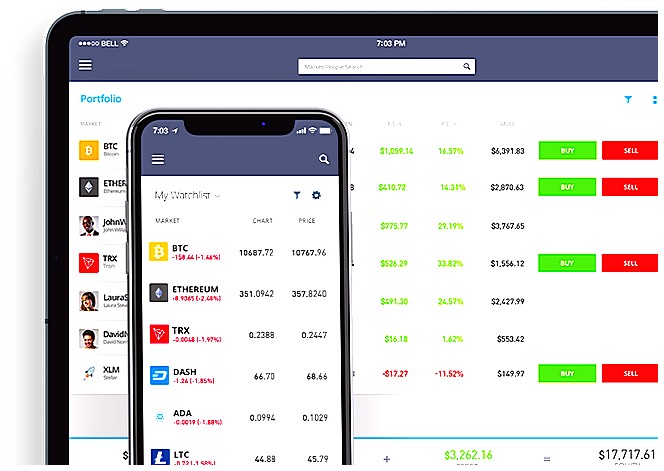

Navigating the Platform Interface

Navigating the Platform Interface: eToro is a comprehensive trading platform that provides users with access to a wide range of markets and assets. To make the most out of your experience, it’s important to understand how to navigate the platform interface. The main page contains several sections, including Markets, Charts & Tools, Research & Analysis, Portfolio Management and Settings. By exploring each section you can gain an understanding of what eToro has to offer and find features that will help you become successful in investing or trading on the platform. Additionally, there are various educational resources available for those who want to learn more about investing or trading on eToro in Estonia.

Strategies for Successful Investing and Trading on eToro

1. Start Small: Before investing or trading on eToro, it is important to start small and gradually increase your investments as you gain more experience.

-

Research the Market: Investing in stocks and other assets can be risky, so make sure to research the market before making any decisions. This includes researching companies that you are interested in investing in, understanding different types of investments available on eToro, and familiarizing yourself with the risks associated with each type of investment.

-

Utilize Social Trading Features: One of the great features offered by eToro is its social trading platform which allows users to copy trades from experienced traders who have a successful track record on the platform. By copying their strategies, new investors can learn how to trade successfully without having to risk their own capital too much at first.

-

Diversify Your Portfolio: It’s always a good idea to diversify your portfolio when investing or trading online; this means spreading out your investments across different asset classes such as stocks, currencies, commodities etc., rather than putting all your eggs into one basket (i.e., only investing in one particular asset class). This will help reduce overall risk while still allowing for potential gains from multiple sources if done correctly!

-

Use Stop Losses & Take Profits: Stop losses and take profits are two essential tools used by traders that allow them to limit their losses or lock-in profits respectively when markets move against them unexpectedly or vice versa – they should not be overlooked! Setting these orders ahead of time will help ensure that you don’t lose more money than necessary due to sudden market movements and also give you peace of mind knowing that any profits made will automatically be locked-in without needing manual intervention from yourself every time there is an opportunity for profit taking!

Choosing Assets to Trade on eToro

Choosing Assets to Trade on eToro

eToro is a great platform for trading and investing in Estonia. It offers a wide range of assets, including stocks, commodities, indices, cryptocurrencies, ETFs and more. With so many options available it can be difficult to decide which asset class or instrument you should trade. Here are some tips to help you make the right decision when choosing assets to trade on eToro:

-

Consider Your Investment Goals: Before selecting an asset class or instrument to invest in, consider your investment goals and objectives. Are you looking for short-term gains? Or do you prefer long-term investments? Knowing what type of return you want will help narrow down your choices significantly.

-

Research Different Asset Classes: Take the time to research different asset classes and instruments that are available on eToro before making any decisions about which ones you would like to invest in. Make sure that you understand how each one works and the risks associated with them before committing any money into them.

3 Copy Trading Strategies from Other Investors: One of the great features offered by eToro is copy trading – this allows investors to automatically copy successful strategies used by other traders on the platform who have achieved good returns over time with their investments.. By copying these strategies instead of trying out new ones yourself can save a lot of time while still giving you access to potentially profitable trades without having too much knowledge about markets or technical analysis required upfront..

4 Use Demo Accounts To Test Strategies: Before investing real money into any strategy or asset class it’s important that first test out different strategies using demo accounts provided by brokers such as eToro where virtual funds are used instead of real capital so there is no risk involved.. This way if something doesn’t work out as expected then at least no real money has been lost during testing phase allowing investor gain experience without risking anything financially..

5 Monitor Markets Regularly & Rebalance Portfolio As Needed: Finally once chosen portfolio has been established it’s important monitor markets regularly order ensure everything remains balanced according original plan set forth at start journey… If necessary rebalance portfolio accordingly either increase exposure certain areas reduce another based upon current market conditions order maintain desired level risk reward ratio….

Analyzing Market Trends and Making Predictions

The Estonian market is full of potential for investors and traders, making it an attractive destination for those looking to capitalize on the latest trends. As such, understanding the current market conditions and predicting future developments can be a key factor in success when trading or investing with eToro in Estonia. In this article, we will explore how to analyze market trends and make predictions that could lead to successful investments or trades. We will look at various methods of analysis including technical indicators, fundamental analysis, news events, sentiment analysis and more. By utilizing these tools correctly you can gain insight into the current state of the markets as well as predict future movements that may prove profitable for your portfolio. With this knowledge in hand you can confidently make informed decisions about your investments or trades with eToro in Estonia.

Managing Risk When Trading on eToro

eToro is a popular online trading platform that allows users to invest in stocks, currencies, commodities and more. It has become increasingly popular in Estonia as it offers an easy-to-use interface and low fees. While eToro can be a great way to make money, it also carries some risks that must be managed carefully. In this article we will explore how to manage risk when trading on eToro in Estonia.

The first step towards successful investing on eToro is understanding the different types of risk associated with the platform. The most common type of risk is market risk, which refers to the potential for losses due to changes in market conditions such as interest rates or currency values. Other types of risks include liquidity risk (the possibility that you may not be able to sell your investments quickly enough), counterparty risk (the chance that someone else involved in the transaction might default) and operational risk (the possibility of errors or malfunctions within the system).

Once you understand these risks, it’s important to take steps to mitigate them by diversifying your portfolio across multiple asset classes and limiting your exposure per trade. Diversification helps reduce overall volatility while limiting exposure reduces individual losses if one particular investment does not perform well. Additionally, setting stop loss orders can help limit losses should prices move against you unexpectedly; however these should only be used after careful consideration as they are not guaranteed protection from large price movements against you.

Finally, it’s important to remember that no amount of preparation can guarantee success when trading on eToro – markets are unpredictable by nature so there will always be some element of uncertainty involved with any investment decision made through this platform. As such, it’s essential for traders using eToro in Estonia to have realistic expectations about their returns and remain disciplined throughout their investing journey by sticking closely with their strategy even during times of turbulence or unexpected events occurring outside their control

Tips for Maximizing Profits with eToro in Estonia

1. Start small and diversify your portfolio: It is important to start with a small amount of capital when trading on eToro in Estonia, as this will help you minimize risk while still allowing you to learn the ropes of investing and trading. Additionally, it is important to diversify your portfolio by investing in different assets across multiple markets. This will help reduce overall risk while also increasing potential returns.

-

Utilize copy-trading features: One of the unique features offered by eToro is its copy-trading feature which allows users to replicate the trades made by other successful traders on the platform. This can be an effective way for novice investors to gain experience without having to take on too much risk or invest large amounts of money upfront.

-

Take advantage of leverage: Leverage allows investors to open larger positions than they would normally be able to with their own capital alone, thereby increasing potential profits (or losses). However, it is important that investors understand how leverage works before using it as it can lead to significant losses if not used properly.

-

Set stop loss orders: Stop loss orders are essential tools for minimizing losses when trading on eToro in Estonia as they allow traders set limits for how much they are willing lose per trade before automatically closing out their position at a predetermined price level – thus limiting any further losses incurred from market movements against them..

5 . Monitor news and trends regularly : Staying up-to-date with financial news and market trends can provide valuable insights into where prices may move next – helping traders make more informed decisions about their investments . Additionally , monitoring social media channels such as Twitter or Reddit can also give useful information about what other traders are thinking or doing , which could potentially influence future price movements .

Conclusion: Exploring Investment Opportunities with eToro

In conclusion, eToro is a great platform for investors and traders in Estonia to explore investment opportunities. With its user-friendly interface, wide range of assets, and low fees, it provides an excellent way to start trading and investing with minimal risk. Additionally, the educational resources available on the platform make it easy for users to learn more about financial markets and develop their own strategies. By taking advantage of all that eToro has to offer, Estonian investors can achieve success in their investments and trades.

| Feature | eToro | Other Trading Platforms |

|---|---|---|

| Fees and Commissions | Low fees and commissions. No hidden costs or surprises. | Varying fees and commissions depending on the platform used. Hidden costs may be present. |

| Variety of Assets Available for Trading | A wide variety of assets available, including stocks, ETFs, commodities, indices, cryptocurrencies, etc. | Generally limited to stocks and ETFs only; some platforms offer a wider range of assets such as commodities or indices but these are not always available in all countries/regions. Cryptocurrencies are rarely offered by other trading platforms outside of eToro. |

| User Interface & Usability | Intuitive user interface with easy-to-use tools for both novice and experienced traders alike. | Differs from platform to platform; some have more complex interfaces that require more experience to use effectively while others may be easier to navigate but lack certain features or customization options desired by advanced traders. |

What are the benefits of investing and trading on eToro in Estonia?

The benefits of investing and trading on eToro in Estonia include access to a wide range of markets, low fees, fast execution times, and the ability to copy other successful traders. Additionally, eToro offers a user-friendly platform with advanced charting tools and educational resources that can help investors learn more about the markets they are interested in. Furthermore, Estonian customers benefit from an additional layer of security due to the country’s strong financial regulations.

How does one open an account with eToro in Estonia?

To open an account with eToro in Estonia, you must first create a user profile on the eToro website. Once your profile is created, you will need to provide personal information such as name, address and date of birth. You will also be required to upload a valid form of identification (such as a passport or national ID card) and proof of residence (such as a utility bill). After providing this information, you can then deposit funds into your account via bank transfer or credit/debit card. Once these steps are completed, your account should be ready for use.

What types of assets can be traded on eToro in Estonia?

eToro offers a wide range of assets for trading in Estonia, including stocks, ETFs, indices, commodities, cryptocurrencies and currencies.

Are there any fees associated with using eToro in Estonia?

Yes, there are fees associated with using eToro in Estonia. These include a commission fee of 0.75% on all trades, as well as spreads and overnight financing fees. Additionally, some deposits may incur additional charges depending on the payment method used.

Does eToro offer any educational resources for investors and traders in Estonia?

Yes, eToro offers educational resources for investors and traders in Estonia. These include webinars, tutorials, trading courses, and other materials designed to help users learn more about investing and trading. Additionally, eToro also provides access to its own research library with market analysis from leading financial experts.

Is it possible to use leverage when trading on eToro in Estonia?

Yes, it is possible to use leverage when trading on eToro in Estonia. Leverage allows traders to open larger positions than they would otherwise be able to with their available capital. This can increase potential profits but also increases the risk of losses.

Are there any risks associated with investing and trading on eToro in Estonia that users should be aware of before getting started?

Yes, there are risks associated with investing and trading on eToro in Estonia that users should be aware of before getting started. These include the risk of losing money due to market volatility, leverage risk, counterparty risk, liquidity risk, legal/regulatory risk and operational risks. Additionally, users should also be aware of potential fees associated with trading on eToro such as spreads and overnight financing charges. It is important for investors to do their own research before making any investments or trades on eToro in order to understand the full range of risks involved.

What customer support options are available to those who invest or trade through the platform from within Estonian borders?

Those who invest or trade through the platform from within Estonian borders have access to customer support options such as telephone, email, and live chat. Additionally, there are a number of online resources available for investors and traders on the platform’s website including FAQs, tutorials, and forums.

05.05.2023 @ 13:46

with a small amount of money to get a feel for the platform and how it works. This will help you avoid making costly mistakes and allow you to learn from your experiences.

2. Do Your Research: Before investing in any asset, it’s important to do your research and understand the market trends and potential risks. eToro provides a range of research and analysis tools to help you make informed decisions.

3. Diversify Your Portfolio: Investing in a variety of assets can help reduce risk and increase potential returns. eToro offers a wide range of assets to choose from, including stocks, currencies, commodities, and more.

4. Use Stop Losses: Setting stop losses can help limit your losses in case the market moves against you. eToro offers a range of risk management tools to help you manage your investments.

5. Follow Successful Traders: eToro’s copy trading feature allows you to automatically copy the trades of successful traders. This can be a great way to learn from experienced investors and potentially increase your returns.

Overall, eToro is a powerful platform that can help you achieve your investment goals. By understanding the basics of investing and trading on eToro in Estonia, setting up an account, navigating the platform interface, and following successful strategies, you can become a successful investor and trader on the platform.