What is eToro?

eToro is an online trading and investment platform that allows users to trade a variety of financial assets, including stocks, commodities, currencies, indices and cryptocurrencies. It provides access to markets from around the world in a user-friendly interface with features such as copy trading and social trading. eToro has become increasingly popular in Ecuador due to its ease of use and low fees for traders. This guide will explore how to get started on eToro in Ecuador, the different types of accounts available, the fees associated with using eToro, and more.

How to Open an Account on eToro

Opening an account on eToro is easy and straightforward. To get started, simply go to the website and click “Sign Up” in the top right corner of the page. You will then be prompted to enter your personal information such as name, email address, phone number, country of residence, etc. Once you have completed this step, you will need to verify your identity by providing a valid government-issued ID or passport. After that is done, you can select your preferred payment method (credit/debit card or bank transfer) and make a deposit into your new eToro account. Finally, once all these steps are complete you are ready to start trading!

Understanding the Trading Platform Interface

The trading platform interface is the foundation of any successful online trading experience. eToro, a leading financial platform in Ecuador, offers an intuitive and user-friendly interface that allows traders to easily navigate the markets. In this guide, we will explore how to use the eToro trading platform in Ecuador and understand its features.

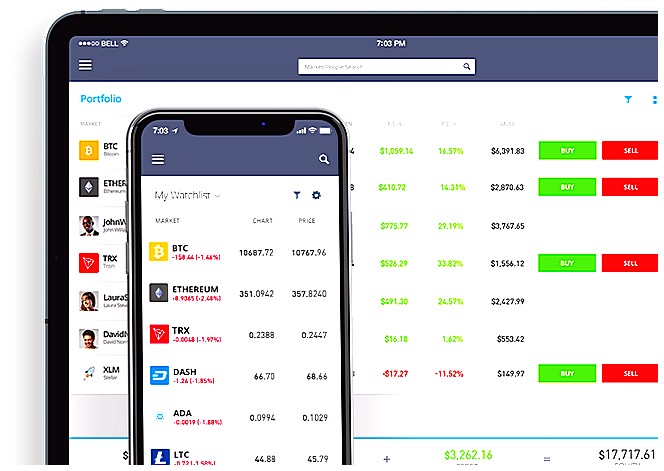

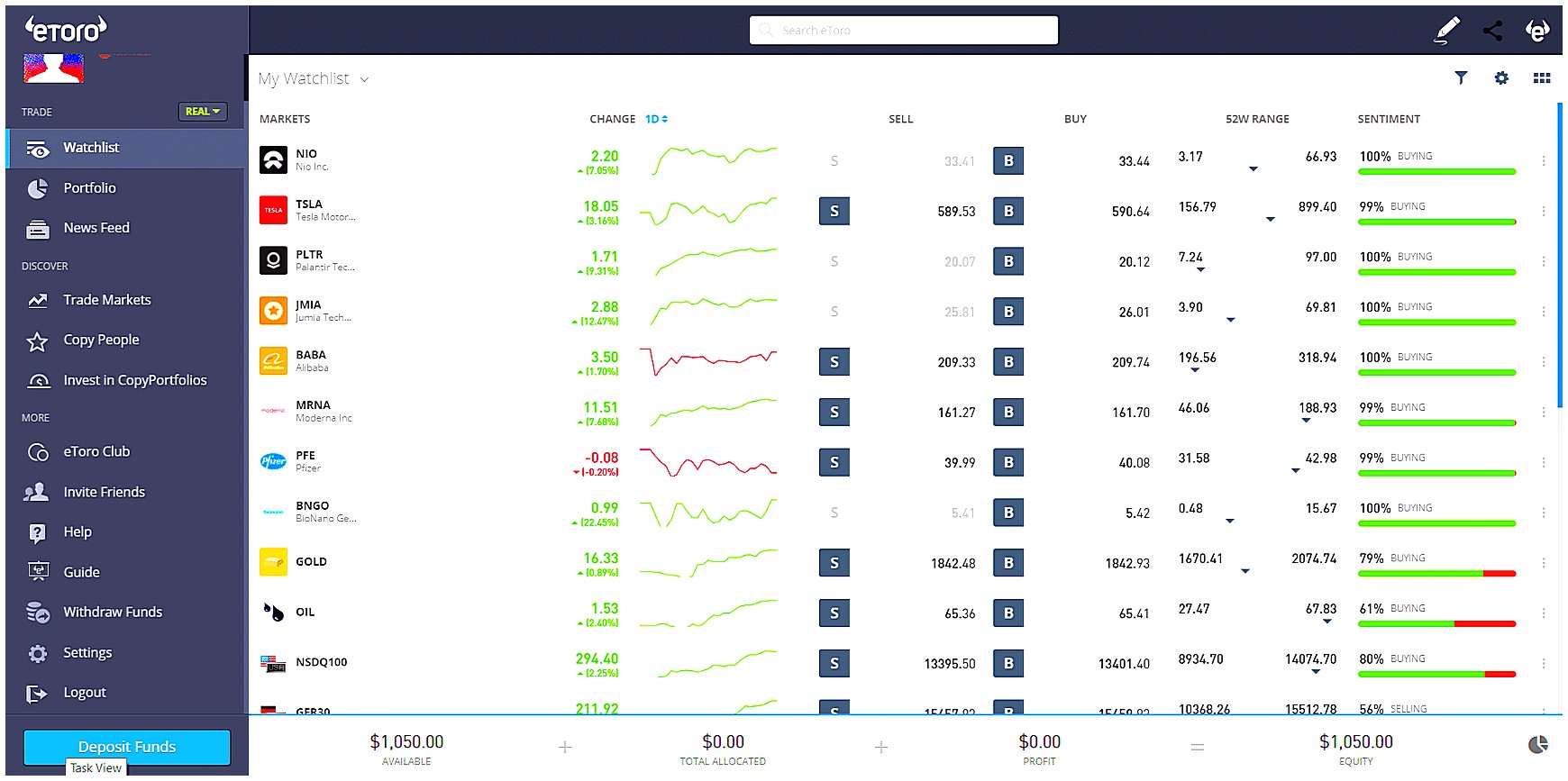

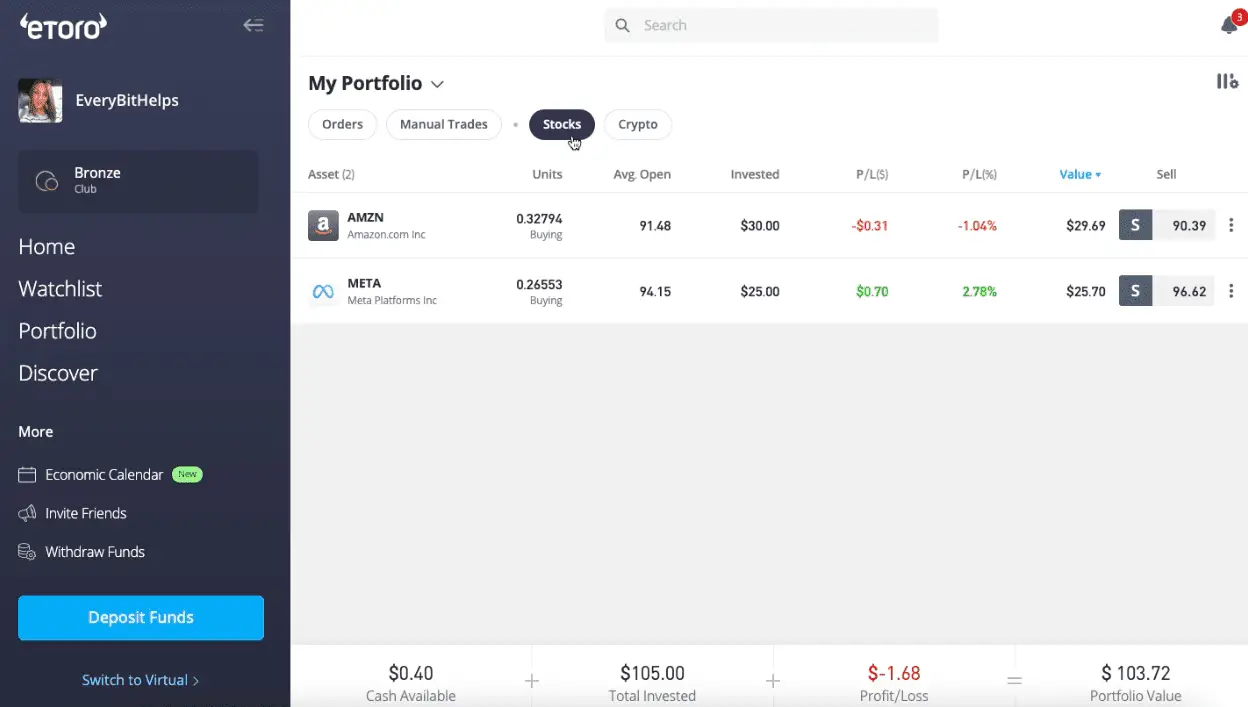

First off, it’s important to familiarize yourself with the different components of the eToro interface. The main page consists of three sections: Markets, Watchlist and Portfolio. The Markets section displays all available assets for trade such as stocks, currencies or commodities; while Watchlist shows your favorite assets which you can monitor more closely; finally Portfolio contains all open positions including their respective performance metrics like gains/losses or leverage ratios.

Once you have selected an asset from the Markets section you will be presented with a detailed chart displaying price movements over time along with other technical indicators such as moving averages or relative strength index (RSI). This information helps traders make informed decisions when placing orders on eToro’s platform by providing them with valuable insights into market trends and volatility levels. Additionally there are several order types available depending on your strategy: limit orders (for buying/selling at specific prices), stop loss orders (to protect against losses) and take profit orders (to lock in profits).

Finally it is important to understand how fees work on eToro’s platform since they vary according to type of instrument traded as well as position size taken up by trader. For example spreads may range from 0 pips for major currency pairs up to 2 pips for minor ones while overnight financing charges depend on whether position is long or short term among other factors . It is therefore essential that users carefully read through terms & conditions before entering any trades so they know exactly what costs are involved beforehand .

In conclusion , understanding the trading platform interface offered by eToro in Ecuador can help traders make better decisions when navigating financial markets . By familiarizing themselves with different components such as charts , order types & fees associated , investors can maximize their returns while minimizing risks associated with investing online .

Exploring Investment Opportunities in Ecuador

Investing in Ecuador can be a great way to diversify your portfolio and take advantage of the country’s strong economic growth. With eToro, you can easily access the financial markets of Ecuador and start trading with confidence. In this guide, we’ll explore how to get started with eToro in Ecuador, including which assets are available for trading, what fees you should expect to pay, and more. We’ll also provide some tips on how to make the most out of your investment opportunities in Ecuador using eToro. So if you’re looking for an easy way to get involved in investing in Ecuador, read on!

Leveraging Social Trading Features on eToro

Social trading is one of the most popular features on eToro, and it’s no surprise why. With social trading, users can copy the trades of experienced traders in real-time, allowing them to benefit from their knowledge and experience without having to do any research or analysis themselves. In Ecuador, this feature has become increasingly popular as more people look for ways to invest their money safely and securely. This article will explore how users in Ecuador can leverage social trading features on eToro to maximize their profits while minimizing risk. We’ll discuss topics such as copying other traders’ strategies, understanding market sentiment through copy trader rankings, and setting stop losses when investing with eToro. Finally, we’ll provide some tips for getting started with social trading on eToro in Ecuador so that you can start taking advantage of this powerful tool today!

Tips for Maximizing Returns with eToro in Ecuador

1. Start small and practice trading with a demo account: Before investing real money, it is important to get familiar with the platform by using a virtual portfolio or demo account. This will help you understand how eToro works and become comfortable with its features.

-

Research before investing: Make sure to do your research on any potential investments before committing funds. Look into the company’s financials, read up on news related to the stock, and consider other factors that could influence its performance in order to make an informed decision about whether or not it is worth investing in.

-

Diversify your portfolio: Don’t put all of your eggs in one basket when trading on eToro – diversifying across different assets can help reduce risk while still providing potential returns from multiple sources. Consider adding stocks, commodities, currencies, indices, ETFs and more to create a balanced portfolio for long-term success.

-

Utilize copy trading: Copy trading allows you to automatically replicate trades made by experienced traders who have proven track records of success – this can be especially helpful if you are new to online trading or don’t have much experience yourself yet but want access to higher returns than what traditional investments offer alone .

-

Monitor markets regularly: It is important that you stay up-to-date with market movements so that you can adjust your strategy accordingly as needed – set alerts for when certain prices reach specific levels so that you know when it might be time to buy or sell certain assets quickly .

Understanding Fees and Commissions Associated with Trading on eToro

eToro is a popular financial platform for trading stocks, currencies, commodities and more. As with any type of investment, it’s important to understand the fees and commissions associated with trading on eToro before you begin. In this article we’ll explore the various types of fees and commissions that may be charged when using eToro in Ecuador.

When trading on eToro, there are two main types of fees: spreads and overnight financing charges. Spreads refer to the difference between the buy price (the amount you pay) and sell price (the amount you receive). This spread can vary depending on the asset being traded; however, most assets have a fixed spread which remains constant regardless of market conditions or time of day. Overnight financing charges are applied when positions remain open after regular market hours; these charges will vary based on how long your position is held open as well as what type of asset is being traded.

In addition to spreads and overnight financing charges, some traders may also incur commission costs when using eToro in Ecuador. Commission rates depend upon several factors such as account size, trade volume and product category; however they generally range from 0% – 2%. It’s important to note that these commission rates can change over time so it’s best to check regularly for updates if applicable.

Finally, there are other miscellaneous fees that may apply while trading on eToro including withdrawal fees or currency conversion costs if applicable; these should all be taken into consideration prior to making any trades or investments through the platform.

By understanding all associated costs upfront you’ll be better prepared for success when utilizing eToro in Ecuador!

Strategies for Managing Risk when Investing through eToro in Ecuador

1. Diversify Your Portfolio: Investing in a variety of assets can help to spread out risk and reduce the impact of any losses.

-

Set Stop Losses: Setting stop losses on your trades will limit the amount you can lose if the market moves against you.

-

Monitor Market Trends: Keeping an eye on market trends and news can help you make informed decisions about when to enter or exit positions, as well as what type of investments may be more profitable at certain times.

-

Use Leverage Wisely: Leverage allows traders to increase their exposure with relatively small amounts of capital, but it also increases potential losses significantly so use it carefully and only when necessary.

-

Utilize Risk Management Tools: eToro offers several tools such as guaranteed stops that can help manage risk by limiting your exposure to large price movements in either direction while still allowing for some upside potential from trading opportunities within a range set by yourself or predetermined levels set by eToro itself .

Analyzing Market Trends and Making Informed Decisions When Trading on eToro 10 .Navigating Regulatory Requirements for Using the Financial Platform

1. Understand the Benefits of Trading on eToro: As an Ecuadorian trader, you can take advantage of eToro’s low fees and intuitive platform to quickly make informed decisions about your investments.

2. Analyze Market Trends: Before making any trades, it is important to analyze market trends and develop a trading strategy that takes into account the current market conditions in Ecuador.

3. Utilize Advanced Tools: Take advantage of advanced tools such as charts, indicators, and news feeds available on eToro to help inform your trading decisions.

4. Make Informed Decisions When Trading: Once you have developed a trading strategy based on market analysis, use this information to make informed decisions when placing orders or entering positions on the financial platform.

5. Manage Risk Appropriately: It is important to understand risk management principles when trading online so that you do not expose yourself to unnecessary losses due to volatility or other factors outside of your control.

6 .Understand Leverage Options Available : Leveraged products can be used for both long-term investing strategies as well as short-term speculation; however it is important that traders understand how leverage works before using these products in order for them not become over exposed with too much risk exposure at once .

7 .Navigate Regulatory Requirements : The Financial Superintendency (SFC) regulates all financial activities in Ecuador including those related to digital assets like cryptocurrencies , so it is essential for users of eToro’s platform familiarize themselves with applicable laws and regulations before engaging in any type of transaction within the country’s jurisdiction . 8 .Educate Yourself About Cryptocurrencies : If you are interested in cryptocurrency markets , then it would be beneficial for you learn more about how they work , what types are available , their potential risks & rewards associated with them etc., prior getting involved in any type transactions involving them through eToro’s platform . 9 .Stay Up To Date With Latest News & Developments : Staying up-to-date with latest news & developments related financial markets will help keep abreast changes which could affect your investments , allowing better decision making process when executing trades via etoro’s system 10.. Navigating Regulatory Requirements For Using The Financial Platform : Regulations governing use digital asset platforms vary from country country – thus understanding requirements necessary abide by local law critical ensure compliance avoid penalties imposed government authorities failure adhere rules set forth

| Pros | Cons |

|---|---|

| Easy to use interface for beginners and experienced traders alike. | Fees can be high depending on the type of trade. |

| Variety of trading options available, including stocks, currencies, commodities and more. | Lack of customer support in some countries outside the US. |

| Low minimum deposit requirements for new accounts. | Limited payment methods accepted in certain countries. |

What are the main features of eToro in Ecuador?

The main features of eToro in Ecuador include:

1. Low Fees: eToro offers some of the lowest fees for trading and investing compared to other online brokers.

2. Variety of Assets: With over 2,400 assets available on the platform, traders can access a wide range of stocks, ETFs, commodities, indices and cryptocurrencies from around the world.

3. Copy Trading Feature: The CopyTrader feature allows users to copy trades from experienced investors in real-time with just one click. This makes it easy for beginners to learn how to trade without having any prior experience or knowledge about markets and investments.

4. Social Trading Platform: eToro is a social trading platform that allows users to connect with each other through their profiles and share ideas on different topics related to trading and investing strategies as well as market news updates.

5. Regulatory Compliance: As an authorized broker regulated by both CySEC (Cyprus Securities & Exchange Commission) and FCA (Financial Conduct Authority), eToro ensures that all transactions are secure and transparent according to international standards set by these two regulatory bodies

How does one open an account on eToro in Ecuador?

To open an account on eToro in Ecuador, you must first register online by providing your personal information. You will then need to verify your identity and residence with a valid form of identification such as a passport or national ID card. Once verified, you can deposit funds into your account using one of the available payment methods and begin trading.

What types of financial instruments can be traded on eToro in Ecuador?

eToro offers a wide range of financial instruments that can be traded in Ecuador, including stocks, commodities, indices, ETFs (Exchange Traded Funds), cryptocurrencies and CFDs (Contracts for Difference).

Are there any fees associated with trading on eToro in Ecuador?

Yes, there are fees associated with trading on eToro in Ecuador. These include spreads, overnight financing charges, and withdrawal fees. Additionally, some payment methods may also incur additional costs. It is important to check the specific terms of each trade before committing to it.

Is it possible to use leverage when trading on eToro in Ecuador?

Yes, it is possible to use leverage when trading on eToro in Ecuador. Leverage allows traders to open larger positions than their available capital would normally allow, which can potentially lead to greater profits or losses. However, the amount of leverage offered may vary depending on the country and instrument being traded.

Does the platform offer customer support for traders from Ecuador?

Yes, the platform offers customer support for traders from Ecuador. The customer service team is available 24/7 to answer any questions or concerns that you may have.

Are there any special regulations that apply to traders from Ecuador using the platform?

No, there are no special regulations that apply to traders from Ecuador using the platform. All users of the platform must comply with the terms and conditions outlined in our User Agreement.

How secure is user data and funds stored on the platform for users from Ecuador?

The security of user data and funds stored on the platform for users from Ecuador depends on the specific platform. Different platforms have different levels of security, so it is important to research a particular platform before using it. Generally speaking, most reputable platforms use encryption technology and other measures to protect user data and funds from unauthorized access or theft.

05.05.2023 @ 13:45

Spanish:

eToro es una plataforma de trading e inversión en línea que permite a los usuarios operar una variedad de activos financieros, incluyendo acciones, materias primas, divisas, índices y criptomonedas. Proporciona acceso a mercados de todo el mundo en una interfaz fácil de usar con características como el copy trading y el social trading. eToro se ha vuelto cada vez más popular en Ecuador debido a su facilidad de uso y bajos costos para los traders. Esta guía explorará cómo comenzar en eToro en Ecuador, los diferentes tipos de cuentas disponibles, las tarifas asociadas con el uso de eToro y más.

Abrir una cuenta en eToro es fácil y sencillo. Para empezar, simplemente vaya al sitio web y haga clic en “Registrarse” en la esquina superior derecha de la página. Luego se le pedirá que ingrese su información personal, como nombre, dirección de correo electrónico, número de teléfono, país de residencia, etc. Una vez que haya completado este paso, deberá verificar su identidad proporcionando una identificación válida emitida por el gobierno o un pasaporte. Después de eso, puede seleccionar su método de pago preferido (tarjeta de crédito/débito o transferencia bancaria) y hacer un depósito en su nueva cuenta de eToro. Finalmente, una vez que se completen todos estos pasos, ¡estará listo para comenzar a operar!

La interfaz de la plataforma de trading es la base de cualquier experiencia exitosa de trading en línea. eToro, una plataforma financiera líder en Ecuador, ofrece una interfaz intuitiva y fácil de usar que permite a los traders navegar fácilmente por los mercados. En esta guía, exploraremos cómo usar la plataforma de trading de eToro en Ecuador y entender sus características.

En conclusión, comprender la interfaz de la plataforma de trading ofrecida por eToro en Ecuador puede ayudar a los traders a tomar mejores decisiones al navegar por los mercados financieros. Al familiarizarse con diferentes componentes como gráficos, tipos de órdenes y tarifas asociadas, los inversores pueden maximizar sus ganancias mientras minimizan los riesgos asoci