Introduction to Andorra

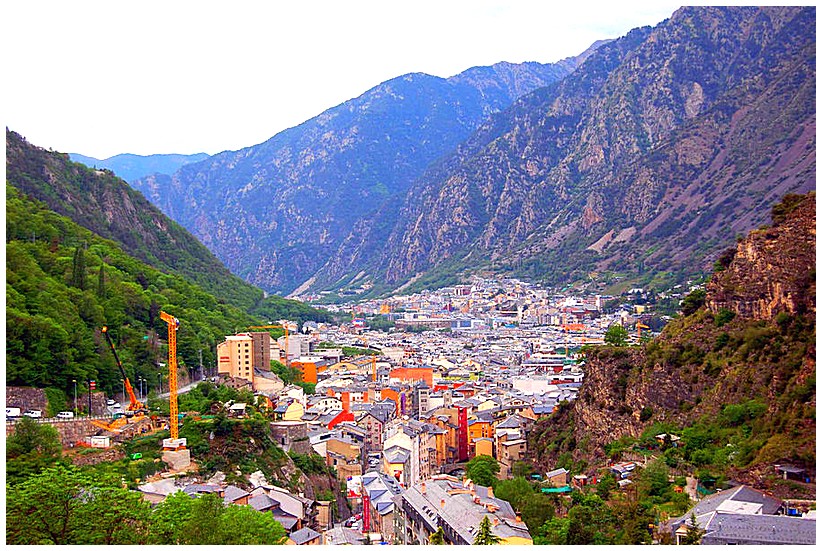

Andorra is a small, mountainous principality located in the Pyrenees Mountains between France and Spain. Despite its size, Andorra has become an increasingly popular destination for tourists and investors alike due to its stunning natural beauty, tax-free status, and modern infrastructure. In this article, we’ll explore what makes Andorra such an attractive investment opportunity through eToro’s platform. We’ll cover topics like the country’s economy and political system as well as how you can use eToro to invest in Andorran assets with ease. By the end of this guide, you should have a better understanding of why investing in Andorra could be a great choice for your portfolio.

History of Andorra and its Economy

Andorra is a small, mountainous principality located in the Pyrenees Mountains between France and Spain. It has been an independent state since 1278, when it was established as a buffer zone between its two powerful neighbors. Since then, Andorra has developed into one of the world’s most prosperous countries with a strong economy based on tourism and banking services.

The history of Andorra can be traced back to Charlemagne’s conquest of the Iberian Peninsula in 795 AD. The area became part of the County of Foix-Béarn in 1020 AD before being ceded to Aragon in 1133 AD. In 1278, King James II granted sovereignty over Andorra to both France and Aragon as part of a peace treaty ending hostilities between them. This agreement gave rise to what is known today as the “Co-Principality” system whereby both countries share joint responsibility for governing Andorra while maintaining their respective national identities within its borders.

Throughout its long history, Andorran citizens have relied heavily on agriculture and livestock farming for sustenance but these activities have become increasingly less important due to urbanization and industrialization over time. As such, tourism now accounts for more than 80% of GDP while financial services are also playing an increasingly significant role in driving economic growth through investments from abroad by wealthy individuals seeking tax havens or attractive returns on capital gains taxes compared with other European nations like France or Spain where rates are higher.

In recent years, technological advancements have allowed investors around the world access to opportunities available within this unique country via platforms like eToro which offer access to stocks listed on major exchanges including those based out of Europe such as Euronext Paris or Madrid Stock Exchange (BME). Furthermore, eToro allows users from all corners of globe invest directly into companies operating within Andorran borders without having worry about currency exchange rates or local regulations that may otherwise restrict foreign investment flows into this region – making it easier than ever before explore investing options here!

The Benefits of Investing in Andorra with eToro

Andorra is a small, independent principality located in the Pyrenees Mountains between France and Spain. It has become increasingly popular as an investment destination due to its tax-friendly policies and low cost of living. With eToro, investors can take advantage of these benefits while also enjoying the convenience of online trading. Here are some of the key benefits that come with investing in Andorra through eToro:

-

Low Tax Rates: Andorra has one of the lowest corporate tax rates in Europe at just 10%. This makes it attractive for businesses looking to save on taxes or individuals who want to invest their money without worrying about high taxation levels. Additionally, capital gains taxes are only 5%, which is significantly lower than other countries such as France or Spain where they can be up to 25%.

-

High Returns: Investing in Andorran assets can yield higher returns than other markets due to its relatively low risk level and lack of volatility compared to more developed economies like those found in Europe or North America. Additionally, there are no restrictions on foreign investments so investors have access to a wide range of options when choosing where they want their money invested.

-

Easy Accessibility: With eToro’s user-friendly platform, investors can easily open accounts and start trading within minutes from anywhere around the world – all without having to visit Andorra itself! The platform also provides users with real-time market data and analysis tools so they can make informed decisions when it comes time for them to buy or sell assets based on current trends and conditions in the market place.

-

Security & Transparency: All transactions made through eToro’s secure system are protected by encryption technology which ensures that your funds remain safe from any potential cyber threats or fraudsters trying to steal your information or funds during trades executed over this platform . Furthermore, all transactions made through this broker are subject full transparency rules ensuring you know exactly what you’re getting into before making any investments into Andorran markets .

Understanding the Tax System in Andorra

Andorra is a small country located in the Pyrenees mountains between France and Spain. It has become an increasingly popular destination for investors looking to diversify their portfolios with its low taxes, political stability, and access to Europe’s financial markets. However, before investing in Andorra it is important to understand the local tax system. This article will provide an overview of Andorran taxation so that you can make informed decisions when considering investments in this beautiful principality.

The most important thing to know about taxes in Andorra is that there are no personal income or corporate taxes on profits earned within the country. Instead, businesses pay a flat 10% rate on gross sales revenues as well as a 5% withholding tax on dividends paid out by companies based in Andorra. Additionally, there are some additional levies such as property transfer fees and stamp duties which must be taken into account when making any investment decision related to real estate or securities trading activities within the country.

In addition to these basic rules regarding taxation of profits made within Andorra itself, investors should also consider how they may be affected by international agreements signed between countries where they have other sources of income (such as from employment). In particular, double taxation treaties exist between many nations including France and Spain which could potentially impact your overall tax liability depending upon your specific circumstances – so it’s always best practice to consult with a qualified accountant prior to making any investment decisions involving assets held outside of your home jurisdiction.

Finally, it’s worth noting that while Andorran authorities do not levy capital gains taxes on investments made locally – foreign investors may still be subject to such charges depending upon their residency status and/or whether or not they benefit from certain exemptions granted under bilateral agreements with other countries (e.g., those outlined above). As such it’s always wise for anyone interested in investing through eToro or another platform operating within the principality’s borders –to thoroughly research all relevant regulations beforehand so that they can properly plan ahead for any potential liabilities associated with their transactions accordingly

Exploring Financial Markets in Andorra

Andorra is a small country nestled in the Pyrenees Mountains between France and Spain. It has long been known as a tax haven, but it is also becoming increasingly popular for its financial markets. With eToro, investors can now explore Andorran financial markets from the comfort of their own homes. This guide will provide an overview of investing in Andorra with eToro, including information on available stocks and ETFs, taxes and fees, trading strategies, and more. Whether you’re looking to diversify your portfolio or take advantage of low-tax investments, this guide will help you get started on your journey into exploring Andorran financial markets with eToro.

Different Types of Investment Products Available Through eToro

eToro is a great platform for investors to explore the world of investing in Andorra. With eToro, you can access a variety of investment products that are available in the Pyrenees Principality. These include stocks, ETFs, commodities, indices and cryptocurrencies. You can also use eToro’s CopyTrader feature to copy successful traders from around the world and gain exposure to their portfolios. Additionally, you can invest in CFDs (Contracts For Difference) which allow you to speculate on price movements without owning any underlying assets. Finally, if you want more control over your investments, there are options such as copy portfolio where you can create your own customised portfolio or use one of eToro’s pre-made ones.

Risks Associated With Investing In Andorra

1. Exchange Rate Risk: The Andorran currency, the Euro, is subject to fluctuations in exchange rates that can affect your investment returns.

-

Political Risk: Andorra is a small principality with limited political stability and may be subject to changes in government or other events that could adversely affect investments.

-

Regulatory Risk: There are few regulations governing investments in Andorra and investors should be aware of the potential for fraud or other risks associated with investing without proper oversight from local authorities.

-

Taxation Risk: Investors should understand the taxation laws of both their home country and Andorra before making any investments as taxes on capital gains may vary significantly between countries and regions within them.

Regulations and Compliance Requirements for Investors

Andorra is a small country located in the Pyrenees mountains between France and Spain. It has become increasingly popular as an investment destination due to its favorable tax regime, political stability, and access to European markets. However, investors should be aware of the regulations and compliance requirements for investing in Andorra.

The first step for any investor looking to invest in Andorra is to obtain a valid residence permit from the government. This will allow them to open bank accounts and purchase securities within the country. Additionally, investors must also register with the Financial Services Authority (FSA) before conducting any transactions related to investments or trading activities within Andorra’s borders.

Investors should also be aware that there are certain restrictions on foreign ownership of assets such as real estate or stocks listed on local exchanges. In addition, all financial transactions must comply with anti-money laundering laws which require disclosure of beneficial ownerships and identification documents from both parties involved in each transaction. Furthermore, all investments made by non-residents must be reported annually through a special form issued by the FSA which includes details about their investments including profits earned during the year as well as capital gains taxes paid if applicable.

Finally, it is important for investors to understand that although Andorran law does not impose any restrictions on foreign exchange trading activities conducted within its borders, they may still need authorization from other countries depending on where they are based or what type of activity they plan on engaging in while investing in Andorra. As such it is essential that potential investors research these regulations carefully before making any decisions regarding their investment plans so that they can ensure full compliance with all relevant rules and regulations governing international finance operations

Tips For Making a Successful Investment in Andorra

1. Research the local market: Before investing in Andorra, it is important to understand the local economy and political climate. This will help you identify potential opportunities and risks associated with investing in Andorra.

-

Understand the investment regulations: It is essential to be aware of any laws or regulations that may affect your investments in Andorra before making a commitment. Make sure you are familiar with all relevant rules and restrictions before committing funds.

-

Diversify your portfolio: As with any investment strategy, diversification is key when investing in Andorra’s markets. Investing across different asset classes can help spread risk while still providing potential for growth over time.

-

Utilize an online trading platform: Online trading platforms such as eToro provide investors with access to global markets at low cost and minimal effort – ideal for those looking to invest in Andorran stocks or other assets from outside of the country itself!

5 . Monitor performance regularly : To ensure success, it’s important to monitor your investments on a regular basis so that you can adjust your strategies accordingly if needed – especially when dealing with volatile markets like those found in Andorra!

Conclusion: Why You Should Consider Investing In The Pyrenees Principality

Conclusion: Investing in the Pyrenees Principality of Andorra is a great opportunity for investors looking to diversify their portfolio. With its stable economy, low taxes, and strong tourism industry, it offers a unique investment opportunity that can help you grow your wealth over time. Additionally, with eToro’s user-friendly platform and wide range of products available, investing in Andorra has never been easier or more accessible. For those interested in exploring new markets and opportunities outside of traditional investments, the Pyrenees Principality is an excellent choice.

| eToro | Other Investment Platforms |

|---|---|

| Easy to use platform with user-friendly interface | Complicated and difficult to understand platforms with limited customer support |

| Variety of asset classes available for trading, including stocks, commodities, currencies and cryptocurrencies | Limited range of assets available for trading such as stocks or bonds only |

| Low fees on trades and no commissions on stock purchases | High fees on trades and commissions charged on stock purchases |

| Ability to copy successful traders using CopyTrader feature | No similar features available |

What makes Andorra an attractive investment destination?

Andorra is an attractive investment destination due to its low taxes, stable political and economic environment, highly developed infrastructure, strong banking system, and access to the European Union. Additionally, Andorra offers a variety of incentives for foreign investors such as tax breaks on profits made in Andorran companies and generous grants for research and development projects. Furthermore, the country has a well-educated workforce with multilingual capabilities that make it easier for businesses to operate there. Finally, Andorra’s location between France and Spain makes it easy to access markets from both countries.

How does the eToro platform facilitate investing in Andorra?

eToro provides a platform for users to invest in Andorra by offering access to various financial instruments such as stocks, ETFs, commodities and cryptocurrencies. The platform also offers educational resources on investing in Andorra and the ability to copy successful traders’ portfolios. Additionally, eToro’s CopyTrader feature allows users to automatically replicate the trades of experienced investors with proven track records. This makes it easier for new investors to get started with their investments in Andorra without having any prior knowledge or experience.

What are some of the unique benefits to investing in Andorra through eToro?

Some of the unique benefits to investing in Andorra through eToro include:

1. Access to a wide range of investment options, including stocks, ETFs, commodities and cryptocurrencies.

2. Low trading fees and spreads compared to other online brokers.

3. Ability to copy successful traders with CopyTrader technology.

4. Easy access to global markets with low minimum deposits required for trading on eToro’s platform (only $200).

5. A user-friendly interface that allows investors of all levels to easily navigate the platform and make informed decisions about their investments quickly and efficiently

Are there any restrictions or limitations on foreign investments in Andorra?

Yes, there are restrictions and limitations on foreign investments in Andorra. Foreign investors must obtain prior authorization from the government before investing in certain sectors of the economy such as banking, insurance, energy, telecommunications and real estate. Additionally, foreign investors may not own more than 49% of a company’s capital or have control over its management decisions. Finally, foreign investment is subject to taxation according to local laws and regulations.

How has the economic climate of Andorra changed over time and what impact has this had on investments made through eToro?

The economic climate of Andorra has changed significantly over time. In the past, it was heavily reliant on tourism and duty-free shopping for its income, but in recent years it has shifted towards a more diversified economy with a focus on finance and technology. This shift has had a positive impact on investments made through eToro as the country now offers greater opportunities for investors to benefit from its new industries. Additionally, the government’s commitment to developing an attractive tax regime has also helped attract foreign investment into Andorra. As such, investments made through eToro have become increasingly popular due to their potential for higher returns than those available elsewhere in Europe or North America.

What types of assets can be invested in through eToro when exploring opportunities in Andorra?

When exploring opportunities in Andorra through eToro, investors can invest in a variety of assets including stocks, commodities, currencies (forex), indices, ETFs and cryptocurrencies.

Are there any tax advantages for investors looking to explore opportunities within the Pyrenees Principality with eToro?

Yes, there are tax advantages for investors looking to explore opportunities within the Pyrenees Principality with eToro. The principality has a favorable taxation system that encourages foreign investment and offers generous tax breaks on capital gains, dividends, and other income earned from investments in the region. Additionally, eToro provides its users with access to an extensive range of financial instruments including stocks, ETFs, commodities, indices and more which can be used to diversify their portfolios while taking advantage of the principality’s advantageous taxation system.

Is it possible to diversify a portfolio by investing both locally and internationally when using the eToro platform for exploring options within Andorra?

Yes, it is possible to diversify a portfolio by investing both locally and internationally when using the eToro platform for exploring options within Andorra. The eToro platform offers access to global markets including stocks, ETFs, commodities, indices and cryptocurrencies from around the world. This allows investors to diversify their portfolios across different asset classes and geographical regions.

05.05.2023 @ 13:46

stable economy. With eToro, investors can easily access Andorran stocks and other assets, potentially earning higher returns on their investments.

Ease of Access: eToro provides a user-friendly platform that allows investors from all over the world to easily invest in Andorran assets. With just a few clicks, investors can buy and sell stocks, track their portfolio, and stay up-to-date on market trends.

Diversification: Investing in Andorra through eToro can help diversify your portfolio, reducing overall risk. Andorra’s economy is not heavily reliant on any one industry, making it a stable investment option.

In conclusion, Andorra is a small but attractive investment destination due to its tax-friendly policies, stable economy, and modern infrastructure. With eToro, investors can easily access Andorran assets and potentially earn higher returns on their investments.