Introduction to eToro in Croatia

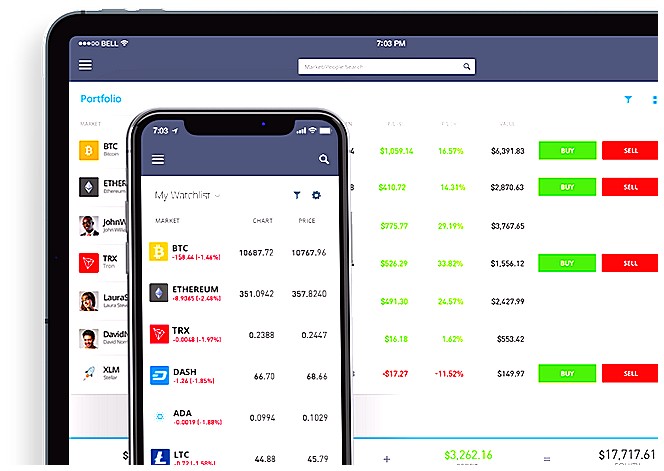

eToro is an online trading and investment platform that has been gaining traction in Croatia. With its user-friendly interface, easy to use tools, and wide range of features, eToro offers a great opportunity for investors and traders alike to get involved in the financial markets. In this article, we will explore eToro in Croatia and provide a guide on how to start investing or trading with the platform. We’ll discuss topics such as account setup, available assets, fees & commissions, customer service support, security measures taken by eToro for Croatian users and more. So let’s dive right into exploring eToro in Croatia!

Understanding the Basics of Investing and Trading on eToro

Investing and trading on eToro can be a great way to make money, but it is important to understand the basics before you get started. This guide will provide an overview of investing and trading on eToro in Croatia, including what types of investments are available, how to open an account, and some tips for success. We’ll also discuss the risks associated with investing and trading on eToro so that you can make informed decisions about your finances. By understanding the basics of investing and trading on eToro in Croatia, you can start building wealth today!

Advantages of Using eToro for Croatian Investors

1. Easy to Use: eToro is a user-friendly platform that allows Croatian investors to easily access and manage their investments with minimal effort.

-

Low Fees: eToro offers low fees for trades, making it an attractive option for those looking to save money on trading costs.

-

Variety of Assets: With a wide range of assets available, including stocks, ETFs, commodities and cryptocurrencies, Croatian investors can diversify their portfolios and take advantage of the different markets available on the platform.

-

Professional Advice: eToro provides professional advice from experienced traders who are familiar with the Croatian market so that users can make informed decisions about their investments without having to do extensive research themselves.

-

Social Trading Network: Through its social trading network, users can follow other successful traders in Croatia or around the world and learn from them by copying their strategies or investing alongside them in real time – all while staying up-to-date with current market trends through news feeds and live updates on the platform’s dashboard page

How to Open an Account with eToro in Croatia

Opening an account with eToro in Croatia is a simple process. Here’s how to get started:

1. Visit the eToro website and click “Sign Up” at the top of the page.

2. Enter your personal information, including name, email address, and country of residence (Croatia).

3. Create a username and password for your account. Make sure you choose something secure that you won’t forget!

4. Verify your identity by providing proof of identification such as a passport or driver’s license – this is required for all users on eToro who wish to trade real money assets.

5. Fund your account with Croatian Kuna or another accepted currency via bank transfer or credit/debit card payment methods available in Croatia (e-wallets are not currently supported).

6. Once you have completed these steps, you will be ready to start trading on eToro!

Depositing Funds into Your eToro Account from Croatia

Croatia is one of the many countries that have embraced eToro, a leading social trading and investing platform. With its user-friendly interface and wide range of assets, it’s no wonder why so many Croatians are turning to eToro for their investment needs. But before you can start trading or investing on eToro, you need to deposit funds into your account. This article will provide an overview of how to deposit funds into your eToro account from Croatia.

Depositing Funds Into Your eToro Account From Croatia

The first step in depositing funds into your eToro account from Croatia is signing up for an account with the platform. Once you’ve created an account, you can begin the process of transferring money into it. Depending on where you live in Croatia, there are several different ways to make deposits:

- Credit/Debit Card: You can use any major credit or debit card (Visa, Mastercard etc.) to transfer money directly from your bank account into your eToro wallet instantly and securely. All payments are processed through secure online payment gateways such as PayPal or Skrill which ensure all transactions remain safe and secure at all times.

- Bank Transfer: If you prefer not to use a credit/debit card for making deposits then another option available is using a bank transfer via SEPA (Single Euro Payments Area). This allows users from EU countries including Croatia to easily send money directly from their local banks without having to worry about exchange rates or other fees associated with international transfers. The only downside is that this method may take up two days before the funds appear in your wallet due processing time by both banks involved in the transaction

- Cryptocurrency: For those looking for more flexibility when it comes to depositing funds onto their accounts then cryptocurrency might be worth considering as well! Crypto deposits allow users who own digital currencies like Bitcoin or Ethereum access instant transfers while also avoiding high fees typically associated with traditional banking methods such as wire transfers or credit cards purchases abroad

Regardless of which method suits best for each individual investor’s needs; once deposited successfully these amounts will immediately become available within one’s portfolio balance allowing them full access over trading activities on etoro right away!

Types of Assets Available for Investment and Trading on eToro in Croatia

eToro in Croatia offers a wide range of assets available for investment and trading. These include stocks, commodities, indices, ETFs (Exchange Traded Funds), cryptocurrencies, and more. Stocks from the Croatian Stock Exchange are also available to trade on eToro in Croatia. Additionally, traders can access global markets such as US stocks and international indices through CFDs (Contracts For Difference). Cryptoassets including Bitcoin (BTC), Ethereum (ETH) and Ripple (XRP) are also available for trading on eToro in Croatia.

Leverage and Margin Requirements when Trading on eToro in Croatia

eToro is a popular online trading platform that allows users to invest and trade in financial markets from around the world. For those living in Croatia, eToro provides an easy way to access global markets without having to open a traditional brokerage account. In this article, we will explore the leverage and margin requirements when trading on eToro in Croatia.

When investing or trading with eToro, traders can use leverage to increase their potential profits by borrowing funds from the broker. Leverage works by allowing traders to control larger positions than they would be able to with just their own capital alone. However, it also increases risk as losses are magnified too. On eToro, the maximum amount of leverage available for Croatian residents is 1:30 for retail clients and 1:400 for professional clients depending on the asset class being traded (such as forex pairs).

In addition to leveraging trades, traders must also meet certain margin requirements set out by eToro before opening any position on its platform. Margin requirements refer to how much money needs to be deposited into your account as collateral against potential losses incurred while trading leveraged products such as CFDs or forex pairs. On eToro’s platform, margin requirements vary between 2% – 20%, depending on which asset class you are looking at investing/trading in (for example cryptocurrencies may have higher margins than stocks).

By understanding both leverage and margin requirements when using eToro in Croatia investors can make more informed decisions about how best manage their investments and limit risks associated with leveraged products like CFDs or Forex pairs

Fees Associated with Investing and Trading on eToro in Croatia

When investing and trading on eToro in Croatia, there are a few fees associated with the process. The most common fee is the spread, which is the difference between the buy and sell price of an asset. This can range from 0% to 3%, depending on what type of asset you’re trading. Additionally, when opening or closing a position, you may be charged an overnight fee if your position remains open for more than one day. Finally, withdrawal fees may apply when withdrawing funds from your account.

Strategies for Successful Investing and Trading on etorro in Croatia

1. Start small: Before investing or trading on eToro in Croatia, it is important to start with a small amount of money and gradually increase your investments as you gain more experience.

-

Diversify your portfolio: To reduce risk, diversifying your portfolio by investing in different assets can be beneficial. This will help spread out the risk associated with any single investment and give you greater returns over time.

-

Research the markets: Before making any trades or investments, it is important to research the market thoroughly so that you understand what you are getting into and make informed decisions about where to invest your money.

-

Set realistic goals: Setting realistic goals for yourself when investing or trading on eToro in Croatia can help ensure that you don’t get too greedy or take unnecessary risks with your money.

-

Use stop-loss orders: Stop-loss orders are an effective way of limiting losses if a trade goes against you by automatically closing out a position at a predetermined price level set by the trader themselves prior to entering into the trade itself .

6 Monitor performance regularly : Regularly monitoring how well (or not) each of your investments is performing can help keep track of progress and adjust strategies accordingly if needed .

Security Measures Taken by etoro to Protect Croatian Investors

eToro is committed to providing a secure trading environment for Croatian investors. To ensure the safety of its customers, eToro has implemented several security measures:

-

Two-Factor Authentication: All users must enable two-factor authentication when signing up for an account. This provides an extra layer of protection against unauthorized access and data theft.

-

Encryption Technology: All user data is encrypted using industry-standard encryption technology to protect it from hackers and other malicious actors.

-

Account Monitoring: eToro monitors all accounts on a regular basis in order to detect any suspicious activity or fraudulent transactions that may occur.

-

Regulatory Compliance: eToro complies with all applicable regulations in Croatia, including those related to anti-money laundering (AML) and know your customer (KYC). It also works closely with local authorities to ensure compliance with all relevant laws and regulations in the country where it operates..

| Feature | eToro | Other Trading Platforms |

|---|---|---|

| Minimum Deposit | $200 | Varies |

| Maximum Leverage | 1:400 | Varies |

| Fees & Commissions | Low | High |

| Tradable Assets | Stocks, Cryptocurrencies, ETFs, Forex and more. |

What types of investments and trading are available on eToro in Croatia?

On eToro in Croatia, investors and traders can access a wide range of investments and trading options. These include stocks, commodities, indices, ETFs (Exchange Traded Funds), currencies (Forex), cryptocurrencies, copy trading and social trading.

How does the platform compare to other investing and trading platforms in Croatia?

The platform compares favorably to other investing and trading platforms in Croatia. It offers a wide range of features, including advanced charting tools, real-time market data, and access to global markets. Additionally, the platform provides low fees for both buying and selling stocks as well as providing educational resources for new investors. The user interface is also intuitive and easy to use. Overall, this makes it an attractive option for those looking to invest or trade in Croatia.

Are there any fees associated with using eToro in Croatia?

Yes, there are fees associated with using eToro in Croatia. These include a spread fee for each trade and an overnight fee for positions held overnight. Additionally, there may be other fees such as withdrawal or deposit fees depending on the payment method used.

Is it easy to open an account on eToro for Croatian investors?

Yes, it is easy to open an account on eToro for Croatian investors. All you need to do is visit the website and follow the instructions provided. You will need to provide some personal information such as your name, address, date of birth, and other details in order to create an account. Once your account has been created, you can start trading with eToro right away.

What is the minimum amount required to start investing or trading on eToro in Croatia?

The minimum amount required to start investing or trading on eToro in Croatia is €200.

Does eToro offer educational resources for Croatian investors who are new to the platform?

Yes, eToro offers educational resources for Croatian investors who are new to the platform. These include webinars, tutorials, market analysis and other educational materials in both English and Croatian.

Are there any restrictions or limitations that apply specifically to Croatian users of eToro?

Yes, there are restrictions and limitations that apply specifically to Croatian users of eToro. These include a maximum leverage of 1:30 for CFDs on Forex, Stocks, Commodities and Indices; a minimum deposit requirement of $200; no cryptocurrency trading available; and no access to the CopyTrader feature. Additionally, Croatian residents may not open accounts with other European countries’ entities such as UK or Cyprus.

Are there any customer support services available for Croatian traders and investors using the platform?

Yes, customer support services are available for Croatian traders and investors using the platform. The customer service team can be contacted via email or telephone in both English and Croatian. Additionally, there is an online chat feature that allows customers to get help quickly from a representative of the company.

05.05.2023 @ 13:42

r eToro account from Croatia is to log in to your account and navigate to the “Deposit Funds” section. From there, you can choose your preferred payment method, which includes bank transfer and credit/debit card payments. It’s important to note that e-wallets are not currently supported in Croatia.

Once you have selected your payment method, you will be prompted to enter the amount you wish to deposit. Make sure to double-check the amount before confirming the transaction. Depending on the payment method you choose, it may take a few days for the funds to appear in your eToro account.

Overall, eToro offers a great opportunity for Croatian investors and traders to get involved in the financial markets. With its user-friendly interface, low fees, and wide range of assets, it’s no wonder why eToro is gaining traction in Croatia. By understanding the basics of investing and trading on eToro, and following the steps to open and fund your account, you can start building wealth today.