Introduction to eToro and Bhutan

This article provides an introduction to eToro and Bhutan, two powerful forces in the world of trading and investing. eToro is a leading online broker that offers users access to global markets with low fees and intuitive tools. On the other hand, Bhutan is a small landlocked country nestled in the Himalayas known for its unique culture, stunning landscapes, and progressive economic policies. By combining these two entities, investors can gain insight into both traditional investments as well as new opportunities available through digital assets such as cryptocurrencies. This guide will provide readers with an overview of how to use eToro to trade in Bhutanese markets while also exploring some of the unique features offered by this platform.

Understanding the Basics of Trading on eToro

Trading on eToro is a great way to get started in the world of investing and trading. With its easy-to-use platform, it’s an ideal place for beginners to learn the basics of trading and investing. In this article, we will explore what eToro has to offer Bhutanese traders and investors.

Understanding the Basics of Trading on eToro

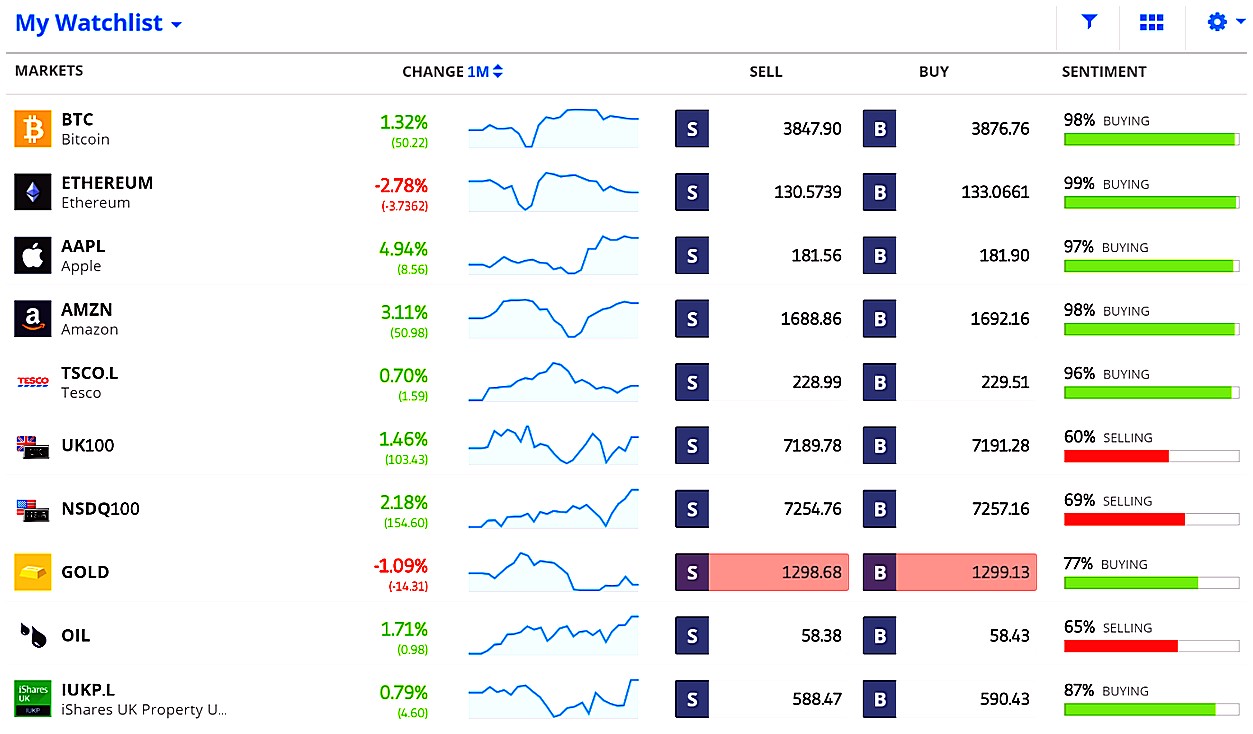

eToro offers a variety of different types of investments that can be traded on their platform. These include stocks, commodities, currencies, indices, ETFs (Exchange Traded Funds), cryptos (cryptocurrencies) and more. The main advantage with using eToro is that you don’t need any prior knowledge or experience in order to start trading; they provide all the tools you need to get started right away.

When it comes to understanding how trades work on eToro there are two main concepts: buying and selling assets. When you buy an asset such as a stock or currency pair, you are essentially betting that its price will increase over time so that when you sell it later at a higher price than what you bought it for – then your profit is the difference between those two prices (minus any fees). On the other hand if you believe an asset’s price will decrease then instead of buying it outright –you can short sell it which means borrowing shares from another trader who owns them already and selling them off immediately while hoping they fall in value before having to buy them back again at a lower cost than what was originally borrowed from someone else – thus making money off this transaction too!

The second concept involves leverage which allows traders/investors with limited capital access larger positions by borrowing funds from brokers like etoro at specific rates depending upon market conditions -this increases potential profits but also carries greater risk due increased exposure should markets move against one’s position(s). Leverage can be used both when buying assets directly or through CFDs (Contract For Difference) where traders speculate on whether prices will go up or down without actually owning anything themselves!

Finally before getting into real money trading users should always practice first using virtual funds provided by most platforms including etoro -this helps familiarize oneself with different features available as well as develop strategies based upon personal goals & risk tolerance levels etc…

Setting Up an Account with eToro in Bhutan

eToro is an online trading and investing platform that has become increasingly popular in Bhutan. With its user-friendly interface, low fees, and wide range of assets to trade, it’s no wonder why so many investors are turning to eToro for their financial needs. In this guide, we’ll take a look at how to set up an account with eToro in Bhutan and what you need to know before getting started.

Setting up an account with eToro in Bhutan is easy and straightforward. First, you will need to create a username and password for your new account on the eToro website or mobile app. You will then be asked to provide some personal information such as your name, address, date of birth, email address etc., which is necessary for compliance purposes. Once all the required information has been provided correctly you can start trading right away!

In order to deposit funds into your newly created eToro account from Bhutanese banks or other local payment providers like Khalti or IME Pay ,you will first have to verify your identity by submitting copies of documents such as passport/ID card/driving license along with proof of residence (utility bill). This process usually takes around 24 hours but once completed you can start depositing money into your eToro wallet via bank transfer or credit/debit cards issued by any international provider accepted by the platform (Visa & Mastercard).

Finally when everything is ready just click “Deposit Funds” button on the dashboard page of your profile and follow instructions given there – select currency type (USD), enter amount you want to deposit and choose payment method from available options – Bank Transfer / Credit Card / Debit Card etc.. After successful completion of transaction funds should appear in balance within few minutes depending on chosen method – bank transfers may take several days due nature of banking system though .

Once all these steps have been taken care off ,you are now ready explore world investment opportunities offered by etoro!

Navigating the Platform: A Step-by-Step Guide

Navigating the Platform: A Step-by-Step Guide

-

Create an Account: To get started with eToro in Bhutan, you’ll need to create a trading account. Visit their website and click on “Sign Up” at the top of the page. You will be asked to provide some basic information such as your name, email address, and phone number. Once you have completed this step, you can start exploring all that eToro has to offer!

-

Explore Markets & Assets: After creating your account, take some time to explore the different markets and assets available for trading on eToro in Bhutan. From stocks and ETFs to cryptocurrencies like Bitcoin and Ethereum – there are plenty of options for traders looking for new opportunities!

-

Set Your Trading Goals: Before diving into any trades or investments, it is important to set clear goals for yourself so that you know what success looks like when using eToro in Bhutan. Consider how much money you want to make from trading or investing each month/year; how long do you plan on holding onto your assets; what type of risk profile are comfortable with? Setting these goals ahead of time will help ensure that your experience is successful one!

-

Choose Your Strategy: Now that you have set clear goals for yourself, it’s time to decide which strategy best suits them – whether it be manual trading (buying/selling manually) or copytrading (copying other traders). If manual trading appeals more than copytrading then consider researching different strategies such as swing trading or day trading before executing any trades!

5 . Make Trades & Monitor Performance : Finally , once everything is setup , it’s time t o start making trades ! Keep track of all transactions by monitoring performance through graphs , charts , and other tools provided by etoro . Also remember t o stay up -to -date with news related t o markets & assets y ou’re interested in investing i n order t o maximize returns !

Researching Potential Investments on eToro

Investing can be a great way to grow your wealth, and eToro is one of the most popular online trading platforms. In this article, we’ll explore how you can use eToro in Bhutan to research potential investments and start trading. We’ll look at the different types of assets available on eToro, how to analyze them for risk and return potential, as well as other tips for successful investing. With these insights, you’ll be ready to make informed decisions about where to invest your money.

Making Your First Trade on eToro in Bhutan

Trading on eToro in Bhutan is a great way to get started with investing and trading. With its user-friendly platform, it’s easy to make your first trade. In this guide, we’ll walk you through the steps of making your first trade on eToro in Bhutan.

First, create an account with eToro and deposit funds into your account. You can do this by linking a bank account or credit card to your eToro profile. Once you have deposited funds into your account, you are ready to start trading!

Next, select the asset that you would like to invest in. On eToro, there are many different assets available for trading including stocks, commodities, currencies and cryptocurrencies such as Bitcoin and Ethereum. Choose the asset that best suits your investment goals and risk tolerance level before proceeding further.

Once you have selected an asset for trading on eToro in Bhutan, decide how much money you want to invest in it and set up a buy order accordingly using the ‘Buy’ button located at the bottom of each page within the platform’s interface. Enter all relevant information such as quantity (number of shares/units) desired price per share/unit etc., before clicking ‘Confirm & Open Trade’ button which will complete your purchase order successfully .

Finally review all transaction details carefully once again before submitting them so that everything is accurate according to what was entered earlier while setting up buy order initially . After submission , wait until market conditions become favorable enough for execution of buy order after which purchased units will be credited into respective investor portfolio along with any associated fees if applicable .

Now that you know how easy it is to make trades on eToro in Bhutan , why not give it a try today ?

Tips for Successful Investing with eToro in Bhutan

1. Start small and diversify your portfolio: When investing with eToro in Bhutan, it is important to start small and diversify your investments across different asset classes such as stocks, commodities, currencies, etc. This will help reduce the risk of losses from any one investment while still allowing you to take advantage of potential gains.

-

Research thoroughly before investing: Before investing in any asset class or stock on eToro in Bhutan, make sure to research the company thoroughly by reading up on their financials and news reports about them. This will give you a better understanding of how the company operates and whether it’s a good fit for your investment goals.

-

Utilize copy trading features: One great feature that eToro offers its users is copy trading which allows investors to automatically replicate another user’s trades without having to manually place each trade themselves. This can be an effective way for new traders who are unfamiliar with markets or strategies to get started with minimal effort but should not be relied upon exclusively when making decisions about investments as past performance does not guarantee future results.

-

Set stop-loss orders: Stop-loss orders are essential tools for managing risk when trading with eToro in Bhutan as they allow investors to set predetermined limits at which their positions will be closed if prices move against them too much so that losses can be minimized if necessary.

5 .Monitor markets regularly: Finally, it is important for all investors using eToro in Bhutan (or anywhere else) to monitor their portfolios regularly so that they can stay informed about market movements and adjust their positions accordingly if needed

Leveraging CopyTrading Strategies on eToro

eToro is a great platform for traders and investors in Bhutan to explore. It offers a wide range of trading options, including CopyTrading strategies. CopyTrading allows users to copy the trades of experienced traders with proven track records, allowing novice traders to benefit from their knowledge and experience without having to invest time and effort into learning the markets themselves. This article will provide an overview of eToro’s features, as well as advice on how best to leverage CopyTrading strategies when using eToro in Bhutan.

Monitoring Your Portfolio Performance with Market Analysis Tools

eToro is a popular online trading platform that has become increasingly popular in Bhutan. It offers users the ability to trade and invest in stocks, currencies, commodities, indices, ETFs and more. In addition to its comprehensive suite of trading tools, eToro also provides investors with powerful market analysis tools for monitoring their portfolio performance. With these tools, you can analyze your investments’ performance over time and compare them against other assets or markets. This article will provide an overview of how to use eToro’s market analysis tools to monitor your portfolio performance in Bhutan.

Conclusion: The Benefits of Investing and Trading with eToro in Bhutan

Conclusion: The Benefits of Investing and Trading with eToro in Bhutan are numerous. With its user-friendly platform, access to a wide range of markets, low fees, and excellent customer service, eToro is an ideal choice for those looking to invest or trade in Bhutan. Additionally, the platform offers unique features such as CopyTrader™ which allows users to copy successful traders’ portfolios and CopyPortfolios™ which allow investors to diversify their investments across different asset classes. As a result, investing and trading with eToro in Bhutan can be a great way for individuals to grow their wealth over time.

| eToro Features | Pros | Cons |

| — | — | — |

| Social Trading Platforms | Allows users to copy the trades of other successful traders, reducing risk and allowing for diversification. Can be used to learn from experienced investors.| May require significant capital investment depending on the type of trading being done. Potential losses may outweigh potential gains due to lack of experience or knowledge.|

| CopyPortfolios™ Investment Strategies | Diversified portfolios that are managed by professionals, reducing risk and providing access to a variety of asset classes in one portfolio. Low minimum investment amount required compared to traditional investments such as stocks and mutual funds.|| Higher fees than investing directly in individual assets, making it more expensive over time. Not suitable for those looking for specific asset allocations or who want full control over their investments. ||

What are the benefits of trading and investing on eToro in Bhutan?

The benefits of trading and investing on eToro in Bhutan include access to a wide range of global markets, low fees, the ability to copy successful traders, and access to social trading tools. Additionally, eToro offers a secure platform with advanced security features that protect users’ funds from unauthorized access. The platform also provides educational resources for new investors as well as comprehensive customer support services.

How does one open an account with eToro in Bhutan?

Unfortunately, eToro does not currently offer its services in Bhutan.

Are there any restrictions or limitations when trading and investing on eToro in Bhutan?

Yes, there are restrictions and limitations when trading and investing on eToro in Bhutan. All investments must be made in accordance with the laws of Bhutan, including any applicable foreign exchange controls or other regulations that may apply to a particular investment. Additionally, some assets may not be available for purchase due to local regulations or restrictions.

What types of assets can be traded and invested on eToro in Bhutan?

eToro does not currently offer services in Bhutan.

Does eToro offer any educational resources for traders and investors based in Bhutan?

No, eToro does not offer any educational resources for traders and investors based in Bhutan.

Is it possible to trade cryptocurrencies on eToro from within Bhutan?

No, it is not possible to trade cryptocurrencies on eToro from within Bhutan. Cryptocurrency trading is currently prohibited in Bhutan.

Are there any additional fees associated with using the platform from within Bhutan?

No, there are no additional fees associated with using the platform from within Bhutan.

Does the platform provide support services specifically tailored for users based in Bhutan?

No, the platform does not provide support services specifically tailored for users based in Bhutan.

05.05.2023 @ 13:44

mail address, and phone number. Once you have provided this information, you will need to verify your identity by uploading a copy of your passport or national ID card. After your identity has been verified, you can then fund your account using a variety of payment methods such as credit/debit cards, bank transfers, or e-wallets. It’s important to note that eToro requires a minimum deposit of $200 in order to start trading. Once your account is funded, you can then start exploring the different assets available on the platform and begin trading. Overall, eToro is a great option for investors in Bhutan who are looking for a user-friendly and affordable way to trade and invest in a variety of assets.